Unveiling Uttar Pradesh: A thriving export hub

Uttar Pradesh is the fourth-richest state in India with a gross state domestic product of Rs. 20.48 trillion (US$ 247.83 billion) in 2022-23. Exports from the state have grown significantly over the past few years. It ranked fifth among all states in India’s export share as of 2021-22, according to a NITI Aayog report. Exports of the state stood at US$ 21.68 billion in 2022-23, up from US$ 16.24 billion in 2018-19.

Export policy, infrastructure development, investment, and improved transportation are considered key drivers in UP’s promising export performance.

Image Source: Shutterstock

Boasting an area of 240,928 sq km, Uttar Pradesh is a landlocked state, placed seventh overall in the Export Preparedness Index with a score of 61.23. It is the 3rd largest economy in the country and has achieved remarkable growth in exports during the last few years. As of 2022-23, Uttar Pradesh stood 5th in the country in terms of export value (US$ 21.68 billion).

When it comes to districts, five districts from the state came under the top hundred export-centric districts in 2022-23. The major exporting cities of Uttar Pradesh are Agra, Kanpur, Lucknow, Varanasi, and Noida. Be it tourism, footwear or leather, Agra counts among the leading contributes. While Kanpur is famous for its hosiery and textile industry, Varanasi is known especially for the finest silks, gold and silver brocades. On the other hand, Noida is emerging as the hub for electronics and IT industry.

Additionally, data from a survey by central bank officials indicated that in a year of record project sanctions, Uttar Pradesh topped the list of states in drawing investment capital from banks and financial institutions, surpassing Maharashtra. According to a report titled ‘Private Corporate Investment: Performance and Near term Outlook’, the share of UP in investments from banks increased from 1.1% in 2013-14 to 16.2% in 2022-23.

Several factors have played a pivotal role in propelling Uttar Pradesh’s export growth. The state is well-positioned to continue this growth in the years to come, as it has a number of advantages that make it an attractive destination for exporters. The Uttar Pradesh government has implemented a number of initiatives, such as the UP Export Policy 2020-25 and the UP Export Excellence Awards. The setting up of export promotion councils for various sectors, such as the UP Electronics Export Promotion Council and the UP Handloom Export Promotion Council has also provided financial assistance, training, and other necessary support to exporters.

The state has a large and skilled workforce, which is a major advantage for exporters. It is home to many educational institutions, including technical and engineering colleges, which provide training for a variety of skilled occupations. UP has a major advantage with a population of around 24 crore and 56% of its population size in the working age group. The state’s per capita income has grown by 23% during 2016-20, according to Invest UP.

UP has made significant investments in infrastructure in recent years, which has made it easier and cheaper for exporters to do business. The state has built new roads, railways, and airports, and it has also improved its telecommunications network. Some of the highlights of the state’s infrastructure are as below:

- 5 domestic and 3 international airports

- India’s first Inland Waterway NW1 connects major exporting hubs to Haldia Port via Varanasi and Prayagraj

- Largest road network in India – total road length of 4 lakh km.

- State of the art expressways including Agra-Lucknow at 302 km, which is among India’s longest.

- Rail track of 8949 km with railway density twice of India’s average.

- Planned developments of investment regions, industrial townships, manufacturing clusters under the Delhi-Mumbai Industrial Corridor and Amritsar-Kolkata Industrial Corridor

- With a total capacity of nearly 16 million metric tonnes, Uttar Pradesh has the highest number of cold storage facilities.

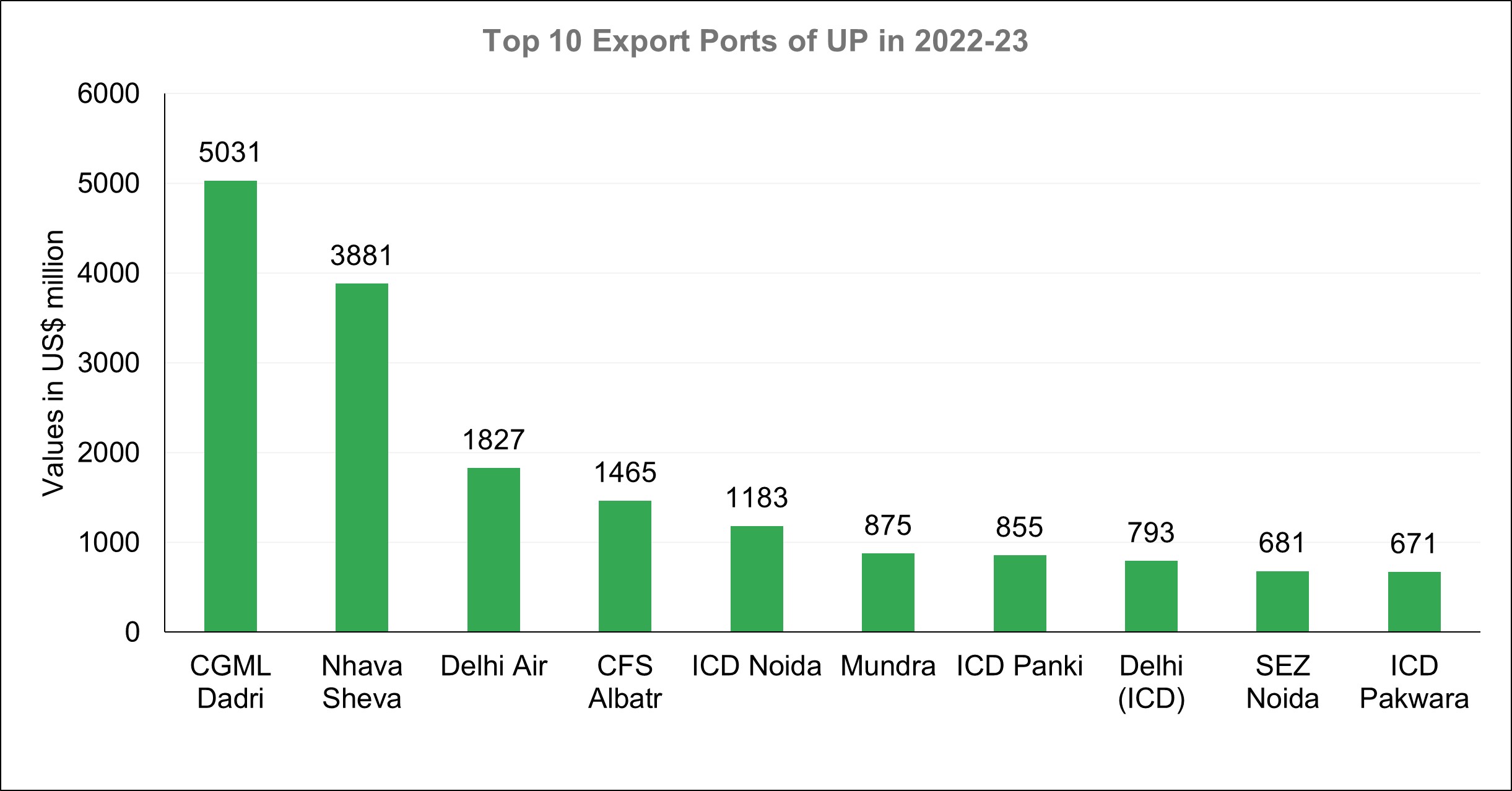

Its strategic location, with easy access to major ports like CGML Dadri Port, Nhava Sheva Port, Delhi Air, CFS Albatr, ICD Noida and Mundra Port, provides a competitive advantage. The state’s well-connected transportation infrastructure facilitates the smooth movement of goods.

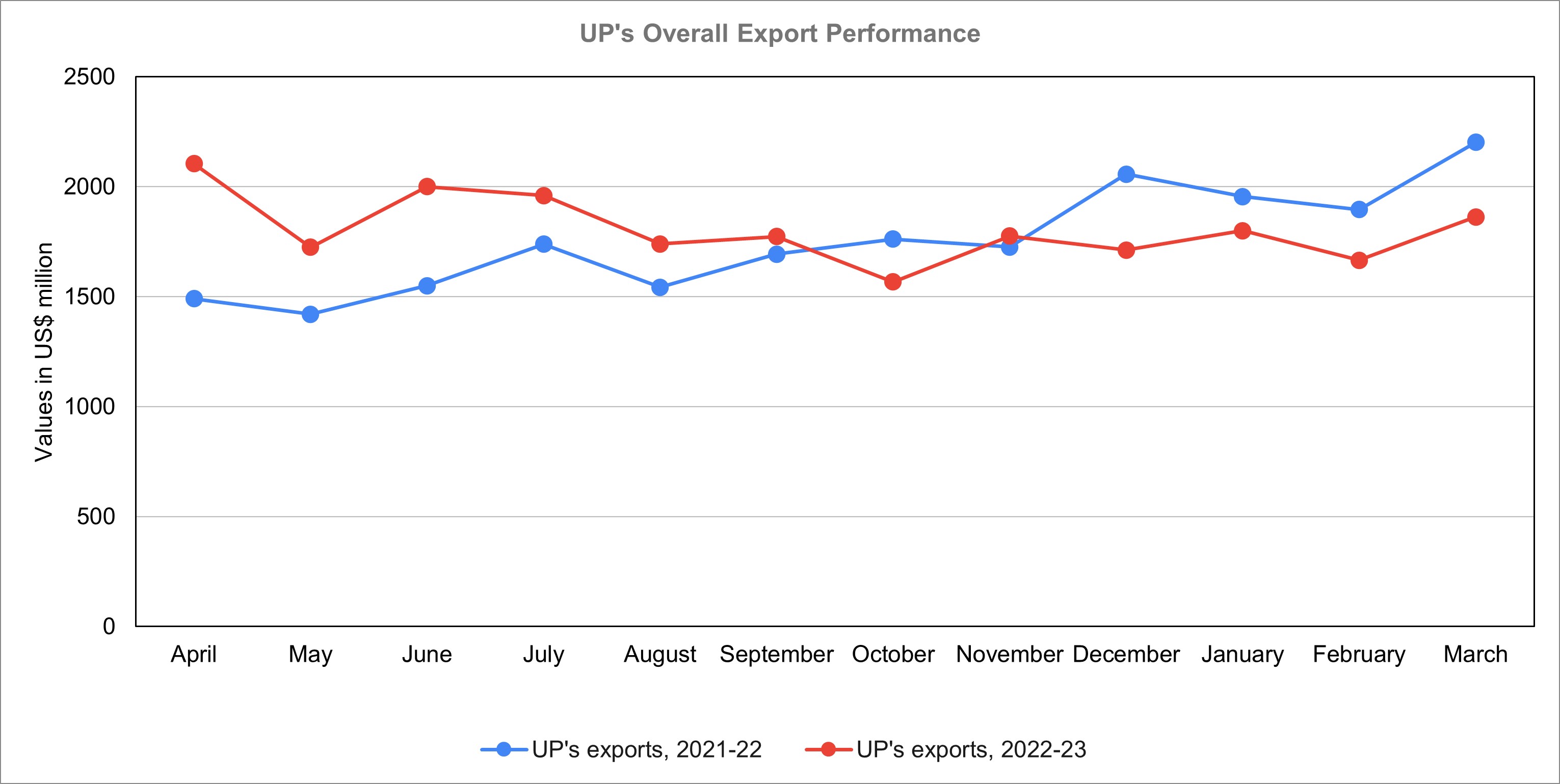

Export performance of the state

UP’s contribution to India’s export share hovered in the range of 5.42% to 4.98% in the period of 2019-20 to 2021-22. It exports 163 commodities to 215 countries through 131 ports, according to DGCIS.

Source: Directorate General of Commercial Intelligence and Statistics

UP’s exports have grown from US$ 16.24 billion during 2018-19 to US$ 21.68 billion during 2022-23.

Source: Directorate General of Commercial Intelligence and Statistics

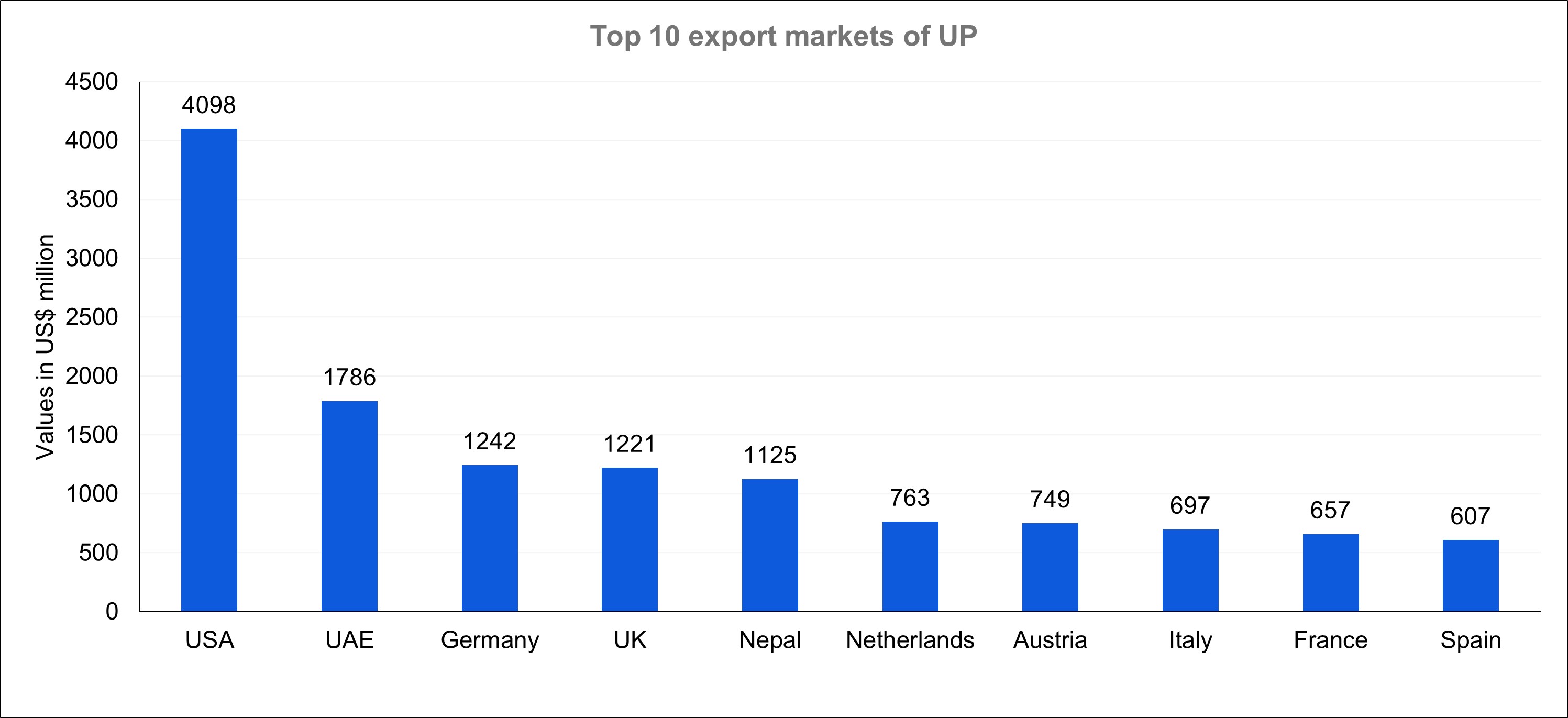

The export data indicates a diverse set of export markets explored by the exporters from Uttar Pradesh. In 2022-23, the US was the largest export market for the state with a value of US$ 4.1 billion followed by UAE ( US$ 1.8 billion), Germany (US$ 1.24 billion) and the UK (US$ 1.22 billion).

Source: Directorate General of Commercial Intelligence and Statistics

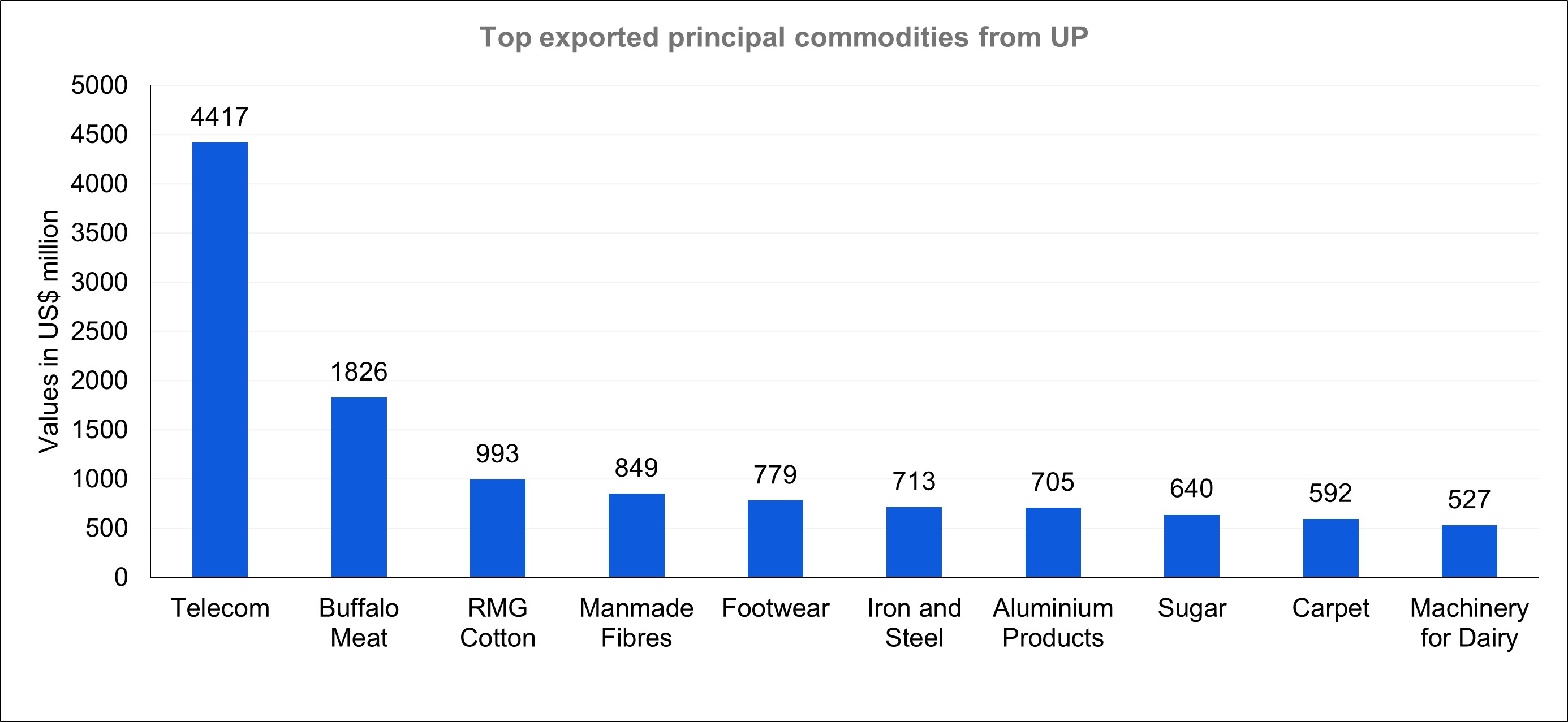

UP’s export product basket showcased appreciable product diversity. As of 2022-23, the state’s exports were led by telecom products at US$ 4.42 billion followed by buffalo meat (US$ 1.8 billion), cotton (US$ 993 million), manmade fibres (US$ 849 million), footwear (US$ 779 million), iron & steel (US$ 713 million), aluminium products (US$ 705 million), sugar (US$ 640 million), carpet (US$ 592 million) and also in machinery for dairy (US$ 527 million).

Source: Directorate General of Commercial Intelligence and Statistics

UP’s potential to top in India’s export share

Dr. Pralok Gupta, Associate Professor, Centre for WTO Studies, said, “Looking at its current growth, state government efforts and investment climate UP could become the top contributing state in India’s export share, but it will not happen overnight, it will take time. Currently, UP is far behind and competing with other states. With the right policies, infrastructure development, and focus on innovation, UP can unlock its full export potential and it can become India’s leading state in exports.”

UP has a huge potential to increase its share in India’s exports. Its potential as an export-focused state is further increased by the existence of industrial clusters and special economic zones (SEZs). With its well-established SEZs, the Noida-Greater Noida area has drawn investments from global corporations, greatly boosting UP’s export development.

To provide a framework for a policy that supports exports, the state has taken actions such as developing District Export Action Plans, export promotion policies, and selecting thrust sectors. For enterprises, Uttar Pradesh offers low-cost, high-tension power as well as 23 IT/pharma parks.

The “One District, One Product scheme has led to the identification and promotion of unique products from each district, boosting exports. Additionally, UP aims to attract significant investments, further fueling export growth.

Experiencing a remarkable surge of more than 2700 new exporters, the state has harnessed the potential of trade fairs, exhibitions, and a dedicated Export-Promotion Zone to facilitate export activities originating from Uttar Pradesh. Upholding international quality benchmarks, the state boasts NABL-accredited laboratories that aid exporters in product testing, ensuring conformity with global standards. With 34 Geographical Indication (GI) tagged products available for export, the state is emphasising adherence to stringent quality norms, intending to capitalize on the distinctive features of its products.

According to SBI Ecowrap, “At least two Indian states, Maharashtra and Uttar Pradesh, will break the US$ 500 billion mark in 2027 or 2028 when India achieves third place in the global economy.” However, some of the challenges that experts point out include the gap between the supply and demand of power by industries, low FDI, and less manufacturing value addition.

Leave a comment