Wind Energy in India: Navigating Challenges for Brighter Horizons

In 2022, the world added 77.6 GW of wind power, reaching a total of 906 GW, growing by 9%. However, India’s wind energy capacity growth as the fourth-largest contributor has been comparatively slower, emphasizing the need to address challenges and accelerate expansion to unleash its full potential. Given that wind is a crucial resource for achievement of India’s zero carbon goals, IBT takes a look at the factors impacting growth and roadmap to be followed.

Source: Shutterstock

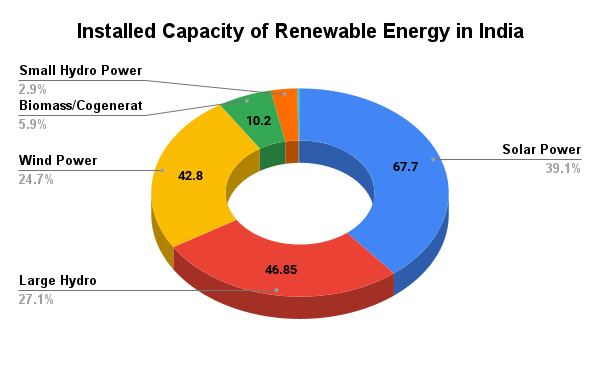

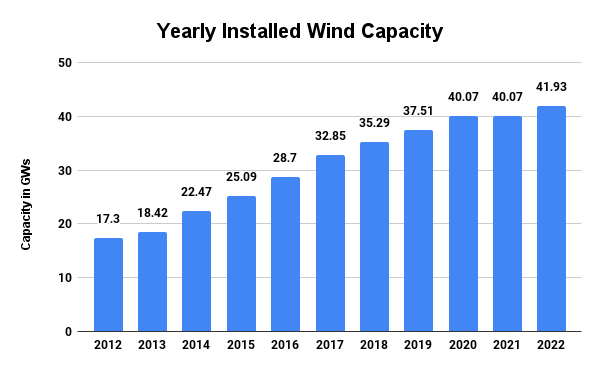

India has a combined renewable energy installed capacity of 179.32 GW out of a total installed power capacity of 416 GW. Wind energy holds a portion of 24.82% of total RE capacity among renewables and continues as the major supplier of clean energy. Currently, at an installed capacity of 42.8 GW. India stands 4th in Wind Power capacity (as per REN21 Renewables 2022 Global Status Report) and has set an enhanced target at the COP26 of 500 GW of non-fossil fuel-based energy, with 140 GW of wind capacity by 2030.

In 2022, 77.6 GW of new wind power capacity was connected to power grids globally. This brought the total installed wind capacity to 906 GW, representing a growth of 9% compared to 2021. The mid-term outlook for wind energy in 2023 shows a double-digit growth rate of 15%. Global Wind Energy Council (GWEC) Market Intelligence predicts that 680 GW of new capacity will be added in the next five years, equivalent to more than 136 GW of new installations per year until 2027.

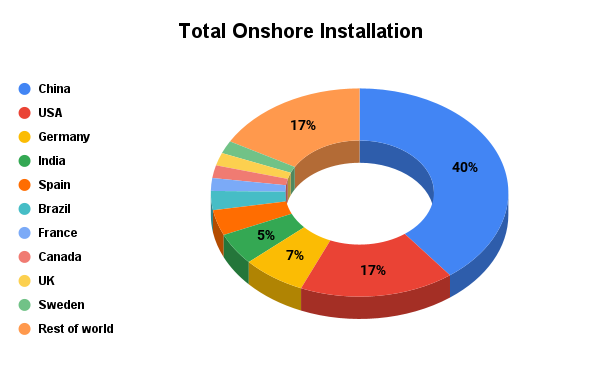

China dominates global onshore wind turbine nacelle assembly with 82 GW of identified annual capacity. With 21.6 GW of annual assembly capacity per annum, Europe is the world’s second-largest onshore turbine nacelle production base, followed by the US (13.6 GW), India (11.5 GW) and Latin America (6.2 GW).

Source: Global Wind Report 2023

Cumulatively, China, the US, Germany, India, and Spain accounted for 72% of the world’s total installed wind power capacity by the end of 2022.

Despite global wind energy capacity experiencing a robust 9% growth in 2022, India’s progress in the sector has been comparatively restrained. While 1.58 GW of wind power was commissioned in the first three quarters, the overall additions fell short of projections due to factors like high inflation, grid unavailability, and extended timelines for commissioning.

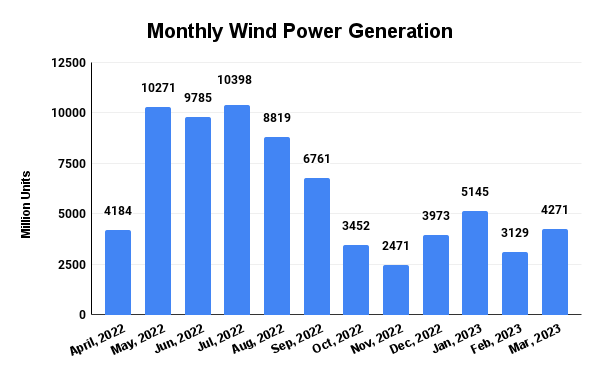

This noticeable downward trend in India’s monthly wind generation output over the past 12 months raises concerns about the stability and growth of the country’s wind energy sector.

Source: renewableindia.in

In April 2022, the wind generation output was 4184.03 million units (MU), which was significantly lower compared to the previous months. This trend continued with fluctuating figures in subsequent months, hitting its lowest point at 2,471.9 MU in November 2022. While there was a slight recovery in December 2022 and January 2023, the numbers are still lower compared to the earlier months.

What’s causing the slowdown?

The Indian wind energy sector has faced competition from the rapidly growing solar photovoltaic (PV) power sector. In recent years, experts feel that there has been significant policy attention and support devoted to the solar sector in India. Manoj Sail, Senior Manager (Renewable), Agarwal Groups of Companies, states “Withdrawal of industry-friendly incentives such as tax breaks on the sale of power as well as disruption to the supply chain have impacted the sector. A strong and stable policy framework is required that spurs demand for wind turbines and incentivises manufacturers to restore supply to the domestic market. The sector requires a higher level of technical qualifications and skills to build turbines and construct and maintain wind farms. The talent demand will be especially high when offshore wind farms come in, and they will need to make investments in skills development and training for their workers.”

India has published a strategy paper projecting 37 GW of offshore wind by 2030. This indicates the country’s intention to develop the offshore wind sector, but it also highlights the need to create a market for offshore wind and address the associated challenges.

When we have a talk with M. K. Deb, Chairman, Consolidated Energy Consultants Ltd (CECL), about the challenges faced by wind energy industry, he said, “Presently, the main constraint for new capacity addition of Wind Power Projects is availability of suitable sites. Over the past few years, there have been quite a few undesirable developments in terms of land mafias inflating prices, farmers hesitant to sell at fair rates, obstacles to site access and Right of Way, and escalating charges by State Nodal Agencies post-project commissioning, including added taxes.”

Furthermore, India aims to capitalize on supply chain opportunities, particularly by leveraging the role of MSMEs in the wind manufacturing sector. This focus on the domestic supply chain may require time to fully develop and contribute to the growth of the sector. Other challenges contributing to stagnation include transition to the reverse auction route, lack of financial incentives, challenges in securing land at windy sites and establishing power evacuation infrastructure for projects.

However, M.K. Deb adds on future potential, “As regards increase in new capacity addition of Wind Power Projects – there has been some improvement in FY 2022-2023 as compared to previous year. The new capacity addition in the year 2022-23 is 2275.75 MW while the previous year’s addition of 1110.5 MW.”

A study was conducted by the National Institute of Wind Energy to assess the wind power potential of the country at a height of 150 Meters. The potential now assessed for onshore projects is 1,163 GW. However the potential sites having high Capacity Utilization Factor (CUF) of 36% and above (which is necessary for financial viability of the project) is 163 GW. India has already utilized sites of total capacity of 42 GW and now a balance 120 MW would be available for new development.

Source: Investindia

The wind power capacity in India is expected to grow steadily from 3400 MW in 2023 to 5000 MW in 2030 according to the Global Wind Energy Corporation, with periods of moderate increases and slight fluctuations. The projections suggest a more significant expansion in the later years, potentially driven by factors such as investments, technological advancements, and supportive policies, contributing to India’s efforts to expand its renewable energy sector. Wind energy needs to be fully exploited to its full potential, and the addition of offshore projects will boost the wind supply chain. The government is trying to scrap the bidding process, waive charges on the sale of wind power between states, and announce new renewable energy parks to make land available for wind-farm developers.

Source: Statista

M. K. Deb further adds, “In the previous year – there has been three significant developments – which would probably encourage investment in the sector. SECI stopped reverse bidding, increasing selling price to Rs 3.24/kWh, thereby attracting private investment. Stricter ESG norms have led to increased demand for clean wind energy in commerce and industry. National Hydrogen Mission will also boost clean wind power consumption.”

Conclusion

India’s wind energy sector has experienced slower growth compared to global trends, despite being the fourth-largest contributor to wind power capacity. Challenges such as competition from the solar sector, policy changes, disrupted supply chains, and land acquisition issues have hindered progress. The withdrawal of incentives and lack of stable policies have affected demand and supply.

The sector’s talent needs and technical skills are also cited as concerns, particularly with the upcoming offshore wind projects. To address these issues requires a more stable policy framework, incentives for manufacturers, redressal of land acquisition challenges, investment in skill development, and focus on the domestic supply chain. Despite the challenges, there have been improvements in recent years, and the potential for growth remains promising, especially with the addition of offshore projects and increasing demand for clean energy.

Leave a comment