Flavourful shifts driving the processed potato market

Embarking on a flavorful journey, our exploration dives into the heart of the global potato processing market, unlocking trends, challenges, and opportunities that define this dynamic industry. As the market catapults from $29.28 billion in 2021 to a projected $46.99 billion by 2030, our focus sharpens on the crucial role played by Indian processed potato exporters in this growth trajectory.

The article identifies strategic considerations for Indian exporters. From quality control measures to collaborative initiatives, the piece aims to equip Indian stakeholders with the knowledge needed to harness the immense potential within the global processed potato market. Stay tuned for an in-depth analysis tailored for those steering the course of Indian potato exports in the international marketplace.

Image source: Pixabay

According to Skyquest’s recent research report, the global potato processing market was valued at US$ 29.28 billion in 2021. It is expected to rise from US$ 38.74 billion in 2022 to US$ 46.99 billion by 2030, rising at a CAGR of 5.42% over the forecast period (2023-30).

The potato processing market is driven by the rising demand for healthier and organic potato products. Other factors include:

- Rising popularity of value-added potato snacks

- Increasing focus on sustainable and eco-friendly processing methods

- Introduction of innovative potato processing techniques, and

- Growing market for specialty and gourmet potato products.

Other than this, the expansion of the ready-to-eat potato meal segments and rising demand for customised and flavoured potato products are also adding to the growth. Expansion is further aided by adoption of automation and digitalization in potato processing facilities, emerging markets, and untapped opportunities for potato processing.

Potato processing involves the conversion of potatoes into a variety of food products and by-products via various manufacturing methods. French fries, potato chips, mashed potatoes, and dehydrated potatoes are the most popular processed potato items. The techniques of processing are determined by the desired result as well as the quality of the potatoes.

Quick-service restaurants (QSRs) have also played a pivotal role in fueling the growth of processed potato products. The convenience and affordability of potato-based items have made them a staple on QSR menus worldwide. French fries, for instance, have become synonymous with fast food, contributing significantly to the industry’s success. In India, renowned QSR chains like McDonald’s, KFC, and Burger King have all integrated potato-based products into their offerings.

Read More:

- India’s Processed F&B exports to US: Envisioning a $5 bn export target

- From Local to Global: Empowering India’s Food Processing Sector

- Flaring vegetable prices levitate India’s headline retail inflation

Global trade analysis

The US accounted for 16.2% of global imports of processed potatoes, valued at US$ 1.68 billion in 2022, with a CAGR of 14% between 2018 and 2022. The UK came in second (US$ 960.17 million, CAGR of 5%), followed by Japan (US$ 648.55 million, CAGR of 8%), France (US$ 636.06 million, CAGR of 2%) and Germany (US$ 414.06 million, CAGR of 4%).

World’s Top 5 Importers of processed potatoes

| Importers | Value imported in 2022 (US$ million) | Average annual growth in value, 2018-22 (%) | Annual growth in value, 2021-22 (%) | Share in world imports (%) |

| World | 10,401.2 | 7 | 29 | 100 |

| US | 1,683.5 | 14 | 26 | 16.2 |

| UK | 960.2 | 5 | 95 | 9.2 |

| Japan | 648.6 | 8 | 36 | 6.2 |

| France | 636.1 | 2 | 15 | 6.1 |

| Germany | 414.1 | 4 | 10 | 4 |

Source: ITC, Trade Map, Data for HS Code 200410

The global import of processed potatoes stood at US$ 10.4 billion in 2022, up from 8.05 billion in 2021, growing at a CAGR of 7% during 2018-22.

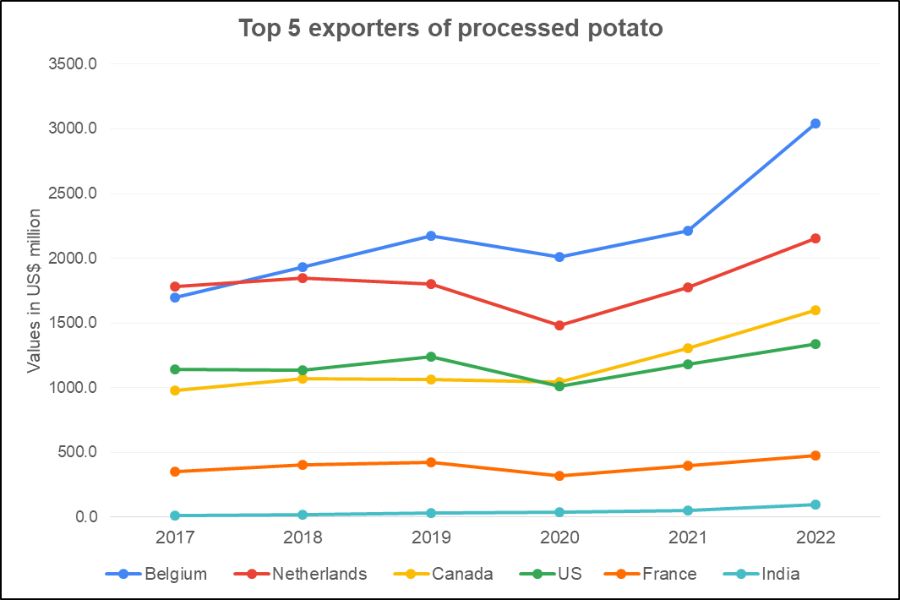

Source: ITC, Trade Map, Data for HS Code-200410

World’s Top 5 exporters of processed potatoes

| Exporters | Value exported in 2022 (US$ million) | Average annual growth in value between 2018-22 (%) | Annual growth in value for 2021-22 (%) | Share in world exports (%) |

| World | 10,184.4 | 7 | 26 | 100 |

| Belgium | 3,040.3 | 10 | 38 | 29.9 |

| Netherlands | 2,153 | 3 | 21 | 21.1 |

| Canada | 1,600.5 | 11 | 23 | 15.7 |

| US | 1,339.6 | 3 | 14 | 13.2 |

| France | 476.6 | 3 | 19 | 4.7 |

Source: ITC, Trade Map, Data for HS Code-200410

Among the top exporting countries, Belgium accounted for 29.9% of the world’s overall exports of processed potatoes, valued at US$ 3.04 billion in 2022, with a 10% CAGR between 2018 and 2022. It was followed by the Netherlands (US$ 2.15 billion, negative CAGR of 1%), Canada (US$ 1.6 billion, CAGR of 6%), the US (US$ 1.33 billion, CAGR of 0%), and France (476.55 million, CAGR of 1%).

India’s trade in processed potatoes

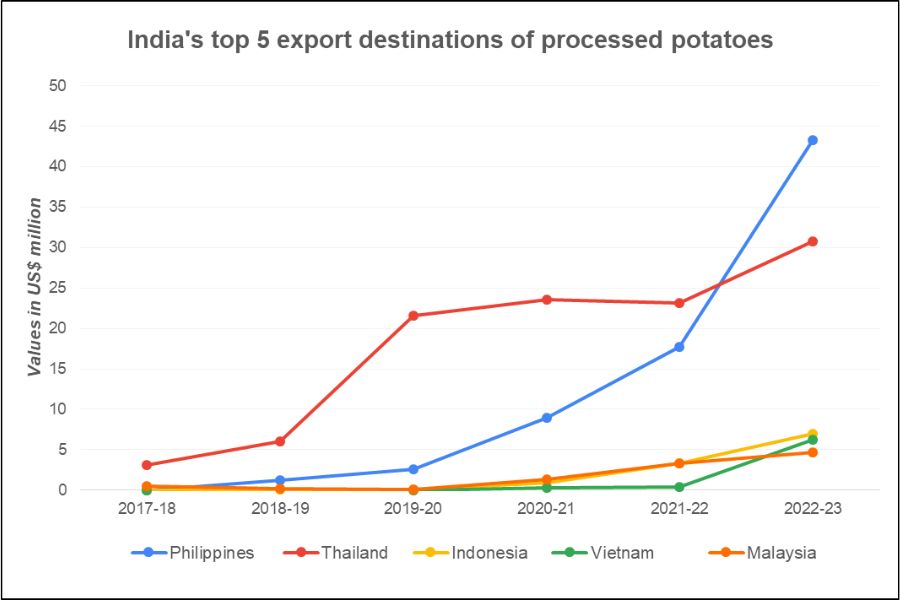

India’s processed potato exports to the world have been growing for the past few years. In 2022-23, India exported US$ 107.49 million of processed potatoes to the world, up from US$ 56.7 million in 2021-22, growing at a CAGR of 44.2% during the period (2017-23).

Source: Ministry of Commerce and Industry, Data for HS Code-200410

India’s total exports of processed potato to the Philippines stood at US$ 43.24 million in 2022-23, followed by Thailand (US$ 30.78 million), Indonesia (US$ 6.99 million), Vietnam (US$ 6.22 million), and Malaysia (US$ 4.64 million).

India’s processed potato export share is negligible when it comes to the world’s top 5 importers, i.e. US, UK, Japan, France and Germany. This indicates opportunity for Indian processed potato manufacturers and exporters to cater to the global demand and grow their exports in the growing international markets.

A notable trend is the growing numbers of health-conscious consumers who are looking for healthier alternatives to traditional potato products, leading to the development of baked or air-fried options.

Additionally, the inclusion of innovative flavours and seasoning blends, as well as the use of sweet potatoes and other root vegetables, has diversified the product portfolio, appealing to a broader audience. And, India has the potential to meet these requirements.

However, in the view of Prashant Srivastava, Incubation Expert at EY, “The current situation in the potato market has been influenced by global pressures, prompting a temporary relaxation in export regulations. The future of potato product exports depends upon our ability to increase production and meet the stringent quality standards mandated by importing nations. Meanwhile, the domestic potato market continues to witness elevated prices, and this trend is likely to persist until the arrival of new harvests.”

Challenges in exporting processed potatoes

Indian exporters of processed potato face some specific challenges in expanding their potato production and exports, such as:

- Quality and safety standards in importing countries: Importing countries often have stringent quality and safety standards for processed food products, which can be difficult and costly for Indian exporters to meet. For example, the European Union has strict regulations on the use of certain pesticides and additives in food products.

- Lack of awareness and acceptance of Indian processed potato products in international markets: Indian processed potato products are not as well-known or accepted in international markets as some other processed food products from India, such as spices and rice. This can make it difficult for Indian exporters to find buyers and compete with established brands from other countries.

- High competition from other exporting countries: There is a lot of competition in the global market for processed potato products. Major exporters include China, the Netherlands, Belgium, and the US.

- High freight costs: The cost of transporting processed potato products to international markets can be high. This is especially true for products that require cold storage, such as frozen potato fries. High freight costs can make Indian processed potato products less competitive in international markets.

- Lack of infrastructure: India’s infrastructure for processing and exporting food products is underdeveloped. This can lead to delays and spoilage, which can increase costs and reduce the quality of products.

- Seasonality: Potato production in India is seasonal, which can make it difficult for exporters to maintain a consistent supply of products throughout the year.

According to Manish Sharma, founder of Best Fruit, “India’s small businesses in the potato sector often grapple with limited storage infrastructure, making it challenging to maintain potatoes for extended periods for processing and ensuring a smooth supply chain.”

Addressing these challenges requires strategic investments in modern storage facilities and improved cold chain logistics. Collaborative efforts between the government and private sector can enhance storage capabilities, fostering sustainable growth in the industry.

Future Potential

The future potential of the processed potato industry appears promising. As more consumers seek convenient, affordable, and flavorful food options, processed potato products are likely to remain a staple in the global market. The industry’s ability to adapt to changing consumer preferences and embrace sustainability practices will be crucial to sustaining this growth.

Despite the challenges this industry is facing, there is a growing demand for Indian processed potato products in international markets. Indian exporters can overcome these challenges by investing in processing and packaging technology, adopting best practices for food safety and quality control, and developing strong marketing and branding strategies.

This industry will continue to evolve, driven by changing consumer preferences and the innovation of products. Stakeholders in India and around the world need to stay attuned to these developments, ensuring a bright future for the processed potato industry.

Leave a comment