Millets: A sustainable superfood revolution?

The global millets market is experiencing significant growth, valued at US$ 14.22 billion in 2023 and projected to reach US$ 23.83 billion by 2033, with India playing a pivotal role. The Indian millets market, valued at US$ 5.05 billion in 2022, reflects the country’s dominance, producing over 40% of the world’s millets.

Recognising the nutritional richness of millets, the United Nations declared 2023 the International Year of Millets. India, among the top 5 global exporters, aims to tap into a US$ 2 billion export opportunity by promoting millets and millet-based products.

As millets continue to evolve beyond traditional boundaries, the creative integration of these grains into various domains showcases their potential as not just a dietary staple but a source of innovation and sustainable solutions.

Image source: Shutterstock

The global millets market is valued at US$ 14.22 billion in 2023. It is projected to reach US$ 23.83 billion by 2033, growing at a CAGR of 5.3% during the forecast period, according to the FactMR report.

The Indian millets market was valued at US$ 5.05 billion in 2022, according to the research report ‘Indian Millets Market Overview’ published by Bonafide Research. In March 2021, UNGA (United Nations General Assembly) recognised 2023 as the International Year of Millets, with 72 countries supporting India’s request.

Millets were among the first crops cultivated for food, as documented in 3000 BC during the Indus Valley civilization. Indian millets are a group of nutritiously rich, drought-tolerant crops, mostly grown in the arid and semi-arid regions of India. They are small-seeded grasses belonging to the botanical family Poaceae. They constitute an important source of food and fodder for millions of resource-poor farmers and play a vital role in the ecological and economic security of India.

These millets are also known as “coarse cereals” or “cereals of the poor.” Indian millets are nutritionally superior to wheat and rice, as they are rich in protein, vitamins, and minerals. They are also gluten-free and have a low glycemic index, making them ideal for people with celiac disease or diabetes.

India’s Millets Production Scenario

India is the world’s millet capital, accounting for more than 40% of global production and nearly 80% of millet production in Asia. There are three major millet varieties: Ragi (Finger Millet), Jowar (Sorghum), and Bajra (Pearl Millet).

In addition to these three major millets, there are a number of minor millets, including Kutki (Little Millet), Kangni (Foxtail Millet), Barri (Proso Millet), Jhangora (Barnyard Millet), and Koden (Kodo Millet).

India produced an average of 16.39 million tonnes of millets between 2017-18 and 2021-22, comprising 9.75 million tonnes of pearl millet, 4.54 million tonnes of sorghum, 1.74 million tonnes of finger millet, and 0.37 million tonnes of minor millets. The nation has averaged 13.28 million hectares of millet cultivation, of which 55% is under pearl millet, 33% is under sorghum, 8% is under finger millet, and 4% is under minor millet.

Millets are grown in approximately 21 states throughout the country. Rajasthan became the largest producer of millets in the country in 2021-22, followed by Maharashtra, Uttar Pradesh, Madhya Pradesh, Gujarat, Haryana, Jharkhand, Karnataka, Tamil Nadu, and Andhra Pradesh, which collectively have a more than 95% production share.

| Millets Segmentation | |

| By Nature | Conventional |

| Organic | |

| By Product | Pearl Millet |

| Foxtail Milet | |

| Sorghum | |

| Finger Millet | |

| Other (Kodo Millet, Proso Millet & Barnyard Millet) | |

| By Application | Ready to Eat & Ready to Cook Food |

| Bakery (Cake, Muffins & Cookies) | |

| Beverages | |

| Breakfast (Flakes) | |

| Direct Consumption | |

|

By Distribution Channel |

Traditional Grocery Stores |

| Trade Associations & Organisations | |

| Supermarkets | |

| Online Retail Stores | |

| Other (Speciality Stores) | |

Source: APEDA, Bonafide

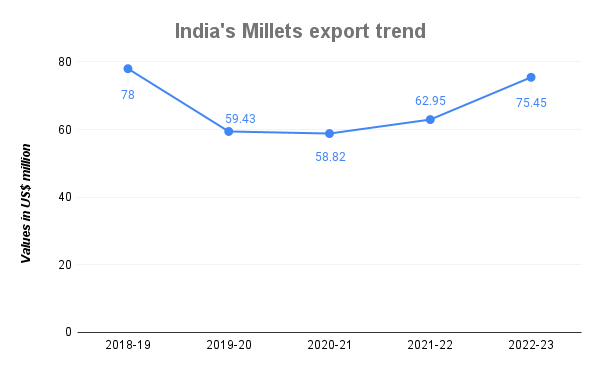

Millets Exports Scenario

India is looking forward to tapping a US$ 2 billion export opportunity by promoting millets, according to a FICCI-PwC knowledge paper. Ragi, Jowar, Bajra and millet-based products are healthy and environment-friendly alternatives to water-guzzling wheat and rice. Millets have been grown and consumed in the country for ages, but they have faded into oblivion with the success of wheat and rice in recent decades.

Source: DGCIS

India exported millets worth US$ 75.45 million in the year 2022–23, against US$ 62.95 million in 2021-22. The share of millet-based value-added products in exports is negligible (DGCIS).

According to brand architect and export strategist Prathiba Guru’s article on ‘Exporting Millets from India: Opportunities & Challenges’, India can primarily consider exporting to:

- Africa: Africa, especially the Sahel region (Burkina Faso, Niger, Mali, Chad, Senegal, and others), is one of the world’s largest millet eaters. Thus, Indian exporters can look for exporting to the African region.

- Russia: Exporters can also export to Russia. It has a large market for millet, which is used primarily for food, feed, and malted products.

- European Union: The EU is an important market for Indian millet exports as there is growing demand for millet-based products among health-conscious consumers.

- Southeast Asia: With a growing population that prefers healthier food options, countries like Vietnam, the Philippines, and Indonesia are becoming major markets for India’s export of millets.

Challenges in Exporting Millets

One of the most pressing challenges that millet entrepreneurs face is the short shelf life of millet products. Millets are prone to spoilage, rancidity, and bitterness because of their natural oils and fats. This is a significant disadvantage because it reduces the product’s shelf life and complicates storage and distribution.

Despite growing awareness, a sizable portion of the population remains unaware of millets, creating a barrier to market penetration. Furthermore, the perception that millets are difficult to prepare discourages consumer adoption. Sensory attributes can also be a challenge, as some people find the taste and texture of millet-based products unfamiliar, when compared to traditional staples like rice and wheat.

Varun Sethi, owner of Sethi International (exporter of millet flour), said, “There is opportunity for millet flour but not for its value-added products. This is something new, and it will take time for consumers to shift their eating habits, except for those who are already aware. For this to penetrate the global market, we need to make proper strategies, know where the demand is coming from, know consumer preferences, and work on branding.”

Addressing the historical image of millet as “poor man’s food” is another issue that entrepreneurs must address. Furthermore, developing trust in the quality and safety of millet products is critical, as consumers can be hesitant to try new and unfamiliar foods. Finally, due to millet crops’ longer gestational cycle, careful planning for extended production timelines is required, which can have an impact on entrepreneurs’ business strategies.

The Way Ahead

As we look ahead, the potential for millet in India remains vast. With a growing market and more people recognising their nutritional advantages, millet entrepreneurs are in a great position to influence the future of sustainable and healthy eating in the country. Millets, often referred to as “superfoods,” are packed with nutrients and capable of withstanding climate challenges, making them an ideal choice for a sustainable food ecosystem.

The Central Food Technological Research Institute (CFTRI) explores millet-based technologies, unlocking possibilities for the development of smart foods. Studies also indicate that millet flour can replace up to 40% of wheat flour, leading to innovative bakery products.

Approximately 1,000 millet product startups are operating in the nation as of 2023, according to the Indian Council of Agricultural Research. These entrepreneurs quickly recognised millet’s potential as a sustainable and nutritious food source, prompting them to diversify their product portfolios accordingly. Furthermore, many Indian entrepreneurs intend to increase production, consumption, and exports of millet-based products.

According to Amit Goel, owner of Bansal Foods, “there is a lot of potential for millets and their products in the future, but consumers are unaware of their benefits. It is true that the government is making efforts to increase awareness of the benefits of millets, but that is not enough. We need to target our consumer markets first, know their preferences, and make products according to their needs.”

He further added, “Our focus should be on marketing, branding, and targeting – marketing to increase its awareness as a healthy, organic, and nutritional food; branding to enlighten consumers about its benefits and targeting niche markets that are health conscious.”

Leave a comment