India’s exports: Staying steady amidst turbulent waters?

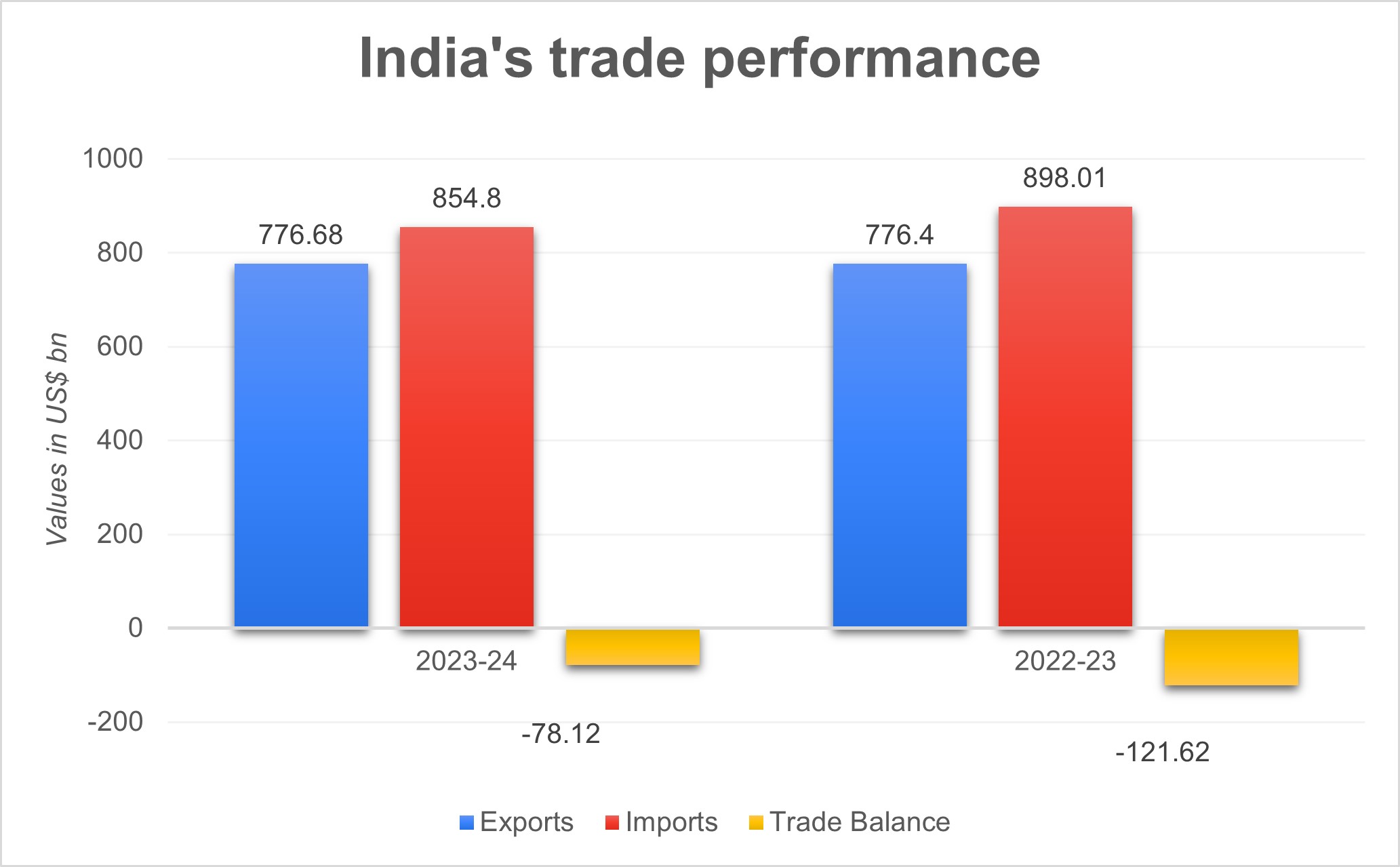

India’s total exports in 2023-24 are estimated to have reached US$ 776.68 billion, growing marginally by 0.04% YoY amidst global challenges. However, service exports are projected to have grown by 4.39% YoY to reach US$ 339.62 billion in 2023-24. As we look ahead, the World Trade Organisation (WTO) forecasts a rebound in global trade for 2024, but warns of downside risks driven by regional conflicts, geopolitical tensions, and economic policy uncertainty.

Source: Shuttersock

According to recently released trade data by the Ministry of Commerce and Industry, total exports in 2023-24 are anticipated to marginally exceed last year’s record, despite ongoing global uncertainties. It is expected to reach US$ 776.68 billion in FY 2023-24, compared to US$ 776.40 billion in 2022-23. Total imports are also expected to have declined to US$ 854.80 billion, registering a negative growth of 4.81% YoY.

India’s exports and imports are under pressure in the face of a global economic slowdown, especially with the ongoing Red Sea crisis and the Iran-Israel conflict. In FY24, it’s worth noting that service exports have shown positive growth as compared to goods exports in FY24.

Source: PIB

The overall trade deficit for 2023-24 is estimated to be US$ 78.12 billion, down by 35.77% YoY. Merchandise trade deficit on the other hand, is estimated at US$ 240.17 billion, representing a 9.33% decline YoY.

Under merchandise exports, 17 of the 30 key sectors exhibited positive growth in 2023-24, despite ongoing global uncertainties.

| Major sectors witnessing positive growth | ||

| Iron Ore (117.74%) | Electronic Goods (23.64%) | Tobacco (19.46%) |

| Ceramic Products & Glassware (14.44%) | Fruits & Vegetables (13.86%) | Meat, Dairy & Poultry Products (12.34%) |

| Spices (12.3%) | Coffee (12.22%) | Drugs & Pharmaceuticals (9.67%) |

| Cereal Preparations & Miscellaneous Processed Items (8.96%) | Oil Seeds (7.43%) | Oil Meals (7.01%) |

| Handicrafts, Excl. Hand Made Carpet (6.74%) | Cotton Yarn/Fabs./Made-Ups, Handloom Products Etc. (6.71%) | Carpet (2.13%) |

| Engineering Goods (2.13%) | Tea (1.05%) | |

Source: Ministry of Commerce & Industry

The US remained India’s largest goods export market with a value of US$ 75.65 billion in 2023, albeit with a decline by 5.5% YoY. It was followed by the UAE (US$ 33 billion, decline by 5.3% YoY) and Netherlands (US$ 23.1 billion, increase by 24.6% YoY). In fact, Netherlands was the fastest growing market on a YoY basis among the top 10. On the other hand, Bangladesh witnessed the steepest decline by 19.6% YoY to reach US$ 11.25 billion.

| India’s top 10 export markets | |||

| Importing nations | 2022 | 2023 | % Growth |

| USA | 80.05 | 75.65 | -5.5 |

| UAE | 31.34 | 33.01 | 5.34 |

| Netherlands | 18.55 | 23.11 | 24.57 |

| China | 15.15 | 16.23 | 7.12 |

| UK | 11.22 | 12.42 | 10.72 |

| Singapore | 11.81 | 12.04 | 1.96 |

| Bangladesh | 13.99 | 11.25 | -19.56 |

| Saudi Arabia | 10.05 | 10.84 | 7.87 |

| Germany | 10.46 | 9.67 | -7.58 |

| Hong Kong | 9.81 | 8.72 | -11.08 |

Source: Ministry of Commerce & Industry

Among the top 10 rankings, UK overtook Singapore to take the fifth position, while Bangladesh’s rank dropped from 5th to 7th. Saudi Arabia (US$ 10.8 billion, growth of 7.9% YoY) overtook Germany (US$ 9.7 billion, decline of 7.6% YoY) to take the 8th position.

Future Outlook

As we look ahead, the World Trade Organisation (WTO) forecasts a rebound in global trade for 2024, but warns of downside risks. The volume of world merchandise trade is expected to grow by 2.6% in 2024 and 3.3% in 2025, while the value of merchandise exports is projected to decline by 1.2% in 2023. Trade developments on the services side are more upbeat, with commercial services exports up 9% to US$ 7.54 trillion in 2023. However, regional conflicts, geopolitical tensions, and economic policy uncertainty pose substantial downside risks to the forecast.

India finds itself on a trajectory with notable advancements in export sectors that were previously deemed weak, amidst the complexity of global trade dynamics. India’s exports and imports have shown resilience in the face of a global economic slowdown due to the ongoing Red Sea Crisis and Iran-Israel conflict. In FY24, service exports have shown positive growth as compared to goods exports in FY24. A major highlight in recent years is the growth in e-commerce exports, that are currently estimated at around US$ 1 billion annually. Capitalising on this channel could make transformational gains in India’s exports in the coming years, driven by the ambitions of millions of MSMEs and emerging entrepreneurs across the country.

Leave a comment