Meeting the Rising Demand: Strategies for Expanding India’s Animal Feed Exports

Animal feed is way more than just sustenance for livestock, poultry, and aquaculture—it is the cornerstone of their growth, health, and productivity as well. And now with a burgeoning population and changing dietary habits. With an estimated value of US$ 501.9 billion in 2o22, the global animal feed market is expected to grow at a CAGR of 3.3%. India’s animal feed sector being the fourth-largest producer of animal feed, accounted for a US$ 11.66 billion feed market in 2022, it holds huge potential to support future generations and their growing demands of nutrition.

The analysis run by TPCI’s research team reveals opportunity areas for expanding exports.

Image Source: Pixabay

Animal feed is the food given to domestic animals in the course of animal husbandry. Globally, the feed industry serves a variety of animals including poultry, dairy (cattle, calf, and beef), aquatic/marine, pig, pets etc. The feed demand for different animals varies with respect to socio-cultural dynamics, eating habits and economic importance of animals in the region.

India is glaring at a critical fodder problem over the past few years, according to market reports. According to a recent coverage, India is facing a major challenge in terms of producing adequate feed and fodder for its livestock, given its shrinking land resource. Erratic fodder supply during summer/ drought creates a further gap in the supply chain. The deficit in green fodder is estimated at 11.24%. Currently, fodder is being cultivated on 8.4 million hectares (nearly 4% of gross cropped area), whereas experts suggest a share of 14-17%.

In fact, animal feed is a huge and diverse industry with lucrative growth opportunities across end user segments led by growing demand. TPCI’s research team has undertaken a deep dive into the animal feed industry to ascertain critical growth opportunities for Indian exporters.

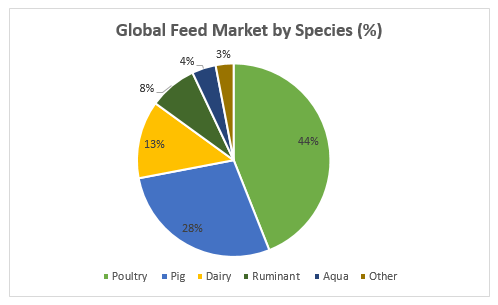

Source: International Feed Industry Federation

In most of the countries across world, the poultry segment occupies a major share of overall feed production volume, according to IFIF, estimates, 2021. The global animal feed market reached US$ 501.9 billion in 2022 and is expected to grow to US$ 606.3 billion by 2028, exhibiting a CAGR of 3.3% during this period. The 2023 Altech Agri-Food Outlook revealed that despite significant macroeconomic challenges that affected the entire supply chain, global feed production remained steady 2022 at 1.27 billion metric tons (BMT) in 2022, a decrease of less than one-half of one per cent (0.42%) from 2021’s estimates. Data compiled from more than 140 countries and around 2,800 feed mills revealed that the top 5 feed-producing countries over the past year were:

- China (260.739 million metric tons [MMT])

- The U.S. (240.403 MMT)

- Brazil (81.948 MMT)

- India (43.360 MMT)

- Mexico (40.138 MMT)

The top 10 countries produced 64% of the world’s feed production. China, the US, Brazil and India account for half of the world’s feed consumption.

According to International Feed Industry Federation (IFIF), commercial feed manufacturing generates an estimated annual turnover of over US$ 400 billion. The industry continues to expand in volume and value in response to increases in world population, urbanization and growing consumer purchasing power.

The above predictions can be substantiated by the estimates compiled by the Food and Agriculture Organization (FAO), i.e. by 2050, the world has to produce 60 per cent more food to feed a total population of 9.3 billion. Therefore, animal-based protein production is expected to increase along with this increase. OECD-FAO Agricultural Outlook 2021-30, projects the global meat supply to expand over the period, reaching 374 Mt by 2030. Growth in global consumption of meat proteins over the next decade is projected to increase by 14% by 2030 compared to the base period average of 2018-2020, driven largely by income and population growth.

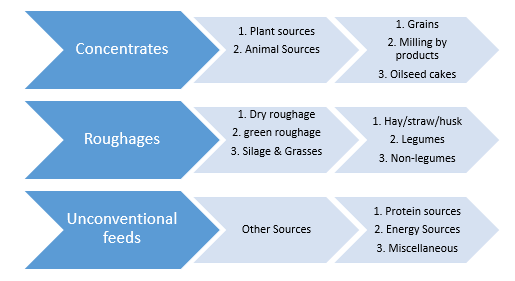

Food grains are the most important source of animal feed globally. Compound feed, which is in high demand as a source of a nutritionally balanced diet, is also being manufactured using advanced lab facilities and under the supervision of nutritionists. The depiction below illustrates different feed types.

Classification of feedstuff

Source: Ministry of Food Processing Industries, Government of India

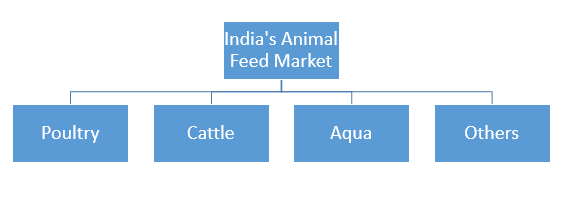

India’s Animal Feed Sector

India’s animal feed market has completed its 57 golden years in 2022. The country is known to have one of the largest and fastest-growing compound feed markets in the world. It has built a strong base for compound feeds, which are nutritionally balanced in the form of pellets. It becomes composite with 20% protein and 2-3% fat content.

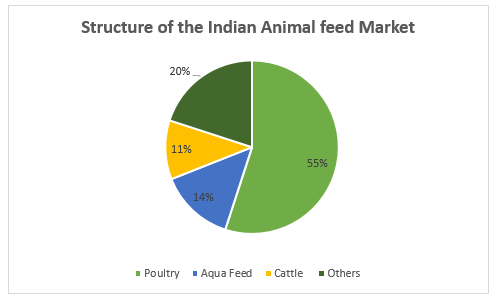

Feed manufacturing on a commercial and scientific basis started around 1965 in India, with the setting up of medium-sized feed plants in northern and western India. Today, the industry is undergoing a very exciting phase of growth for the next decade. It is classified into three broad categories as shown below, with the poultry feed market showing dominance.

In terms of its share, the aqua feed segment has seen the maximum growth out of the three major segments, despite being a late starter.

Source: Yes Bank Research Report, Indian Feed Industry: Revitalizing Nutritional Security

The India’s Animal feed market grew at 3.5% CAGR over the last 5 years and the size reached Rs 956.7 billion in 2022 (approx. US$ 11.66 billion), as mentioned in the latest report by IMARC Group titled on Indian Animal Feed Market. There is an expectation for the market to reach Rs 1,578.2 billion by 2028 (~US$ 19.23 billion) exhibiting a CAGR of 8.2%.

Major India’s Animal Feed Markets

India has established strong markets for Cattle and Poultry feeds. Both are growing at 15% and 8-9% respectively have grounds for huge potential in future. Cattle feed mainly comprises grains (like jowar, millets etc.) and their cakes, mustard, cotton seeds and their oil cakes, de-oiled rice and soyabean. On the other hand, poultry is mainly fed maize, jowar, wheat, soy and their concentrates.

With being the fourth largest broiler producer and third largest egg producer, India has witnessed 120.6 billion egg production in the FY 2021-22, registering a 6.19% YoY growth. The steady growth of poultry consumption over the last decade has been associated with an increase in animal-based protein intake at affordable prices. This has kept feed consumption growing with the broiler industry being the strongest driver behind this development. The presence of integrators (70% of the total industry) and a shorter production cycle has brought feed-based efficiencies and rationalization to the industry. While poultry integrators are much stronger in regional pockets of Andhra Pradesh, Karnataka and Tamil Nadu, the much larger landscape for the poultry industry and its expansion beyond these belts provide ample opportunity for standalone feed players. The use of compound feed in the layer industry varies from 5 to 25% and is highly underpenetrated which offers plenty of opportunities of growth.

On the same lines, India is the largest milk producer in the world, contributing 24% of global milk production in the year 2021-22. India’s milk production has registered a 51% increase during the last 8 years. The level of consumption has been constantly boosting demand for Cattle feed. Western India has been registering the maximum share in cattle feed production followed by North, South and East.

India’s aquaculture feed market has also expanded with a CAGR of 3.5% (2017-22) on the basis of the revenue generated. The market stood at a value of around US$ 1.4 billion in 2020 and is expected to grow at a CAGR of 8% from 2023-28. One of the major determinants of the growth of the aqua feed market in India is attributed to the surging demand for shrimp globally. As of FY 2022, there were approximately 30 high-tech feed mills operating to cater to the rising export and domestic demand. India is the second largest aquaculture country in the country in world accounting for 8% of global production. With an annual growth of 10.34% in fish production in 2021-22, the sector grew at a CAGR of 8% over the last 8 years.

Established industry players like Anmol Feeds find the Aqua feed industry a pretty under-researched area. For other major Aqua feed manufacturers like UNO feeds, and Avanti feeds, the main problem lies with the procurement of raw materials to produce the feed, especially when the genetically modified soybean and maize are not allowed to be used by the Indian government whereas it is allowed in the other countries like Vietnam and Thailand. Narsimha Rao, Managing Partner, UNO Feeds mentions that it makes it difficult to capture the market since the production gets costly by up to 30-40% and makes Indian exports expensive. According to aqua feed manufacturers, there is a misconception that it creates health issues.

Animal Feed Price: A major deciding factor

The increasing competition with the human diet resulting in less availability of raw materials has forced the manufacturers to shift to other materials along with conventional sources. Due to this, price volatility affects feedstock production. Mr. Parv Badjati, Managing Director, Bharat Feeds mentioned that Maize prices have reached Rs. 19.5 per kg from Rs. 10 to 12 kg years back, causing issues in generating cost-effective feeds. Not only this but Mr. Amit from Godrej Agrovet shares his experience with issues arising in cattle feed raw material procurement. According to him, there is no sync between cattle milk prices and cattle feed prices. This is also being felt for poultry feeds. Exporting maize affects domestic prices in turn affecting the feed price.

Along with nutrient-rich additives, by-products of the ethanol industry i.e DDGS getting utilized in animal feed production (7-10%), according to Mr. Chirag Garg, Director Pro Rich Agro) and is regarded as a star ingredient for future requirements. But the farmers are not well aware of its usage in the feed. Apart from some major players, even the industry has information lacunas.

DDGS is the byproduct produced in ethanol production which contains 90% of water content, i.e. on drying up 1 kg of by-product, only 80-90 grams of DDGS is produced which cost Rs. 28 per kg coming out to be equally costly as the conventional grains.

The wet DGS is easily available to the farmers set up near distilleries and is easily fed due to the cost advantage. But the healthier option, the Dried DGS usually isn’t that cost-effective, as drying the matter is a costly affair. Therefore, DDGS does hold the potential to support the conventional methods of feed production with booming grain-based ethanol production in India but the above issues should be taken into consideration to boost the usage.

India’s Animal Feed Ex-Im Analysis

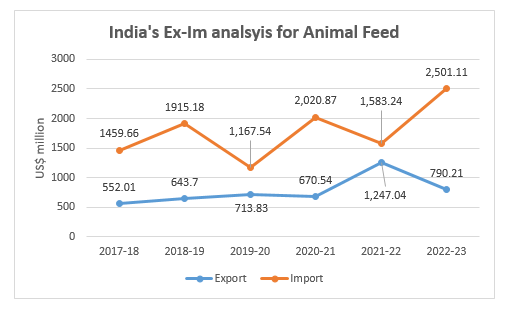

India established a total trade of US$ 3.29 billion in Animal Feed (HS 23) in 2022-23. While exports rose to US$ 2.5 billion (0.1% YoY growth) during the same year, imports dipped to US$ 790.21 million (decline by 36.6% YoY).

Source: Ministry of Commerce and Industry

Among the top 10 export markets, China (97.7%), Thailand (28.3%), Indonesia (25%) and Vietnam (19.6%) have registered highest CAGR in the last 5 years. India witnessed an 11.4% CAGR in exports over a span of 5 years. The country’s exports touched an all-time high in these 5 years. The following were India’s top export destinations for 2022-23:

- Bangladesh (US$ 510.29 million)

- Vietnam (US$ 506.55 million)

- Korea (US$ 225.64 million)

- Thailand (US$ 180.56 million)

- China (US$ 149.29 million)

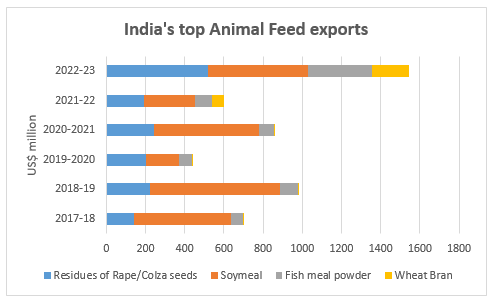

For product-wise analysis, we have analysed the data for Residues and Waste from the food industries: Prepared Animal fodder (HS 23) at the eight digit level. Below are the top 10 exported products to the world, accounting for 90.6% share in total exports:

Top 10 India’s Animal feed products exports

| Product | Export value in 2022-23 | Top Export Markets |

| Residues from Rape and Colza seeds (HS 23064900) | 517.88 | Korea, Thailand, Bangladesh |

| Soymeal (HS 23040030) | 509.27 | Vietnam, Nepal, Bangladesh |

| Fish meal powder (HS 23012011) | 327.88 | China, Vietnam, Taiwan |

| Wheat bran (HS 23023000) | 188.49 | Bangladesh, Nepal, Bahrain |

| Other feeding preparations (HS 23099090) | 174.64 | Bangladesh, Nepal, Hong Kong |

Source: DGCIS

Among the top 10 exported products, White Bran (US 297.5%) has registered the highest CAGR over a span of 5 years. The 3rd highest exported product Fish meal powder (39%) has registered the second highest CAGR, followed by the highest exported product, Residues of Rape and Colza seeds with a 29.6% CAGR over 5 years.

Export analysis of India’s animal feed products

| HS codes

(at 8 digit) |

Commodity Name | Export value in 2017- 18

(US$ mn) |

Export Value in 2022-23

(US$ mn) |

Export YoY Growth

(%) |

CAGR over 5 years

(%) |

Share in exports 2022-23

(%) |

| 23064900 | Residues of Rape/Colza seeds | 141.63 | 517.88 | 1.4% | 29.6% | 20.7% |

| 23040030 | Soymeal | 492.95 | 509.27 | 0.7% | 0.7% | 20.4% |

| 23012011 | Fish meal powder | 63.14 | 327.88 | 4.5% | 39.0% | 13.1% |

| 23023000 | Wheat Bran | 0.19 | 188.49 | 4.9% | 297.5% | 7.5% |

| 23099090 | Other preparations of animal feeding | 131.03 | 174.64 | 0.5% | 5.9% | 7.0% |

| 23040010 | Oil cake and oil cake meal of soybean | 122.66 | 159.1 | 0.4% | 5.3% | 6.4% |

| 23040090 | Other solid residues from Soybean | 120.71 | 150.86 | 2.5% | 4.6% | 6.0% |

| 23069090 | Other oil cakes | 75.16 | 116.7 | 0.7% | 9.2% | 4.7% |

| 23091000 | Dog/Cat pet food | 36.33 | 61.76 | 1.6% | 11.2% | 2.5% |

| 23069027 | Oil cake and oil cake meal of Castor seeds | 32.85 | 59.73 | 2.2% | 12.7% | 2.4% |

| Total exports | 1459.66 | 2,501.11 | 0.1% | 11.4% | 90.6% |

Source: Ministry of Commerce and Industry, figures in US$ million

Source: Ministry of Commerce and Industry

India’s Animal feed Import Analysis

Indian imports in 2022-23 are majorly from the countries mentioned below.

- Sri Lanka (US$ 130.76 million)

- Thailand (US$ 115.58 million)

- Argentina (US$ 73.04 million)

- China (US$ 69.92 million)

- Singapore (US$ 41.7 million)

Among the top 10 sources, Argentina (181.9%) established the highest CAGR over a span of 5 years, followed by South Africa (78%), Singapore (26%) and Belgium (25.1%).

Top India’s animal feed products imported

| Products | Import value in 2022-23 | Top Import Sources |

| Other preparations of animal feeding (HS 23099090) | 329.2 | Sri Lanka, China, Singapore |

| Pet Dog/Cat food (HS 23091000) | 129.49 | Thailand, South Africa, Italy |

| Soymeal (HS 23040030) | 104.65 | Argentina, Bangladesh, Brazil |

| Concentrated for compound animal feed (HS 23099020) | 39.6 | Sri Lanka, China, US |

| Prawn and shrimps feed (HS 23099031) | 38.14 | Vietnam, Thailand, US |

Source: DGCIS

Among the top 10 food products, Soymeal imports (222.5%) have registered the highest CAGR, followed by Oil cake/oil cake meal of Soybean (37.6%),Pet Dog/Cat food (28.2%) and other animal feed preparations (16.1%). Every imported product has registered negative import growth, except Other animal feed preparations.

Mapping potential exports: Product-wise at 6 digit

India is ranked 19th in the world occupying a total of 1.3% share in total exports of the world. According to the analysis, India is ranked 9th in overall exports of the most imported product,

Oil cake and residues of Soybean oil. Global imports by value in 2022 were recorded at US$ 36.97 billion, out of which India exported US$ 502.14 million. With the growing prominence of Aquaculture in India, another potential product for India’s exports is Flour/meals and pellets of fish and crustaceans, where the country is ranked 11th with US$ 154.9 million in exports. Global imports were recorded at US$ 6.3 billion over the same period.

Both these products have been registering positive import CAGR in the world along with a significant share in total imports. With growing demand and India’s capacity in production, the two shortlisted products are:

- Oilcake and other residues of Soybean oil- (HS 230400)

- Flour, meals, and pellets of fish, crustaceans… – (HS 230120)

Way forward

The world’s animal feed market is projected to reach new heights within the next five years with the right policies in place. Apart from established partners, Indian industry find huge potential in exports to other nations lacking in native productions like UAE, China, Russia and Brazil.India’s share of 1.3% in the world’s total exports can be further boosted due to increased domestic and international demand by bringing in some government interventions and increased investments in research and developments for feed manufacturing.

The industry’s ongoing demands regarding financial support in the form of subsidies along with uniform implementation of the standards for credible players to stay in the market should be considered. Besides this, the industry is also looking for an unsynchronized regulatory framework. There are restrictions on compound cattle feed regarding nutrient contents, but no such restriction is there on raw materials. This makes it difficult for manufacturers to produce feed, according to the norms.

Compound feed manufacturers are levied with restrictions for the content on protein content (permissible upto 9-10%) and usage of only Non genetically modified products. But no such measures are imposed on the raw materials which are used in compound feed manufacturing. Selecting raw materials according to the standards for compound feed manufacturing is a time consuming process and in turn becomes costly. Similar restrictions on raw materials will be beneficial to the sector.

Leave a comment