Bulk liquid storage: Building blocks for a brighter future

The Indian bulk liquid storage and logistics industry needs to ramp up capacities, improve customer-centricity and fast-track deployment of new technologies to cater to prospects of growing demand in end-user industries.

- The bulk liquid storage industry provides vital support to diverse industries including crude oil LNG, POL products, bulk chemicals and petrochemicals.

- In the context of India, bulk liquids, – petroleum, oil & lubricants (POL), bulk liquid chemicals and edible oil account for around 32% of volume share at major ports. The sector has huge relevance to India considering that it is the 6th largest chemical producer and 4th largest agrochemical producer in the world.

- However, India faces critical shortcomings in liquid storage and logistics infrastructure. The liquid bulk capacity utilization is presently at around 90-95%, while the desirable international average is 70-75%. While overall port capacities in India are estimated to grow at a CAGR of 6-8%, liquid bulk capacity growth is lower, at around 3-5%.

- The industry needs to come up with respect to building end-to-end capacities, improving efficiencies and fast-tracking deployment of new technologies like IoT, automation and blockchain.

In the initial days of the COVID-19 pandemic, the world witnessed record low oil prices due to the lockdowns and virtual absence of demand. For the first time in history, WTI crude oil prices fell to –US$ 37.63 per barrel on April 21, 2020. This situation provided oil importing countries like India with a terrific window of opportunity to boost its oil storage as an important buffer against future externalities. Peter Davidson, Executive Director, Tank Storage Association (UK), explains that this realisation has been pretty much consistent across the global bulk liquid storage industry:

“Against the background of increased demand for petroleum storage globally and a decline in oil demand due to the COVID-19 pandemic, the critical importance of bulk liquid storage terminals in responding to market fluctuations and in improving the flexibility of the entire supply chain has undoubtedly come to the fore.”

However, India’s strategic oil reserve capacity (of around 39 billion barrels) is particularly low, providing cover for only around 9 days. This compares quite unfavourably to countries like US (730 million barrels) and China (550 million barrels). Two strategic oil reserves which were planned in 2018 will take India’s total reserves to 87 days (including 67 days of commercial stocks in refineries and armed forces stocks). However, they would take 5-7 years to complete.

This instance highlights the importance of a strong and robust storage and logistics industry, which caters to not just oil, but a wide range of other liquids. The bulk liquid storage industry provides vital support to diverse bulk liquid industries including crude oil LNG, POL products, bulk chemicals and petrochemicals. It holds inventory to guard against supply/demand mismatch, hedge against price volatility, safety buffer or even strategic reserves of national importance.

These liquids act as raw materials for a number of downstream sectors – automobiles, textiles, consumer durables, personal care, energy, food production and processing. Marine transport is estimated to account for 95% of volume and 70% of volume transfer of bulk liquids.

Globally, tank storage is growing a CAGR of 7-9%, owing to increasing demand for fuel and raw materials in emerging economies, rise of new producers in segments such as shale oil, and cleaner fuels like LNG. Another major driver is the growth in chemical feedstock demand from Asia and Africa, as they increase their capacity for processed chemicals and agro-chemicals for domestic and overseas markets.

Regional dynamics are in a state of flux, with restructuring and consolidation across refining capacities in Europe, Japan and Australia on one hand, and new capacity in Middle East, India and Southeast Asia on the other. Growth in demand for vegetable oils such as palm, rapeseed and sunflower oil as well as a rise in preference for processed food products and Western lifestyles are also driving the growth of the bulk liquid storage industry.

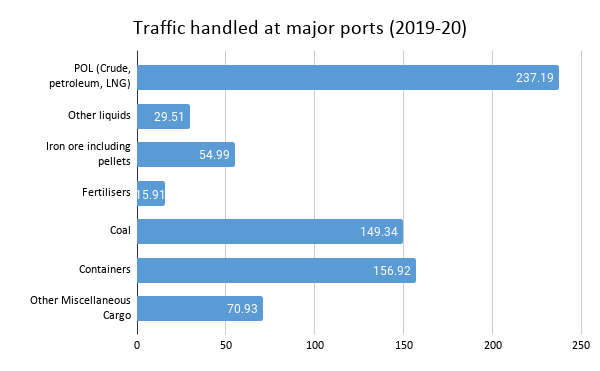

In the context of India, bulk liquids – petroleum, oil & lubricants (POL), bulk liquid chemicals and edible oil – account for around 32% of volume share at major ports. The sector has huge relevance to India considering that it is the 6th largest chemical producer and 4th largest agrochemical producer in the world.

Development of PCIPRs is also expected to contribute to the growing demand. Both upstream and downstream oil companies are lining up their expansion plans in terms of refining capacities as well as distribution infrastructure. Per capita energy consumption is still at around one-third of the global average, making India an attractive energy growth market.

Mukesh Parikh, Adjunct Professor, Adani Institute of Infrastructure Management, envisions India making great strides in the coming years with respect to chemical and petrochemical industries:

“The focus may shift from import dominance to export or coastal movements; nonetheless, the ports will need to gear up to handle about 50 Million MT of chemicals in the next 10 years. The storage capacity available at ports will need to be doubled. In addition to West Coast of India, for an even distribution, liquid storage capacity is also required to be put up at South and East Indian locations – Karnataka, Tamil Nadu, Andhra Pradesh, Odisha.”

While crude oil, refineries and POL are driven by large format players, he emphasises that chemical logistics offers opportunities for both domestic players and MNCs. Incumbents do enjoy the advantages of existing customer base and relationships, but new players with high quality standards and expanding business horizons may be able to successfully venture into the chemicals logistics value chain, with appropriate policy support towards ramping up infrastructure.

Bulk liquid storage and logistics business has a high level of capex and low level of opex. The capex depends on factors like type and nature of products, capacity of individual storage facilities, overall storage capacity, internal pipelines, receipt and delivery systems, marine facilities for ships, location and land price, hinterland connectivity and a host of other factors related to development of infrastructure, superstructure, equipment, automation and technology applied.

Returns from the business are determined by the volume of business and utilization level of assets. A specialized feasibility study and detailed Project Report covering business, commercial, technical, operational and financial aspects brings out these details on case-to-case basis.

Deficiencies across the supply chain

In line with the unenviable scenario vis-à-vis lack of strategic storage in petroleum as indicated earlier, India indeed faces constraints on bulk liquid storage. The liquid bulk capacity utilization is presently at around 90-95%, while the desirable international average is 70-75%. While overall port capacities in India are estimated to grow at a CAGR of 6-8%, liquid bulk capacity growth is lower, at a CAGR of around 3-5%.

Some of the critical constraints affecting bulk liquid storage capacity include:

- Low draft depth at Indian ports of 9-14 m compared to 12-23 m at international ports.

- Lack of dedicated berths for handling liquid cargoes – Only 18% dedicated for liquid bulk.

- Lack of pipelines – only 4-5 chemical lines per jetty – this can lead to damages, apart from extra time, freight and logistics costs.

- Poor hinterland connectivity and multimodal transport options – most liquid bulk transported by road.

- Coastal shipping handles just 7% of total freight compared to 43% in EU

- Regulation limits the setting up of liquid chemical storage facilities at the waterfront.

- The fragmented nature of a large number of logistic service providers and several points of disconnect among these service providers – be it port authorities, bulk liquid storage service operators, road, rail transporters, CHAs, surveyors and numerous other players.

- Need for technological innovation at all operational points – vessel/shore operations, cleaning and maintenance, tank gauging and inventory control, cargo delivery/receipt between tank storage area and hinterland. Most customers expect these standards in the services as well as strict compliance with HSE standards.

In addition, future development and expansion in bulk liquid storage needs to focus on customer-centricity, adherence to performance parameters on factors like waiting time and turnaround times of ships and technology-enabled operating systems that are true to world class standards and HSE compliances.

Futuristic technologies

Technology is fast changing the landscape of the sector globally. Robots and drones are being deployed to conduct inspections. When done by human inspectors, these facilities have to be shut down to ensure their safety. Using robots helps reduce risk exposure and downtime, thereby increasing efficiency.

In fact, automation can be adopted in multiple operations including level, temperature and safety systems that remotely alert terminal operators about the state of the tanks and cargo. Similarly, IoT and software can inform operators if a tank is being heated/blended, what pumps are being used, etc. Predictive analytics is bringing about another wave of transformation across ports, terminals, and shipping companies. According to estimates, the maritime and shipping industry generates 100 million data points each day. This has the potential to optimize operations, improve cybersecurity, and increase overall efficiency of the supply chain.

Another growing trend is the use of blockchain in the terminal industry, which is expected to bring immense benefits to importers, exporters, terminals, transporters and ship owners. Kathryn Clay, President, International Liquid Terminal Association, comments:

“Blockchain technology has the potential to increase efficiency and lower costs in the exchange of goods and shipments, while increasing trust and resilience throughout business networks. In just the last few years, some of the most important shipping companies, such as Maersk, Hyundai Merchant Marine and Maritime Silk Road Platform, have teamed up with tech giants to create blockchain shipping systems to streamline their logistics, reduce administrative costs, and safeguard against cybercrime.”

Emphasising further, she points out to how most parties in the maritime industry have been communicating through lengthy paper chains, which makes it impossible to track shipments in real time. With blockchain, all parties can have access to pertinent information as transactions occur, thereby making it easier to plan operations efficiently and to reduce costs. Going forward, it is important for the Indian bulk liquid storage and logistics industry to embrace these trends to better service the needs of fast growing downstream industries.

Leave a comment