Winning the war against rising CPI

The persistently high CPI figure may look worrisome, as the latest numbers have beaten economic expectations. But they are expected to ease out in the coming months, especially with the rabi season showing promise. Furthermore, international factors like robust employment rates and growth in consumption in the U.S. will also ease non-core inflation of India.

Photo Source: Shutterstock

New Delhi, February 14: The latest monthly inflation figures have taken many by surprise. On one hand, the Consumer Price Inflation (CPI) figures were elevated more than market’s expectations, and on the other the Wholesale Price Inflation (WPI) figures were marginally lowered. As per central government’s figures for the month of January, India’s annual retail inflation was at 6.52%.

The WPI, however, eased to 4.73% in January on an annual basis as compared to December figures of 4.95%. IBT spoke to expert economists to know the combined effect of CPI and WPI, and the subsequent steps that may be taken by the central bank to ease the inflation.

Higher CPI than predicted

Industry leaders and economists had predicted an elevated CPI figures upto 6.1%. The released figure took many by surprise. However, the general consensus is that the rabi season will bring some respite to the retail inflation. External factors such as Russia-Ukraine war, Russia’s decision to cut crude oil import in March have had a significant impact in the CPI figures of January 2023.

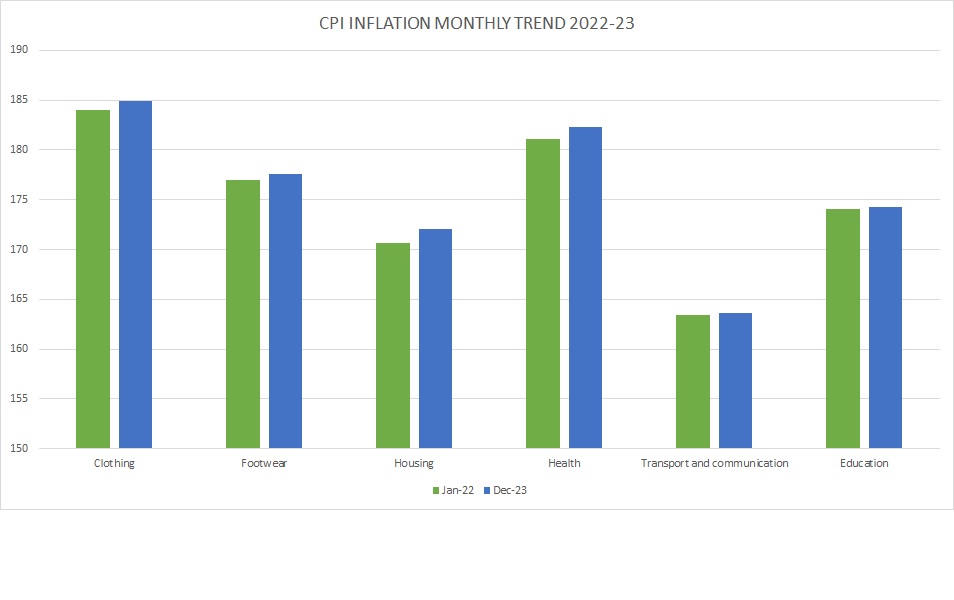

Data Source: PIB

Speaking to IBT, Bank of Baroda Chief Economist, Mr. Madan Sabnavis, said, “Even though they (Central Bank) have looked at a number of 6.5% for the entire year, it is assumed that in this 4th quarter the numbers will come below 6%. This definitely has been a surprise but it sort of vindicates the stand of RBI, which has actually indicated a possibility of further action being taken. They haven’t changed their stance for the same reason.”

The economist further explained that the focus will now shift to lowering the inflation rate to 5% in the coming financial year. He stated that inflation is still a tricky issue and there appear to be certain forces which are keeping it (inflation) in the higher trajectory.

We were also looking at a higher number of 6% to 6.1%, but the official figures have come out as a surprise to almost everyone.

He further explained, “One major part of it is core inflation, which continues to be above 6%. We are all cognizant of that also. The critical factors are as to how food items are behaving. If you see things like cereals, concern over their rising prices will continue till the Rabi harvest is over. The rise in the price of wheat has been responsible for most of this inflation.”

It is likely that core inflation will remain elevated, even though, there is the advantage of high base year. Experts think that the relaxation of CPI inflation numbers will come in the next financial year.

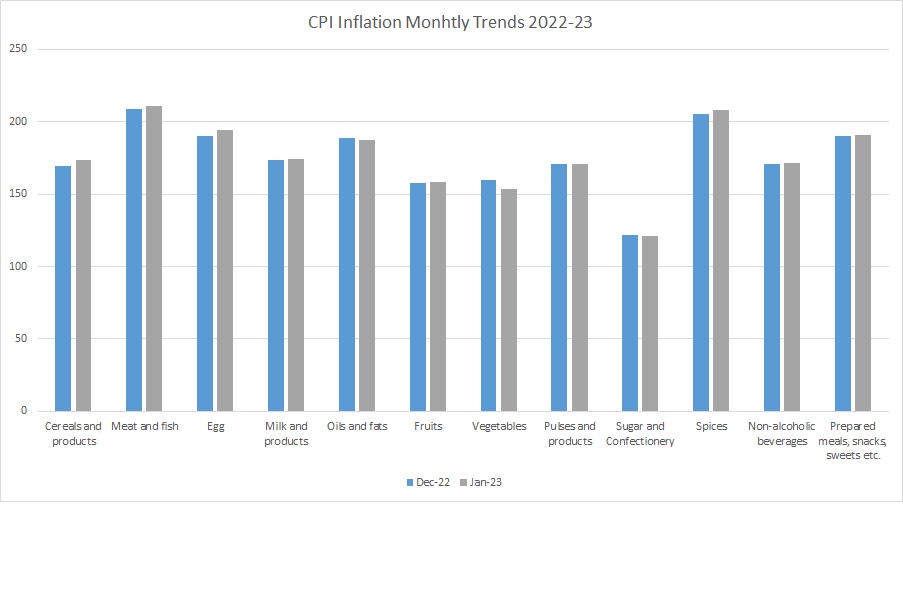

Food Inflation January 2023

The CPI and WPI figures may run in the opposite spectrum, but it indicates a commonality, i.e., food inflation. Domestic factors such as rice in price of milk, eggs, cereals have provided minimum relaxation to the retail and wholesale inflation.

Data Source: PIB

Reflecting on the food inflation, B.O.B Chief Economist Mr. Sabnavis added, “(Diving into the data) even if we have the negative numbers for vegetables, vegetables prices have started going up, milk prices have been revised continuously for the third time in the last six months. Potential for food inflation is also going up, it is quite significant. Under these conditions we could be expecting inflation to remain elevated even in the next couple of months. But probably it may not go beyond 6.5%. We do think it will come down but will remain in the region of 6%.”

Combating Rising Prices of Wheat

2022 proved to be a challenging year for wheat production and harvest in India due to crop damage and the Russia-Ukraine war. The central government announced a ban on wheat exports last year; however, wheat prices jumped to a record high. The reason can be attributed to strong demand and dwindling supply from a crop damaged by heat wave. The Russia-Ukraine war was also a discouraging factor as it disrupted global supply chains and sent commodity prices soaring. India is world’s second largest wheat producer, whereas Ukraine accounted for 12% of the total global wheat exports.

IIM Lucknow’s Professor D. Tripati Rao, spoke to IBT and said, “You see we thought that inflation stabilised during Sep-Oct, but while rising WPI anchored by Sep-Oct, but CPI figures surprisingly neither stable nor broad based. If you see the figures, non-core inflation is elevated due to rising prices of cereals, eggs, milk, meat and of course crude oi. So there are combination of both robust aggregate demand as well as continued global supply chain disruption due to continued war uncertainty. Aggregate demand may continue to sustain on the back reasonably good agricultural production and fiscal infra push.”

On February 11, the central government announced its decision to remove freight charges and sell the grain at a reserve price of ₹2,350 per quintal to bulk users pan India through e-auction. The decision can be seen as a move to arrest rising wheat prices.

Partial relaxation in WPI, but food inflation remains a concern

The decline in the rate of inflation in January 2023 is primarily contributed by mineral oils, chemicals and chemical products, textiles, crude petroleum and natural gas, textiles and food products. The month-over-month change in WPI for January 2023 stood at 0.13 % as compared to December, 2022. In WPI, primary articles weigh 22.62%. The prices of crude petroleum and natural gas declined by 0.85% in January, 2023 as compared to December, 2022. Fuel and power weigh 13.15%, manufactured products weigh 64.23% and WPI Food Index weight 24.38%.

The latest WPI number could be favourable for corporates as a dip in wholesale prices might ease pressure on corporate earnings. Lower input costs might also bode well for retail prices. There are two indices that measure inflation in India. One is Consumer Price Inflation (CPI) and the other is Wholesale Price Inflation (WPI). The WPI captures prices at the level of production or manufacturing, taking into account goods traded between companies, as against the CPI that measures prices at the retail consumer level.

Professor Rao explains further in saying that core inflation might remain stable, whereas retail inflation may remain under pressure due to non-core inflation. He added:

WPI figures lowered because of the aggressive monetary stance by most central banks, the expectation that there will be global recession, this led to slow down in global commodity and to some extent (inflation) stabilization. that is why you have ease in WPI, robust growth in agriculture production and surge in manufacturing segment. The core inflation continues to be stabilized.

Next Big Step To Control WPI and CPI?

Based on the latest numbers released by the government, experts predicts that the non-core component of WPI and CPI may continue to remain elevated due to trade dynamics (global demand for food especially wheat exports, and supply chain disruptions). The global supply chain continues to be disrupted to certain extent for cereal and pulses, in the international market.

Professor Rao further explained that in non-core inflation, commodities such as milk supply will also remain affected due to the Lumpy Cow disease which has crippled the dairy supply in India. He says that the way to tackle milk inflation is by addressing the root cause of the disease itself and its containment.

“Central Banks do not directly influence policy reforms, that squarely falls in fiscal space. But unlike conventional monetary policy which doesn’t directly address sector and institution specific credit flows, which RBI made sure through unconventional monetary policy measures post-Covid. During last two years to ensure not only systemic liquidity expansion but also target specific lending flows,” he said.

Leave a comment