Will El Niño disrupt India’s edible oil market?

Around 85% of the world’s palm oil is produced in Indonesia and Malaysia, and shifting weather patterns in the Equatorial Pacific Ocean, particularly El Niño, may have a significant impact on those nations’ agricultural output. IBT analyses the possible impact on India, given its heavy reliance on palm oil imports.

Image Source: Pixabay

Palm oil is a much more ubiquitous part of our modern day life than we can ever imagine. At present, it is estimated to be part of around 50% of supermarket products, like shampoos, lipsticks, and packaged foods. It’s popular due to its texture, taste, and shelf life. Moreover, it’s cheap, versatile, and meets 40% of global vegetable oil demand on just 6% of the land used for vegetable oil production (Ritchie & Roser, 2020; WWF, 2022).

In 2022, the global palm oil market had a value of US$ 67.3 billion and is projected to experience a CAGR of 5.1% from 2023 to 2030. This growth is attributed to the soaring demand from diverse industries, including food, beverages, biofuel, energy, personal care, and cosmetics.

Although 85% of global palm oil comes from Indonesia and Malaysia, palm oil is also grown in parts of Africa, South America, and Southeast Asia. Indonesia (US$ 27.7 billion), Malaysia (US$ 17 billion), and the Netherlands (US$ 1.2 billion) have been the largest exporting countries during 2016-22. India (US$ 11.7 billion), China (US$ 5.8 billion) and Pakistan (US$ 3.8 billion) have consistently been the largest importers (Source: Trade Map/ HS Code 1511). India has been pushing hard for self sufficiency in edible oil production, which makes it vulnerable to global disruptions in demand and supply.

A recent example was the Russia-Ukraine war last year, when Indonesia banned palm oil exports, and domestic prices shot up immediately. In May this year, a lot of Indian buyers took the decision to cancel palm oil orders as import restrictions by Indonesia pushed palm oil prices to a premium, thereby making sunflower and soy oil more attractive.

Keen eye on El Niño patterns

Changing climatic conditions in the equatorial Pacific Ocean, particularly El Niño, can have significant implications for agricultural regions worldwide. In Southeast Asia, Malaysia and Indonesia may suffer from severe droughts due to disrupted rainfall frequencies caused by warming Pacific waters. This could seriously damage their agriculture, affecting palm oil production.

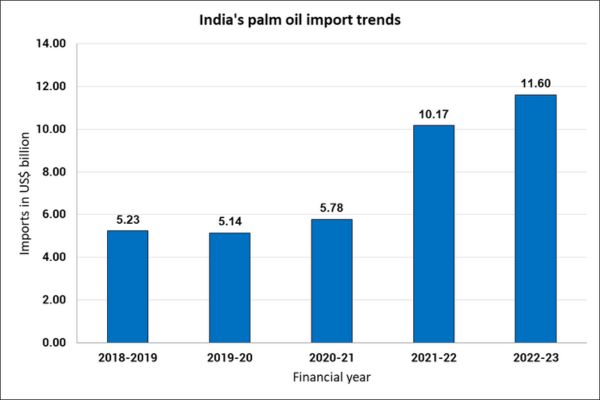

For countries heavily reliant on edible oil imports, like India, this poses a challenge. India imports about 56% of its total annual edible oil consumption, with palm oil accounting for approximately 8 million metric tons out of 25 million metric tons in total. The annual palm oil imports in 2022 amounted to around US$ 11.7 billion, constituting roughly 35% of total food and beverages imports (US$ 33.39 billion) (Source: Trade Map). Malaysia and Indonesia are the primary sources of India’s palm oil imports.

The year 2023 has witnessed the onset of El Niño – a climate pattern that pertains to the unusual warming of surface waters in the Pacific Ocean. it is known to suppress monsoons unlike its polar opposite La Nina, which indicates abnormal cooling of surface waters and aids rainfall. India has already faced the brunt with low rainfall in rice growing regions, which compelled the government to ban rice exports recently.

Source: DGCIS

An update from the World Meteorological Organization (WMO) forecasts that there is a 90% probability of the El Niño event continuing during the second half of 2023. It is expected to be at least of moderate strength. There are diverse expert opinions pertaining to the impact of El Nino on the production and cost of palm oil in Malaysia and Indonesia. Malaysian Palm Oil Board (MPOB) chairman Datuk Mohamad Helmy Othman Basha opines, “There will unlikely be a major impact on palm oil yields due to El-Nino in the second half of this year.”

The anticipated impact on production, which they had initially expected, will not materialize as they thought. There won’t be a significant increase in production for June, but the trend is still showing an upward trajectory for the future. However, it won’t be as substantial of a jump as observed in May, he added. The Malaysian Meteorological Department predicts that this year’s El Nino event will be relatively moderate. Nonetheless, the prolonged dry period may still have an impact on palm oil production.

However, some research firms believe that a climate event such as El Niño could reduce yields and production in the coming year. They believe that May production increased by 321,000 tons from April, indicating potential stock growth, but the shift to El Niño may halt this upward trend, leading to reduced production and inventories.

Changes in weather patterns typically take around six months to impact palm oil production. As a result, the 2022-23 season may not experience the usual decline associated with the drier outlook caused by El Niño. However, there is a possibility of reduced yields in the 2023-24 season, which could potentially lower the final output.

During the initial months of 2023, Malaysia received nearly double the average cumulative precipitation, which has helped in building soil moisture reserves and may aid palm trees in enduring the initial decline in rainfall.

Despite this, average yields have been decreasing, going from a high of 20.16% in 2018-19 to an anticipated average of 19.83% in 2022-23. If this downward trend continues into 2023-24, average output might fall below Fastmarkets’ current prediction of 19.71 percent.

Potential Outcomes

On the basis of past outcomes of El Nino, abnormally heavy rains and flooding can lead to several issues in addition to crop loss and transportation difficulties. When palm tree harvesters cannot reach submerged trees and fruits remain on the tree for an extended period, the oil extraction rate decreases.

Furthermore, the regular fertilizer application schedule for optimal performance is disrupted by flooding, resulting in a time lag that negatively affects production. El Nino, typically associated with a prolonged dry season, can bring additional challenges such as tree stress, fewer female flowers, and reduced pollination activities.

When we asked Prof. Sthanu S. Nair, Indian Institute of Management, Kozhikode, about the impact of changing climatic conditions due to El Nino on crop production, he said, “Due to these uncertain weather conditions, there will be significant impacts on the production of crops in the Equatorial Pacific Ocean regions, which will eventually increase the price of the commodities, so it will have an impact on countries like India, which are highly import dependent, and India needs to take precautionary measures to prevent shortages of crop products.”

When we asked about the impact of El Nino on the price of Palm oil, he said, “We can say that it will create a certain imbalance in the price of agricultural products, including Palm oil, as there will be an increase in the price in the global market. As the price increases in the market, it will create a spiral effect in India.”

With decreased supply, higher palm oil prices can lead to increased costs for India’s edible oil imports, triggering inflationary pressures in the economy and affecting consumer spending. The trade imbalance may arise due to reduced production in exporting countries, requiring India to consider alternative sources or diversify its edible oil imports. Additionally, reduced palm oil production may impact India’s renewable energy goals as it is used as a feedstock for biofuels.

Mazboot article.