Empowering tomorrow: Dynamics of Interim Budget 2024-25

Union Finance Minister Nirmala Sitharaman presented the 2024-25 Budget on February 1 ahead of the upcoming general elections. The Interim Budget has prioritized initiatives for youth and women empowerment, maintaining fiscal consolidation and sustaining capital expenditure.

Additionally, the Finance Minister announced an 11.1% increase in the capital expenditure outlay for the next fiscal year, amounting to Rs 11,11,111 crore, or 3.4 per cent of the GDP. The First Advance Estimates project a 7.3% growth in India’s Real GDP for FY 2023-24. This article explores key highlights of the Budget 2024-25 focusing on crucial sectors.

Image Credit: Shutterstock

Union Finance Minister Nirmala Sitharaman unveiled her sixth budget on February 1, which serves as an interim budget preceding the upcoming general elections later in the year. The Interim Budget for 2024 prioritized initiatives for youth and women empowerment while upholding fiscal consolidation and sustaining capital expenditure. She revised the fiscal deficit target for FY25 to 5.1% of the GDP from 5.8% previously. Notably, there were no alterations made to the rates of direct and indirect taxes.

While introducing the Interim Union Budget for 2024-2025, the finance minister declared a notable 11.1% increase in capital expenditure outlay for the upcoming year, reaching Rs 11,11,111 crore, equivalent to 3.4% of the GDP.

Furthermore, in alignment with the Finance Minister’s address, the First Advance Estimates of National Income for FY 2023-24 indicate a projected growth of 7.3% in India’s Real GDP. This aligns with the upward adjustment in growth forecasts for FY 2023-24 by the RBI during its December 2023 Monetary Policy Committee meeting, raising it from 6.5 percent to 7 percent, driven by robust growth in the second quarter of FY 2023-24.

With the ‘mantra’ of ‘Sabka Saath, Sabka Vikas, and Sabka Vishwas’ and the whole national approach of “Sabka Prayas”, the Budget 2024-25 is focused on the upliftment of four major castes – Garib (Poor), Mahilayen (Women), Yuva (Youth) and Annadata (Farmer).

In this blog, we discuss a few key takeaways from the Budget 2024-25 along with the latest announcements focusing on key areas:

Focus Areas

Garib Kalyan (Upliftment of the poor): To uplift the poor section of the country, the government has introduced various schemes like –

- PM-SVANidhi provided credit assistance to 78 lakh street vendors out of which 2.3 lakh have received credit for the third time.

- PM-JANMAN Yojana that aids the development of particularly vulnerable tribal groups (PVTG)

- PM-Vishwakarma Yojana provides end-to-end support to artisans and craftspeople engaged in 18 trades.

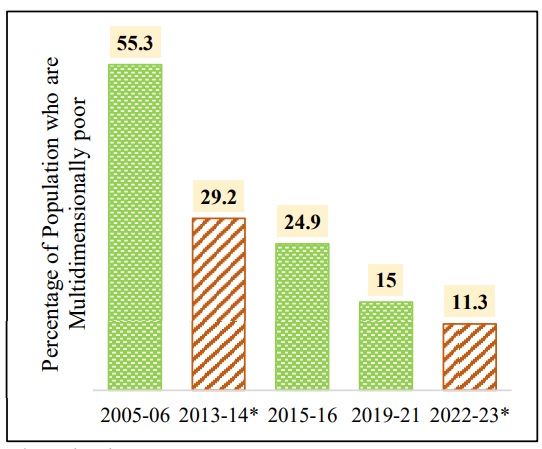

- The government has assisted 25 crore people out of multi-dimensional poverty in the last 10 years. According to the data, the number of multidimensional poor in India has decreased to 11.3% in 2022-23 from 29.2% in 2013-14.

Projections on decreasing percentage of multidimensional poor population* (Source: indiabudget.gov.in)

Mahilayen (Women): Budget 2024-25 focuses on the betterment of women across both rural and urban areas. As per information shared by the Finance Minister, over 30 crore Mudra Yojana loans have been disbursed to women entrepreneurs. Female enrolment in higher education has witnessed a jump of 28% in the last 10 years. Moreover, over 1 crore women have been assisted by 83 lakh Self Help Groups (SHGs) to become Lakhpati Didis.

Yuva (Empowering the Youth): Emphasizing the growth of youth, the Finance Minister declared a golden era for our tech-savvy youth, revealing the establishment of a corpus amounting to Rs 1 lakh crore through a fifty-year interest-free loan. She emphasized that this corpus would facilitate long-term financing or refinancing with extended tenors and minimal to zero interest rates. The initiative aims to stimulate significant growth in research and innovation within sunrise domains, encouraging substantial contributions from the private sector.

In the allocation for the upcoming financial year, the Union government has earmarked ₹73,008.10 crore for schools, reflecting a slight uptick of 0.73% from the revised estimate for 2023-24. Conversely, there was a significant decrease of ₹9,600 crore (16.8%) in the budget allocation for higher education, which was set at ₹47,619.77 crore.

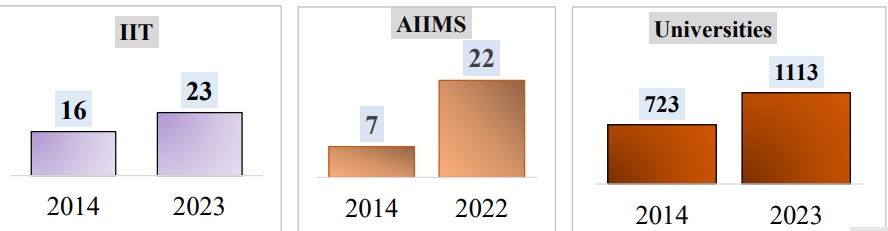

Additionally, over 1.4 crore youth have been trained under the Skill India Mission and over 43 crore loans sanctioned under PM Mudra Yojana to foster the entrepreneurial aspirations of the youth. The budget also highlighted the increased numbers of IITs, AIIMS and Universities across the country.

Educational institutions (in number)* (Source: indiabudget.gov.in)

Annadata (Welfare of Farmers): Through the PM-KISAN SAMMAN Yojana, direct financial aid is extended to 11.8 crore farmers, encompassing both marginal and small-scale farmers. Additionally, crop insurance is allocated to 4 crore farmers under the PM Fasal Bima Yojana. Moreover, the Electronic National Agriculture Market has integrated 1,361 mandis, and is providing services to 1.8 Cr farmers with a trading volume of INR 3 Lakh Cr.

Taxation

The Interim Budget does not introduce any alterations to taxation. The existing rates for both direct and indirect taxes, encompassing import duties, remain unchanged. Nevertheless, to maintain consistency in taxation, specific tax benefits for Start-Ups and investments from sovereign wealth or pension funds, along with tax exemptions on particular income for some IFC units, have been prolonged by one year, extending until March 31, 2025.

Numerous petty, unverified, unreconciled, or disputed direct tax demands persist on the records, with some dating back to as early as 1962. These unresolved demands create concern for honest taxpayers and impede the processing of refunds for subsequent years. The Interim Budget suggests the withdrawal of such outstanding direct tax demands, amounting to Rs. 25,000/- for the period up to the financial year 2009-10 and Rs. 10,000/- for the financial years 2010-11 to 2014-15. This measure is anticipated to benefit approximately one crore taxpayers.

The budget emphasized the government’s efforts in reducing and rationalizing tax rates. Under the previous revisions, taxpayers with income up to Rs. 7 lakh have no tax liability. Furthermore, corporate tax rates for existing domestic companies were reduced from 30% to 22%. For specific new manufacturing companies, the rate was further reduced to 15%.

Strategies for Amrit Kaal

Prime Minister Narendra Modi used the term “Amrit Kaal” in 2021 during the 75th Independence Day celebrations, in reference to the coming 25 years wherein he shared his vision to make India a developed economy. The Budget 2023-24 was the first budget of Amrit Kaal announced by Nirmala Sitharaman with a vision of a technology-driven and knowledge-based economy.

During Budget 2024-25, the Finance Minister announced strategies for “Amrit Kaal” under various categories:

1. Sustainable Development

India has committed to meeting “Net Zero” by 2070 for which the government has been undertaking several initiatives and planning strategies:

- Setting up of coal gasification and liquefaction capacity of 100MT to be set up by 2030

- Phased integration of compressed biogas (CBG) into compressed natural gas (CNG) for transportation and piped natural gas (PNG) for domestic use is set to be enforced.

- Under the rooftop solarization plan, 1 crore households will be provided up to 300 units of free electricity per month which will enable them to save Rs 15,000 to Rs 18000 annually.

- The government is also emphasizing the adoption of e-buses for public transport networks as well as strengthening the e-vehicle ecosystem by supporting manufacturing and charging

Sharing his views on the rooftop solarization plan announced in Budget 2024-25, Hitesh Doshi, Chairman, Waree Group states –

“In light of the growth in the renewable energy sector, especially with the introduction of the new solar rooftop scheme, it can be a game-changer for India. Envisioned to power up 10 million homes, the sheer scale of this initiative sets it apart from the previous schemes. The government’s commitment to providing subsidies and embracing progressive technology underscores its dedication to reducing electricity bills for the needy and is expected to contribute significantly to India’s self-reliance in the energy sector.

He added that the scheme not only addresses the immediate needs of millions but is also expected to propel our nation towards energy self-sufficiency. The impact of the scheme resonates across the entire solar supply chain, which may lead to creation of demand right from the level of panel glass to aluminium to solar modules, and various components associated with them.

This, in turn, will not only aid growth of the industry but also catalyze employment generation. With India already at a local manufacturing capacity of 62.85 GW for solar PV, complemented by the upcoming 39.6 GW under the PLI scheme, the nation is prepared to meet the demands of this project.

He opined that the scale of this order is expected to ensure a seamless supply and cost benefits that will be passed on to the end consumers. Beyond economic advantages, the new policy marks a paradigm shift and is expected to relieve pressure on traditional generators and foster a sustainable and self-sufficient energy landscape. As we embrace this era of change, the payback for solar energy is expected to become a tangible reality, bringing us closer to a future where sustainable energy is not considered just a choice but a way of life.

2. Infrastructure and Investment

- The Budget 2024-25 proposed the implementation of 3 major railway corridor programmes under PM Gati Shakti to improve logistics efficiency and reduce costs.

- Promotion of foreign investment via bilateral investment treaties will be negotiated.

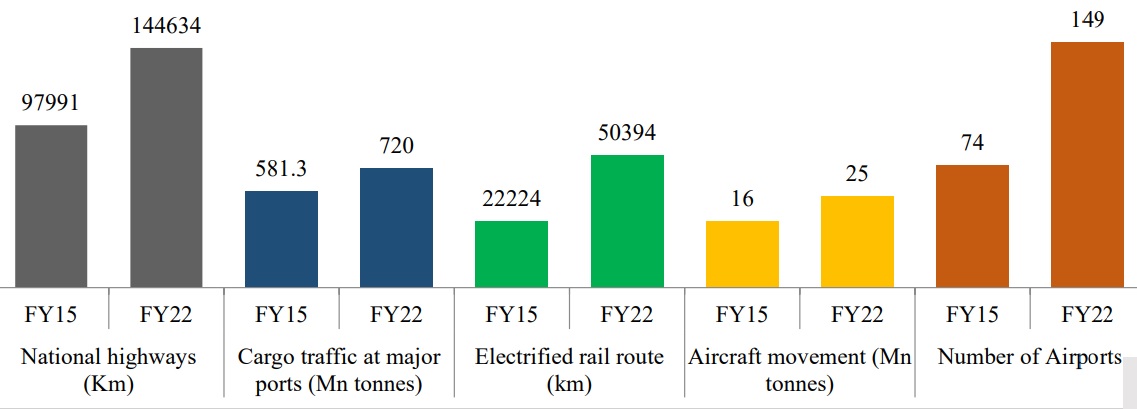

- Under the UDAN scheme, the government plans to expand existing airports and comprehensive development of new airports.

Improvements in physical infrastructure* (Source: indiabudget.gov.in)

3. Inclusive Development

- Under inclusive development strategies, the budget introduced the Aspirational District Programme to assist States in faster development including employment generation.

- It also plans to encourage Cervical Cancer vaccination for girls aged between 9-14.

- ‘Saksham Anganwadi and Poshan 2.0’ are to be implemented for improved nutrition delivery, early childhood care and development.

- Immunisation efforts of Mission Indradhanush are to be rolled out on the U-WIN platform.

- Health cover under the Ayushman Bharat scheme is to be extended to all Asha, Anganwadi workers and helpers.

- As for Housing, the Pradhan Mantri Awas Yojana (Grameen) is close to achieving the target of 3 crore houses, an additional 2 crore are targeted for the next 5 years. On the other hand, housing for the Middle-Class scheme is to be launched to encourage the middle class to buy/built their houses.

- To promote tourism, States will be encouraged to undertake the development of iconic tourist centres to attract business and promote opportunities for local entrepreneurship.

- The government plans to provide long-term interest-free loans to States to encourage development. Moreover, projects for port connectivity, tourism infrastructure and amenities will be taken up in islands including Lakshadweep.

4. Agriculture and Food Processing

To accelerate the growth of the agriculture sector, the government will actively encourage both private and public investments in post-harvest activities. This includes support for aggregation, modern storage, efficient supply chains, primary and secondary processing, as well as marketing and branding initiatives.

The Budget also plans to formulate Atmanirbhar Oilseeds Abhiyaan Strategy to achieve Atmanirbharta for oilseeds. Moreover, the implementation of Pradhan Mantri Matsaya Sampada Yojana is to be stepped up to enhance aquaculture productivity, double exports and generate more employment opportunities.

Allocation for Specific Ministries

| Ministry | Allocation (in Rs lakh crore) |

| Ministry of Defence | 6.2 |

| Ministry of Road Transport and Highways | 2.78 |

| Ministry of Railways | 2.55 |

| Ministry of Consumer Affairs, Food & Public Distribution | 2.13 |

| Ministry of Home Affairs | 2.03 |

| Ministry of Rural Development | 1.77 |

| Ministry of Chemicals and Fertilizers | 1.68 |

| Ministry of Communications | 1.37 |

| Ministry of Agriculture and Farmer’s Welfare | 1.27 |

Allocation to Major Schemes

| Scheme | 2023-24 (BE) | 2024-25 (BE) |

| Mahatma Gandhi National Rural Employment Guarantee Scheme | 60,000 | 86,000 |

| Ayushman Bharat – PMJAY | 7,200 | 7,500 |

| Production Linked Incentive Scheme | 4,645 | 6,200 |

| Modified Programme for development of Semi-conductors and display manufacturing ecosystem | 3,000 | 6,903 |

| Solar Power (Grid) | 4,970 | 8,500 |

| National Green Hydrogen Mission | 297 | 600 |

Source: indiabudget.gov.in, figures in Rs Crore

Budget 2024-25 reflects a strategic approach to economic recovery, emphasizing crucial sectors like agriculture, technology, and education. The government’s focus on fiscal responsibility, coupled with targeted investments, aims to propel sustainable growth. The extension of tax benefits and withdrawal of outstanding demands signal a commitment to ease the burden on taxpayers. With a vision for inclusive development, this budget lays the groundwork for a resilient and dynamic economy, fostering optimism for the nation’s future prosperity.

Leave a comment