Indian wheat: Exploring new horizons

The global disruption in supply chains due to the Russia-Ukraine conflict has provided an opportunity for India to position itself as an alternative supplier. While current year production trends are not encouraging, IBT analyses the key markets that could open up for Indian wheat in the coming years.

Image credit: Shutterstock

Ukraine and bordering parts of Russia are abundant with the popular mineral-rich ‘black soil’ that is perfect for growing grains, earning it the title of the ‘world’s bread basket’. The two countries are major sources of wheat, barley, corn and sunflower oil to countries in Asia, Africa and the Middle East. But the global cereals trading system has been severely shaken since the conflict in Ukraine began. To compound it further, crop failures and supply chain disruptions, which failed to satisfy rising global demand, have led to a decline in food production and export supplies.

Continued imposition of Western sanctions, restrictions on Black Sea ports, mounting casualties, and destruction of Ukrainian agricultural areas has delivered a significant impact on global supply of wheat.

Around the world, countries that rely on food imports are grappling with a devastating cocktail of high interest rates, a soaring dollar and elevated commodity prices, eroding their power to pay for goods. Food importers from Africa to Asia are struggling to pay bills as a rise in the US dollar fuels a price rise.

In Egypt (one of the world’s top wheat importers), according to the Chamber of Cereal Industry, almost 80% of millers ran out of wheat and ceased operations as 700,000 tonnes of grain have been stuck at the port due to a forex liquidity crisis. Politics, public health crises, and climate change practically ensure that there will continue to be shortages in food supply.

India is the second largest producer of cereals, and was the world’s third-largest exporter in 2021. As a result, India was increasingly seen as an alternative source to fulfil global demand, particularly in wheat, given its huge buffer stocks. But the country imposed a temporary export restriction on wheat on May 13, in response to the damage of wheat crops brought on by early onset of summer and record heat waves. The government has revised downwards the estimate of wheat production by 5.7% YoY to 105 million tonnes in 2021-22. On October 19, the government has hiked the MSP of wheat, along with six rabi crops to boost reserves (which are at a 5-year low) and control inflation.

While current year trends are not encouraging, this report analyses export trends, growth rates, and market opportunities for India in Wheat and Meslin (HS 1001), which is the country’s second largest cereal export after rice.

Top markets for Indian wheat

From Tables 1 and 2, we see that India has negligible presence in the top 10 wheat importing countries, excluding Bangladesh, Indonesia and Philippines. These are the only three markets that feature among the top 10 wheat markets for India as well as for the world.

Table 1: World’s top importers and share of India’s exports in ‘Wheat and meslin’(HS 1001)

| Importers | Imported Value (US$ mn) in 2021 | Import CAGR (2017-2021) | Value exported by India in 2021 (US$ mn) | Export CAGR of India (2017-2021) | India’s share in imports (%) |

| Indonesia | 3,548.356 | 6 | 98.571 | 427 | 2.8 |

| China | 3,038.667 | 38 | 0.001 | 0 | 0 |

| Nigeria | 2,742.845 | 24 | 0.044 | 54 | 0 |

| Türkiye | 2,692.623 | 28 | 0 | 0 | 0 |

| Iran, Islamic Republic of | 2,486.51 | 494 | 0.273 | 0 | 0 |

| Egypt | 2,463.551 | -2 | 0 | 0 | 0 |

| Algeria | 2,342.526 | 6 | 0 | 0 | 0 |

| Italy | 2,296.833 | 7 | 0 | 0 | 0 |

| Bangladesh | 1,958.455 | 13 | 1031.427 | 489 | 52.7 |

| Philippines | 1,950.906 | 9 | 86.759 | 0 | 5.3 |

Source: ITC Trade Map

Table 2: The top-10 countries for exports of ‘Wheat and meslin’(HS 1001) from India

| Importers | Value exported in 2021 (US$ mn) | Share in Partner’s imports (%) | CAGR of exports (2017-2021, %) | YoY growth in exports in 2021 (%) | Share in India’s exports (%) |

| Bangladesh | 1,031.43 | 52.7 | 489 | 999 | 59.8 |

| United Arab Emirates | 135.18 | 39.8 | 185 | 501 | 7.8 |

| Sri Lanka | 123.63 | 34.6 | 283 | 550 | 7.2 |

| Indonesia | 98.57 | 2.8 | 427 | 5.7 | |

| Philippines | 86.76 | 5.3 | 23540 | 5 | |

| Yemen | 74.84 | 9 | 4.3 | ||

| Nepal | 60.15 | 100 | 20 | -21 | 3.5 |

| Qatar | 34.77 | 64.3 | 576 | 538 | 2 |

| Korea, Republic of | 22.65 | 1.3 | |||

| Oman | 21.33 | 17.2 | 361 | 9,506.00 | 1.2 |

Source: ITC Trade Map

The leading markets where India has been unable to mark its presence are China, Nigeria, Turkey, Iran, Egypt, Algeria and Italy. Iran is the fastest growing import market for wheat among the top 10 importing countries between 2017 and 2021 (CAGR of 494%). It is followed by China (38%) and Turkey (28%).

When we consider India’s top 10 exporting markets, the fastest growth is being witnessed in in Qatar (576%), followed by Bangladesh (489%) and Indonesia (427%).

Bangladesh accounted for nearly 60% of India’s wheat exports, while UAE, Sri Lanka, and Indonesia had a share of 7.8%, 7.2%, and 5.7% respectively. On the other hand, India has low share in imports of Indonesia (2.8%), Yemen (9%) and Philippines (5.3%). This shows that each of these markets can be explored more deeply for potential gains in share. Besides these, India has managed to send shipments to Egypt (US$ 20.42 million), Turkey (US$ 18.74 million) and Nigeria (US$ 13.67 million), according to data for April-August, 2022-23. As discussed earlier, these are among the global top 10 importers of wheat where India had a negligible share. India can look to build its momentum in these markets, as they are lucrative for wheat imports.

Focus market: Indonesia

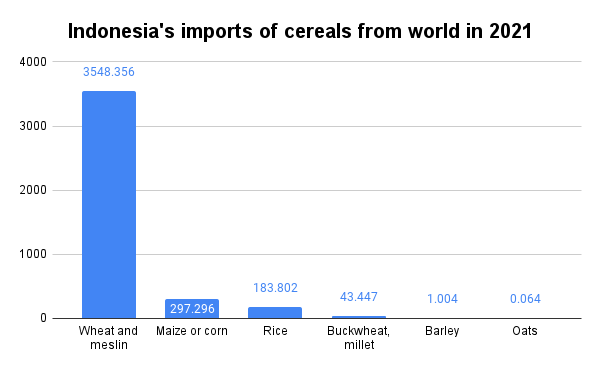

After a more detailed assessment, we have selected Indonesia for a deeper analysis into product groups. Indonesia is entirely dependent on imports of raw material to satisfy its growing consumption of wheat-based products and keep its growing flour milling sector supplied. India has a great opportunity to export to Indonesia as it is the largest wheat importing country in the world, with total imports of US$ 3.5 billion in 2021.

Source: ITC Trade Map, value in US$ million

Indonesia’s position as an importer of wheat is unlikely to change because of the rapid rise in consumption of wheat by both people and livestock. While Indonesia’s imports from the world have grown by 6% over 2017-21, India’s growth in exports to Indonesia during the period is 427%.

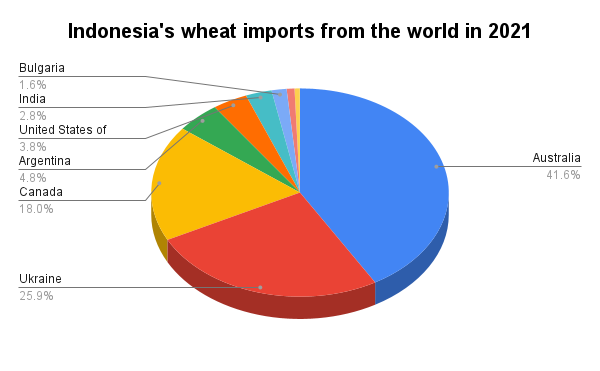

Furthermore, Table 2 shows that India’s exports account for very little share in Indonesia’s market (5.7%) with a value of US$ 98.57 million. Indonesia’s imports of wheat mainly come from Australia (41.6%) Ukraine (25.9%) and Canada (18%).

Due to the ongoing conflict between Ukraine and Russia, Indonesia’s dependence on Ukraine for large-scale food imports is costing it dearly. India can position itself an alternative source of wheat and enhance its market share in Indonesia.

VERY DEEP INSIGHT BUSINESS LEAD. GOLDEN OPPORTUNITY.