IoT, AI & automation can be lucrative for Indian manufacturing SMEs

Dr. Anuj Sharma, Chairperson – Centre for international Business & Policy & Associate Professor – IB, Birla Institute of Management Technology, feels that the changing landscape of global manufacturing, while posing challenges for SMEs, also provides a lot of new opportunities. India, with a strong base of technical manpower, can play pivotal role in frugal innovation. SMEs can provide solutions for low-cost automation. Internet of Things and fields of artificial intelligence and data analytics can create new opportunities for SMEs.

IBT: In your opinion, what have been the major transformative changes in the global manufacturing ecosystem over the past decade when it comes to factors like use of technology, outsourcing/nearshoring, manufacturing best practices, supply chain management, etc?

Dr. Anuj Sharma: In the last two decades, there has been a globalization of the manufacturing ecosystem. This has impacted corporates, countries and people across the world positively. It has resulted in creation of high-value jobs and a rise in standard of living of people in several countries especially in emerging nations.

Numerous factors have facilitated this rapid globalization. There has been significant improvement in political relations between developed economies like US and many European nations and emerging countries like India, China and Brazil (notwithstanding the ongoing US-China trade war). Higher levels of digitization, improvement in physical and financial infrastructure, widespread use of new and innovative manufacturing technologies, and the signing of several bilateral and multilateral trade agreements between nations have brought about significant improvements in the manufacturing eco-system across the globe.

These factors have permitted the disaggregation of supply chains, allowing a company to source materials and components, and manufacture products in any part of the world and serve customers in almost any part of the world. These companies leveraged many emerging economies as locations of low-cost labour, developed significant manufacturing and innovation capabilities.

These capabilities permitted these countries to produce advanced and highly sophisticated products. This resulted in China emerging as the factory of the world and India as the biggest service provider along with Singapore emerging as one of biggest logistics hubs.

Thus we can say that in order to take advantage of price difference that exists in different countries for various factors of production, companies around the world, in the last one decade, have extensively adopted an arbitrage strategy by locating different elements of the supply chain in different locations.

IBT: How has the competitive landscape between countries transformed in your view, especially considering the rise in prominence of new destinations like Vietnam and Philippines? What factors have driven the choice of destination for investing companies?

Dr. Anuj Sharma: Following are the factors that drive the choice of destination for investing companies:

- Availability of cheap and skilled labour

- Infrastructure facilities including logistics

- Cost of capital

- Local market size

- Lower tax rates

- Congenial political ideology and stability

- Access to Free Trade Areas, and

- Ease of Doing Business

Countries like Vietnam and Philippines are able to attract investment, primarily because governments in these countries are able to provide a conducive business environment to foreign companies. Vietnam has been able to leverage its stable political environment. It introduced a new regulatory framework, enhanced transparency and speed of work through higher digitization and simplified its procedures for establishing and running businesses.

These countries, through active and flexible fiscal policies, brought in several changes like reduction in corporate tax, provision of tax holidays and support packages for national and international companies in several sectors. With introduction of reforms in several areas, Vietnam was ranked at number 70 in the Ease of Doing Business report published by World Bank in 2020.

Infrastructure facilities including logistics are also better in these countries than many competing nations. According to Logistics Performance Index published by World Bank, Vietnam was ranked at 39th position. It outranked several countries in the region, including Bangladesh (100), Cambodia (98), Indonesia (46) and India (44). Vietnam’s sizable market and availability of young and skilled labour force at lower cost in comparison to other countries like China has also attracted investment from companies from countries like US, South Korea and Japan.

Another important factor that attracts investment is access to free trade areas. Vietnam currently has 16 independent free trade agreements with strategic partners from around the world, which further enhances prospects of multinational companies to do trade with partner countries of Vietnam.

The recently concluded FTA with European Union has further enhanced the attractiveness of the country.

IBT: What are the major positives for India over this decade in terms of evolving as a global manufacturing hub? What are the key areas for improvement?

Dr. Anuj Sharma: Manufacturing has emerged as one of the high growth sectors in India. According to CII, India is now the one of the largest manufacturing countries in the world. It is at 3rd position after China and Japan among Asian countries. India’s biggest industries are automotive, electronic goods & equipment, chemical, healthcare and pharmaceutical construction, textile and defence.

The Government of India has taken several initiatives to promote a healthy environment for the growth of manufacturing sector in the country. Make in India programme of the Indian Government aims to position India as a global manufacturing hub. Under this initiative, the Government of India has identified and taken many steps to improve competitiveness of Indian manufacturing organizations. As a result of several reforms undertaken by the Government, India’s ranking jumped 14 position to reach 63rd from 77th out of 190 countries in World Bank’s Ease of Doing Business report of 2020.

Other recent initiatives of the Government includes increase in foreign direct investment in defence manufacturing under the automatic route from 49% to 74%, financial assistance to the Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme for development of world class infrastructure through Electronics Manufacturing Clusters (EMCs) and training of 73 lakh people during 2016-20 under Pradhan Mantri Kaushal Kendras.

In order to make India a global manufacturing hub, there are several areas that need improvement. First one is the cost of logistics, for India it is around 14% of GDP, whereas in many developed nations, it is just about 8-10%. The second is cost of credit; at present loans in India are extended at around 10% rate of interest, whereas in countries like China, Vietnam and South Korea it is available at around 4%.

The third is the high tariff on imported raw material. Government of India has hiked the tariff on many products since 2018, which is making Indian products uncompetitive in foreign markets. For example, the Indian engineering sector, which imports steel for its production, is severely impacted by high tariff rates. The price of locally available steel is very high in comparison to international prices.

Finally, there is inefficient usage of several Free Trade Agreements (FTAs) which India has signed with many countries/regions of the world. This is evident from the fact India runs into trade deficit with countries like Japan, South Korea and ASEAN countries with whom it has already signed FTAs.

Along with having a relook on existing FTAs, there is a need to speed up the process of negotiations for free trade agreements with EU and US for different product categories. There is also a need to reform labour, land and capital market.

Recently governments of Uttar Pradesh, Madhya Pradesh and Gujarat have announced labour reforms for a period of three years. While these reforms are good but in order to attract MNCs in India, these should be more long drawn and permanent in nature.

Similarly, the Indian government has been supporting small size firms, particularly in the labour intensive sector, this has restricted bigger players to enter in these sectors.

India, in order to improve infrastructural facilities, should think of developing larger Special Economic Zones. The median size of SEZs in India is 0.3 square km with the biggest SEZ of Mundra in Gujarat having size of 64 square km. However, the size of Shenzen SEZ in China is 1,953 square km.

Such larger SEZs, having capabilities for large scale manufacturing, will require favourable labour laws coupled with other infrastructural facilities like continuous power supply, efficient logistical services, etc to help companies to shift their supply chains to India. Ease of doing business reforms also need to be further pushed to make the environment conducive for attracting bigger foreign companies.

IBT: In what ways has COVID-19 disrupted the manufacturing landscape globally? How are companies responding, and what impact is this expected to have in the near term?

Dr. Anuj Sharma: According to World Bank estimates, there will be 5.2% contraction in global GDP in 2020. United Nations Conference on Trade and Development (UNCTAD) estimates that due to the COVID pandemic global FDI will decrease by 5-15%. This is due to the reduction in manufacturing output as factories in many countries of the world have been shut down.

In the long run, the pandemic may trigger deep recessions in many economies of the world and there will be disruption in global trade and supply linkages, which will result in short supply of raw material for different industries. The negative effects of COVID-19 on FDI investments are expected to be high in several sectors, which include energy, chemical, electronics, automotive and airlines.

The Indian manufacturing sector has also been hit severely by the pandemic. Supply chains across several sectors have been severely hit. Most of the migrant labourers have returned to their homes and are not ready to return due to the fear of COVID. The problem is not only on the supply side, but also on the demand side. As a large number of people have lost their employment or their businesses have closed, this has resulted in a shortage of surplus money to buy products and services.

Companies in COVID times are quite concerned about physical health and mental well-being of their employees. To reduce the spread of infection, many companies have asked their employees to work from home. They are making use of online meeting platforms and virtual collaboration tools extensively as a substitute to offline meetings. For employees who needs to be in office or factories, companies are ensuring that Government guidelines regarding COVID are followed.

Staggered shifts are being also being employed to limit exposure of employees. Companies have also reduced on site working hours for employees. They are also conducting free therapy sessions to take care of the mental health of their employees. Companies have also started reassuring customers about the safety of their products and services. In sectors like aviation, retail and hospitality, where there is direct physical contact of companies with customers, all necessary precautions regarding social distancing etc. are being taken to assure the customers about their health and safety.

IBT: How are the dynamics of global manufacturing expected to change in the coming decade, especially with the rise of Industry 4.0, automation, technologies like AI, IoT, etc and the disruptive impact of COVID-19?

Dr. Anuj Sharma: In the coming decade, the following trends are likely to emerge:

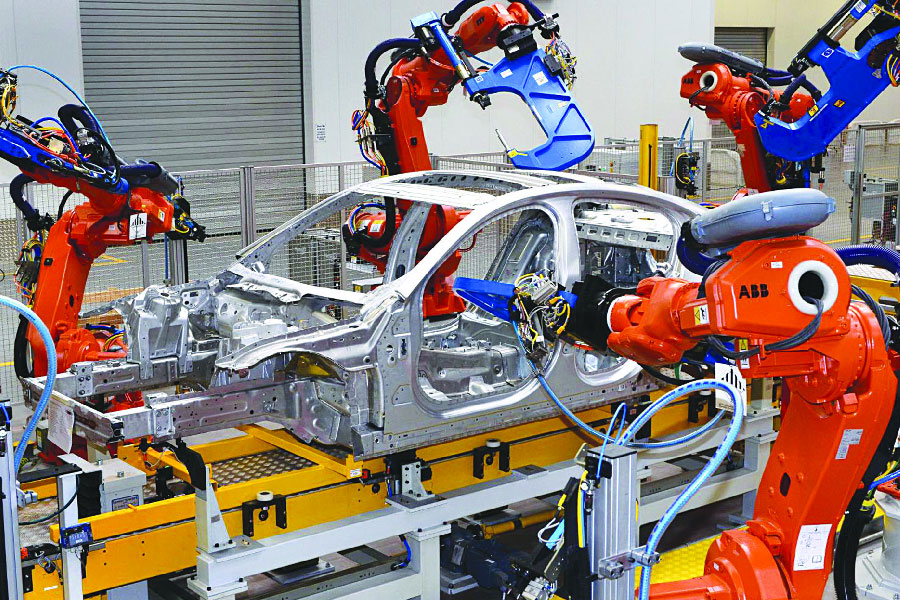

- Manufacturing processes all round the world will be more automated and there will be higher use of collaborative robots (cobots). This trend will not only be with big players, but there will be an increase in the number of small and medium sized manufacturing companies embracing collaborative robots.

- Additive manufacturing and 3D printing will be used extensively in manufacturing. According to Global Data, the 3D printing industry was worth US$ 3 billion in 2013 and grew to US$ 7 billion in 2017. By 2025, it is expected to grow to US$ 20 billion. Industries will be integrating multi-part assemblies including combinations of 3D printed metal and plastic parts.

- The importance of 5G technology will be recognized and this will be used by manufacturers around the world. As the list of technologies impacting today’s production environments increases, which also includes the expansion of the Internet of Things (IoT), the number of connected devices will increase tremendously.

This would require much higher bandwidth, which could only be solved by adopting 5G technology. The latest generation of network technology, 5G satisfies the need for high speed, reliable and secure connectivity. - Internet of Things is a pipeline connecting and collecting large amount of data from large number of equipment and devices. Investments in IoT in future will continue and more number of companies will use this. Manufacturers who have not implemented IoT will be required to do so in future. According to the PwC’s 2019 Internet of Things Survey, manufacturers are optimistic about IoT, with 93% believing its benefits exceed its risks.

- The impact of COVID-19 on global supply chains will be huge. The current wave of COVID will have a negative impact on globalization. Japan has already set aside US$ 2 billion for firms to bring back high value production back home from China. US is also asking companies like Intel and Taiwan Semiconductor Manufacturing Company to relocate their production to US. In a post-COVID scenario, regionalisation of global supply chains is likely to happen.

Image Credit: Smart world

Image Credit: Smart world

IBT: How is this shift expected to pan out for Indian SME firms in particular, and how would they need to adapt?

Dr. Anuj Sharma: Indian Small and Medium Enterprises (SME) sector is considered as the backbone of India’s economy. In different sectors of the economy i.e. agriculture, manufacturing or services, a large number of SMEs are operating. It is estimated that SMEs account for 45% of industrial output and 40% of total exports in India. The sector is estimated to generate employment for around 60 million people in India and it creates jobs for about 1.3 million people every year.

In order to be compete in a global marketplace, it will be important for India’s SME sector to have a global outlook and be innovative in its approach, adopt and develop latest technologies and also train its people in emerging areas of business. However, there are many challenges and problems that the sector faces.

A significant number of SMEs are not registered and hence remain deprived of many support schemes of the Government. Other challenges that the Indian SME sector faces are lack of capital due to inadequate access to finance and credit, poor infrastructure that results in low production capacity and low quality products, lack of innovation, low technical and digital knowledge, inability to attract talented professionals and lack of marketing know-how.

The changing landscape of global manufacturing, while posing challenges for SMEs, also provides a lot of new opportunities. India, with a strong base of technical manpower, can play pivotal role in frugal innovation. Indian SMEs can provide solutions for low-cost automation. Internet of Things and fields of artificial intelligence and data analytics can create new opportunities for SMEs.

There is an imminent need for India to work on an integrated framework to enable the massive SME sector to embark on a journey towards adopting latest technologies. An integrated approach is required, where all the three key stakeholders – the government, industry and academia work together to achieve the desired results.

IBT: What major steps are needed to capture a greater share in global manufacturing (production and trade) in the post-COVID era?

Dr. Anuj Sharma: In order to capture greater share in global manufacturing and higher exports, the Government of India has to design a conducive policy and infrastructural environment. Concrete steps are required to reduce logistics & credit costs, make inputs available at competitive prices, and explore deeper and meaningful tie-ups with other important countries of the world.

We are currently facing unprecedented times, worse than even World War II, and now everything will be looked as pre-COVID and post-COVID. India will be able to build its manufacturing sector by strengthening and building core competencies in different sectors and also remaining part of the global supply chain. The framework should be such that some of the elements of the supply chain, based on core competencies, remain in India. Simultaneously, India should also be able to benefit from other elements of supply chain located in other countries of the world.

Exporters are required to diversify the export basket and search for newer markets. It is worth noting that 80% of India’s exports are happening only in 20 product categories out of 99 product categories. The Ministry of Commerce, along with exporters, have identified several products categories.

Concerted efforts are required to develop capabilities for industries in these product categories. India has been primarily relying on low risk markets like US, Europe, South-East Asia and West Asia while markets like Latin America and CIS countries remain neglected. In the past, the Government has announced various schemes but these have not been effective.

Government support in terms of providing substantial financial resources for exploring markets is also required. Finally exporters need to develop not only good quality, reliable and differentiated products for the world, but they also need to develop a brand image for their company. The Ministry of Commerce also needs to allocate resources for developing an appropriate brand image of the country; something on the lines of the ‘Incredible India’ image that was created by the Ministry of Tourism in 2002. Prime Minister Narendra Modi also mentioned that world is looking for a reliable partner. Reliability, trust and quality can become brand attributes for India for its ‘made for the world products’.

Dr. Anuj Sharma is working as Associate Professor and Chairperson, Centre for International Business & Policy, BIMTECH, Greater Noida. He has more than 20 years of teaching experience at post graduate level. His current areas of interest are globalization, international marketing, international trade operations, foreign trade policy and sector specific export strategies. He has presented papers and chaired sessions at various national and international conferences. He has also written case studies and research papers in various national and international journals of repute.

He has conducted more than 30 Management Development Programs (MDP) in the area of International Business across all parts of the country. This includes both open and in company programs for reputed government organization like State Trading Corporation (STC), PEC Limited, Handloom and Handicraft Export Corporation (HHEC) and private organizations like Godfrey Phillips India Limited. In association with Federation of Indian Exporters Organisations (FIEO), as Program Director, he has successfully completed seven batches of part time Diploma in Foreign Trade (DFT) for working executives. He has been instrumental in forging relationship with many corporate, trade associations, embassies and public sector enterprises. The views expressed here are his own. Usual disclaimers apply.

Leave a comment