Why India needs to rejuvenate its coffee economy

Indian coffee industry needs to undertake extensive investments in mechanisation and productivity enhancement, while retaining the core attributes that define the distinctiveness of the product itself.

• Global market size of coffee is close to US$ 125 billion which is significantly high for any F&B product. From 2019 to 2024, the world coffee market is expected to grow by 4.37% at CAGR.

• Top coffee producing economies are Brazil (producing 37.5% of global coffee) followed by Vietnam (17.35%), Colombia (8.05%), Indonesia (5.22%), Ethiopia (4.45%), Honduras (4.1%) and India (3.47%).

• Indian coffee has created a niche for itself in export markets, particularly in the markets of Europe.

• However, competitors like Vietnam and Honduras are eating into India’s share, due to better price competitiveness. India needs to invest in greater mechanisation and improvement of productivity to better compete in the global market going forward.

ITC HS CODE: 0901

Being an ubiquitous product, coffee is being cultivated in more than fifty nations among which, 90% are developing economies. Global market size of coffee is close to US$ 125 billion, which is significantly higher than for any F&B product. From 2019 to 2024, the world coffee market is expected to grow at a CAGR of 4.37% at CAGR. According to Business Insider, coffee is the second most sought-after commodity in the entire world

Across global markets, coffee is bifurcated into two varieties – “Arabicas” and “Robustas”. Nearly 59.7% of the global coffee production are “Arabicas”, mainly cultivated in South America and Latin America. The other 40.3% of global cultivation belongs to “Robustas” in South Asia, Southeast Asia and parts of African countries. In this article, we will look at the global trade, production and consumption figures of coffee to assess the potential market for Indian coffee exporters.

Coffee producing countries

Source: ITC Trade Map and International Coffee Organization (ICO), 2020

In the last decade, coffee production grew at a CAGR of 2.26%, as production increased from 135,420 thousand bags (60 kg each) in 2008/09 coffee production year to 172,704 thousand bags in 2019/20. Top coffee producing economies are Brazil (producing 37.5% of global coffee) followed by Vietnam (17.35%), Colombia (8.05%), Indonesia (5.22%), Ethiopia (4.45%), Honduras (4.1%) and India (3.47%). Ranked 7th in world coffee production, India produces 6,002 thousand bags.

If we look at the consumption patterns of coffee, Europe is the largest market with one-third of global consumption, followed by Asia Pacific and North America.

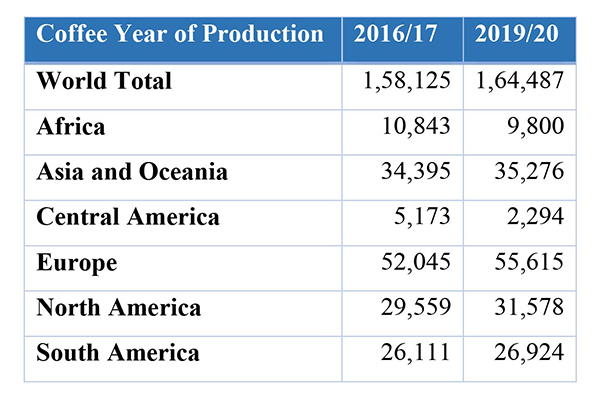

Region-wise coffee consumption

Source: ICO data, units: thousand 60-kgs bags

From 2015 to 2019, the world’s coffee trade has been hovering at US$ 30 billion with no increase in the growth rate. Currently, the size of world’s coffee trade is US$ 29.78 billion with Brazil being the largest exporter, while US is the largest importer. Following table represents the top trading economies of coffee:

Top exporters and importers of coffee

Source: ITC Trade Map, 2020

Brazil exports 15.1% of global coffee followed by Switzerland, Vietnam, Germany and Colombia. India is also considered as one of the exporters of coffee, exporting roughly a little over half a billion worth in value terms (US$). Major markets where coffee is exported by India include Italy, Germany, Belgium, Jordan and Kuwait.

When it comes to quantity traded, India’s exports of coffee surged from 2.1 lakh tons in 2015 to 2.33 lakh tons in 2019 growing at 1.24% CAGR, even though its value of exports remained sluggish. One key observation in this case is volume of exports surged while value did not, signalling there has been a reduction in the per unit price of coffee exports.

Source: ITC Trade Map, 2020, units in tons

Value added at each stage of coffee processing

Source: UNCTAD report on coffee, 2012

A deep dive into the coffee business

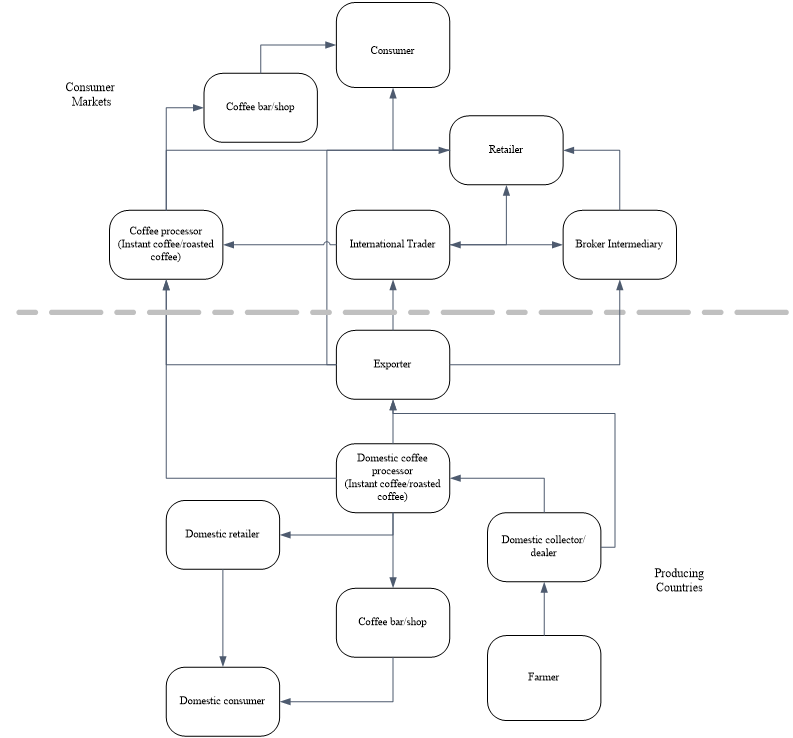

Processing or exporting companies often buy coffee through their own agents or sign a contract with private collecting agents and often buy rush coffee. Only companies that have wet-processing lines buy green coffee from farmhouses. After buying input materials, companies process the coffee.

In order to prepare coffee beans for export, companies reprocess these beans to meet export standards and classify the coffee into different quality levels. But, even after reprocessing, the coffee still has many imperfections, due to inadequate technology. The exports of coffee are often affected by three problems, which are humidity, black and broken beans, and impurities. Processing coffee companies in India carry out roasting and grinding on a small portion of rush coffee (3%-6%), and sell the finished product in the domestic market.

According to the experts, to build a new instant coffee manufacturing plant meeting export quality standards with a total output 3,000 tons per year, enterprises must equip themselves with facilities from professional brands and the minimum investment total is US$ 20 million.

Global Value Chain of Coffee

Source: UNCTAD report on coffee, 2012.

India’s major challenge in exporting coffee is price competitiveness with Vietnamese coffee in particular, as we are directly facing competition from them. According to the Coffee Exporters Association, “any disruption in supply could affect export prospects of the country because of increasing competition from countries such as Vietnam, the second largest coffee producer”. India’s exports mostly comprise Robusta beans, which command a premium in the global market because of superior quality. But at the same time, it has to be matched with an efficient supply mechanism which includes cultivation. This time due to COVID, coffee cultivation has been badly impacted in Kerala and Karnataka, which will affect our coffee production and exports in 2020-21.

According to the current scenario, India’s coffee industry should invest in advertising and promotion, focusing on the positive association with coffee growers and India’s distinctive reputation as a shade grown coffee producer. Since coffee consumption in India is about 1/4th of its production, there is ample scope to escalate and diversify our coffee exports. If India wants to continue being one of the main producers and exporters of coffee in the world, the country has to form strategies for value addition in Indian coffee.

The coffee industry also has to respond assertively to competitors in the international environment such as Vietnam, Brazil and Columbia. The world coffee market is very dynamic: consumer countries are becoming more sophisticated, demanding quality right from the raw material itself, its industrial process, logistics, preparation and service to the final consumer.

The Indian coffee industry should take advantage of its strengths in order to compete with coffee from other origins. It was recently reported how India was losing market share in Italy to competitors like Brazil due to better prices offered by the latter. In fact even Uganda is grabbing coffee market share in Europe at India’s cost due to better prices. In the current scenario, the premium segment is being impacted, which is affecting Indian growers who are unable to compete on price.

On the other hand, it needs to be wary of the rapidly growing trend towards mechanisation of coffee cultivation being led by countries like Brazil and Vietnam. According to farmers in these countries, this is leading to upto 25-30% decline in costs. Data shows that while Vietnam is setting new records in production, Gautemala and Columbia are unable to achieve their record highs over two decades ago.

India, on the other hand, faces significant constraints in terms of mechanisation due to the hilly terrains where coffee is grown. Going forward, it may not be possible to continue to persist with labour intensive cultivation as plantations are suffering from an acute shortage of labour already. Cost of labor alone accounts for 60-70% of total cultivation costs in case of Arabica and about 55-65% in the case of Robusta coffee depending on whether irrigated or not. In recent years, India’s production of coffee has also been on the decline. More research needs to be done in the area of mechanisation and productivity enhancement, which can help cultivators enhance production without compromising on the distinguishing attributes that define Indian coffee.

Thank you so much for providing this information, Unjhawala Tea is a leading processor and Exporters of Premium grain tea, Green Tea, and Powder tea. For more information, you can visit the website http://unjhawalatea.com/

with the perfect subject. Thanks for a great valuable project. Great work! Keep up the ultra do the webjob!

Thanks to detailed content of the article it is clear that India needs to rejuvenate its coffee economy. Abhishek, you should publish your article on Facebook and add followers with https://soclikes.com/ to more people read your work.

Great job! Thanks for sharing.I regularly visit your site and find a lot of interesting information.Thank you.

I am impressed, I must say. Really rarely do I encounter a blog that?s both educative and entertaining, and let me tell you, you have hit the nail on the head. Your idea is outstanding; the issue is something that not enough people are speaking