Resolving India’s export credit issues to drive competitiveness

Capacity building and rectification of Basel III norms, knowledge and technology gaps in domestic financial sector will significantly reduce the risk of marginalization of small and medium exporters in trade transactions. In addition, financial institutions in India must strategize their export credit specifically for SME lending business to offer customised solutions that meet their needs.

- Availability of export credit specifically for MSME exporters in India has been one of the major bottlenecks in achieving their full export potential.

- The government over the years has introduced many schemes and incentives to assist exporters in availing credit to fulfil their export obligations. However, despite those benefits, exporters in India face many issues and challenges for availing export credit.

- Some of the major issues include significant trade finance gap, cost of compliance, large collateral requirements, lack of information about export credit schemes/products, issues with respect to export insurance schemes etc.

- Majority of domain experts believe that Multilateral Development Banks, Export Credit Agencies and National Development Financial Institutions can play crucial role in bridging the trade finance gap. Further steps like, single window clearance system, capacity building and technology gaps in domestic financial sector will significantly reduce the risk of marginalization of small and medium exporters in trade transactions.

Photo by Karolina Grabowska from Pexels

Over the last decade, Indian merchandise exports have hovered around the US$ 300 billion mark on an average. The causes of this relatively muted export performance (juxtaposed with GDP growth and some competing countries) have been attributed, in part, to external market conditions. But at the same time, India also needs to work on a host of internal issues such as taxes and duties, high cost of power, logistics and infrastructure challenges, availability of finance/credit etc. Among all these issues, the lack of access to financial facility and low export credit has been one of the major challenges, specifically for the MSME sector, which accounts for 45-50% of the total exports of the country..

Source: ITC Trade Map calculations based on UN COMTRADE statistics.

Growth in the merchandise & services exports of any country is considered as an indicator of a healthy and vibrant economy. To attain that growth, availability of export credit is considered as a vital tool, where the banking and financial sector plays a crucial role. Availability of adequate and timely credit (both pre-shipment & post-shipment1) is not only vital to start a business but is also very important for maintaining the pace of growth of business. Flexible payment terms and access to the finance/credit, helps companies to export a wide variety of goods and services to various markets, which eventually makes their products more competitive.

In India, over the years, the government has introduced many schemes and incentives to assist exporters in availing credit to fulfil their export obligations. However, despite those benefits the challenges for availing the export credit still persist. Some of the major ones have been discussed below:

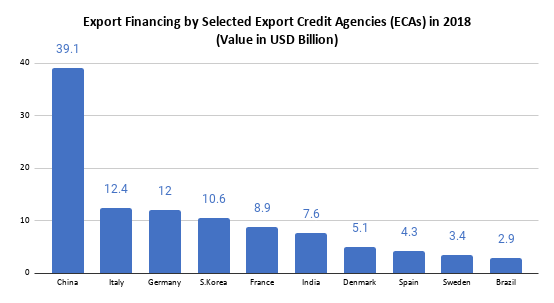

Trade Finance Gap: It has been estimated that there exists a US$ 1.5 trillion global trade finance gap, which is considered as a major constraint for overall export growth, given that trade accounts for more than half of the world’s output. In India, this gap is considered as a major bottleneck, as evident from the fact that the short-term official credit support by the ECAs (ECGC in case of India) is far less when compared with other economies (see figure below). Moreover, the YoY (%) growth of bank credit to commercial sector and components in India was reduced to 6.3% in 2019-20 as compared to 12.6% in the preceding year.

Source: CRS, based on Ex-Im Bank 2018 Competitiveness Report data.

Cost of Compliance

It has been found that compliance with new rules and regulations acts as a major impediment to trade finance. Compliance with respect to the Anti Money-Laundering (AML), combating the financing of terrorism (CFT), and Know Your Client (KYC) requirement has led to significant increase in the cost of export credit products for banks and financial institutions.

A study by EXIM bank of India states that “financial firms are incurring an average cost of US$ 60 million for meeting their obligations, with some firms spending as high as US$ 500 million on compliance with KYC and customer due diligence2”. Apart from this, compliance with Basel III norms, specifically for developing countries like India, has further led to a decline in trade volumes and increase in trade finance pricing.

High-cost finance and large collateral requirements: The high cost of the trade finance facilities offered by the banks makes it almost impossible for small and medium players to avail funds. Consequently, most of the SMEs still depend on the unorganised lenders to meet their requirement of working capital.

In addition to that, entrepreneurs are required to provide higher collateral to avail funds, which often becomes difficult for SMEs. Banks are also cautious in lending money to new exporters or to small and medium size exporters due to high credit risk.

A study done by Engineering Export Promotion Council (EEPC) and Research and information system (RIS) titled “COVID-19 Challenges for the Indian Economy: Trade and Foreign Policy Effects3” states that “almost 93% of the enterprises reported absence of institutional or non-institutional sources of finance. These enterprises with very little collateral or credit history face immense difficulty in obtaining formal finance. A look at the credit deployment to the MSME sector during 2016 to 2020 reveals that the sector bore the brunt with credit growth declining multiple times during this period.”

Unawareness about Export Credit Schemes/Products

Based on various studies, it has been observed that there is lack of knowledge about export finance facilities among exporters. The application procedure is very complex, which eventually leads to delay in the availability of timely credit facilities.

Drawbacks of Export Credit Insurance

In spite of its many benefits, export credit insurance is not free from drawbacks, as most schemes are not available for high-risk accounts. If available, these high-risk accounts are charged with very high fees. Apart from this, export credit insurance schemes generally do not cover every non-payment situation such as slow payment or late payment, and customer disputes or claims with respect to the poor condition of products or inaccurate products.

To resolve the issues and challenges with respect to the export credit, the government over the years has taken many steps, a recent example is the launch of a new scheme NIRVIK, also known as Export Credit Insurance Scheme (ECIS). However, multiple steps are still required to be taken by the government and financial institutions to overcome these challenges.

Many experts believe that the role of Multilateral Development Banks, ECAs and National Development Financial Institutions will be crucial in bridging the trade finance gap. These institutions can enhance the scale of existing collaborations in areas of co-financing, insuring of loan exposures and reinsurance of guarantee exposure.

Capacity building and rectification of Basel III norms, knowledge and technology gaps in domestic financial sector will significantly reduce the risk of marginalization of small and medium exporters in trade transactions. In addition, it is also recommended that financial institutions in India must strategize their export credit specifically for SME lending business to offer customised solutions that meet their needs.

Regarding the time taken for availing credit, large documentation requirements and reducing the compliance cost, it is recommended that a single window system be developed, so that all clearances, approvals, applications and discrepancies can be resolved at a single point to save time and cost for availing of credit by the exporters.

Footnotes:

1Pre-shipment credit is required to support pre-export activities prior to the shipment of product, and is used for meeting wages and other overhead costs during this period.

Post-shipment credit gives sufficient liquidity to the exporter till the time purchaser receives the product and initiates the payment.

2https://www.eximbankindia.in/Assets/Dynamic/PDF/Publication-Resources/ResearchPapers/89file.pdf

3https://www.eepcindia.org/eepc-download/617-Covid19_Report.pdf

The Author is a PhD Scholar in Department of Economics Jamia Millia Islamia, New Delhi. Disclaimer: Please note that any information offered in this article is expressly the opinion of the author of this article and does not (necessarily) reflect the views of any organization/Institution. No part of this publication may be copied, reproduced or stored in a retrieval system or transmitted in any form or by any means, mechanical, electronic, photocopying, or otherwise without the prior written permission of the author.

Nicely framed arguments