Automotive industry post-COVID: How to keep the engine humming

• The Indian automobile industry witnessed weak consumer demand in 2019 owing to economic slowdown and the growing preference among millennials for public transport.

• COVID-19 has compounded woes for the sector. Declining sales, perishing capital flow, import dependency on China and zero sales for the first time in history – the pandemic unfurled a pandemonium in the industry.

• While demand is unlikely to pick up anytime soon this year, the industry is hopeful that signs of recovery will appear by Q3 in 2021.

• To expedite the sector’s recovery, focus needs to be given to self-reliancw in auto-components, workplace safety at work and contactless sales.

The year 2019 turned out to be a tough road for the Indian automobile industry, even as India itself became the world’s fourth largest auto market in the preceding year. Slow economic growth, weak consumer sentiment due to a preference for public transport among millennials and BS-VI transition – all led to an underwhelming performance by the sector.

But 2019 would seem like a dream now in hindsight, given the onset of the coronavirus pandemic in the country this year and the concomitant lockdown imposed by the government in the hope to arrest the spread of the pandemic in India.

To start with, ever since the entire country was put under the lockdown, there were curbs on the movement of people who resorted to working from home. At the same time, vehicle dealerships also remained closed. As a result, April 2020, which was supposed to be a major turning point in the country’s automotive history for transiting to the BS-VI emission-norm compliant model, ended up becoming unforgettable for a quite different reason. Thus, for the first time in the history of India’s automobile industry, April 2020 became the month of zero car and two-wheeler sales. Simultaneously, lockdowns in North America and Europe also meddled with Indian auto exports.

Industry insiders don’t expect this demand to pick up anytime soon this year. This is due to a number of reasons:

(i) A lot of people in the country are on the brink of being sacked by their companies;

(ii) an air of uncertainty looms over the future of those who still have their jobs as they don’t know when they might be fired;

(iii) in a lot of industries, the salaries of employees are being slashed by a significant proportion;

(iv) they might want to stay away from making major discretionary expenses and save for rainy days (when their paychecks stop coming or when they might shell out lakhs in hospitals if they happen to catch the disease); and

(v) the anticipation of the rise in remote working in the country on a wider scale, which might curtail the demand for vehicles significantly.

The Society of Indian Automobile Manufacturers (SIAM) and Automotive Component Manufacturers Association of India (ACMA), estimate that this suspension of production in the country is likely to result in a loss of over Rs 21,000 crore in a short period. On a daily basis, SIAM estimates this loss to be more than Rs 2,300 crore because of plant closures of auto OEMs & components. This, in addition to the dismal sales of vehicles in the March-April period, is likely to create serious financial troubles for the sector. This is a major setback to the country since the Indian automobile industry has an annual turnover of US$ 100 billion and employs 32 million people.

The third major challenge that the country’s vehicle industry faces is the switch from Bharat Stage 4 (BS4) to Bharat Stage 6 (BS6) emission norms from 1st April’20. Inventory correction before the transition to BS-VI emission norms is expected to pull down aggregate revenue of some of the auto and auto ancillary companies. The transition to the world’s cleanest petrol and diesel (BS6) created two major problems for the country’s vehicle dealers – clearing out the stocks of older BS-IV vehicles and getting supply of BS-VI vehicles owing to the shutting down of factories across India to control the spread of the virus. Dealerships across country stare at huge losses because as per the mandate, any unsold BS-IV vehicle would end up as scrap after March 31 as from April 1.

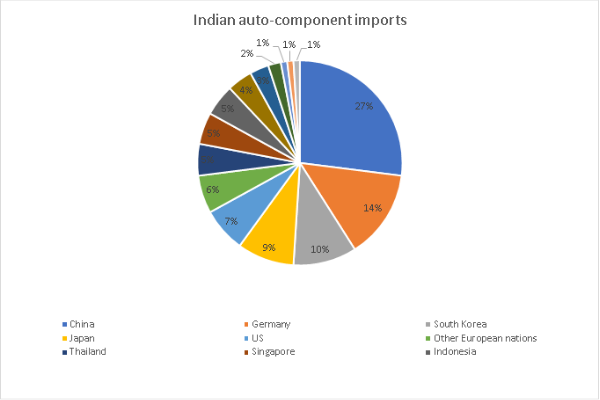

Another challenge that the Indian automobile industry is facing is that of being overly dependent on countries like China to meet its need for importing raw materials. The outbreak of COVID-19 in Hubei – one of the major regions in China responsible for the production of auto-components – choked the supply chain. Rating agency ICRA Ltd estimates that 27% of the roughly US$ 17.5 billion worth of component imports into India comes from China. For example, Hero MotoCorp imports alloy wheels from China. The other major countries which account for these raw materials include Japan, Germany, South Korea & USA.

Source: ACMA & ICRA

Lastly, as production will resume in the near future in these plants, they will also have to deal with issues related to the workforce. A significant number of workers may have fled to their hometowns. Therefore, they may not be able to functions at optimal capacity and meet the production (& sales) targets that they might have set at the beginning of the year. Another major labour issue would be to make the workplace coronavirus-proof. Further, measures must also be taken to ensure that any kind of mishaps such as the Vishakhapatnam gas leak don’t happen at the workplace.

Reigniting the growth engine

Carrying on in the post COVID-19 phase might seem like figuring out a jigsaw puzzle for the auto industry in India. However, timely steps in the right direction can drive this sector back on the path of growth. One of the first steps that needs to be taken is to abide by PM Modi’s advice of being self-reliant. For the automobile sector, this would mean shunning dependence on China & other countries for importing auto components and kick starting their domestic production. This would also auger well for the government’s Make in India initiative and lead to creation of jobs in the country, thereby boosting the consumers’ spending capacity. At the same time, these companies need to establish manufacturing resilience to accelerate the shift when ‘emergency mode’ needs to be activated, so that they can be better prepared to handle a similar situation, should it arise in the future.

Next, in order to ensure that the work premises remain free of the virus, companies will have to ensure initiatives like thermal screening of the workers, rearranging workstations to add distance, increasing the availability of personal protective equipment and rotational system of work. New digital tools can also be used to assist in infection notification and tracking. Also, to make sure that the work place is safe, companies need to abide by the recent National Disaster Management Authority (NDMA) guidelines.

The NDMA guidelines states “To minimize the risk it is important that employees who work on specific equipment are sensitized and made aware of the need to identify abnormalities like strange sounds or smell, exposed wires, vibrations, leaks, smoke, abnormal wobbling, irregular grinding or other potentially hazardous signs which indicate the need for an immediate maintenance or if required shutdown.” Further, new investments in the sector can be made to build sanitized and automated warehousing and logistics solutions.

As far as the question of fixing cash flow is concerned, automotive companies in the country need to be in close contact with major banks (e.g. verify credit lines) and establish a working-capital crisis mode that prioritizes payment obligations. These companies should also consider deploying AI in treasury management to set up real-time cash flow overview and forecasts. The financial health of suppliers and dealers is also something that needs attention. Support plans for high risk dealers and suppliers through liquidity planning and cost-cutting measures also need to be in the pipeline.

Automobile companies and dealers across the country need to devise mechanisms for contactless sale and delivery. Some companies in India have already started embracing digital channels. For example, announcing its plans to digitize its sales and service portfolio, Volkswagen India is integrating 137 sales and 116 service touchpoints, to help customers choose their dealership while booking online. Other companies that have followed the suit include Hyundai, BMW and Mercedes. However, these companies will also need to closely monitor macroeconomic indicators and changes in consumer sentiment for appropriate adjustments in their market approach. Microtargeting specific customer segments and geographies is another strategy to reactivate sales.

Coming to the demand side of the equation, it is being speculated by the auto-experts in India, that like China & South Korea, India could see a U-shaped economic recovery. They opine that the Indian automotive sector will start to see recovery in the third quarter of FY21. The growth in consumer preference towards individual health, hygiene and cleanliness during travel, is likely to drive the switch towards personal mobility. However, given the aversion to higher discretionary spends like buying new vehicles, demand for used vehicles is expected to rise in the next 3-6 months.

Thus, to sum up, India needs to rewrite its automobile story ‘component-by-component’ to get ready to overcome the challenges of a post-COVID-19 era. Reinvention and resilience will be the key in helping the sector get back on its feet and promote growth.

So true, COVID has hit the automobile industry pretty hard. Here’s how automobile has transformed with the COVID crisis. https://www.engati.com/blog/revolutionizing-the-automobile-industry-hussein-dajani-engati-cx