Value added F&B products: The shift that India needs the most

Draft Agri export policy 2018 aims to increase India’s export from US$ 30 billion to US$ 60 billion by 2022. It is a commendable initiative since now the country has shifted its focus towards agricultural exports rather than just production and domestic consumption. India is a leading agricultural commodity producer in many commodities such as rice, wheat and pulses etc. however a significant proportion of it gets consumed within the country owing to its large population. Taking cognizance of it, the most important component of the released draft agricultural export policy 2018 is that it calls for focus on value added food and agricultural product export. As per the released agricultural export policy the share of India’s high value and value added agricultural produce in its agricultural export basket is less than 15% for India compared to 25% in US and 49% in China. The policy draft document cites the example of Cashew apple jams and pastes, flavoured cashew, etc. It mentions that less than 4% of cashew exports are in value added form currently. Also under the organic products, agricultural export policy 2018 mention that only 5.5% of organic food export is processed.

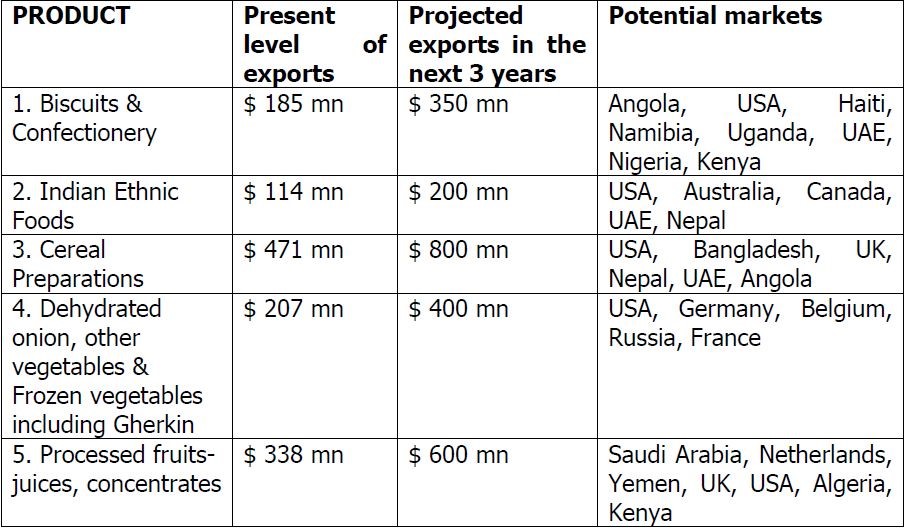

Under the strategic recommendations draft agricultural export policy 2018 mentions a few value added products along with their projected and current exports thus evincing that huge opportunity exists for these products. Also it depicts that the potential market for such product is regionally diversified from African nations such as Angola to USA. The scope to export value added products remain immense.

Some of the primary issues with the raw commodity export is that its demand is inelastic, it is more vulnerable to price fluctuations owing to volatility in production and its inherent dependence to agro climatic conditions and associated volatility. However value addition unleashes the scope to command more price in the global market and generate employment opportunities in the food processing sector. One such case study is of sweet biscuit. Europe’s biscuit import in 2017 was USD 3.7 billion. India’s export is at miniscule US$ 1.2 million. India’s current (2017) share in Europe’s sweet biscuits import is 0.0003%. If we could take it to 5%, it could bring USD 183.9 Million of additional revenue by simply processing wheat and sugar, otherwise abundantly available in the country. TPCI highlighted sweet biscuits as a potential product for export from India to World through its presentation to MOCI.

As per FSSAI, as on 2017, 30,413 Central licenses have been issued to Food Business Operators while 7,92,780 licenses have been issued to Food Business Operators by the State and UTs Licensing Authorities. It evinces that for a country which has an unparalleled agricultural production capacity has as low as 30413 licensed food processing units with an export capacity.

India as a land of large number of products preferred by world such as saffron, cardamom etc. needs to look beyond producing for the domestic market but think for capturing the globe with its value added products. Develop a product which the whole world demands, perhaps that would revolutionise India’s value added product exports.

Leave a comment