India’s Meat Processing Industry: Embracing technology for a sustainable future

India’s meat processing industry is undergoing a metamorphosis. Traditionally dominated by small-scale, decentralized operations, the sector is witnessing a surge towards modernization. This shift is driven by a confluence of factors: a booming population with rising protein needs, growing disposable incomes, and a changing appetite for convenient, processed meat products.

With a vast livestock population and a government actively promoting food processing initiatives, India is poised to become a major player in the global meat processing arena. This article delves into the exciting potential of India’s meat processing industry, exploring how cutting-edge technology is paving the way for a sustainable and efficient future.

Image Credit: Shutterstock

Meat processing in India encompasses a diverse range of practices, reflecting the country’s cultural, economic, and regional variations. Traditionally, meat processing has been largely decentralized, with small-scale operations prevalent across the country. However, in recent years, there has been a noticeable shift towards more centralized and mechanized processing facilities to meet growing demand and ensure quality standards.

India’s meat processing industry primarily focuses on poultry, buffalo, and goat meat. These meats are processed into various forms such as fresh cuts, frozen products, and value-added items like sausages and ready-to-eat meals. Additionally, stringent regulations govern hygiene, sanitation, and food safety in processing plants, enforced by government agencies like the Food Safety and Standards Authority of India (FSSAI).

In recent years, India’s meat production sector has experienced notable growth, with an annual output surpassing 6.3 million tons. Globally, India ranks fifth in terms of production volume, reflecting the industry’s increasing prominence on the international stage.

Processed Meat Scenario in India

With over 65% of the population being non-vegetarian, chicken and fish dominate consumption. Per capita meat consumption exceeds 4.9 kg, with a growing preference for processed options like salted and smoked products, enhancing taste and retaining quality. Leveraging abundant resources and relatively lower per capita consumption, India annually exports over 7,000 metric tons of poultry meat. Presently, frozen meat exports reach 60 countries, with major buyers including Malaysia, Egypt, UAE, Jordan, Thailand, and Yemen, signifying India’s expanding presence in the global meat market.

Changes in dietary preferences, increased awareness about nutritional benefits, increasing influence of international cuisines and escalating demand for convenience and processed meats and government initiatives are some of the key factors driving the market. According to a report by Statista, revenue in the Indian processed meat market amounts to US$ 2.72 billion in 2024 and is expected to grow annually by 6.05% (CAGR 2024-28).

India’s raw meat exports reached a value of US$ 3.6 billion in 2023, growing by 12.1% YoY. A large share of this value is taken up by Meat of bovine animals (US$ 3.2 billion). Exports of poultry products was recorded at US$ 168.6 million, growing by 44.5% YoY. The country was ranked 13th in terms of exports globally. Indian meat products are in demand globally due to cost competitiveness, perceived organic nature and low fat proportion. The Government of India has established standards for exports of meat which include standards for abattoirs and processing plants.

However, India’s exports of processed meat products is much lower at US$ 2.65 million, growing by 57.2% YoY. The country’s exports under HS 16 (Preparations of meat, of fish or of crustaceans, molluscs or other aquatic invertebrates) reached US$ 718.64 million in 2023, declining by 16.6% YoY, with US (US$ 577.3 million) dominating. The country was ranked 20th in global exports. But this export is dominated by marine products, particularly preparations of crustaceans (HS 1605, US$ 633.3 million) and prepared or preserved fish (HS 1604, US$ 82.9 million).

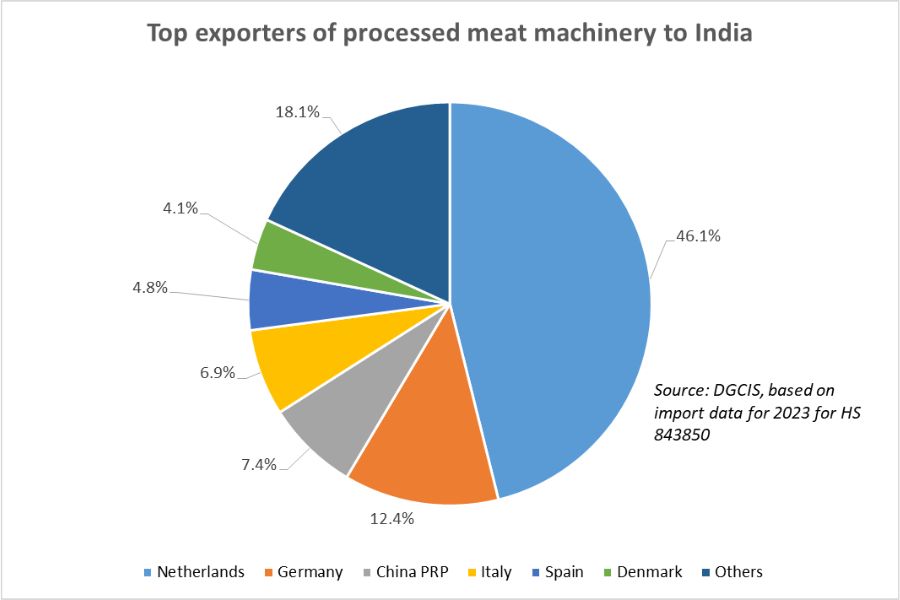

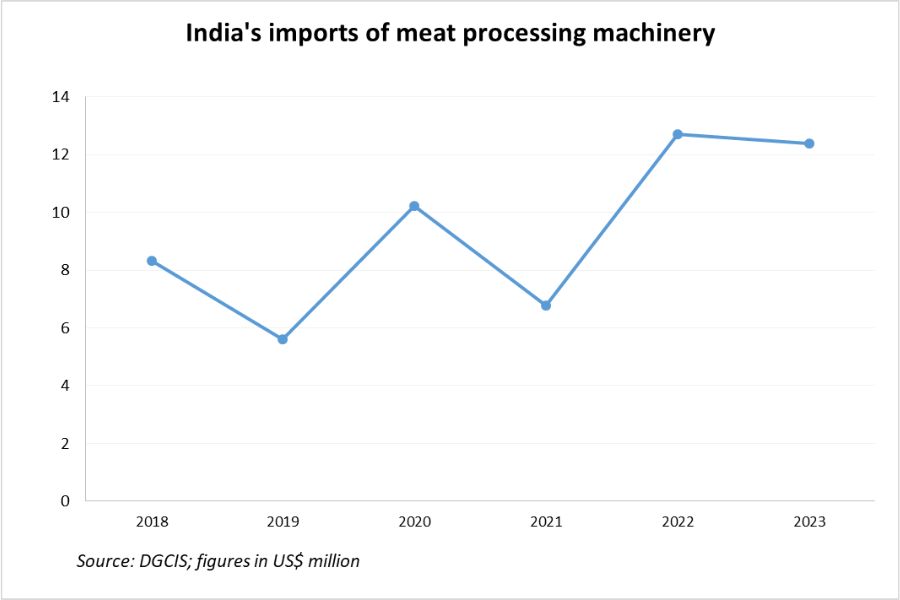

When we look at India’s imports of food processing machinery, it is another strong indicator of the growth potential in the market. Imports of Machinery for industrial preparation of meat or poultry (HS 843850) had reached US$ 12.4 million in 2023, growing at a 5-year CAGR of 8.2%. Top source countries for this machinery presently are Netherlands (US$ 5.72 million), Germany (US$ 1.54 million) and China (US$ 0.92 million).

Untapped potential

India has enormous untapped potential in the meat processing industry. It boasts the world’s largest livestock population, estimated at around 515 million and a global share of 3%. Contribution of livestock in total gross value added of the agriculture and allied sector has increased from 24.4% in 2014-15 to 30.2% in 2021-22. Further, as per Food and Agriculture Organization Corporate Statistical Database (FAOSTAT) production data (2021), India ranks 2nd in Egg Production and 5th in meat production in the world.

Egg production in the country has increased from 78.48 billion in 2014-15 to 138.38 billion nos. in 2022-23, growing at a strong CAGR of 7.35% over the past 9 years. The per capita availability reached 101 eggs per annum in 2022-23 as against 62 eggs in 2014-15. Meat production has increased from 6.7 million tonnes in 2014-15 to 9.77 million tonnes in 2022-23. As per 2019 data, meat processing levels are still very low at around 6% of poultry and 21% of meat.

Moreover, it must be noted that meat processing machinery industry globally is growing at a very strong pace, driven by innovation and disruptive technological advancement. The use of advanced machinery and automated systems have revolutionized traditional processes, with strongly positive improvements in production rates as well as product quality. Tedious and potentially dangerous jobs like slaughter, cutting, and deboning are being increasingly automated with robots. This improves worker safety and consistency.

AI powered vision systems can now assess meat on various quality parameters, optimise cutting processes and minimise waste. Moreover, advanced rendering techniques can also help leverage leftovers for other end use sectors like biofuels or feedstock. The growing interest in environmental conservation is also leading to various interventions, like the use of improved sanitation measures that use less water and utilisation of biodegradable bioplastics for sustainable packaging.

Within this extremely dynamic landscape, the Indian meat processing technology sector is buoyant with opportunities for trade, investment and also innovation, given various factors including strong policy support, a robust domestic market, cost competitiveness, untapped potential in meat processing and a rapidly emerging technology ecosystem. Moreover, discerning customers are increasingly demanding transparency, traceability and diversity in product offerings.

By leveraging its large and growing market, skilled workforce, and focus on sustainability, India can become a hub for developing, deploying and also commercialising advanced technologies that could in fact transform how meat is produced and consumed globally.

Leave a comment