WTO: Growing dissent on India’s ICT duties

• US, Canada, China Taipei, Thailand and Singapore have asked permission to join negotiations between India and EU on ICT tariffs.

• Earlier in April, the EU had filed a case against India, terming some of its tariffs for ICT products as being inconsistent with commitments at the WTO.

• India has increased tariffs over a number of ICT products to curb imports last year, to curb its current account deficit.

• Beyond these stopgap measures, India must urgently strengthen its domestic electronics manufacturing ecosystem to reduce reliance on rising electronics imports.

The case filed by the EU against India’s import duties on ICT products at the WTO has now acquired a whole new dimension. Five countries have asked permission from the dispute settlement body (DSB) to be a part of the negotiations – US, Canada, China Taipei, Thailand and Singapore.

Earlier this month, the EU had accused India of applying duties on several ICT products that were in excess of its commitments to the WTO. These included telephones for cellular networks or for other wireless networks, transmission apparatus for radio-broadcasting or television, television cameras, digital cameras and video camera recorders and microphones, loudspeakers and headphones & earphones.

Alluding to the Information Technology Agreement (ITA), 1996, the EU asserts that India was supposed to have 0% import duties on these products. The duties appliead are impacting EU exports of around € 600 million annually.

India applied a duty of 10% on mobile phones and some other ICT products for the first time in July 2017. This was further increased to 15% the same year and 20% in 2018. In October last year, India also increased the basic customs duty on telecom equipment, and levied duty on printed circuit boards for the manufacturing of the equipment as well as many other electronic products. This has been criticised by several WTO members.

The US has also been in talks with India to remove the duties since last year, pointing out that they were affecting exports worth US$ 490 million. Canada cited a figure of US$ 40.2 million of exports to India on these products during 2016-18, while Thailand stated that its exports in these tariff lines were recorded at US$ 318 million in 2018. Thailand was also the largest exporter of digital cameras to India during 2015-2017, accounting for 34.5% of the total imports. Chinese Taipei or Taiwan also affirmed that the customs territory of Taiwan, Penghu, Kinmen and Matsu had a special interest in ICT goods exports to India.

India has countered the argument by stating that these products did not exist in the market in 1996 and were therefore not a part of the original ITA. Furthermore, India is not taking any new commitments under the ITA-2 agreement that was formalised in 2016.

Last year, India had taken measures to curb non-essential imports and promote exports as a response to the falling rupee and rising current account deficit. The overall trade deficit had risen to US$ 80.4 billion during the first five months of 2018-19 compared to US$ 67.3 billion during the same period in 2017-18. Imports of electronic products had risen by 15% yoy during April-August to reach US$ 24.7 billion. Apart from electronic products, the government had also raised duties on a range of consumer goods like air conditioners, refrigerators, washing machines, footwear, etc.

Bringing down duties in electronic products will run counter to the Make in India and Digital India initiatives of the Government of India. India needs to drastically cut down its dependence on electronics imports. Due to a strong push towards local manufacturing by the government, around 100 new mobile phone manufacturing plants have been set up in India over the last four years. The Indian Cellular & Electronics Association estimates that the developments in the electronics manufacturing ecosystem saved the country Rs 3 lakh crore in imports over four years.

However, around 50% of electronic products that are marketed locally are still imported. In the instance of components, the ratio goes even higher to 80%. Most of the manufacturing units are still assembly hubs; a report by IIM and Counterpoint in 2016 concluded that locally procured components contribute only around 6% of the components in a phone by value in India.

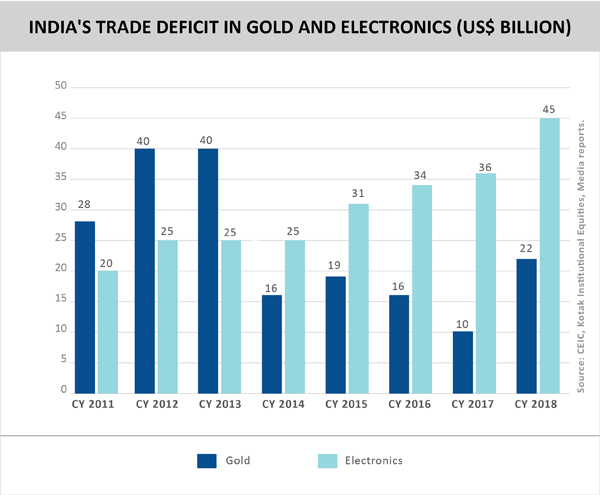

In 2011, the deficit in electronic items was US$ 20 billion and gold & gold jewellery was US$ 28 billion. However, in 2018, the deficit in electronic items had ballooned to US$ 45 billion, far exceeding the deficit in gold and jewellery, which was at US$ 22 billion. This broad category of electronic imports also includes products like computers and renewable energy technologies, besides mobile phones. A report by Deloitte projected that India’s electronics imports could exceed oil imports by 2020.

Clearly, India has genuine concerns with its electronics import bill at present, which necessitates short-term measures to curb imports in dire situations. But it is even more critical to strengthen the local manufacturing ecosystem for electronics, and components in particular, to ensure that electronic imports do not reach unsustainable levels and add another layer of pain for India in terms of its trade deficit, given that India’s electronic hardware demand is expected to reach US$ 400 billion by 2023-24.

Leave a comment