Reducing Component Duties: A Boon for Made-in-India Smartphones?

India has transitioned from being a major importer to a significant exporter of smartphones. The country’s mobile phone production has grown exponentially, and exports are projected to reach nearly one-third of total production. Despite this progress, India faces challenges like a saturated domestic market and high production costs due to import duties on components.

In this article, we present two opposing viewpoints when it comes to import duties on components. One argues that reducing import duties would significantly boost exports. The other emphasizes the need for high duties to nurture a domestic component ecosystem. What path should India actually choose?

Source: Shutterstock

Over the past decade, India’s mobile phone manufacturing industry has witnessed exponential growth, producing approximately 2.45 billion devices valued at ₹19.45 trillion, a shade below its target of 2.5 billion phones worth about ₹20 trillion, stated ICEA. This achievement signifies a significant milestone, aligning with the government’s vision of fostering indigenous manufacturing capabilities.

The Indian Cellular and Electronics Association forecasts that exports will represent nearly one-third of the total domestic production of mobile phones, estimated at about ₹4.1 trillion (US$ 49.2 billion) in FY24. This projection underscores the pivotal role of exports in driving growth and enhancing India’s position in the global market.

A notable contributor to India’s export success story is Apple, which commenced iPhone manufacturing operations in the country in 2017. The expansion of Apple’s production facilities, coupled with the establishment of iconic Apple stores, underscores India’s attractiveness as a strategic market for leading technology companies.

India, the world’s second-largest producer of mobile phones behind China, exported mobile phones worth US$ 11 billion, or about ₹90,955 crore, in FY ’23, with total domestic production at US$ 44 billion, or ₹3.6 trillion.

“The sector has transitioned from being 78% import dependent in 2014 to 97% self-sufficiency currently. The future would be export growth-led,” the association said.

The government now intends to make India a critical part of global supply chains by offering its manufacturing capabilities in electronics to global value chains, or GVCs, as an alternative to China.

“As a next step, we have to ensure that we can shift electronics GVCs to India to create large-scale manufacturing, jobs, and increase domestic value addition,” said Pankaj Mohindroo, chairman, ICEA during an interaction with ET. “This, in turn, requires unprecedented competitiveness and factories that can operate at scales of the kind that have never been witnessed in India.”

He added that the doubling of India’s GDP from $3.7 trillion now to $7 trillion by 2030 will be led by growth in the digital sector and trade. “In both of these areas, electronics manufacturing led by mobile production will play a critical role,” he said.

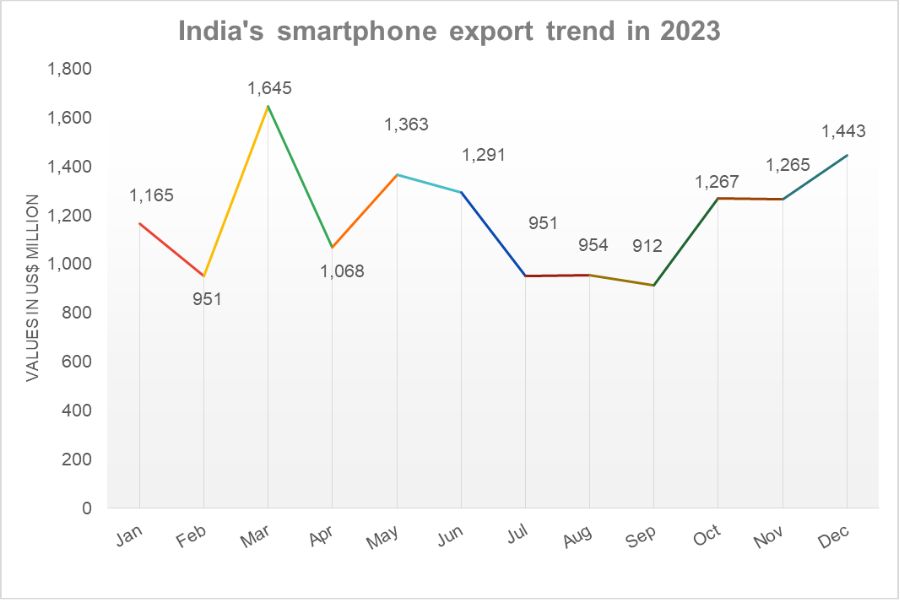

Export trends

As per available data for 2022, China was the topmost exporter of smartphones (HS 851713) with a value of US$ 138.8 billion. It was followed by Vietnam (US$ 33.33 billion), Hong Kong, China (US$ 27 billion), UAE (US$ 20.6 billion) and Czech Republic (US$ 9.6 billion). India was then ranked 7th globally. However, in 2023, India’s smartphone exports were valued at US$ 14.27 billion, registering a growth of 98% YoY. This would catapult its rank to the 5th position above the Czech Republic during the year.

Source: Ministry of Commerce and Industry

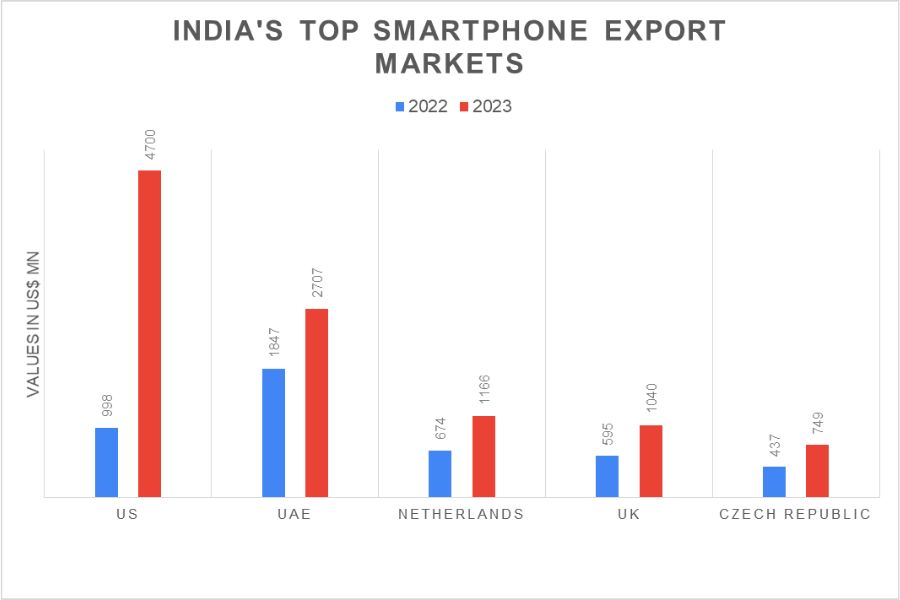

Top export markets in 2023 were the US, UAE, Netherlands, UK and Czech Republic. India has witnessed strong positive growth in all its top 10 markets with the exception of Germany (decline by 14.73% YoY). Turkey has seen the fastest growth in exports (524.5% YoY) followed by the US (371.1% YoY), UK (74.7% YoY), Netherlands (72.9% YoY) and Czech Republic (71.5% YoY).

Source: Ministry of Commerce and Industry

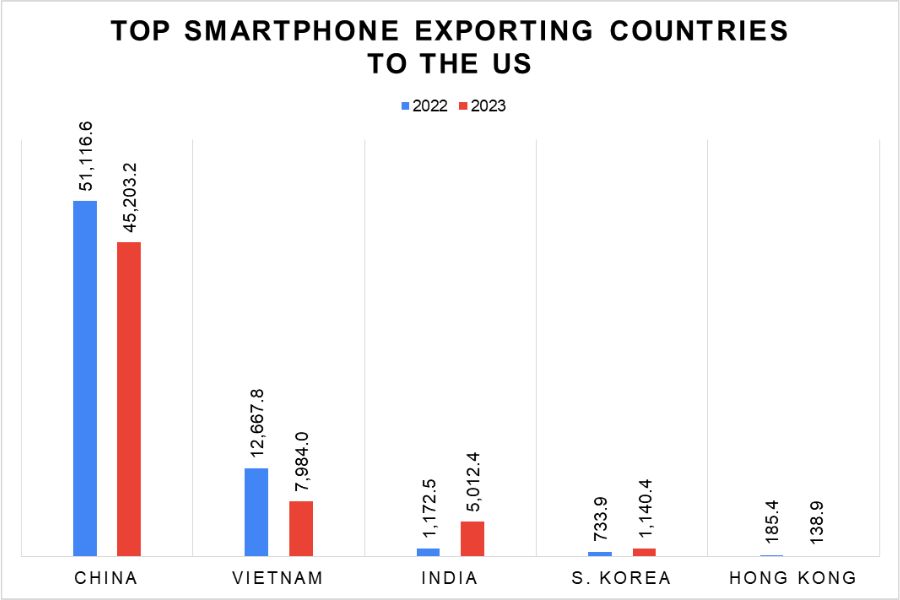

Now when you look at smartphone imports by the US, which is the world’s top market, one can further note the extent to which market share has swung in India’s favour.

US smartphone imports from the top five suppliers fell to US$ 45.1 billion in April-December from US$ 49.1 billion in FY23. China exported US$ 35.1 billion in smartphones to the US market between April and December, a decrease from US$ 38.26 billion the previous year.

Vietnam’s phone shipments fell to US$ 5.47 billion in April-December 2023, up from US$ 9.36 billion the previous year. Lower taxes in China and Vietnam boosted their exports. In 2023, exports accounted for only 25% of India’s smartphone production, compared to 63% for China’s US$ 270 billion and 95% for Vietnam’s US$ 40 billion.

The other two major smartphone exporters to the US are South Korea and Hong Kong. South Korea’s exports to America increased to US$ 858 million from US$ 432 million, while Hong Kong’s sales fell to US$ 112 million from US$ 132 million in April-December 2022-23.

Source: ITC Trade Map, DGCIS

India’s smartphone exports to the US, on the other hand, increased to US$ 5.01 billion in 2023, a staggering growth of 327.5% YoY. According to the Ministry of Commerce and Industry, smartphone exports stood at US$ 11.82 billion, marking a growth of 41.5% YoY in April-January, 2024, up from US$ 8.35 million in the same period last year. With this increase in exports, India has become the third-largest smartphone exporter to the US.

The way ahead

Looking ahead, the Indian government wants to position the country as a key component of global supply chains, offering its strong manufacturing capabilities as an alternative to China. Initiatives such as the Production-Linked Incentive (PLI) Scheme, Phased Manufacturing Programme (PMP), and Foreign Direct Investment (FDI) incentives help to foster a favourable environment for electronics manufacturing.

Despite the remarkable progress, India faces several challenges in establishing itself as a leading smartphone exporter. On the flip side, for instance, domestic market is showing signs of a slowdown. According to the Indian Cellular and Electronics Association (ICEA) of India, total value of domestic phone sales in 2023-24 stood at US$ 33 billion, the same level as FY23. One key reason could be mobile penetration, which has already crossed 83%. The installed base (feature and smartphones) is now touching 1.15 billion in a population of 1.4 billion.

Export percentage disparities persist, with lower tax regimes in competing nations such as China and Vietnam giving them a competitive advantage. Furthermore, high tariffs on specific components and rising production costs impede India’s export ambitions.

Data indicates that India has the highest tariffs among key manufacturing destinations, which constrains companies from de-risking their supply chains beyond China. According to a report by ICEA, India’s simple average tariff is 8.5%, while that for China is 3.7%. Similarly, in the case of FTA weighted average tariffs, India’s average is 6.8% compared to 0.7% for Vietnam.

ICEA cites two factors why increasing tariffs on inputs does not improve localisation. Firstly, India might not have the skills or technology to make these parts yet. Second, there wouldn’t be enough demand for these parts in India alone at present to make building them profitable.

Right now, India is trying to grow by selling phones to other countries. But high taxes on parts make Indian phones more expensive, thereby hurting both export prospects and domestic production. Building export scale is critical to improve investment and scale, which will consequently lead to acquisition of requisite technologies and skills. ICEA in fact claims that reduction in import tariffs could boost India’s smartphone exports by nearly three times to US$ 39 billion by 2027.

Earlier this year, the Centre cut import duties on mobile spare parts from 15% to 10%. The parts in question included battery covers, main lenses, back covers, and other mechanical items crafted from plastic and metal. According to an analyst, the parts comprise around 20-25% of the bill of materials (BOM), and therefore should have a positive impact on the cost.

However, Ajay Srivastava, Founder, Global Trade Research Initiative, feels that this is not a very valid enough argument. Firstly, the domestic component ecosystem has not developed sufficiently. Import share of the value chain is still very high at around 95% of the BOM in premium iPhones. In his view, it is important that import tariffs remain high on components to ensure such an ecosystem is allowed to develop. Furthermore, the likes of Apple and Samsung get total import duty exemption when they export these products, since their units (of contract manufacturers like Foxconn and Wistron) are based in SEZs. The import duties are applicable when the companies are selling these products to the domestic market.

An instance of this is the Apple iPhone 15, which was launched in September last year, retailed for Rs 134,900, which was higher than the prices in other destinations like US, Dubai and Singapore. For the components that Apple imports, it pays an import duty of 22%, even if the smartphone is ‘Made in India’. Combined with GST, it is a whopping 40% of the cost.

However, if one looks at value addition trends of smartphones in India over the past few years, there seems to be definite improvement. Local value addition for smartphones in India has improved steadily from around 6% in 2016 to 16% in 2023. In fact, Samsung is doing much better than Apple according to the report by Counterpoint, with a local value addition of 25-30% of the retail price, as compared to 6-8% for the latter. Analysts attribute it to Samsung’s presence in the country over a much longer period of time.

While there is a contradiction in the views, one thing is clear, that reducing prices of components will bring the cost down in the domestic market, therefore making it a better option for ‘Sold in India’ smartphones. That may actually help build scale in the domestic market. But India cannot also ignore the necessity of building a strong component manufacturing base, which will lead to a truly sustainable and robust ‘Made in India’ smartphone ecosystem. There has been some progress in this regard according to data, and we must not lose sight of this objective either.

Leave a comment