Blue Revolution 2.0: Transformative Measures for Inland Fisheries Cooperatives

India is capitalizing on its competitive edge in the fisheries sector by implementing rigorous quality standards and adhering to global regulations, rendering its aquatic products appealing to international markets. Government incentives supporting export-oriented production and collaborations with nations having robust seafood consumption serve as driving forces in this endeavour.

A major factor behind the growth of production is increased inland aqua farming, which makes up for more than 70% of the fish production. Inland fisheries and aquaculture production doubled in the last 9 years, with projections of 174 lakh tons in 2022-23, indicating a growing interest in the sector.

In this analysis, IBT takes a look at the strong growth shown by inland fisheries sector, for which cooperatives account for a key contribution. There are around 28,000 fisheries cooperatives with membership of around 4 million people across India. Our analysis further focuses on specific growth bottlenecks faced by these cooperatives and how the government can address their needs under the aegis of the Pradhan Mantri Matsya Sampada Yojana.

Photo Source: Shutterstock

India’s fisheries sector is undeniably an integral part of the economy as it provides livelihood, employment and entrepreneurship to more than 2.8 crore fishers and fish farmers at the primary level and several lakhs along the value chain. The fisheries sector, both inland and marine, is growing at a steady pace and generating foreign exchange revenues through exports. Various business outlets and opportunities created by this sector also provide significant support to numerous subsidiary industries.

The fishing industry is seen as a rising industry with enormous potential to promote inclusive and equitable growth through the economic empowerment of society’s underprivileged segments. India is the world’s 3rd biggest fish producer, 2nd largest aquaculture producer, largest prawn producer, and 4th largest seafood exporter, accounting for 8% of worldwide fish production.

The fisheries sector demonstrated a sustained annual growth rate of 8.61%, contributing 1.069% to the National Gross Value Add (GVA) and 6.86% to Agriculture GVA in 2021-22. The government extended Kisan Credit Card (KCC) facilities to fishers and fish farmers, issuing 1,42,458 KCC cards. Significant investments were made in the development of Fishing Harbours and Fish Landing Centres, totalling Rs 9,028.29 crore in the last 9 years.

As per market research firm IMARC, the fisheries market in India is projected to increase at a CAGR of 8.81% from 2023-28, reaching 31.7 million tonnes. Some of the major factors driving the market are the growing consumer awareness of the nutritional advantages of aquatic cuisine, ongoing technological advancements in aquaculture, active government initiatives supporting sustainable fishing practices, and shifting consumer preferences towards diets high in protein.

Growth in inland fisheries

A major factor behind the growth of production is increased inland aqua farming. According to the latest announcement by the Central government, there has been “a growth of inland fish production, export, aquaculture particularly Inland Fisheries that makes up for more than 70% of the fish production with cumulative efforts from Centre, States/UTs and beneficiaries in all fields.”

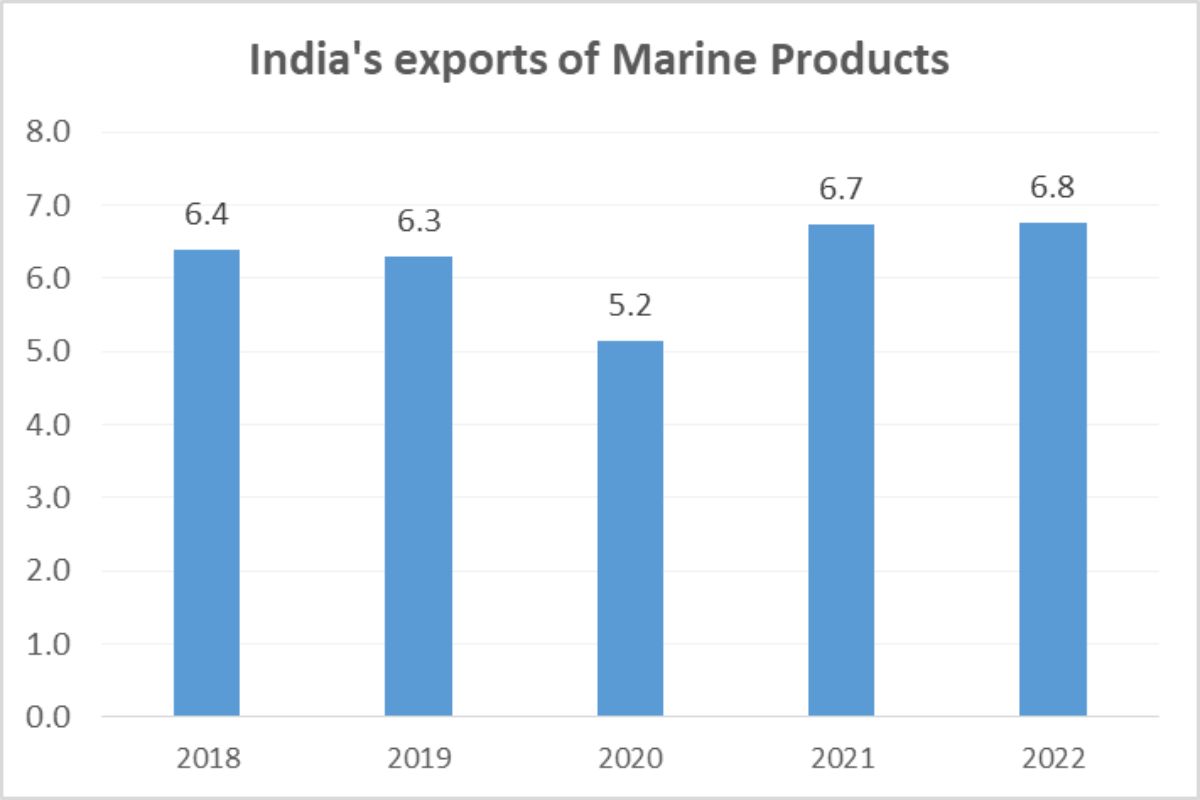

Source: ITC Trade Map, figures in US$ billion, data for HS 03, Fish and crustaceans, molluscs and other aquatic invertebrates

The Annual Report for 2022-23 from the Indian Council of Agriculture Research highlighted the development of a web-GIS application dedicated to location-specific riverine fisheries management. This interactive platform offers a user-friendly interface housing environmental data from 300 sampling stations across 20 major rivers in India. The portal’s robust database and tailored reports are designed to assist researchers, planners, and policymakers in making informed decisions and formulating effective strategies to enhance fisheries resources.

In a joint report released by ICAR and the Central Marine Fisheries Research Institute, it has been said, “The estimated marine fish landings along the coast of the mainland of India during 2022 was 3.49 million tonnes, showing an increase of 14.53% compared to the landings in 2021. An increase of 28.02% was reported in the marine fish landings of 2022 compared to the COVID-19 pandemic year 2020.”

The same report states that Indian mackerel accounted for 3.28 lakh tonnes (9.39% of the national total) of marine fish landings in 2022, followed by oil sardine with 2.51 lakh tonnes (7.20%), ribbon fishes with 2.27 lakh tonnes (6.49%), cephalopods with 2.06 lakh tonnes (5.89%), and threadfin breams with 1.99 lakh tonnes (5.69%).

Inland fisheries and aquaculture production doubled in the last 9 years, with projections of 174 lakh tons in 2022-23, indicating a growing interest in the sector. Seafood exports have also more than doubled since 2013-14, reaching Rs. 63,969.14 crore in FY 2022-23. Brackish water aquaculture, particularly shrimp cultivation, experienced a remarkable growth of 267% in production and 123% in exports.

In India, the total amount of fish produced in 2021–2022 is 16.24 million tonnes, of which 4.12 million tonnes is attributed to marine fish and 12.12 million tonnes stems from aquaculture.

From 2015, the central government has approved or announced cumulative investments to the tune of Rs 38,572 crore. These include:

- Rs. 5,000 crore investment under the Blue Revolution Scheme;

- Rs. 7,522 crore Fisheries and Aquaculture Infrastructure Development Fund (FIDF);

- Rs. 20,050 crore investment under Pradhan Mantri Matsya Sampada Yojana (PMMSY);

- Rs 6,000 crore Sub-scheme under PMMSY, announced in Union Budget 2023-24

The PMMSY was introduced in 2020-21, and the nation’s total fish production has increased, rising from 141.64 lakh tonnes in 2019–20 to 162.48 lakh tonnes in 2021–2022.

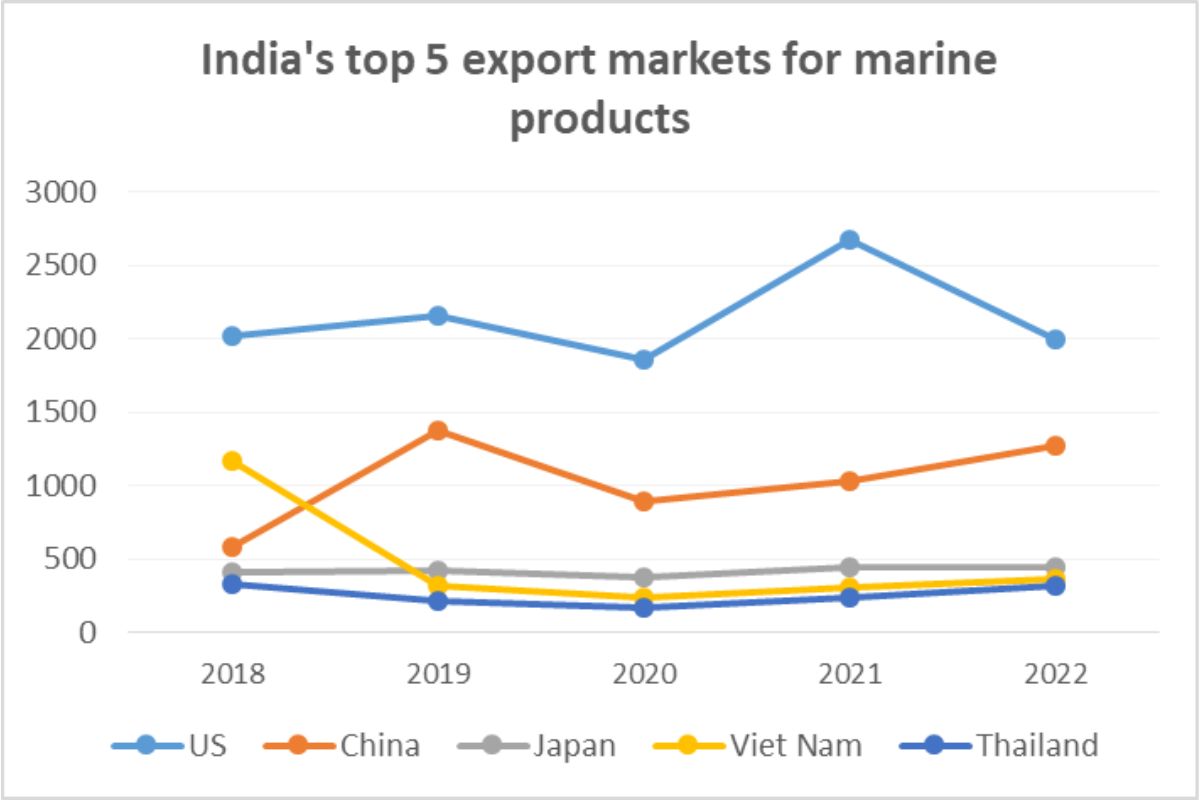

Source: ITC Trade Map; figures in US$ million

India Business and Trade spoke with B. K. Mishra, Managing Director, National Federation of Fisheries Cooperation, on the production capacity of fisheries in the domestic market. Mishra claimed that the cooperative fisheries sector has been thriving for over a decade with a growth rate of 7-8% y-o-y. The driving factor behind the accelerating growth is in-land fisheries, since the growth in the marine fisheries is “saturated”.

“Since the marine culture demands a lot of work, any rise in the industry, even 1% to 2%, is noteworthy. However, the in-land sector has enormous potential and will continue to be the industry’s engine in the near future. I would say more and more people should come into this profession.”

Challenges for fisheries in India

Some of the challenges that need to be addressed are expanding the supply of high-quality seed, maintaining a cold chain, fulfilling infrastructure needs, and building post-harvest infrastructure. For inland freshwater fisheries, there are issues such as unfamiliar fish diseases, often originating from the use of unhealthy fish seeds. Additionally, a significant number of freshwater ponds have remained unchanged for an extended period due to a lack of initiatives from village-level administration.

Fishermen in India have to incur substantial expenses, including the purchase of bleaching powder and lime (Calcium Hydroxide), to revitalize the ponds independently. A considerable portion of the catch is frequently sold at reduced prices in local village markets due to insufficient storage and preservation facilities, compounded by a lack of prompt transportation services to the more central markets.

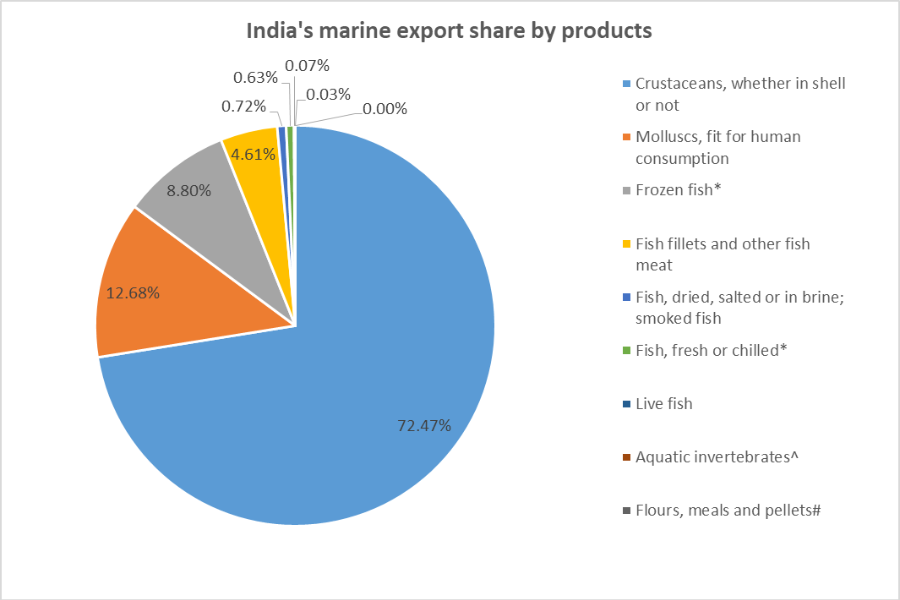

Source: ITC Trade Map data for 2022; *Excl. fish fillets & other fish meat under 0304); ^Other than crustaceans and molluscs…; #Of fish, crustaceans, molluscs, etc…

B. K. Mishra weighed in saying, “Speaking from the fisheries cooperative sector, I would say we need more focus and assistance in terms of marketing from the government. The potential of fisheries production will remain high in the coming days but the cooperative segment needs more attention from the government in my view.”

In fact, he believes that the production levels can reach up to 10% in the coming years through support provided under Pradhan Mantri Matsya Sampada Yojana (PMMSY).

He lauded the PMMSY scheme saying that the efforts to boost the fisheries sector of India are moving in the right direction. However, he noted that the scheme does not include the fisheries cooperatives.

“The scheme (PMMSY) should circulate down to the grassroots level. The central government is planning to establish two lac fisheries cooperatives in the coming five years. As of now, we stand at 28,000 such units and the reason for this restricted figure is lack of awareness. PMMSY has a subsidy component, for individuals up to 40-60% subsidy is available for all type of (fisheries) activities, however, there is little awareness of its benefits amongst smaller cooperatives,” he explained.

Way Forward

The central government is concentrating on creating new Fishing Harbours (FHs) and Fish Landing Centres (FLCs), which may offer secure facilities for fishing vessels to dock, berth, load, and unload. The construction of contemporary Fish Landing Centres (FLCs) and Fish Harbours is essential for the post-harvest management of the exploited fisheries resources.

India’s fisheries sector has grown significantly over the years, making it a major player in the worldwide seafood market. Contributing factors such as demand in global markets, regulatory frameworks, infrastructural development, and the adoption of sustainable fishing methods, all have an impact on the growth of fisheries exports. The latest fisheries export figures indicate that India’s top international markets are Japan, Thailand, Taipei (China), Lithuania and the USA.

“I believe as of now the export size of fisheries from India is at Rs. 6,000 crores and the central government is also focused on increasing the figures up to Rs. 1,00,000 crores in the coming years. But one thing I would like to say is that while the fisheries export market is quite organised, the same is not the case here in the domestic market. Production levels have a growth rate of 7% to 8% year-on-year basis, and I can say that the future of fisheries production is good,” Mishra said.

Mishra strongly emphasised on the inclusion of fisheries cooperative societies to further benefit the sector. There are 28,000 fisheries cooperatives with 40 lac people membership across the country. Mishra said that despite the huge size of the population engaged in fisheries activities, a research survey is yet to be done for such cooperatives. The fisheries cooperative comes under the Ministry of Cooperation. The sector is hoping for the PMMSY scheme to be converged with the Ministry of Cooperation to benefit fisheries farmers in a cooperative structure.

“Cooperative sector has immense potential. With additional support, our sector can contribute 5-10% to the fisheries production capacity. There must be a study on the potential of fisheries cooperatives and their strengths. If assistance is provided to the 24 state-level federations, they can support the cooperatives at the grassroot levels,” he added.

The hope for the convergence of the PMMSY scheme with the Ministry of Cooperation underscores the importance of collaboration for the benefit of fisheries farmers in the cooperative structure. Although the fishing industry in India has seen tremendous success, more work, coordination, and planning are clearly needed to realise its full potential.

Leave a comment