Festive sales: Retail sector’s light at the end of tunnel?

Value-based shopping is likely to continue to gain momentum during the festive period. Consumers could indulge in mid to big ticket purchases that they might have postponed due to the pandemic. Sectors like consumer durables, electronics, FMCG, apparel & gems and jewellery, etc. are likely to do well, aided by a better omnichannel and on-line experience of consumers.

- Festive season is seen as the biggest consumption period in India, accounting for 35-40% of annual sales of most consumer facing companies.

- After a lacklustre retail performance in the first half of the year, retailers in India are eyeing this opportune time with great expectations.

- The big discounts in festive season could see a fillip in value-based shopping with categories such as electronics & appliances, gems & jewellery, fashion and FMCG products gaining momentum.

- E-commerce platforms could be the new playground for all businesses as customers have shown an affinity towards online shopping across cities.

Festive season – seen as the biggest consumption period in India, contributing usually about ~35-40% of annual sales of most consumer facing companies – is just around the corner. Retailers have pinned their hopes on this opportune time after a dismal performance in the first half of the year as a result of the pandemic.

Will Indians indulge in revenge shopping as they release their pent-up demand? What product categories are most likely to gain from this auspicious time? What will be the main drivers of this phenomenon? This blog attempts to analyse these questions in greater detail.

The magic of a festive start?

The retail sector in India reached US$ 950 billion in 2018, growing at a CAGR of 13%, with e-commerce sales growing at an estimated 31% y-o-y to reach US$ 32.70 billion in 2018. However, the onset of the pandemic wreaked havoc for the sector, which accounts for over 10% of the country’s gross domestic product (GDP) and around 8% of the employment.

The first half of the year was marked by protracted lockdowns, job losses & salary cuts, among other things. As people across the country saw their incomes dwindle, they deferred discretionary purchases. Consequently, a number of sectors registered a negative growth in India, as revealed by market estimates.

The ripple effects of this also left an indelible mark on India, the 5th largest retail destination of the world. According to the Confederation of All India Traders (CAIT), the sector suffered losses to the tune of about Rs 15.5 trillion due to the Covid-19 pandemic.

Sectoral impact of COVID-19 & outlook for festive season

| Sector | Impact of COVID on growth | Outlook for festive season |

| Automotive | -23.1% | Positive |

| FMCG | -16% | Positive |

| Gems & Jewellery | -33.02% | Positive |

| Readymade garments | -24.1% | Mixed sentiment |

| Electonics | -13.3% | Positive |

Source: Impact of COVID-19 on consumer business in India Report, Deloitte India, GJEPC & MOCI

*Estimates on the sectoral impact of COVID based on Feb-March.

Festivals: The harbingers of change

With the economy reopening, businesses resuming operations and the government & RBI injecting stimulus into the economy, early signs of recovery have begun to emerge. Thus, in September, the Goods & Service Tax collections grew by 4% over those in August, manufacturing activity expanded at its fastest pace in almost 8 years, rising to 56.8 (PMI) and there was a 13% improvement in the number of cars sent to dealerships for the festive season ahead.

Inspired by these developments, some retailers have gained the confidence to expect growth revival in these festive months. Harsha Razdan, Partner and Head – Consumer Markets and E-Commerce, KPMG, India, opines:

The festive season could see a fillip in categories such as electronics & appliances, fashion, health & hygiene products. Jewellery could be a new entrant, wherein online channels could witness a spike during the festive season. The expected Big-discounting in festival time will lead to a continued uptake in indulgent products – laptops/iPads/computers with online schooling and education picking up. Mobile phones sales could continue to rise as entertainment and infotainment consumptions will continue to pick up with consumers spending more time at home.

True to this expectation, electronics companies are confident that they will record growth in this festive season as Indian households buy household appliances, laptops and mobile phones for work-from-home regimen. According to a report, e-commerce firms Flipkart and Amazon are likely to sell about 1.5 crore smartphones in the country during this period. Reports suggest that Panasonic saw its microwave sales go up by 41%, ACs by 33%, refrigerators by 71% & washing machines by 25% in the Navratri-Dussehra period.

An additional reason for rise in sales of household goods is that consumers these days are looking for a substitute for domestic help amid health safety concerns due to COVID-19. These electronic products saw a double digit growth, according to officials from LG. Likewise, Samsung’s smartphone volumes saw a 50% YoY rise.

This period is turning out to be a favourable one for automobile firms too, which registered zero sales in April amidst the lockdown. Thus, for example, Maruti saw over 20% yoy increase in its retail sales during the Navratri-Dussehra period. Mercedes sold 550 cars in this period, recording double-digit growth & Hyundai clocked a 28% YoY growth in its sales, principally driven by SUVs like Creta and Venue.

The FMCG sector, too, is pretty hopeful that this period will be mark the commencement of good times. Shaishav Mittal, Founder & CEO, Lovely Bake Studio, insists:

Festive spirit is enveloping the entire nation and we have already started getting inquiries and bulk orders for our special festive gift offerings. In our estimate, we expecting a bigger round of sales this Diwali than even last year.

The company is targeting higher market penetration with its range of innovative offerings, which comprise Assorted Eggless Cookies Tin Gift packs in special festive themes and premium traditional Indian sweets (packaged with M.A.P technology for a long shelf life without preservatives). They have also introduced a range of luxurious Indian sweets along with international merchandise including Turkish Baklavas and flavoured Dry Fruit Gift packs.

Apparel retailers, however, are not as hopeful about the upcoming festive season as a significant section of population is still homebound (e.g. schools, universities & IT companies). Added to this is the fact that this year, there are fewer occasions to socialize, with the fear of COVID-19 still looming and restrictions still in place for large gatherings. Sundeep Chugh, MD and CEO, Benetton India, explains, “Matching last year’s revenue will be very difficult, if the cases continue to surge the momentum will be no match to what we are expecting.”

Lastly, the gems & jewellery sector is extremely bullish, as it expects 65% of total business to take place this festival season. Gold jewellers are betting big on the festival of Akshay Trithiya, when it is considered very auspicious to buy gold. Sabyasachi Ray, Executive Director, Gem & Jewellery Export Promotion Council, elaborates:

Our optimism about a positive retail scenario is based on the outcome of the recently concluded B2B show India International Jewellery Show Virtual (IIJS Virtual), where an estimated Rs. 1,000 crore-worth (US$ 136 million) of business was transacted between jewellery manufacturers and retailers.

E-tail: The driver of growth

One additional point worth mentioning here is the fillip to e-commerce post-pandemic. Data from Bain-PRICE survey shows that around 40% consumers resorted to buying more online post-pandemic. Already, e-retail is reaching 95% of Indian destricts. So unsurprisingly, a significant proportion of festive sales will happen through e-commerce platforms like Amazon, Flipkart, Reliance JioMart and Myntra. E-grocers BigBasket and Grofers, furniture etailers like Pepperfry, beauty and grooming platform Nykaa, as well as baby care platform FirstCry are also likely to reap the benefits of online sales around this time.

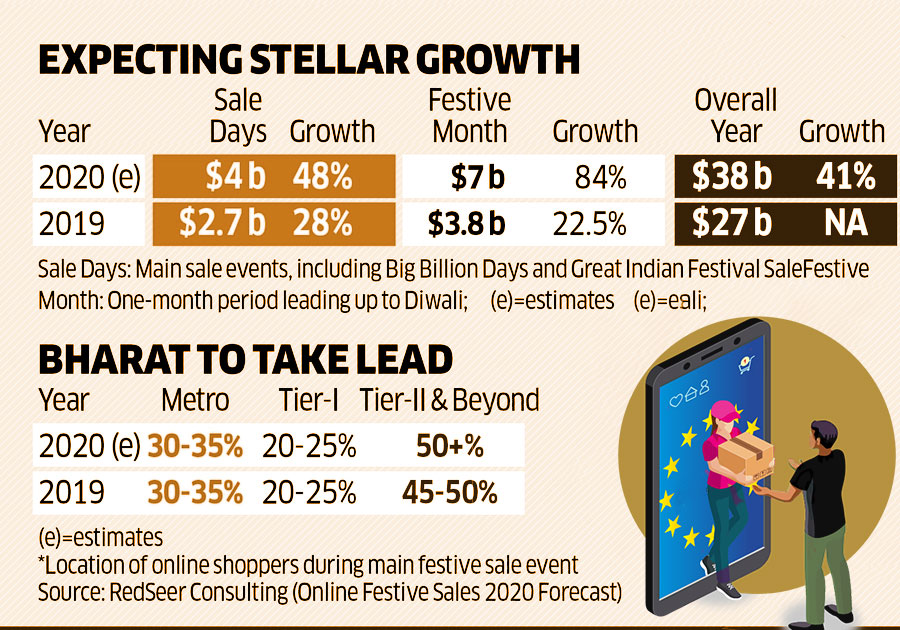

Gross sales for the online retail industry could touch US$ 7 billion, up from US$ 3.8 billion in 2019, during this time, as per an estimate. This growth will be driven by first-time shoppers from tier II and III cities, who are likely to splurge chiefly on low-cost items.

Source: Economic Times

This, however, is not to say that customers won’t step out to shop at all. As Pinakiranjan Mishra, Partner and National Leader, Consumer Products and Retail, EY, explains,

“With the no of cases now slowly on the decline, consumers are becoming more confident about the future and are likely to start spending now. They also want to come out and enjoy themselves, albeit with restraint. We can expect them to start spending beyond necessities including experiences to the extent they are individually comfortable”.

However, value-based shopping is likely to continue to gain momentum during the festive period. Consumers could now indulge in mid to big ticket purchases that they might have postponed due to the pandemic. Sectors like consumer durables, electronics, FMCG, apparel & gems and jewellery, etc. are likely to do well in the coming months. This will be aided by a better omnichannel and on-line experience of consumers, with demand being driven by tier II & III cities.

Leave a comment