US-China trade war: Who should blink first?

China is expected to lose more from escalation of tariffs as a result of the US-China trade war. On the other hand, analysis shows that India presently has an opportunity to benefit to the extent of 0.085% of its GDP.

• The decline of US-China bilateral trade is only indicating trade diversion, which will impact the competitiveness of both Chinese and US products. Also, US’ imports from China are mainly concentrated in labour-intensive goods, represented by textiles and leather and machinery and equipment, where the final assembly stage was performed in China.

• Since the beginning of the trade conflict between US and China, both countries have raised tariffs substantially on each other’s exports, from 2.6% to 17.5% on Chinese imports into the US and from 6.2% to 16.4% on US imports into China.

• As per gravity model results, impact of import tariff escalation by US will be more. Thus, China’s exports to US are expected to be more affected compared to USA’s exports to China. Since US imports relatively less value-added products, they are expected to be fairly inelastic, so even if prices are raised, they will not fetch additional capital gain to China.

• Simulations done by NCAER show that China will lose more than US in terms of both GDP and exports. Here, India will be gaining to an extent, if the trade war continues between US and China. Gain to India could amount to around 0.085% of its GDP, which is just over US$ 1 billion.

Over the past two decades, as globalisation became more pervasive, the global political and economic patterns have undergone drastic changes. The current China-US trade war that started in early 2018 has been the largest of this kind in the global market in the past half century. Predicting what will happen in the near future and the related economic consequences are even more important for people including businessmen and government policymakers to prepare for them and make corresponding decisions. This article tries to provide an unbiased perspective through the lens of empirical trade analysis using trade tools which are used in global trade analysis.

Both economies are badly affected by coronavirus, but the only thing is that, China is hiding the true picture and pretending to be a COVID free country in the larger framework (although now it has seen a resurgence in active cases). US is certainly unhappy with China and is planning to implement sanctions. As a world factory, China imports raw materials and intermediate inputs from resource-rich countries like Chile, Peru, Bolivia and Brazil, and then exports final products to the US, which has led to a transition in the trade surpluses of these countries with US to China’s surplus with the US. This indicates that US trade restrictive measures will not only reduce the level of China’s exports, but also break the industrial division of labour between China and its trading partners, and weaken the importance of China in international trade.

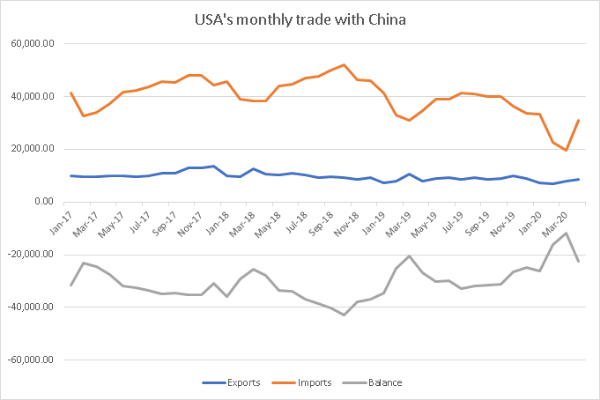

Source: US Census Bureau, figures in US$ million

From 2017 onwards, there is a continuous reduction in US exports and imports from China. In 2017, US exports to China were US$ 130 billion and imports stood at US$ 505.2 billion, which plummeted to US$ 106.5 billion and US$ 451.2 billion respectively by the end of 2019. This decline in US-China bilateral trade is only indicating trade diversion, which will impact the competitiveness of both Chinese and US products.

Also, US imports from China have been mainly concentrated in labour-intensive goods, represented by textiles and leather and machinery and equipment, where the final assembly stage was performed in China. Exports of US to China were mainly concentrated in machinery manufacturing and transportation equipment industries, which had high technology content and value added. This shows that there is a strong complementarity between US and China (they are not competing on similar product profile). It further signals that if there is a continuous escalation of tariff rates, then their trade will be adversely affected, which will cost their GDP.

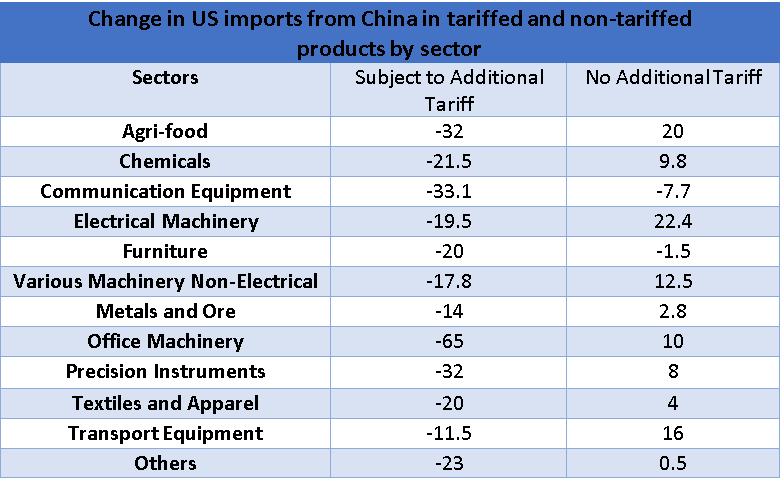

Source: WTO Tariff Data

Since the start of the trade conflict between the US and China the two countries have raised tariffs substantially on each other’s exports, from 2.6% to 17.5% on Chinese imports into the US and from 6.2% to 16.4% on US imports into China. Overall, tariff increases between the US and China have already had strong effects on bilateral trade between the two countries, including anticipation effects post COVID.

Source: Calculations based on US Census Bureau, figures in %

Office machinery has been the hardest hit sector in the trade war. In this category, imports of products subject to additional tariffs dropped by 65%. For other sectors such as agri-products, communication equipment, and precision instruments, trade in additional tariffed goods fell by more than 30%. The discussion so far suggests considerable effects of US tariffs on imports from China.

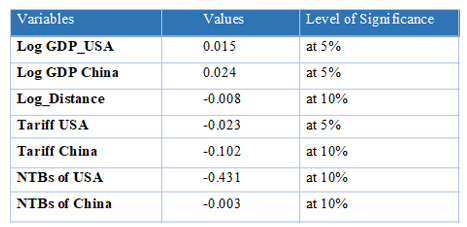

Econometric Analysis using Gravity Model

The gravity model is an empirical model used to analyse trade creation or trade diversion effect. As heterogeneity plays an important role in bilateral flows, individual fixed effects are introduced into the empirical model to be taken into account. The evolution over time of countries’ behaviour can also be examined through temporal fixed effects (for economic or political events). Most studies estimating a gravity model apply the ordinary least square (OLS) method to cross-section data. In this case, the model is defined as follows:

Log of USA-China Trade = Constant + β1.log_gdp + β2log_distance + β3_Tariff + β4_Non-tariff barrier + error

The expected sign for the effect of country size (measured by GDP) on bilateral trade is positive, for distance, tariff and NTBs negative.

Results

Source: CATR research

As per the results, if there is an escalation on import tariff rates, trade diversion will happen as β coefficients of import tariff are coming out to be negative. This means that the trade war will impact the size of bilateral trade. Another interesting thing to notice is that, impact of tariff escalation by US will be more. Since US imports relatively less value-added products, they are expected to be fairly inelastic, so even if prices are raised, they will not fetch additional capital gain to China.

Henceforth, both countries are going to lose market share and exports, but the loss seems greater for China as per the results. As one unit increase in import tariff by US will lead to a much larger fall in China than in the US.

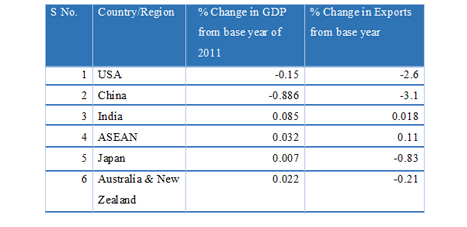

Corroborating with GTAP Results

Simulations done by NCAER (National Council of Applied Economic Research) suggest similar results. Using GTAP version 9. NCAER’s simulation is a specific scenario where US and China increase tariffs against each other by up to 20% on mining and manufacturing sectors. Tariffs already above 20% remain stable at their existing rates. Results of this simulation are presented in the following table:

Source: NCAER’s simulation based on GTAP 9

This result too shows that China will lose more than USA in terms of both GDP and exports. Here India will be gaining a bit if trade war continues only between USA and China. India’s gain will be at around 0.085% of its GDP, which is just over US$ 1 billion. Faced with growing protectionism globally and the possibility of a major US-China trade war and Indian exports facing higher tariffs, Indian policymakers need to consider the impact of these developments and choosing between various policy responses.

Leave a comment