Resolving India’s cotton conundrum

India’s cotton production and exports are experiencing decline and continued uncertainty, subsequently casting a shadow on the textile industry as well. On June 10, the Cotton Association of India (CAI) raised the country’s cotton output to 311.18 lac for the year 2022-23. The previous estimates of the trade body had put the numbers at 298.65 lac, lowest since 2008-09.

Moreover, as cotton prices stay alarmingly high and the industry faces the threat of high imports from China, the textile industry is facing a lot of pressure. IBT spoke with cotton and textile association leaders on the lull market sentiments globally and domestically. Experts believe that the textile industry is likely to jump back into action post October-November 2023.

Photo Source: Shutterstock

New Delhi, July 13: India’s cotton industry is facing challenges on production as well as exports in 2023 and industry leaders have raised concerns on both fronts. The cotton industry is dealing with shaky crop output forecasts, which are raising anxiety. Trade body Cotton Association of India (CAI) earlier estimated cotton output at 298.65 lac bales for 2022-23, the lowest since 2008-09 when the output figure was 290 lac bales. However, on July 10, CAI revised the figures to 311.18 lac bales for the previous year.

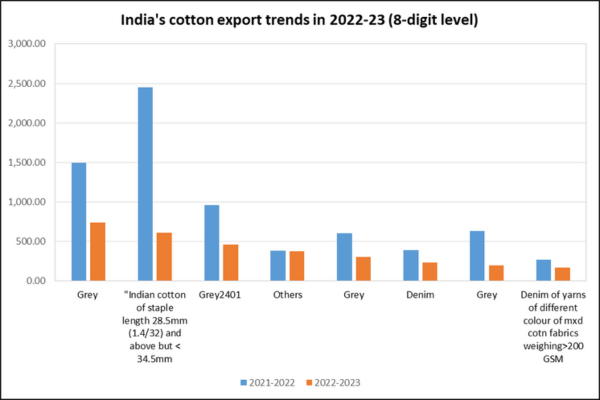

In FY 2022-23, India’s cotton exports were recorded at US$ 5.7 billion, a decline by 47.5% YoY. The major markets experiencing decline included China (-80.4% YoY); Vietnam (-66.9%); Bangladesh (-55.6%); Portugal (-52.5%) and Republic of Korea (-42.6%). Under the present times, changing economic situations of developed nations such as the UK and the US have impacted India’s cotton exports. This is further exacerbated by fierce competition from other exporting countries.

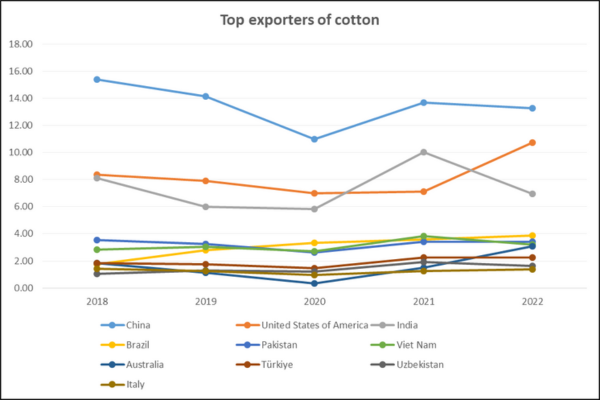

Source: ITC Trade Map; Figures in US$ billion

India has the highest cultivation area in cotton acreage with 120.69 lakh hectares area under cotton cultivation i.e. around 36% of world area of 333 lakh hectares. But declining output of cotton production can be attributed to various reasons such as changing weather patterns, pest infestation, ineffective seed, and wrong agriculture practices. Allied industry segments have begun to feel the heat of the low outcome.

Along with dip in cotton output, the exports of cotton and its derivatives, such as textiles and apparel, are facing steady decline due to lower demand from the international as well as the domestic market.

According to a report published by the United States Department of Agriculture (USDA) on July 3, 2023, cotton output estimate indicates a minor decline in global trade to 43.5 million bales, but an increase of nearly 6.0 million over the prior year. The report further states that nations such as Brazil, United States, Australia and India are likely to remain top exporting countries, though India and United States are likely to witness weaker export figures due to decline in demand.

A slow phase of cotton output in India

Global cotton imports reached US$ 60.2 billion in 2022, increasing by 7% YoY according to the ITC Trade Map. While India’s exports have witnessed a decline by 31% YoY, US and Australia have seen phenomenal increase by 51% YoY and 104% YoY respectively. Amont the other top exporters, Brazil (8%) has seen growth, while Pakistan and Turkey have remained static. China (-3%) and Vietnam (-13%) have also witnessed decline, but India has seen the largest decline of all.

Speaking to IBT, Ashwani Jhamba, Vice President, Indian Cotton Association Limited, stated that situation in Europe is such that the export market is slow, thereby resulting in decline of Indian cotton exports.

“Some of the estimates on crop production which were made were inaccurate. The local production of cotton had a direct impact on the costing of it, which has put India at a disadvantageous position in the international market,” Mr. Jhamba said.

On the international demand front, Jhamba explains that prices of electricity, gas, and the entire cost of living in Europe has increased upto four times. Due to such a situation, countries had to make a hard choice and shift the export priorities.

“So, the priority of the UK and US would be to look into suitable pricing from other competing countries. Russia-Ukraine war has also added to the misery,” he added.

Earlier in April 2023, Union Textiles Minister Piyush Goyal had said that decreasing yarn exports from India should be seen as a good sign for the country as that would make raw materials available for processing them into textiles and eventually, into garments creating jobs and opportunities in the sector.

However, Mr. Jhamba believes that the dip in exports may not prove to be entirely beneficial to the domestic market. On Monday, the Ministry of Commerce and Industry released India’s overall exports figures in June 2023, which states that textiles exports continued to decline in June 2023 because of subdued demand due to recessionary effects in major economies. Under merchandise imports, 21 out of 30 key sectors exhibited negative growth in June 2023… Textile Yarn Fabric, Made-Up Articles registered a negative growth of 33.72% last month.

“India’s production and export of cotton yarn is humungous. Given there is a dip in exports, the product market will also be affected? Exports are necessary to maintain the price balance in the domestic market for yarn and garment. According to my estimates, the textile industry is also operating at 40-60% capacity because domestic demand remains the same. It hasn’t shot up because of availability of surplus cotton yarn,” Jhamba told IBT.

On finding new international destinations to export Indian cotton, he adds that although exporters are attempting to sell yarn and textile to other countries, the competition on garments from China and Bangladesh has proven to be a deterrent for us. He predicts that the government may announce a minimum support price or MSP for raw cotton in the month of October this year.

Indian Textile Industry: No Gain, No Loss

Speaking to IBT, R. K. Vij, President, the Textile Association (India), also feels that the decline in exports has not benefited the textile industry in India. “Cotton production has not increased in the past 3-4 years. If you look at the figures, its production has been decreasing year-by-year. But the decline in exports is more concerning and has little to with the production factor. It is more because of the disturbance in the foreign countries. Global demand of cotton, or even textiles has dipped in European countries and the United States, which are the biggest export destination for the Indian textile industry.” He adds that the delta of the garment and spinning mills is not there, they are below cotton production level.

Usually what happens is that when the cotton production is low, its price shoots up which may result into a loss for the industry. But this time, even with low production of cotton, there is not much affect on the cotton prices because of subdued demand of garments. We were expecting cotton price to reach Rs. 70,000/Candy, however, it remains at Rs. 50,000-55,000/candy, as of today.

The domestic market performance as comfortably better than its competitors China and Bangladesh. Demand for cotton textile in the domestic market is expected to to jump back into action post October-November 2023 during the festive season. But Vij has cautioned against China’s action of dumping sub-standard quality of textile and textile yarn in India. “China is not able to supply to the European countries and the U.S due to some geopolitical disputes. Hence it is directing its products towards India. We are not able to take full benefit of the domestic market. China is dumping Partially Oriented Yarn (POY), Fully Drawn Yarn (FDY), filament, yarn and fabric into India,” Mr. Vij has warned.

Though there is no imposition of an anti-dumping duty on textile imports, the central government is trying to identify low-cost material and restrict dumping of low-caliber textile products from China by placing Quality Control Standard (QCS). This is to ensure at least down-weight material does not enter the domestic market from China and other competitive importing nations.

Leave a comment