India’s trade outlook: Silver lining amidst dark clouds?

Image source: Shutterstock

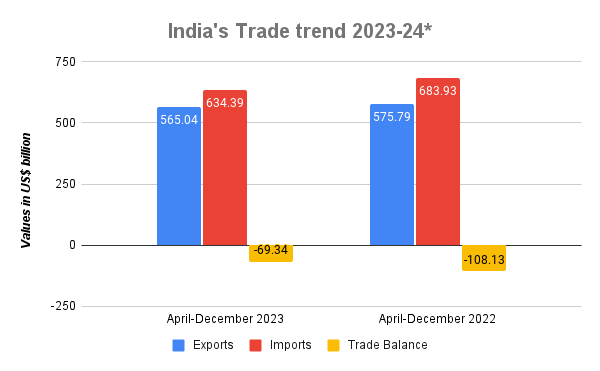

According to the recently released trade data for December 2023, India’s overall exports (Merchandise and Services) are estimated at US$ 66.33 billion, exhibiting a negative Y-o-Y growth of 4.25%. Imports are estimated at US$ 71.50 billion, registering a negative Y-o-Y growth of 7.18%.

India’s exports and imports have come under pressure in the face of a global economic slowdown and the ongoing Red Sea Crisis. While the goods exports have seen a small positive growth, it’s worth noting that the services sector has shown a decline.

Source: PIB

Merchandise trade: In December 2023, India’s goods exports stood at US$ 38.45 billion, registering a small 1% YoY growth. Imports decreased by 4.85% YoY to US$ 58.25 billion.

Services export decline: Services exports in December 2023 are estimated to have reached US$ 27.88 billion, declining by 10.6% YoY. Similarly, service imports reached US$ 13.25 billion, marking a 16.19% decline YoY.

India’s overall exports (Merchandise and Services combined) in April-December 2023 were estimated to be US$ 565.04 billion, exhibiting a decline by 1.87% YoY. Overall imports were estimated at US$ 634.4 billion, declining by 7.24% YoY. Services exports during the period were estimated at US$ 247.9 billion, up by 3.5% YoY. On the other hand, merchandise exports were pegged at US$ 317.12, declining by 6% YoY.

Sectoral Overview

Under merchandise exports, 17 of the 30 key sectors exhibited positive growth in December 2023, despite global uncertainties and the Red Sea Crisis.

| Major sectors witnessing positive growth | ||

| Iron Ore (265.64%) | Tobacco (38.94%) | Meat, Dairy & Poultry Products (29.76%) |

| Spices (27.68%) | Fruits & Vegetables (25.36%) | Electronic Goods (14.41%) |

| Gems & Jewellery (14.07%) | Cereal Preparations & Miscellaneous Processed Items (13.5%) | Plastic & Linoleum (10.43%) |

| Engineering Goods (10.19%) | Handicrafts Excl. Hand Made Carpet (9.37%) | Drugs & Pharmaceuticals (9.3%) |

| Cotton Yarn/Fabs./Made-Ups, Handloom Products etc. (8.62%) | Oil Seeds (8.48%) | Mica, Coal & Other Ores, Minerals Including Processed Minerals (5.17%) |

| Carpet (3.82%) | Ceramic Products & Glassware (2.95%) | |

Source: Ministry of Commerce & Industry

Some important highlights:

- Non-petroleum and non-gems and jewellery exports in December 2023 totaled US$ 28.7 billion, compared to US$ 27.19 billion in December 2022.

- Engineering goods exports in December 2023 grew by 10.19% to US$ 10.04 billion, the highest monthly export in the current financial year.

- Gems and Jewellery exports in December 2023 were estimated at US$ 2.9 billion, improved by 14.07%.

- December recorded the highest monthly export of electronics in the current financial year. Electronic goods exports marked an increase of 14.41% at US$ 2.62 billion.

- Drugs and pharmaceutical products in December 2023, valued at US$ 2.47 billion, registered an increase of 9.30% YoY.

- Agricultural exports also grew in December 2023, including Tobacco (38.94%); Meat, dairy & poultry products (29.76%); Spices (27.68%); Fruits & Vegetables (25.36%); Cereal Preparations & Miscellaneous Processed Items (13.5%) and Oil Seeds (8.48%).

For the period of April-December, 2023, the major products that witnessed positive growth are Iron Ore (215.5%); Oil Meals (27.36%); Electronic goods (22.24%); Ceramic products and glassware (18.75%); Fruits & Vegetables (16.3%) and Tobacco (13.2%). On the other hand, the highest negative growth was witnessed by Other cereals (-47.7%); Jute mfg (-24.11%); Gems & Jewellery (-16.2%); Petroleum products (-15.6%); RMG of textiles (-14.4%); Leather and leather products (-12%) and Organic & Inorganic chemicals (-12%).

Future Outlook

According to Commerce Secretary Shri Sunil Barthwal, “There are uncertainties for trade in January going forward due to global uncertainties and the Red Sea crisis.” This had led to a disruption of the supply chain, causing a significant increase in logistics costs. Exporters are looking for the government’s assistance in getting insurance for shipping consignments amidst the ongoing crisis in the Red Sea.

About 80% of India’s merchandise trade with Europe happens through the Red Sea, where shipping has been attacked by Yemen’s Iran-backed Houthi militants in a spillover from Israel’s more than three-month war with Hamas in Gaza. The country’s exports could be impacted by US$ 30 billion in the current fiscal year if the Red Sea crisis continues.

According to the Ministry of External Affairs, while the situation in the Red Sea impacting the flow of commerce was worrisome, the Indian Navy is trying its best to secure the sea lanes in the North and Central Arabian Sea and Gulf of Aden. The government has advised exporters to focus on markets in the east, such as Australia, in order to avoid higher costs as well as security issues.

This is over and above the global trade projection, which, according to the UNCTAD, is projected to decline by almost US$ 2 trillion in 2023 or 7.5% YoY. On the other hand, services trade is expected to have increased by US$ 500 billion or 7% YoY. Going forward, the report points to a positive economic outlook, but with significant disparities among countries and regions that exporters should be wary of.

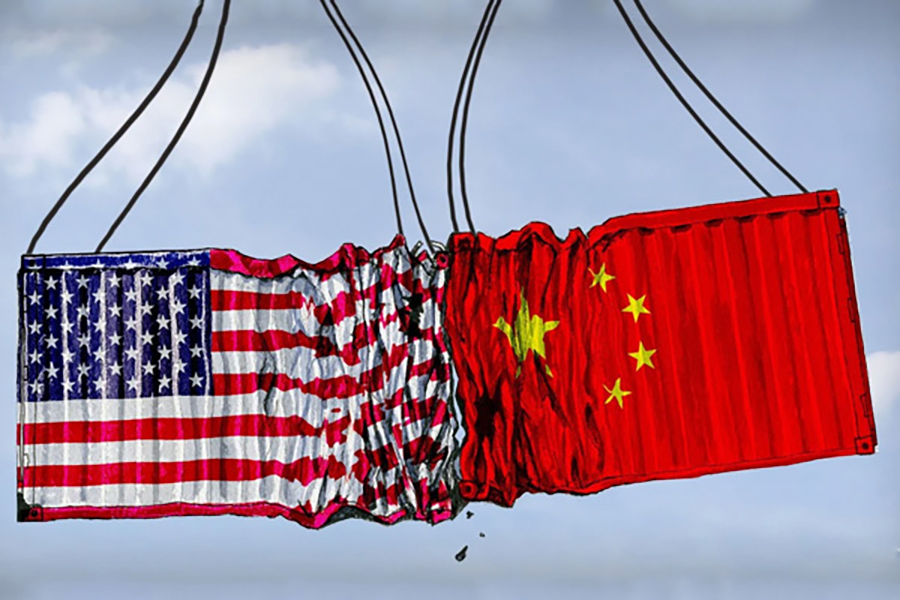

Interest rates remain high in several economies, while industrial output could remain subdued for the two largest economies (US and China) in the coming months. Commodity prices, interestingly could remain volatile, especially for critical minerals given the ongoing rush towards transitioning to clean energy.

As supply chains get realigned due to changes in trade policy and geopolitical tensions, there is particularly significant impact on linkages between China and the US. This is providing opportunities to companies in other regions to integrate into global supply chains. Amidst the overall subdued scenario, this trend is like a silver lining for Indian manufacturers going forward.

Leave a comment