India’s banana exports: Time to build on the momentum

Amidst the vibrant landscape of global agricultural trade, bananas emerge as a crown jewel, with India positioned as a significant player in this lucrative market. As the world’s largest producer of bananas, India boasts a rich diversity of banana varieties cultivated across its fertile lands. However, despite its prodigious production capacity, India’s banana exports have historically lagged behind, constrained by various challenges ranging from logistical hurdles to market dynamics.

In this exploration, we delve into the intricate landscape of India’s banana export industry, uncovering the recent surge in exports and the hurdles that still impede its full potential. From the bustling banana farms of Andhra Pradesh to the bustling ports facilitating trade, we unravel the narratives of farmers, exporters, and policymakers striving to propel India’s bananas onto the global stage.

Join us on this journey as we unravel the complexities, triumphs, and aspirations shaping India’s quest to carve a niche in the global banana trade, offering insights into the opportunities and challenges that lie ahead.

Banana, also called Musa acuminata, Musa balbisiana or hybrids, can arguably claim the title of king of fruits. By some estimates, it is the largely consumed fruit globally, with around 100 billion bananas consumed every year. Grown in more than 150 countries, it is estimated that there are over 1,000 types of banana varieties in existence. The most common out of them is the Cavendish, which is also frequently used in export markets.

Although the fruit is largely grown in the tropics, its appealing flavor, high nutritional content, and year-round availability have made it highly sought after globally. Bananas are most commonly eaten fresh and may be consumed as fried or mashed.

Various value added products of banana-based products include banana chips, flour, chocolates, vinegar, jam, banana bars, cakes and wine. They are also widely used to flavour muffins, cakes, breads, pies or puddings etc. Their usage in value added products prevents wastage due to their perishabile nature.

Ripe banana fruits are high in dietary fibre, potassium, manganese, and vitamins B6 and C, and may contain up to 22% carbohydrates. Bananas are good for the heart and are known to reduce swelling, protect against developing Type 2 diabetes*, help in weight loss, strengthen the nervous system and boost production of white blood cells. It can be helpful in overcoming depression and better sleep. *According to the International Glycemic Index Database, ripe bananas have a low GI of 51. Slightly under-ripe bananas have even lower at 42; they have a moderate glycemic load, GL, between 11 to 13.)

Global production and consumption of bananas

The total banana consumption in the world, according to Faostat, reached 100,332 kt in 2021. This is 3.88% higher than the previous year and implies a decadal growth of 13.4%. Being ranked at the top, India accounted for 26% of total banana consumption in the world in 2021.

However, as of 2023, Uganda is the world’s leader in terms per capita consumption of banana. It is followed by India, New Zealand, the United States, Papua New Guinea, the Philippines, Rwanda, Cameroon, and many other countries across Africa and South Asia.

Globally, banana production has gone up from 97 million metric tons in 2008 to almost 125 million tons in 2021, a gain of about 24%. Currently, the industry is worth US$140.84 billion. It is expected to grow at a compound annual growth rate (CAGR) of 0.80% for the period between 2024 and 2029 according to Mordor Intelligence.

Demand for bananas increased 1.7% in 2020 (pandemic year) as compared to 2019, since the fruit is peel-protected, affordable, nutritious and can boost immunity.

Global trade in bananas

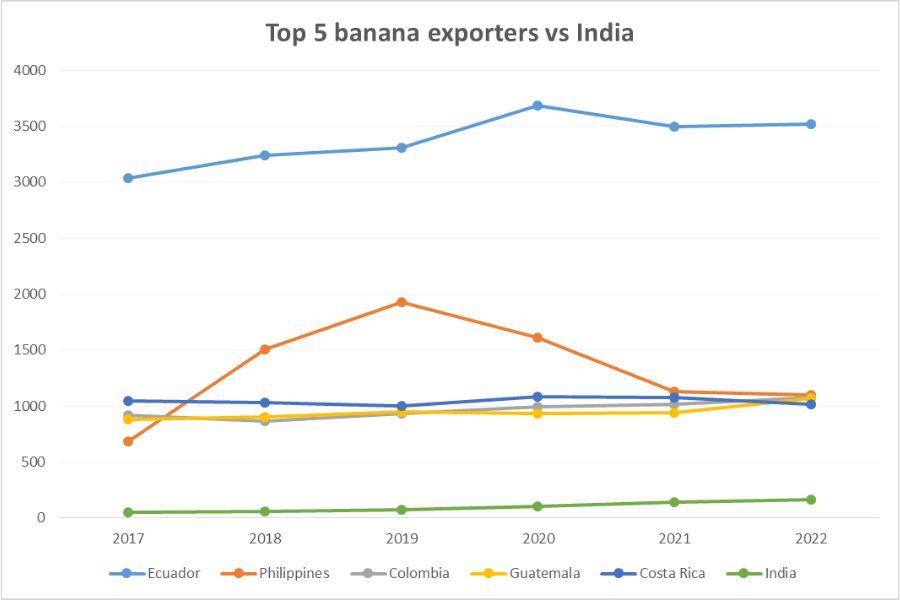

Latin American countries have been among the largest banana exporting countries. The US, China and Germany are among the major importers of the fruit. Ecuador is the top exporter in terms of value at US$ 3.5 billion in 2022, growing at a 5-year CAGR of 3%. It accounted for 26% of banana exports during the year and was followed by Philippines (US$ 1.09 bn), Colombia (US$ 1.07 bn), Guatemala (US$ 1.07 bn) and Costa Rica (US$ 1.02 bn). India was ranked 18th with exports of US$ 162.8 bn, albeit with a high 5-year CAGR of 27%.

Source: ITC Trade Map, figures in US$ million for HS Code 0803

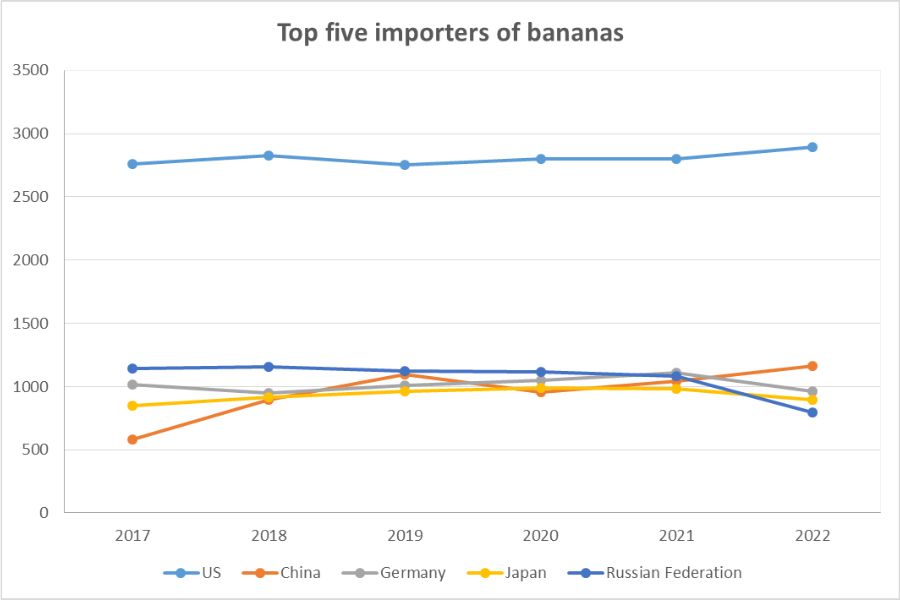

The US was the largest importer of banana, with a value of US$ 2.8 billion in 2022 and a global import share of 18.2%. It was followed by China (US$ 1.2 billion, market share of 7.3%), Germany (US$ 965.2 million, market share of 6.1%) and Japan (US$ 897.73 million, market share of 5.6%). Among the top 10 markets, China has witnessed the fastest 5-year CAGR (14.9%) followed by France (6%). Belgium has seen the fastest five year decline by 14%.

Source: ITC Trade Map; figures in US$ million

India’s banana trade

India is recognized as the fruit and vegetable basket of the world. The vast array of climatic and physio-geographical parameters/conditions that India enjoys are suitable for horticultural crops. The banana cultivation in the country involves more than 25,000 farmers. It is estimated to provide employment for over 50,000 aggregators who are either directly or indirectly linked to the supply chain. India is the largest producer of fruits- mango, papaya and banana in the world.

The country’s agro-climatic zone ensures production of several varieties of banana. Some of the most popular banana varieties In India include: Robusta, Rasthali, Poovan, Nendran, Red Banana, Monthan, Malbhog, and Yelakki.

The Cavendish variety of banana is mostly in demand for exports. Hence, it is being commercially grown in India at a large scale for export purpose.

India’s production of banana during 2021-22

| State | Production (‘000 tonnes) |

Share (%) |

| Andhra Pradesh | 5,838.88 | 17.99 |

| Maharashtra | 4,628.04 | 14.26 |

| Gujarat | 3,907.21 | 12.04 |

| Tamil Nadu | 3,895.64 | 12 |

| Karnataka | 3,713.79 | 11.44 |

| Uttar Pradesh | 3,391.01 | 10.45 |

| Total | 32,454.11 |

Source: National Horticulture Board (NHB), 2021-22 (1st Adv. Estimate)

Andhra Pradesh is the largest banana-producing state in India, followed by Maharashtra, Karnataka, Tamil Nadu, and Uttar Pradesh. In FY 2022-23, these five states together accounted for around 67% of India’s total banana production.

As per Advanced Estimate of ‘Horticultural Statistics at a Glance 2021-22’, the production of banana has decreased to 32,454 MT in an area of 880 ha from 33,062 MT in an area of 924 ha in 2020-21.

Expanding banana exports

Despite being the largest global producer of bananas, India’s exports share was at just 1.2% in 2022, a major reason for which is large domestic demand. But another major reason for low banana exports is their perishability during transit. Over the past five years, however, exports of bananas are now growing at a meteoric pace. According to DGCIS data for 2023, exports of bananas from India had reached US$ 251.4 million, growing at a five-year CAGR of 35.1% and YoY growth of 54%.

India’s top markets for the year were Iraq (US$ 69.2 million, ↑121.4% YoY), Iran (US$ 51.9 million, ↑17.3% YoY), UAE (US$ 47.9 million, ↑65.2% YoY), Uzbekistan (US$ 23.2 million, ↑124.7% YoY) and Oman (US$ 19.3 million, ↑18.8% YoY).

India has been developing sea protocols for trial shipments of bananas to key destinations, providing technical guidance technical guidance in harvesting, post-harvest handling operations, packing and cold storage. For instance, the Agricultural and Processed Food Products Export Development Authority (APEDA) facilitated the export of the first trial shipment of fresh bananas to the Netherlands, via the sea route.

The first such shipment was flagged off on November 9, 2023. This trial shipment would open up significant export potential of the European market for Indian bananas. In fact, India’s banana exports are estimated to reach the US$ 1 billion mark in the coming five years, with this first trial shipment. The US, Russia, Japan, Germany, China, South Korea, the Netherlands, the UK, and France are among the other potential markets that India is exploring in this regard. Similarly, under a joint venture by the ICAR-NRCB, Tiruchirappalli, and VFPCK, Kerala, a consignment of 10 tons of farm fresh Nendran bananas was shipped to London on 8th March, 2021.

Meanwhile, Russia has recently shown interest in the procurement of tropical fruits from India, including bananas. A consignment of 20 MT (1540 boxes) of bananas was flagged off on 17th February 2024 from Maharashtra. When compared to Ecuador, India has the benefit of lower delivery time. News of a disease plaguing Ecuador’s bananas also opens up potential opportunities for India’s exports.

Bridging the gaps

IBT interacted with Waseem Hasan Khan, Proprieter, Meem Exim, to understand better the reasons for the boost in banana exports, lingering issues as well as further efforts that can be made to improve exports. On the positive side, he commented that the industry has learnt a lot in terms of global best practices for export competitiveness. These include quality control at the farm level, cutting the bud at the right stage, ensuring the right transit conditions to improve shelf life, using improved packaging materials, etc.

At the same time, he also highlights a few major challenges. Firstly, banana farms are relatively smaller and very scattered as compared to other exporters like Ecuador and Philippines. That obviously brings benefits in terms of economies of scale, and producers can deliver a huge variety of bananas from the same packhouse (where bananas are prepared for market by washing, grading, packing, cooling and storing them to avoid damage and extend shelf life). But for Indian exporters, it is difficult in terms of scale as well as maintaining of the same quality. With different farm sizes, different production methods, crops undergoing various stages of production, distance, etc, it becomes difficult to produce the same level of quality.

Furthermore, Indian producers are unable to give a stable price. Sometimes, the prices are very high, say Rs 25, 26, 30 rupees a kg and at times, they may come down to Rs 10 per kg. This way, even farmers are not assured of a stable income. Due to unstable prices, farmers are unable to commit to big contracts from major retail chains abroad, even if they are looking to buy from India. In comparison, countries like Ecuador are able to manage contract farming on a huge scale. Waseem suggests that there should be some kind of overarching entity or body that should look into the price and ensure stability.

He agrees that the increasing inquiries from Russia are positive, but the major issue is transit times, as there is no big shipping line in India and exporters have to rely on foreign vessels. There is no proper vessel to take control of the transit time within which the goods will reach the Russian port. Having such a shipping arrangement would ensure price monitoring and also that the product reaches on time and in good condition.

Another major issue he highlights is the sanction on Iran. For most CIS countries, the viable route for export is via Iran only, i.e. Bandar Abbas. So exporters have to transport the bananas to Bandar Abbas, and from there, route it to destination markets like Uzbekistan, Turkmenistan, etc. But due to the sanction, the banks here don’t accept payments. As a consequence, trade has to be routed via Dubai, which is again a very expensive proposition. The vessel first goes to Dubai and then to the Iran port and these cost escalati0ns, if avoided can greatly enhance India’s export competitiveness.

Conclusion

In conclusion, India’s banana exports have shown remarkable growth in recent years, driven by efforts to enhance quality, explore new markets, and improve transportation logistics. Despite being the largest global producer, India’s export share remains modest due to domestic demand and challenges such as perishability during transit, farm size variations, price instability, and logistical constraints.

To unlock its full export potential, India must address these challenges. This can be achieved through implementing best practices in quality control, investing in infrastructure for transportation and cold storage, and establishing stability mechanisms for prices to incentivize farmers and attract long-term contracts. Additionally, streamlining shipping routes and addressing financial barriers, such as sanctions affecting trade routes, are crucial for improving export competitiveness.

The successful trial shipments to European and CIS markets, along with increasing inquiries from countries like Russia, signify promising opportunities for India’s banana exports. By bridging the identified gaps and leveraging its strengths in banana production, India has the potential to significantly expand its presence in the global banana trade and emerge as a key player in the industry.

Leave a comment