India-EFTA TEPA: Beyond Norwegian Røkelaks & Swiss Cheese

India has just signed a pivotal Trade and Economic Partnership Agreement (TEPA) with EFTA countries, a group that comprises Switzerland, Iceland, Norway & Liechtenstein, on March 10, 2024. The deal marks another successful culmination of India’s efforts to fast track such agreements with important trade partners.

A key highlight of the agreement is the signing of binding commitment of US$ 100 billion in cumulative foreign direct investment by EFTA countries in India over the next 15 years, as well as the facilitation of 1 million direct employment in the country. This kind of commitment is unprecedented in the history of FTAs. In this article, we take a look at the key provisions of the agreement and its potential impact on India’s current trade profile with these partners, which is dominated by industrial goods.

Image Credit: PIB

India has just signed a benchmark Trade and Economic Partnership Agreement (TEPA) with EFTA countries, a group that comprises Switzerland, Iceland, Norway & Liechtenstein, on March 10, 2024. The agreement was approved by the Union Cabinet chaired by the Hon’ble Prime Minister has approved signing of the TEPA with EFTA States. The EFTA is an inter-governmental organization set up in 1960 for the promotion of free trade and economic integration for the benefit of its four Member States.

Provisions of the agreement

The deal marks another successful culmination of India’s efforts to fast track such agreements with important trade partners. The agreement encompasses 14 chapters that include market access related to goods, rules of origin, trade facilitation, trade remedies, sanitary and phytosanitary measures, technical barriers to trade, investment promotion, market access on services, intellectual property rights, trade and sustainable development and other legal and horizontal provisions.

However the highlight of the agreement clearly is the signing of binding commitment of US$ 100 billion in cumulative foreign direct investment by EFTA countries in India over the next 15 years (excluding foreign portfolio investment), as well as the facilitation of 1 million direct employment in the country. This kind of commitment is unprecedented in the history of FTAs.

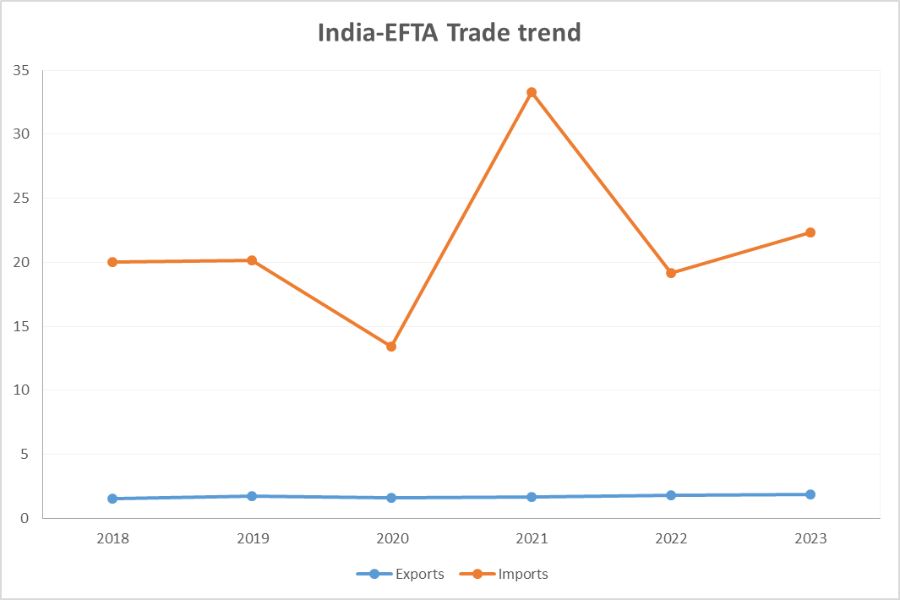

Source: DGCIS, figures in US$ billion

The EFTA block is offering 92.2% of its tariff lines, which covers around 99.6% of India’s exports. The market access commitment covers 100% of non-agri products and includes tariff concession on Processed Agricultural Products (PAP).

On the other hand, India is offering concessions on 82.7% of its tariff lines, which covers 95.3% of EFTA exports. Out of this over 80% of import access comprises gold. The effective duty on Gold has not changed. Sensitivity related to PLI in sectors such as pharma, medical devices & processed food etc. have been taken into account, while sectors such as dairy, soya, coal and sensitive agricultural products are in the exclusion list.

Tariffs on watches, clocks, cocoa bean and powder, malt products, tuna, trout and olive oil will be reduced to zero by India over a period of seven years. While bound duty rates have been brought down to 39% from 40%, effective rates in India are 15% so there is no relief there either. On the other hand, products that will immediately get benefit of duty removal by India are coal, medicines, dyes, textiles and apparels and iron & steel.

According to the government’s press release, TEPA is also expected to promote India’s services exports in sectors including IT services, business services, personal, cultural, sporting and recreational services, other education services, audio-visual services etc. The bloc has offered better access through digital delivery of Services (Mode 1), commercial presence (Mode 3) and improved commitments and certainty for entry and temporary stay of key personnel (Mode 4).

The agreement has provided for Mutual Recognition Agreements in Professional Services like nursing, chartered accountants, architects etc. It also provides an opportunity to utilise Switzerland as a base for tapping EU’s services market (as EU accounts for over 40% of Switzerland’s global services exports). Finally, TEPA also facilitates technology collaboration and access to world leading technologies in precision engineering, health sciences, renewable energy, Innovation and R&D.

Trade profile

India’s exports to EFTA reached around US$ 1.9 billion in 2023 (YoY growth of 2.8%), while imports were at US$ 20.5 billion during the same year (YoY growth of 20.5%).

Switzerland (73.5%) and Norway (25.8%) accounted for over 99% of India’s exports to EFTA countries during the year. The import scenario is even more lopsided with Switzerland garnering around 96.1% share of imports and Norway taking a share of 3.8%.

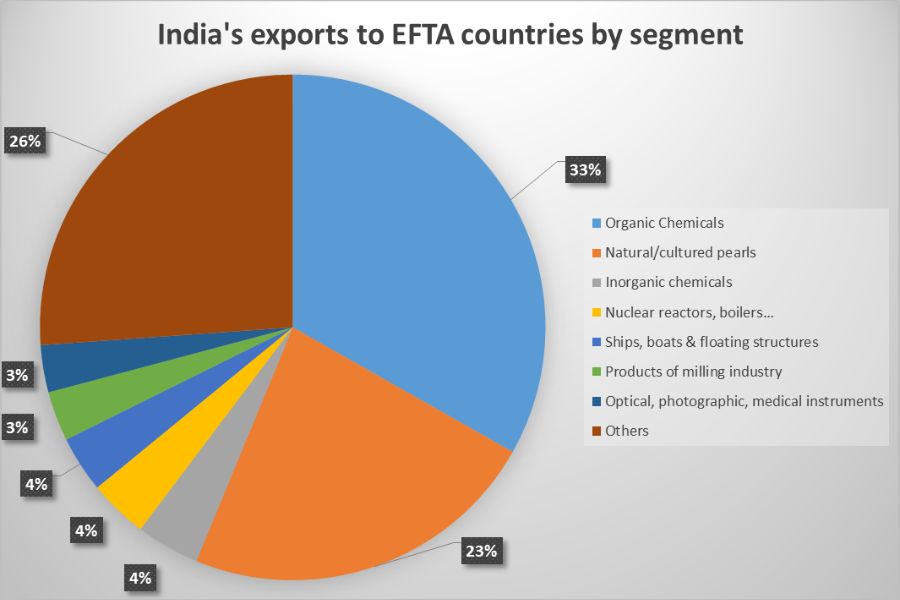

When it comes to product distribution, India’s top exports to EFTA in 2023 were Organic Chemicals (US$ 623.72 million), Natural or Cultured Pearls (US$ 432.55 million), Inorganic Chemicals (US$ 76.3 million), Nuclear Reactors (US$ 71.2 million) and Ships, Boats & Floating Structures (US$ 67.7 million). Imports are dominated by gold and silver (US$ 16.7 billion) and mineral fuels (US$ 780 million, predominantly coal, liquefied butane and liquefied propane).

For the purpose of assessing EFTA market potential, we created a group of available data for three countries – Switzerland, Norway and Iceland for which trade data is available till 2022. This country grouping had total imports of around US$ 473.8 billion in 2022. Around 25% of this import is accounted for by natural or cultured pearls, followed by pharmaceutical products (11%), mineral fuels (8%), nuclear reactors (7%), vehicles (7%) and electrical machinery & equipment (6%).

When it comes to countries exporting, Germany leads the list with exports of US$ 83.3 billion followed by the US (US$ 45.18 billion); China (US$ 35.7 billion); Italy (US$ 28 billion) and France (US$ 26.6 billion). India is currently ranked 25th among the top exporters to the region. The fastest growing export from India in terms of 5-year CAGR is mineral oil products (495%). This is followed by aluminium (84%) and electrical machinery & equipment (20%). It can be concluded that our trade with EFTA nations largely comprises industrial goods.

As a policy brief prepared by Ajay Srivastava, Founder, Global Trade Research Initiative (GTRI), around 98% of India’s exports to Switzerland are industrial products and they will be imported duty free. However, these products already enjoyed 0% duty under MFN regime. The remaining 2% are agricultural products, but Switzerland has excluded most agricultural products from the agreement, including dairy products, honey, various vegetables, and wheat, maize flour, and cane sugar.

The main benefit of the agreement, however, comes from investment commitments made by EFTA nations. It stems from a recognition of India’s annual nominal GDP growth rate of around 9.5% in US dollars terms over the last two decades, which was accompanied by a sustained increase of nominal foreign direct investment stocks from the EFTA States into India (around 13% annual increase over the same time period). The foreign direct investment stock of EFTA states in India stood at US$ 10.7 billion in 2022.

The four EFTA states rank among global leaders when it comes to competitiveness, wealth creation per inhabitant, life expectancy and quality of life. Switzerland is a world leader in pharmaceuticals, biotechnology, machinery, banking and insurance. Liechtenstein has strengths in capital-intensive and Research & Development driven technology products. Iceland is rich in renewable natural resources and fishing, and has increasingly diversified into other industries and services. Norway’s economy is also driven by oil and gas exploration and production, and fisheries, apart from key service sectors such as maritime transport and energy-related services. As these countries enhance their investments under the agreement, their competitiveness in these critical sectors will also work towards the benefit of Indian industry in the long run.

Finally, the FTA is a strong signal of India’s intent in terms of fast tracking trade integration with its key global partners. Dr Pralok Gupta, Associate Professor, Centre for WTO Studies, comments, “For India, it is the first agreement with any European country. It is good from the posturing perspective also and is a signal that India is on the path of finalising trade agreements. The investment commitment is a new and really unique element in this deal. We must understand that it is not a hard commitment because ultimately it is for the private sector to invest. EFTA countries will provide a facilitative regime with the aim to ensure this quantum of investment flows to India over the period. This is a win-win situation for both India and EFTA.”

Conclusion

The India-EFTA TEPA marks a major step forward for India’s ongoing efforts to finalise trade agreements with key partners. A critical element of this trade agreement is the signing of a commitment by EFTA countries to facilitate cumulative foreign direct investments of US$ 100 billion into the Indian economy over a period of 15 years.

Around 98% of the goods exported by India to EFTA countries are industrial goods, which already enjoy duty free access. However, the agreement provides additional commitments for services including IT services, business services, personal, cultural, sporting and recreational services, other education services, audio-visual services etc. While the agreement does not provide market access benefits for merchandise exports, enhanced investment by EFTA-based companies could be pivotal in boosting the Indian economy, improving domestic competitiveness in key sectors and enhancing employment.

Leave a comment