India needs to strategically pave its oil diplomacy route

• India has been highly dependent on crude oil imports to meet domestic demand, especially since the past two decades. India’s oil imports grew at a CAGR of 4.8% in terms of quantity in the past ten years.

• As a rule of thumb, an increase of US$ 10 per barrel in crude oil prices will lead to an adverse impact of US$ 10-11 billion (or 0.4% of GDP) on current account deficit.

• In the past five years, India did not witness double digit inflation. But the issue may return to haunt the economy, unless escalated crude oil prices are mitigated.

• It will be beneficial for India to transact in other currencies and bypass the US dollars, as it reduces the pressure and engenders the prospect of increasing the demand of rupee.

India’s crude oil imports have always been a matter of discussion, even during the pre-liberalization period. The importance of oil as a trade commodity can be assessed from the oil shock of 1973, when members of the Organization of the Petroleum Exporting Countries (OPEC) formed a cartel, which resulted in a massive oil price surge. This resulted in daunting outcomes for some of the developed economies, including USA.

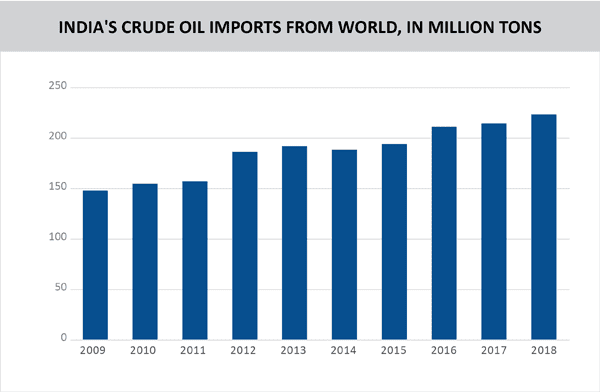

India has also remained excessively dependent on crude oil imports to meet domestic demand, especially from the past two decades. The country’s oil imports grew at a CAGR of 4.8% during the past decade. This statistic eloquently signals that dependence on crude oil is increasing at a faster rate than India’s population. In 2009, India used to import 148 million tons of crude oil, which escalated to 225.5 million tons in 2018. Analyzing the volume of crude oil imports is more pragmatic rather than comparing values, as global oil prices in past have been prone to volatility.

Source : UN Comtrade

As a rule of thumb, an increase by US$ 10 per barrel in crude oil prices will lead to an adverse impact of US$ 10-11 billion (or 0.4% of GDP) on the current account deficit. Since the country is heavily dependent on oil imports to the tune of over 80% for meeting its domestic demand, it remains susceptible to global crude price shocks.

Tough road ahead?

Now India is on the verge of entering into the vicious trap of oil economics, as eclectic parameters are working against its interests. Firstly, the US has given an ultimatum to withdraw oil imports from Iran as the waiver period over sanctions on Iran is going to be over from the beginning of May.

The key advantage for India while importing oil from Iran was that there was no pressure to pay in US dollars. The trade was settled partly in rupees, and partly in the form of food and pharma supplies. Now, it is quite likely that India will be forced to pay dollars depending upon the sources of import.

Secondly, global crude oil prices have been on a continuous surge since the past four months. There is an increase of almost US$ 18 per barrel during this period. This is going to exacerbate our current account deficit and domestic market prices in the coming six months, if not cushioned adequately. In past five years, India didn’t observe double digit inflation, but now it seems that we may experience it again until and unless escalated crude oil price is mitigated.

Thirdly, India’s major oil imports are catered to by the Middle East (OPEC) economies. Approximately 63% of India’s domestic oil demand is met by these nations. Globally, India is the third largest oil importer after China and USA, which means that we are a major consumer for oil supplying economies. Thus we have an upper limit when it comes to diversifying our oil import basket.

Countries like Russia, Nigeria Kazakhstan, Angola and Algeria also feature amongst the top supplier of crude oil. We need to mould our oil diplomacy in a favorable way so that risks during oil price volatility are minimised. India’s import of crude oil from Russia burgeoned from US$ 85 million to a whopping US$ 1.2 billion from 2016 to 2018.

Also it will be beneficial for India to transact in other currencies and bypass US dollars, as it reduces the pressure and engenders prospects of increasing the demand of the rupee. In the past, Russia and China have also bypassed US dollars while signing a bank deal. A number of other countries are also aiming to cut their dependence on the US dollar in the future, as Washington uses access to the dollar payment system as a weapon to punish nations.

Leave a comment