EV industry: Is COVID-19 a vital pitstop?

COVID-19 is expected to greatly decelerate the progress of the automotive industry towards electric vehicles. But India can also view the pandemic as an opportunity to reassess its strategic approach towards a dynamic & sustainable EV ecosystem.

- From people sitting in their homes for months (& therefore, hardly any need for mobility) to the lifting of the lockdown curbs and the preference of travelling solo, COVID-19 has changed the face of commuting in the country.

- Amid the pandemic, the country has made major strides towards e-mobility by leapfrogging from BS IV to BS VI norms.

- Supply chain disruption, diminished investment, lower purchasing power of customers and reduced government focus have been identified as short-term challenges for Indian e-mobility segment.

- India must utilise this period to relook at its strategic approach towards the EV sector. This would involve measures to reduce import dependence as well as ensuring adequate incentives on both the demand and supply side.

The proliferation of COVID-19 has had very serious impacts on the country’s automobile industry. From the macroeconomic environment and regulatory trends to technology and consumer behaviour, the Indian automobile industry has been compelled to relook at its strategic approach towards business sustenance and growth. The same is true of the electric vehicle (EV) industry in the country – the eco-friendly solution to India’s mobility problems.

The fact that EVs were making their presence felt in the country slowly and steadily is buttressed by the 20% year-on-year growth in EV sales in the financial-year 2019-20 to reach 1,56,000 units. Besides being cleaner modes of transports, EVs are also likely to auger well for any economy. According to a study, the shift to electric vehicles is estimated to lead to a 1% increase in EU’s GDP; while another one suggests that about 2 million additional jobs will be created by EVs by 2050. Further, the introduction of sustainable mobility will also enhance last mile connectivity, at a time when Prime Minister Modi is trying to devise a master plan to improve multi-modal connectivity in industrial hubs to cut the cost of logistics.

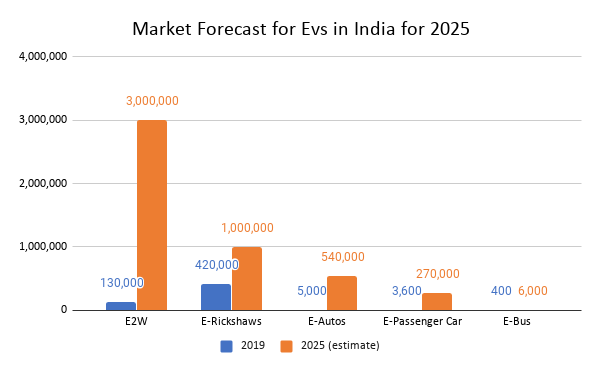

Source: Frost & Sullivan

An analysis by Frost & Sullivan shows a promising future for electric vehicles in India, noting that the penetration of EVs and is expected to reach as high as 4.8 million by 2025. This will be driven by a push from the Indian government towards electric vehicles. Some of the major steps taken by the government include:

- Launch of Faster Adoption and Manufacturing of (Hybrid) and Electric Vehicles in India (FAME 2) scheme to incentivize the purchase of EVs in the country. With an outlay of ₹10,000 crore till 2022, it intends to augment the number of EVs in the commercial fleet.

- Slashing of Goods and Services Tax (GST) rate on EVs from 12% to 5%.

- An additional deduction of Rs 1.5 lakh in income tax for interest paid on loans for purchase of EVs.

A bumpy ride ahead

The advent of COVID-19 has severely disrupted the country’s journey towards embracing this change. One eminent change is the disruption of supply chain. Given the lack of availability of raw materials – lithium, cobalt, manganese, nickel – needed to produce EVs and the ensuing high cost of manufacturing them locally, India imports these components from other nations, especially China. As the epidemic broke out in China & factories were forced to shut down, supply chains dried up in the country, thereby halting the production process of EVs in India.

Another effect of the contagion is that in the near future, investment of Indian original equipment manufacturers (OEMs) in the EV sector might contract. With mounting losses due to the disruption in operations and plans to recover investments made for meeting Bharat Stage VI emission norms, they may strive to revive existing operations and aggressively sell Bharat Stage-VI vehicles in which they have already invested. Hero Electric, Kinetic, Mahindra Electric and others have deferred capex and programmes deemed non-critical in the Indian market in an effort to conserve cash. Thus, dedicated research and development for the e-mobility sector might also slow down post COVID-19. Sulajja Firodia, founder & CEO, Kinetic Green Energy and Power Solutions, notes:

“We will invest only in the most critical programmes which we have already started and all other capex programmes will be postponed by 2-3 quarters. Some programmes like half tonne delivery fleet vehicle will continue.”

Further, with the government easing its purse strings for relief and development work across other sectors like MSMEs and agriculture, funding from the government may also diminish. Consequently, procurement programs for e-buses and e-cars are likely to take a backseat. The same may be the case with a number of private players who were expected to drive the demand for EVs in almost all vehicle segments.

The declining purchasing power of consumers in the face of job losses and salary cuts, despite the anticipated trend towards the rise in private vehicle ownership owing to the looming fears of the infectious disease, is also painting a grim scenario for the industry.

Lastly, this situation is further compounded by several problems that the sector was already grappling with, like the lack of sufficient public e-charging ports. While it is said that EVs can be charged overnight conveniently at home, quite a few parts of the country still don’t have access to electricity. Moreover, even those regions which have access to electricity, grapple with the problems of load shedding – frequent power cuts, fluctuation of voltage & low voltage.

Secondly, leapfrogging to EVs encompasses a shift in the behavior patterns of consumers, which might not be an easy thing to achieve. For instance, it was observed that just a few months after the launch of Ola’s ambitious Electric Vehicle project in Nagpur, many drivers wanted to return their electric cars and switch back to conventional variants owing to high operating expenses and long queues at charging stations.

COVID-19 will definitely delay India’s progression towards electric vehicles, as Rajeev Singh, Automotive Leader, Deloitte India, opines:

“New investments in evolving technologies may take a step back as there will be shift in focus to clear the backlog of inventories and revive the prevailing operations. Moreover, EV manufacturers are expected to face mammoth pressure due to component shortfalls, for which there is heavy reliance on other geographies.”

Addressing the elephant(s) in the room

Even though the present scenario presents challenges, India can utilise this opportunity to carefully assess and calibrate its strategic approach towards Electric Vehicles. Firstly, it is important to consider how we can shed our import dependence on other countries and facilitate the indigenisation of EVs in the country. For raw materials, in particular, the country can look at alternatives to lithium and cobalt like sodium & sulphur.

Another question that arises is how we make EVs more affordable for the people. As batteries dominate costs of electric vehicles, NITI Aayog recommends local production of battery chemistry with optimized cost and performance at Indian temperatures. Alternatively, India can also consider recycling of used batteries.

At the same time, efforts must be focused on incentivising innovations to increase vehicle efficiency by using more efficient electric motors with better tyres, enhancing the aerodynamics of the vehicles and reducing weight. These initiatives can reduce energy consumption and also enable a vehicle to travel the same distance on a smaller battery pack.

Developing an ecosystem of fast-charging batteries will also be imperative in enticing buyers when they eventually redevelop the propensity for vehicle ownership. Charging infrastructure can be rolled out on a city-by-city basis across the country to ensure greater adoption of EVs by customers. Domestically produced and technologically superior EVs, chargers and components could also bring down total cost of ownership (TCO) to parity with ICEs.

Lastly, more incentives need to be created on the supply side & the demand side. For producers of EVs, this could mean measures to infuse liquidity into the sector. For the consumers, increasing tax on conventional fuel, reducing total cost of ownership of electric vehicles and developing adequate charging infrastructure could prove particularly catalytic in terms of driving demand.

Leave a comment