Pharma sector: Thrust towards self-sufficiency

• India’s pharmaceutical sector has been impacted by the non-availability of raw materials and price increases due to high reliance on imports from China.

• While pharma manufacturing has been exempted from lockdown, non-availability of labour and difficulty in reaching manufacturing plants have resulted in production shutdown for many pharmaceutical companies.

• Remote working is difficult to implement for pharmaceutical manufacturing and it can be encouraged for non-essential work force in the current situation.

• The post-COVID-19 era could witness an increase in the adoption of modes like tele-medicine, remote diagnosis & consultation, app-based interaction, e-pharmacy, etc.

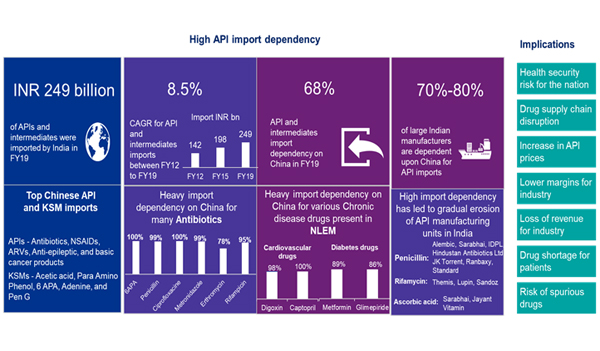

COVID-19 pandemic has created an unprecedented disruption and impacted all business globally. For the pharmaceuticals sector in India, the coronavirus related supply-chain interruptions have highlighted the vulnerabilities in the drug supply chain. The sector has been impacted due to non-availability of raw materials and price increases – as the reliance on imports from China is quite high.

The strategic nature of this dependence and potential supply shortage of essential drugs due to variations in the market dynamics – pose a threat to India’s drug security. There is an urgent need to improve India’s self-sufficiency and boost domestic manufacturing to achieve global leadership.

Following are the key impact areas of Covid-19 pandemic on pharmaceutical industry –

– APIs and KSM supply disruption

The domestic pharma industry relies heavily on import of bulk drugs as India imported around INR249 billion worth of bulk drugs in FY19, accounting for approximately 40% of the overall domestic consumption. With India’s API imports from China averaging around 68% of its consumption by value, the local industry is at the risk of supply disruptions.

– Increase in raw material cost

Due to supply disruption from China, the cost of many bulk drugs have increased i.e. Price of Paracetamol has gone up to Rs 400-450 per kg from Rs 250- 300 per kg; The price of vitamins and penicillin have increased by 40%-50% in India

– Ancillary goods supply constraint

Ancillary goods used in medicine production such as bottle, caps, packaging material are not considered under essential services and may face major supply disruptions in lock down period

– Inter-state transportation challenge

Lot of medicine stock comes from clusters like Baddi, Sikkim, Hyderabad etc. but due to the lockdown, inter-state transport is a challenge and it has become difficult to reach the retailers. Moreover, non-availability of transport facilities is also a major concern for the industry

– Labor force shortage

While pharma manufacturing has been exempted from lockdown, non-availability of labour and difficulty in reaching manufacturing plants has resulted in production shutdown for many pharmaceutical companies

– Low capacity utilization

Low capacity utilization of 40%-50% for both small and big manufacturers due to national lockdown. Non-availability of transport and logistics services, lack of courier services, reverse migration of contractual workers to their native places, absence of a significant number of staff in pharma units, raw material shortage among others, have led to low production in pharma manufacturing plants

– Export restrictions

The Indian pharma industry has been a world leader in generics both globally and in domestic markets contributing significantly to the global demand for generics in terms of volume. During COVID-19 pandemic situation, Government of India has conducted rigorous analysis around import dependency including finished APIs/raw material/KSMs, indigenous capacity and consumption to allow/restrict export of various drugs.

Employees in the pharmaceutical manufacturing play a crucial role in this unprecedented time as they ensure uninterrupted supply of medicines to patients. Pharmaceutical companies can manage operations while ensuring employee safety and social distancing by adopting following key measures –

– SOP guidelines: Develop an SOP to maintain social distancing and safety protocols

– New work shifts: Establish flexible work hours (e.g., staggered shifts), half work shifts, rostered duties, work from home for whoever it is possible etc.

– Transport alternatives: Company transportation buses and cars with social distancing norms to avoid public transportation

– Temperature checks: Thermal scanning of all employees prior to boarding company bus and before entering manufacturing sites

– PPE usage: Personal protective gear and hand sanitisers needs to be available at multiple locations at the sites

– Effective communication: Regularly communicating and educating employees on keeping minimum distances and refraining from physical contact

– Self-identification: Asking for self-identification through regular surveys or interview

– Mitigation measures: Mitigation measures for employees contacting COVID-19 and engaging with local authorities & healthcare providers

Remote working is difficult to implement for pharmaceutical manufacturing and it can be encouraged for non-essential work force in the current situation. With adoption of latest technology, many pharmaceutical companies are expected to slowly adopt to remote working for various functions. It will help in lowering the health risk for the workforce and avoiding unnecessary medical and insurance costs.

In the current COVID-19 pandemic situation, pharmaceutical companies are largely focused on facilitating access to medicines, streamline manufacturing operations, safeguarding employees, enabling employees to operate in a new environment and reaching hospitals and patients in new ways. Post COVID-19 crisis, following could be the new normal –

Drug and vaccine development effort in response of COVID-19 pandemic is unprecedented in terms of scale and speed. It is expected that a vaccine could be developed in next few months and this will indicate a fundamental change from the traditional vaccine development pathway which takes around 10 years. This example will necessitate the changes in the traditional approach to a more parallel, collaborative and adaptive development approach. In future, the industry, regulators, policymakers, funders, public health bodies and governments will need to collaborate more for speedy drug development process.

Sanjay Singh is Partner, Deal Advisory and Head, Life Sciences for KPMG in India.

Leave a comment