Cellphone industry: A case for holistic self-reliance

While ramp up in FDI is critical to the Indian cellphone industry, it must not come without a corresponing improvement in domestic capabilities.

• COVID-19 provides an opportunity for India to attract greater investments from global lead firms in cellphone manufacturing for domestic scaling up as well as exports.

• Recently announced policies including PLI, SPECS and EMC 2.0 are important interventions by the government in this regard.

• The industry has laid out a post-COVID roadmap with an ambitious target of US$ 110 billion in mobile handset exports by 2025.

• While the ramp up of FDI is critical to this technology-intensive industry in the near term, it should also lead to a rise in domestic capability with the build up of a strong component ecosystem.

The US-China trade war laid the foundations for a growing sentiment in a lot of Western companies to reduce reliance on China, and either shift back production to their home country or look for alternatives across the world. The same thought reverberated across the ecosystem in 2020 when COVID-19, the virus that originated in China, made its presence felt across the globe. This has ensured a greater distrust towards China and strengthened the resolve among nations to diversify their supply chains away from the Middle Kingdom.

While not country-specific, the Prime Minister’s Aatma Nirbhar Bharat initiative was launched as a clarion call to Indian industry to reduce dependence on imports. This, of course, has also acquired a China-specific dimension with the ongoing tensions at the border. However, the push for self dependence itself has to be based on a well planned, long term strategy, rather than a reactionary response to sudden crisis or geopolitical considerations.

The Indian electronics industry is one example, wherein the government proactively led the call to promote indigenisation under the Digital India programme. With the active involvement of the industry, the initiative has met with considerable success, especially in the cellphone sector. In 2018, India managed to replace Vietnam and catapult itself as the second largest mobile phone producer in the world after China, according to Indian Cellular Association. The findings suggest that annual production of mobile phones in India increased from 3 million units in 2014 to 11 million units in 2017; while imports of devices reduced to less than half in 2017-18.

Over the past 5 years, India has tried substituting imports by imposing duties on finished mobile phones and parts like batteries, chargers, wired headsets under the Phased Manufacturing Program by Ministry of Electronics and IT (MeitY). The country has consequently ended up becoming an assembling point for mobile phone devices like China & Vietnam.

Lucrative global arena

The amazing potential in networked products has been buttressed by the Economic Survey 2020-21 in the chapter on ‘networked products.’ The survey makes a case for export promotion over import substitution of networked products (including mobile handsets) and states, “By integrating ‘Assemble in India for the world’ into Make in India, India can create 4 crore well-paid jobs by 2025 and 8 crore by 2030. Exports of networked products, which is expected to equal US$ 7 trillion worldwide in 2025, can contribute a quarter of the increase in value-added for the US$ 5 trillion economy by 2025.”

The domestic manufacturing of smartphones in India is expected to grow at a faster CAGR of 48.4% between 2017 and 2025, as per a Frost & Sullivan estimate. India Cellular and Electronics Association (ICEA) and consultancy major EY have set a huge target to take mobile handset exports to US$ 110 billion by 2025. It is a goal worth pursuing for strategic reasons as well, since electronics are among the top import product categories in most markets across the world. Morever, with 3x growth between 2018 and 2025, the Indian mobile handset market is expected to get relatively saturated.

The COVID effect

COVID-19 has proved to be a double edged sword for the mobile handset industry. On the not so bright side, market research firms International Data Corporation (IDC) and Counterpoint Research estimate that sales in the Indian smartphone market are likely to decline by 13-15%. This forecast is attributed to the recent spate of job and salary cuts leading to deferred purchases, companies unable to ramp up production impacting supply of models, and the recent increase in GST on smartphones from 12-18% making models pricier.

On the brighter side though, the pandemic has created opportunities for the Indian mobile handset industry to replace China as the top mobile phone producer in the world. While PMP has helped in arresting the import of finished mobile phones partially due to shift of assembling operations to India, imports of parts and components have persisted due to lack of volumes within India.

Nothing has made India’s dependence on other countries like China more apparent than the COVID-19 outbreak and the consequent supply chain disruption. A report by market intelligence firm Counterpoint Research predicts that India’s share in global smartphone production is set to fall to levels seen four years back due to the pandemic from 16% in 2019 to 9% in 2020.

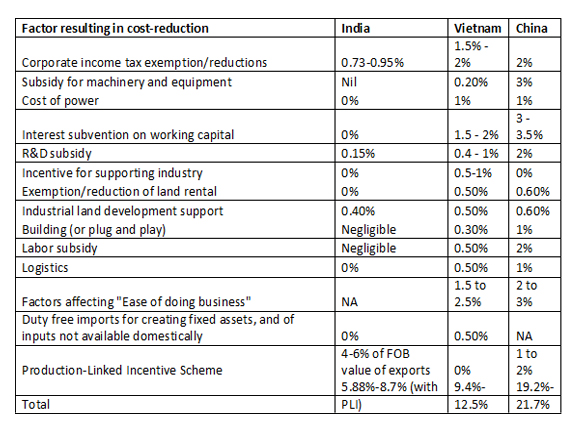

Apart from import dependency, there are other roadblocks affecting the sector’s performance. This is quite evident when India is compared to neighbours like Vietnam & China on a string of factors like corporate income tax exemptions; subsidies for machinery and equipment; R&D subsidy; labour subsidy; and so forth. If one looks at the overall subsidies offered by India (5.8%-8.7%), they are far lower than those offered by Vietnam (9.4%-12.5%) and China (19.2%-21.7%).

Source: Mobile manufacturing in a post COVID-19 world, An ICEA-EY report

On the road to the top

Recently, the government unveiled guidelines for three electronics manufacturing schemes – PLI, SPECS & EMC 2.0. As per the fresh guidelines, the Production-Linked Incentive Scheme will extend an incentive of 4-6% on incremental sales (over base year) of goods manufactured in India and covered under the target segments, to eligible companies, for a period of five years subsequent to the base year.

Meanwhile, Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors will provide a financial incentive of 25% on capital expenditure for the identified list of electronic goods. These include electronic components, semiconductor/display fabrication units, Assembly, Test, Marking and Packaging (ATMP) units and specialized sub-assemblies. Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme will enable the creation of world class infrastructure along with common facilities and amenities for attracting major global electronics manufacturers, along with their supply chains.

Pankaj Mohindroo, Chairperson, ICEA, is positive that these schemes will play a pivotal role for the mobile phone and the larger electronics industry to become a major export hub in the coming years:

“The recently announced trilogy of schemes – PLI, SPECS and EMC 2.0 – have laid the foundation for starting something big. The impact of the PLI scheme will be visible before the end of FY 2020-21. PLI is a very critical policy for the growth of our mobile phone exports. It is the engine of growth for the entire electronics industry.”

The roadmap provided by ICEA-EY in their report provides some insights into how the target of US$ 110 billion in exports can be approached. Firstly, it proposes that India incentivise the lead firms to undertake large-scale investments. Globally, around 80% of global mobile handset revenues are occupied by five lead firms – Samsung, Apple, Huawei, Oppo and Vivo. Greater policy certainty can encourage these firms to grow global supplies from India according to the report. This could help plug India into the global value chain and possibly facilitate transfer of technology and design capabilities. Prof Sunitha Raju, IIFT, offers a similar perspective for the entire electronics industry:

“If India has to emerge as a dominant player like China and South Korea, it needs to have the design capability coupled with manufacturing resilience and a developed tooling industry. Particularly with high rate of obsolescence and evolving technology in this industry, the investment climate needs to be conducive.”

Further, the report stresses on capitalising India’s labour arbitrage and demographic dividend over the next 10 years, since these advantages are not perennial. Due to rising complexity in manufacturing and the ever evolving technology trends, labour needs to be equipped with new-age technologies. The country is blessed with a burgeoning population with low skilled labour. While this kind of a model could thrive when it came to assembling mobile phone handsets, the country needs to specialise in skill-intensive stages such as R&D in order to produce sufficient number of mobile phone components.

Sum of parts dilemma

The report also argues for reduction in the high import duties for components sub-components, as they affect the price of the end product. This highlights the key challenge in achieving greater self-dependence. India certainly can emerge as a hub for the assembly of the final product, and it has made remarkable progress in the exports of mobile handsets, but the dependence on components for imports remains high. Local value addition is estimated at just around 10-15% when it comes to electronics manufacturing in India. MNCs continue to import a large share of the components, as evident from the rising component imports.

A strong local component ecosystem needs to be developed, as increasing FDI should also be coupled with rise in domestic capability. India has already achieved something similar in the automotive industry. Earlier, automotive MNCs focused on R&D of components, but had tier 1 and 2 suppliers that were primarily subsidiaries in their parent country or a third country. Indian ancillaries were tier 3 suppliers. They were largely restricted to producing spare parts. But as a result of the support provided to them, they moved up into the technology space in terms of making dyes and adapting to the technology.

Now these MNCs are importing from domestic suppliers in India. As a result, these domestic suppliers are catering to multiple companies extremely well. By following this route, India can boost its trade balance, encourage local enterprise, value addition and skill set upgradation in the near term. Over time, it may also lay the groundwork for the evolution of some homegrown brands in the cellphone space.

Leave a comment