Globalisation: Hurting, but on the mend?

The DHL Global Connectedness Report 2024 concludes from data that globalization is not moving in reverse. Instead, it reveals that globalisation, which means a holistic score based on trade, capital, investment and people flows, actually reached its highest level in 2022 and remained quite close to that level in 2023.

India’s rank in the index is higher than China and the Russian Federation, but lower than all the other top 10 economies in terms of GDP size. When we look at past trends, India’s score has been relatively static in the range of 49-53 on the index. However, it’s rank has improved significantly from 71 in 2001 to 62 in 2023. The most significant positives for India are on the parameter of Capital. In terms of announced greenfield FDI (share of GDP), India ranks 37 (outward) and 44 (inward).

Also, it is noteworthy that US and China are showing a significant impact of de-coupling in terms of trade and investment, whereas US imports from India are growing at a robust pace. This trend indicates that India is possibly among the gainers from the reduction in US-China trade, and this trend needs to be analysed further.

Image credit: Shutterstock

The world has witnessed significant turmoil over the past few years, be it the COVID-19 pandemic, the US-China trade wars, Brexit and the ongoing Russia-Ukraine war. There seems to be a growing tendency among countries to look inward and prioritise self-reliance. However, for those who fear that globalization is now accelerating in reverse gear, the DHL Global Connectedness Report brings some encouraging news. It concludes from data that globalization actually reached its highest level in 2022 and remained quite close to that level in 2023.

The report seeks to provide a more holistic perspective to globalization that goes beyond just trade flows. Their essential premise in this analysis is that globalization should encompass how much of a country’s trade, capital, investment and people flows are international rather than domestic. It also measures the distribution of international flows, i.e. whether they are broader or concentrated between specific origins and destinations.

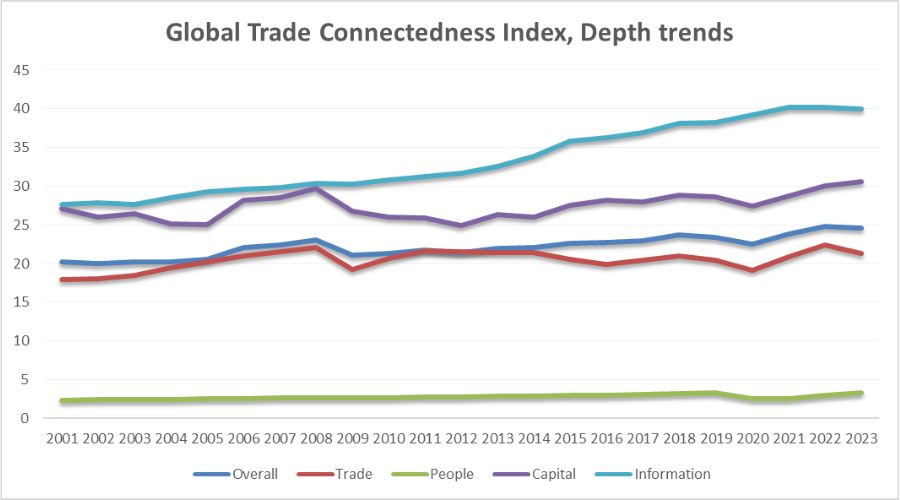

This is indicated by the DHL Global Connectedness Index depth trend, that measures international activity related to domestic activity. The results are measured on a scale of 0% (nothing crosses international borders at all) – 100% (a completely frictionless world). In 2023, the level of globalization stands at nearly 25%. Given that this is a record as mentioned earlier, we know that we are far away from the prospect of true globalization.

Source: Altman, Steven A. and Caroline R. Bastian. DHL Global Connectedness Report 2024. Bonn: DHL Group. DOI:10.58153/7jt4h-p0738

When we look at individual parameters, trade depth is indeed lower as anticipated due to global macroeconomic headwinds, from 22.44 in 2022 to 21.29 in 2023. Capital depth is slightly higher from 30.04 to 30.57. Although FDI flows are weak, measures that track new business commitments like greenfield FDI are strong. In terms of people flows, the depth has improved from 2.97 to 3.25, whereas information depth has also fallen slightly from 40.21 to 40. Although information has been the strongest pillar of globalization, it is also witnessing some pressure now due to geopolitical tensions and policy restrictions on data flows. People flow, on the other hand, seems to be recovering post-COVID and is expected to reach back to pre-pandemic levels by 2024.

An interesting trend that the report tracks is the trade between US & China on one hand and Russia and the EU on the other, considering their respective trade and geopolitical tensions. Here, you definitely see a reversal – US import share from China reduced to 14% in 2023 (21% in 2018) as did Russia’s import share from EU (17% in 2023 vs 39% in 2018). But excluding Russia and US-China trade, there is no significant regional split. The report concludes that these geopolitical rivalries have not yet led to a significant fragmentation of international flows.

Global ranking and India’s position

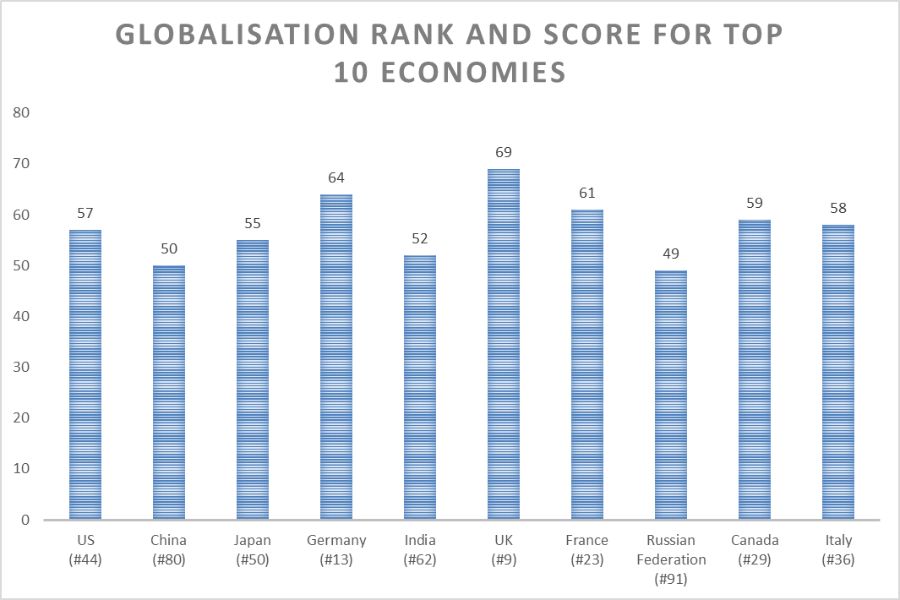

Quite intriguingly, the top 10 economies in GDP terms are not exactly breaking records on global connectedness. The list is actually led by Singapore (score of 79) whose economy is also considered a barometer of global trade health. It is followed by Netherlands (75), Ireland (74), Luxembourg (73) and Malta (71). However, it needs to be noted that the index ranks economies on both breadth and depth. Large economies tend to have relatively lower depth due to massive domestic economies. The scores and ranks of the top 10 economies is as given below.

India’s rank in the index is higher than China and the Russian Federation, but lower than all the other top 10 economies in terms of GDP size. When we look at past trends, India’s score has been relatively static in the range of 49-53 on the index. However, it’s rank has improved significantly from 71 in 2001 to 62 in 2023. India’s score on depth in 2022 is 41 (#161) while its score on breadth is much better at 66 (#16). Similarly, China’s global rank on breadth (23) is much higher than its rank on depth (171).

Source: Altman, Steven A. and Caroline R. Bastian. DHL Global Connectedness Report 2024. Bonn: DHL Group. DOI:10.58153/7jt4h-p0738, figures in brackets indicate ranks.

The country’s scores on various parameters are as below:

Trade: 53 (#64)

Capital: 53 (#35)

Information: 52 (#65)

People: 48 (#65)

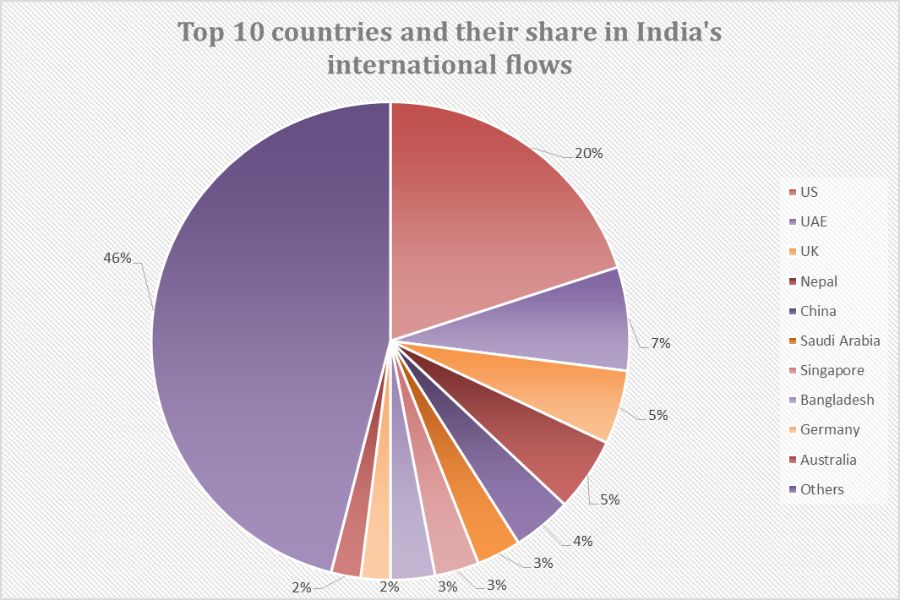

The top 10 countries by their share of India’s international flows are provided below. The US holds the maximum share (20%) followed by the UAE (7%) and the UK (5%). India’s globalization ranking in terms of overall trade (outward) is 140, while it is 145 for inward trade. The rank is considerably better for outward services trade (82), while it is at 147 for inward trade.

The most significant positives for India are on the parameter of Capital. In terms of announced greenfield FDI (share of GDP), India ranks 37 (outward) and 44 (inward). Its rank is also high on M&A transactions as a share of GDP, ranking 44 for outward and 50 in the inward category, possibly reflecting recent efforts by the government towards ease of business and liberalizing investments in a number of sectors, especially via the PLI Scheme. FDI inflows into India have risen to a record US$ 84.84 billion in 2022, before dropping to US$ 71 billion in 2023.

Conclusion

The DHL Global Connectedness Index 2024 report shows that even though globalization is undergoing a phase of stress, it remains steady amidst economic and geopolitical headwinds. So far, there is no meaningful indicator of a fragmentation of global flows despite ongoing tensions between blocks, particularly US-China and Russia-EU.

The report shows that the top 10 economies, including India, rank low on the index, but that is largely because of lower depth of globalization, attributed to their large internal economies. India ranks 8th in its globalization score among the top 10 economies, surpassing only Russia and China.

Notably, the trade dynamics of these two economies are worth observing for other reasons. The rise of geopolitical tensions has impacted Russia’s trade with the EU. And in a similar vein, US-China flows have shown a decline. However, the report only attributes the decline in US-China merchandise trade and scientific research collaborations to geopolitics. On the other hand the decrease in US’ outbound M&A and greenfield investments are more indicative of a long term trend, which is also true for the rest of the world vis-à-vis China.

When you look at trade data, it’s worth noting that US imports from China have de-grown at a CAGR of 4.5% over 2018-2023. Conversely, US imports have increased at a brisk pace from Vietnam (CAGR of 18.3%), Chinese Taipei (CAGR of 13.7%), Republic of Korea (CAGR of 9.5%) and India (CAGR of 9.1%). This trend indicates possibilities of India finally gaining from a shift in US-China trade dynamics, and needs to be explored further.

Leave a comment