Indian pharma post-COVID: On the innovation trail?

Post-COVID-19, India needs to strengthen its pharma R&D ecosystem to tap into emerging drug development opportunities, particularly in the realm of infectious diseases. As the global R&D ecosystem moves towards a more collaborative approach and possibly accelerated new drug development cycles, India needs to reorient its pharma industry to become an innovation hub.

• Indian pharmaceutical industry is a global leader in generics space. But it still grapples with low investments and capabilities in R&D.

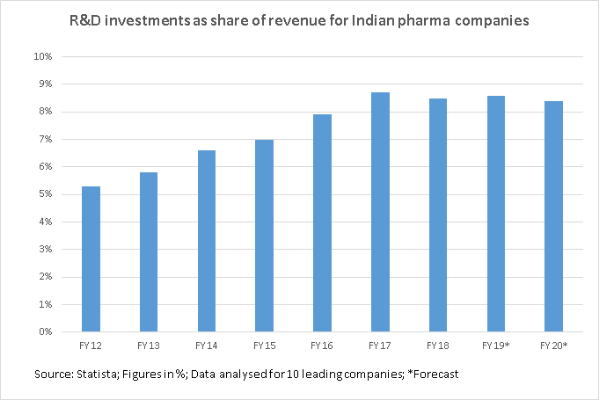

• As a result, the industry is the third largest in the world by volume but the 13th largest by value. Indian companies typically invest much less in R&D as a proportion of sales at an average of 8.5%. In comparison, global pharma leaders invest around 20-25% of their revenues in R&D.

• There is a need to tap into emerging opportunities to become a global R&D leader, by ensuring greater government-academia collaboration, higher investments and improvements in the quality and the efficiency of the new drug development process.

• Post-COVID-19, Indian industry needs to initiate greater collaboration with academia and government to build a strong R&D ecosystem to tap into emerging opportunities, particularly in the realm of infectious diseases.

Indian pharma has long been a leading supplier of generics drugs. The industry provides 20% of the global supply of generics drugs by volume and 62% of the global supply of vaccines. Around 60,000 Indian generic brands cover 60 therapeutic categories and manufacture over 500 different Active Pharmaceutical Ingredients (APIs).

Once we have a winner in the race towards the development of a vaccine for COVID-19, India is pivotal to ensuring global access, as the leading producer of vaccines in the world. In fact India itself is part of the race with an indigenous vaccine in trial stage – Bharat Biotech’s Covaxin based on the inactivated virus procured by ICMR.

As the global pharma R&D ecosystem goes through a massive upheaval in the midst of the pandemic, innovation is equally a point of introspection for Indian pharma companies. Over the years, the debate has intensified on how it has become critical to improve India’s capabilities as well as agility in terms of R&D, be it in terms of new pharmaceutical products, specialty generic complex drugs, biologics or biosimilars. But given that India has not yet been able to develop a globally competitive R&D ecosystem, it could cost the industry several lucrative opportunities to reach the big league, particularly in the post-COVID period.

The Indian Pharmaceutical Alliance (IPA) and McKinsey jointly released a report The Indian pharmaceutical industry – the way forward’ in 2019, which stresses that India needs to be an innovation leader, by 2030, if it aspires for global leadership in the pharma industry. The report states:

We believe that the industry can aspire to build a strong innovation pipeline (with three to five new molecular entities launched or in late clinical trial phases and 10-12 incremental innovation launches per year by 2030) and enhance Indian pharma’s significance beyond generics, to biologics, new drug development and incremental innovations.

This can help it tap new lucrative opportunities; for instance, biosimilars is projected to be worth US$ 60 billion by 2030. By just capturing just 10% of this share, the industry can grow by 13%, according to the report.

So far, the Indian pharma industry has a rather unenviable record on R&D. The report concludes that this is in part due to a limited government-funded research ecosystem. Moreover, India has just around 2,000 PhD students in pharmacy institutes, placing it unfavourably vis-a-vis a competitor like the US, which has 15,000 students enrolled.

Furthermore, the report bats for a more conducive interface between the government and industry for the success of innovation-focused research initiatives. Securing participation from government institutes in clinical trials is also difficult due to multiple regulations.

Indian pharma companies are also not very aggressive in terms of investments into R&D. An analysis of 10 leading pharma firms in India shows an average R&D investment of 8.5% of sales in FY ’18, which is forecasted to decline to 8.4% in FY’20.

On the other hand, the average R&D investment for pharma firms is pegged at around 17% of revenue globally, which is only bettered by the semiconductor industry. Leaders like AstraZeneca, Eli Lilly and Roche spent even more, in the range of 20-25% of revenues. R&D intensity remains consistently high for competing countries, particularly the US, which accounts for over half of global pharma R&D investments.

The reasons can be better understood when we look at the broad data on R&D outcomes. New drug development typically requires investments of US$ 10-12 billion, and an average development time of 10-12 years. Yet, only around 8% of developed drugs get regulatory approval.

The industry is looking at ways to reduce both the development times and costs, and improve chances of successful applications. These include interventions like in-silico, computational modelling and proteomics.

Digitisation of labs can be quite fruitful in streamlining and seamlessly integrating the entire pharma product life cycle process, besides improving quality controls, efficiency and cost optimization, according to Dr Chaitanya Kumar Koduri, Associate Director International Public Policy, Advocacy and Engagement, United States Pharmacopeia.

Facing new realities post-COVID-19

Experts are confident that global efforts to fast track the vaccine development and approval process itself could lead to a disruptive transformation in the new drug development process in the coming years. One instance is the use of real world evidence (RWE) to identify treatments and fast track the process. Sanjay Singh, Partner, Deal Advisory, KPMG India, affirms:

Drug and vaccine development effort in response of COVID-19 pandemic is unprecedented in terms of scale and speed. It is expected that a vaccine could be developed in next few months and this will indicate a fundamental change from the traditional vaccine development pathway which takes around 10 years.

This could be a harbinger of changes in the traditional approach to more parallel, collaborative and adaptive development mechanisms. Such an approach will involve more closer coordination and engagement between actors, including the industry, regulators, policymakers, funders, public health bodies and governments.

De-centralisation of clinical trials has received a major push during the pandemic. Trials have already been shifting to a more patient-centric model. An example is the use of an oral therapy for patients rather than IV. This ensures they do not have to stay in the hospital for half a day to a complete day before they can go home. A tertiary care network of nurses can in fact assist them from the comfort of their homes.

Digitisation was also an evolving trend, accelerated due to the necessity to have minimum patients in the hospitals amidst the pandemic. Clinical trial operations have also been severely disrupted due to the pandemic. To manage the disruption, clinical leaders are focusing on options to reduce patient and site burden, including remote patient engagement, in-home nurse visits, shipping investigational medicinal products directly to patients (with appropriate support), and conducting site-level outreach to ensure monitoring.

A number of companies have shifted to distributed trials with remote monitoring and source document verification, with tools and technologies such as eConsent, wearables, telehealth, telemedicine, and remote SDV.

The role of technologies like artificial intelligence is also getting very prominent amidst the COVID-19 crisis. What’s more, AI/ML is also being deployed to help find a vaccine against COVID-19. The systems search current literature on disease, study the DNA and structure of virus and then consider the suitability of various drugs. This is where natural language processing (NLP) comes in handy.

Dr Sriparna Saha, IIT Patna, affirms that techniques can be applied in building biomedical knowledge graphs, which illustrate the relationship between different biological entities (such as drugs and proteins) generated after processing several scientific articles. These disruptive trends in pharma R&D could act as an opportunity for Indian pharmaceutical companies to build a more sustainable R&D ecosystem.

Finally, the pandemic is expected to lead to a surge in interest towards treatment of infectious diseases. So far, government entities like U.S. National Institute of Allergy and Infectious Diseases, and philanthropic organizations like Bill & Melinda Gates Foundation have led this research. Infectious disease programs account for less than 2% of overall development pipeline. Considering the huge economic cost of the pandemic, there are indeed expectations of a major transformation in the approach of all stakeholders towards this area.

Winning in the brave new world

How can India make use of these emerging opportunities, and leverage the prospects of a shift in traditional R&D dynamics? P. D. Vaghela, Secretary, Department of Pharmaceuticals, has revealed during a virtual event in early August that the government is planning to come up with an exclusive Research & Development policy for the Indian pharma sector, to bring it at par with the industry in US and Europe.

He also highlighted how, in the absence of a strong push towards new drug development, India’s pharma industry ranked 3rd largest globally by volume but the 13th largest by value.

Towards this objective, the government is looking for ways to incentivise scientists for breakthrough innovations, even if they are on its own payrolls. In addition, it is planning to set up three National Centres of Excellence (CoE) for drugs discovery and medical devices.

One area of concern is that Indian companies have moved or are partly looking to move their R&D bases to the US due to 10% tax arbitrage. Well targeted incentives will be important to boost R&D, considering the huge costs involved. The industry has suggested that rather than the regime that provides 200% tax on R&D investments, the government could exempt revenues from patented and commercialised drugs from income tax.

In addition, strong price control mechanisms, generic prescriptions and ban on fixed dose combinations makes it less attractive for R&D investment for drugs to treat chronic and rare diseases, according to Sanjay Singh. While this policy orientation is understandable given that India is a developing country, ramping up penetration of health insurance can significantly bring down treatment costs for the masses. If health insurance adequately covers such ailments, it would encourage R&D investments in new and better drugs, as India becomes a more lucrative market for them.

Leave a comment