Value addition – The key to boost India’s horticulture exports

Adding value to India’s horticultural produce is a need of the hour as not only will enhance profit margins and agri exports of the country, but it will also be a right step in the direction of enhancing farmers’ income.

- Despite being a leading producer of fruits and vegetables, India’s horticultural exports are at a bare minimum, in contrast to nations like Thailand, the US & China.

- Adding value to India’s horticultural produce is a need of the hour as not only will enhance profit margins and agri exports of the country, but it will also be a right step in the direction of enhancing farmers’ income.

- But in order to truly leverage its food processing capabilities, India needs to fix the issues related to value addition such as quality, low R&D and infrastructural gaps.

- There is need for government to work with different stakeholders starting from the farmers to ensure uniform quality of produce, better storage and processing technology.

India is ranked second in fruits and vegetables production in the world. Despite abounding with great horticultural produce, India lags behind when it comes to the exports of its processed fruits and vegetables. Thus, they contribute merely 2% of the total agricultural exports of India. This is starkly low in comparison to Brazil (30%), USA (70%) and Malaysia (82%). However, according to experts, one of the ways to boost India’s horticulture exports is by adding value to India’s horticultural products.

Value addition to horticultural products has numerous advantages for all stakeholders. Besides enhancing the shelf life of the product & reducing food wastage, value addition leads to higher monetary return for the food & beverage industry. This will also mean higher incomes for farmers as exports and profits in the sector increase. This blog explores the reasons that have prevented India from leveraging its potential in terms of value addition to horticultural products and strategies to overcome the same.

Value addition potential of arid fruits

| Arid Fruits | Value Added Products | Income Profit Margins |

| Ber | Preserve, candy and squash | 40-60% |

| Kachra | Melosip, traditional drying | 60-70% |

| Ker | Dried fruits, pickle | Up to 80% |

| Khejri pods | Dried sangri | 40-60% |

| Amla | Jam, candy, preserve, pickle | 50% |

| Bel | Squash | 50-60% |

| Pomegranate | Squash and anardana | 40-50% |

| Carrot | Fresh juice | 40-50% |

Source: ICAR

Missing the bus?

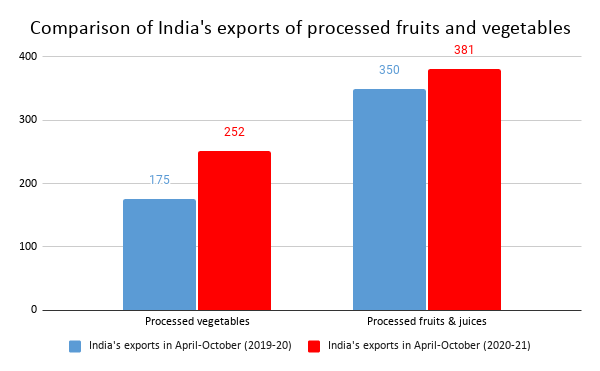

According to Agricultural and Processed Food Products Export Development Authority, in April-October 2020-21, India exported processed fruits worth US$ 381 and processed vegetables worth US$ 252. According to SBI Ecowrap, India’s share of high value and value added agri product in its agri export basket is less than 15%. In contrast, in countries like the US & China, these commodities account for 25% and 49% of their exports.

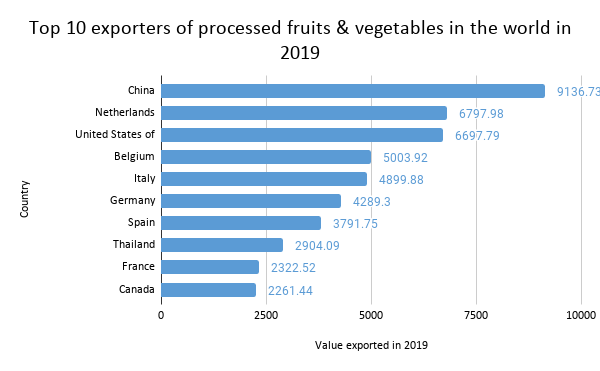

Source: ITC Trade Map. All values in US$ million.

Source: APEDA. All values in US$ million.

One of the reasons for low value addition in India is the failure to live up to the quality parameters set by other nations. This is quite evident in the context of Indian snacks being rejected in US due to high pesticide levels. What happens here is that in most cases, exporters in India source their raw materials from middlemen or mandis without having complete knowledge about which farm the product is sourced from. This variation gives birth to the challenge of meeting rigid food safety requirements of key markets.

Another related issue that the country’s food and beverage industry faces is the multiplicity of testing standards with bodies like FSSAI for imports and domestic market and APEDA and EIC for exports. This difference in standards can create confusion among farmers when it comes to following standards for domestic and external markets and leads to ambiguity in food standards. This is worsened by the fact that there is a lag in implementation of laws and enforcement of safety standards and the ill-equipped state of these testing labs.

In addition to this, there are many technological and logistical barriers that the sector faces. There is a lot of scope for R&D in agriculture w.r.t development of better quality high yielding seeds, an efficient plant disease forecast system and effective post-harvest management. This is attributed to the low expenditure on R&D as a share of agricultural GDP in India (0.30%) in comparison to China (0.62%), USA (1.20%), Brazil (1.82%) or even South Africa (3.06%). Further, logistical challenges like dearth of cold storage in India and shortage of containers are impacting the performance of the sector. Critical linkages like reefer transport and on farm infrastructure are also conspicuous by their absence in India.

Last, but not the least, there is the challenge of securing adequate credit for the sector. A recent report notes:

The RBI has classified loan to food and agro based processing units and cold chain under agriculture activities for Priority Sector Lending subject to aggregate sanctioned limit of INR 100 crore per borrower from the banking system, in order to encourage the setting up of food processing units. However, the procedural hurdles involved in obtaining credit from financial institutions acts as a drawback in the development of the industry.

Adding value to value addition sector

India, being a leading producer of fruits and vegetables, must play to its strength and leverage this agricultural bounty by adding value to its produce. While the government has taken some positive steps like priority sector lending to food processing companies, FDI in food processing sector and establishing mega food parks, there is still room for improvement. As ICRIER’s Professor Arpita Mukherjee explains:

There is need for government to work with different stakeholders starting from the farmers to ensure uniform quality of produce. Better storage and processing technology has to be shared at the local level which will enable farmers to store and do the primary processing. There is need to use technology to ensure traceability to farms and technology and training facility should be provided to farmers and SME producers.

Lastly, India can also learn from countries like Thailand, which has one of the most advanced food processing industries in Southeast Asia. It has more than 10,000 food and beverage processing factories. This is the result of 6 developments: (i) a shift towards high-value products; (ii) a shift towards imported raw materials; (iii) the increase in the internal demand for safe food; (iv) emergence of national brands and the consequent growth of the large-scale distributors; (v) the rapid rise of foreign retailers; (vii) rising intra-ASEAN trade in food; (viii) contract farming and (ix) the vertical integration of food producers. Incorporating some of these changes will significantly enhance the sector’s performance and hence its contribution to GDP.

Leave a comment