Indian start-ups to witness ‘spring’; investors upping the hopes

Indian startups can anticipate a sense of relief in the near future, as investors are foreseeing a resurgence of funding opportunities within the next six to twelve months. This comes after a prolonged period of limited funding availability which is often referred to as the funding winter.

- About 50% of investors anticipate the end of the current start-up funding winter in the next 6-12 months.

- Active investors have doubled in number, increasing from 400 in CY18 to about 900 by FY22.

- The number of registered start-ups in India has grown 9 times over the last five years, reaching around 90,000 in CY22.

Image Credit: Shutterstock

There is a favourable shift in funding prospects for Indian startups after a period of funding winter ending within the next 6-12 months, signalling a resurgence of funding opportunities. The Indian startup ecosystem has grown significantly in recent years, with a notable increase in the number of registered startups and active investors.

Funding spring revival expected for Indian start-ups

Funding spring refers to a favourable period when funding for startups becomes more abundant and accessible. This might happen during periods of economic growth, increased investor confidence, or the emergence of new technologies or industries that attract investment.

According to a report from Redseer, around 50% of investors anticipate that the current start-up funding winter will come to an end within the next 6-12 months, leading to a renewed period of increased funding opportunities.

Over the last five years, India’s start-up ecosystem has experienced significant growth, with the number of registered start-ups increasing by 9 times, going from approximately 10,000 start-ups in CY18 to around 90,000 in CY22. Concurrently, the number of active investors has doubled, rising from 400 investors in CY18 to about 900 investors by FY22. This growth isn’t limited to domestic investors alone, as global sources of funding have also become more varied than in the past.

The United States, European Union, United Arab Emirates, and Japan are the leading contributors to funding for Indian start-ups, comprising 5% of global funding and 20% of total funding in the Asia-Pacific region, said Kanishka Mohan, a partner at Redseer Strategy Consultants.

Half of the investors are confident about a funding resurgence within the next 6 to 12 months, whereas 17% believe it could happen in 15-18 months. Others have to say that it might take 12 to 18 months or longer for the funding constraints to ease.

Based on current funding trends, the outlook for 2023 suggests a return to the established patterns seen in the years between CY17 and CY20, with funding levels expected to range between US$ 12 billion and US$ 15 billion. Beyond that, a bullish trend is predicted for CY24, potentially reaching US $15 to US $20 billion.

The number of funding deals, which declined to 700-900 deals in early CY23 from 1,519 in CY22, is projected to rebound to 1,000-1,200 deals in CY24. Venture capitalists (VCs) presently possess more available funds than before. Additionally, this year is expected to witness a significant proportion of seed or early-stage deals, aligning with the trend observed since CY17.

Redseer evaluated over 1,000 start-ups and identified ten noteworthy themes, including BPC, health and wellness, diagnostics and clinics, gaming and app studios, personal loans, CRO/CRM, industrial eB2B, Insurtech, DevOps, and finance. These sectors are poised to produce the next wave of unicorns throughout the coming decade.

What does funding winter mean?

Funding winter is the period of time when startups may find it difficult to secure funding from venture capitalists, and other sources. This could lead to fewer opportunities for early-stage companies to grow and develop.

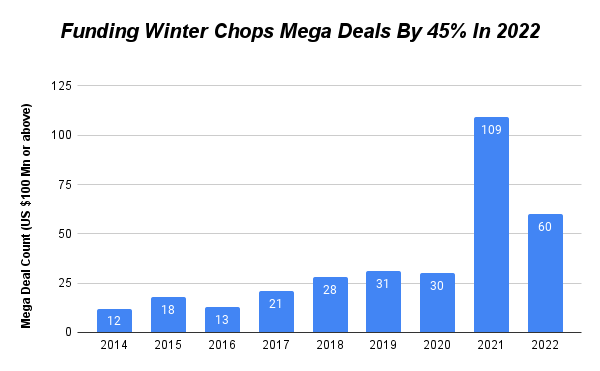

Example: Funding winter affected the year 2022 majorly and chopped mega deals by 45%.

Source: Inc42

The low participation of SoftBank and Tiger Global in large funding rounds came out as the major reason for falling mega deals. Both Tiger and SoftBank participated in over 40 such deals in 2021 which came down to 18 in 2022.

The values exhibit fluctuations over the years, with an initial low point of 12 in 2014, followed by an increase to 18 in 2015. A slight decrease was observed in 2016 with a value of 13, before a significant rise to 21 in 2017. Subsequent years show a consistent upward trend, with values of 28 in 2018, 31 in 2019, and 30 in 2020. However, a remarkable spike was seen in 2021 with a value of 109, indicating an exceptional anomaly in that year. The trend reverses in 2022, dropping to 60.

Final word

Indian startups are expected to get more financial support soon. This means they will have better chances to grow. Investors believe this funding spring will happen in the next six to twelve months. Over the past few years, the number of startups in India has grown a lot, and more investors are interested in supporting them. In 2022, there were fewer very big funding deals because some major investors didn’t participate as much.

Looking ahead, the relationship between investors, startups, and new technologies will shape the future of Indian startups. The expected increase in funding, along with the focus on specific growth areas, suggests a positive future for these startups in India.

Leave a comment