Shrimp industry: A chance at redemption?

Faced with stringent timelines for its summer production cycle, the Indian shrimp industry suffered immense losses due to the lockdowns in the initial months of the pandemic. However, the industry has the opportunity to capitalise on an anticipated demand revival in the US as well as a possible uptick in the domestic market.

The Indian shrimp industry has suffered reversals across the value chain in the aftermath of COVID-19. A research by the Central Institute for Brackishwater Aquaculture (CIBA) revealed that the restrictions post the COVID-19 outbreak had led to a loss of 30-40% of business for shrimp hatcheries, farms, processors, retailers and exporters. Production of shrimps in Kerala went down by 500 tonnes post-COVID according to CIBA, leading to losses of around Rs 308 crore, and costing thousands of jobs.

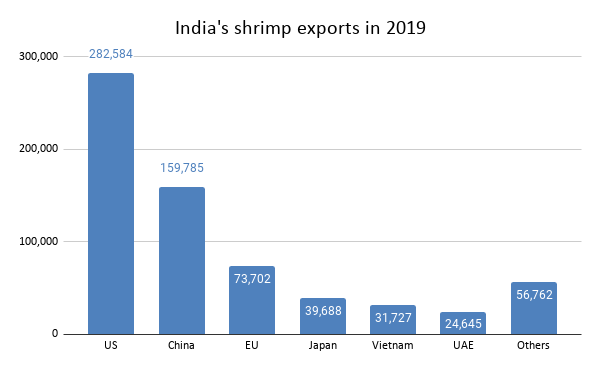

The scenario is a reversal in fortunes if you look at the performance of the sector last year. Prior to pandemic, the production of shrimps in India increased by 31% in 2019. As per Department of Commerce, the production of shrimps was at 615,692 MT in 2018 and 804,000 MT in 2019. Also, exports of shrimps witnessed a growth of 8% in 2019. The top markets for India’s shrimp exports in 2019 were US, China, EU, Japan and Vietnam. India has currently 366 MPEDA-approved seafood companies along with 60 facilities for cold storage. It is the largest supplier of the farmed shrimps with the share of approximately 6% in the fish production.

Even before the onset of the pandemic, there was a serious imbalance in global supply and demand due to the extended lockdowns in China, which carried on till the annual Chinese New Year holiday. Later, the spread of the pandemic across countries further disrupted demand for shrimps across the globe, which led to fall in the prices. Observing the low prices, the farmers harvested their shrimps early, which kept prices low until early May as a result of oversupply.

Prices for shrimps recovered in May, but demand remained limited to the retail sector. Since people were at home, there seemed to be an increased trend in home cooking, leading to a change in buying patterns. As a result, the demand for shrimp stock by retail stores has increased compared to demand by the food service sector. Also, supply in India was affected as a result of falling prices. Furthermore, the community of shrimp farming is fragmented and the farmers are price takers. Thus, lower prices led farmers to halt the stocking and availability of shrimps in the market for processing reduced. This, in turn, impacted their volumes and margins. During the lockdown, around 20-25% of the total capacity was utilised in the seafood sector.

In July, India experienced a fall in exports of shrimps by 23% with export to US dropping by 14%. One reason is the fall in supply of farm-raised shrimps. Also, exports of processed shrimps have faced a decline due to shortage of labour in processing firms. Shrimp production is also dependent on the availability of specific pathogen free (SPF) broodstock, which was in short supply due to lockdowns.

As per a shrimp trader from Gujarat, only 40% of the workforce was present at factories in comparison to pre-pandemic levels. Most of the workforce was unable to come back from their homes, even when the government lifted lockdown restrictions on the fishery sector in early April. As a result of the shortage of the workforce, the manufacturers were not able to fulfil their contracts.

Since shrimp production cycles are relatively inflexible, the impact of the pandemic was even more dire on the shrimp sector. D. Ramraj, president of All India Shrimp Hatcheries Association, said that the production this year is going to drop as a result of shortage of labour supply, reduced stocking and other production issues due to the pandemic.

Source: Ministry of Commerce and Industry

Road to recovery

Export volumes in 2020 are expected to be nearly 40% lower on a YOY basis, which could suppress prices by 35% before 2021. To help the sector mitigate the impact of the pandemic, CIBA recommends designating key elements of the aquaculture value chain as essential activities just like fish farming and processing. Beyond this, enforcement of a fixed minimum price for farmed shrimp will be helpful to both farmers and processors. There is also a need to ensure protection for businesses and labourers, encourage investments into sustainable fish farming and boost investments across the value chain, which are interventions planned under the Fisheries Development Initiative of the government.

There is a welcome news of revival on the trade front. Shrimp exports to the US have increased by 6.6% YOY in August to reach 31,676 tonnes after recording a decline during May-July 2020. Total shrimp demand in the US for August 2020 has also improved to 82,233 tonnes as against 70,153 tonne in the year ago period.

Given the inventory situation in US, the positive trajectory is expected to continue. Even the domestic market could provide a demand boost, according to Paresh Kumar Shetty from Avanti Feeds, who states, “People are looking to shrimp as an alternative to chicken, as chicken prices have shot up. At least 5-6% of Indian shrimp production is domestically consumed – if only 10% of the Indian population eat shrimp the market is huge.

All the processors are looking to promote shrimp to the domestic market.” Moreover, shrimp harvests could come down globally due to the pandemic by 15-20%, and India is in a good position to capitalise with its diverse geographical and climatic conditions, huge processing capacity, rupee depreciation as well as inland farming.

Leave a comment