Steel sector: A relook at FTAs with Japan & South Korea

India’s steel industry faces disadvantages due to FTAs with Japan and South Korea despite being the most cost competitive among major global steel producers. It is important for the government to renegotiate the FTAs with provisions to curb excess imports.

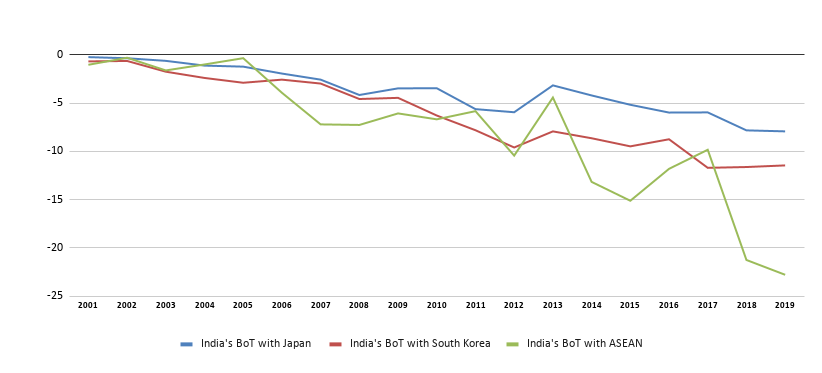

- India’s overall merchandise trade deficit with major RTA/FTA partners has widened significantly in post-FTAs period and has remained one-sided from its inception stage till date.

- In terms of the steel trade, Japan and South Korea pose serious challenges for Indian steel industry due to their large surplus capacities and high exports to production ratio. Balance of Trade (BoT) in steel products has significantly deteriorated since the inception of the FTA with both of these countries.

- The need to re-negotiate these agreements also arises due to high cost difference for Indian steel mills vis-à-vis other countries, to check violation of Rules of Origin (ROO) and to amend the safeguard provision under these agreements.

- To protect the domestic industries and to promote Atmanirbhar Bharat initiative, the government must renegotiate these agreements uncompromisingly to include Auto-Trigger Safeguard Mechanism. In addition to that government should focus on the introduction of Border Adjustment Tax (BAT) and Quantitative restriction (QR) as done by other countries like the United States of America and European Union.

Image credit: Shutterstock

India’s experience with Regional Trade Agreements/Free Trade Agreements has not been very encouraging over the years. The country has recorded significant trade deficit in most of its major trade agreements. As per a study by NITI Aayog[1]– “India’s exports to FTA countries has not outperformed overall export growth or exports to rest of the world.” The study further states that the utilisation rate of trade agreements by exporters in India has remained very low. India’s overall merchandise trade deficit with ASEAN, South Korea and Japan has widened significantly in post-FTAs period and has remained one-sided from its inception till date.

Balance of Trade in All Products with Japan, ASEAN and South Korea

Source: ITC Trade Map, value in US$ billion

In terms of the steel sector, Japan and South Korea pose serious challenges for the industry. Both countries have large surplus capacities in steel making and significantly high exports to production ratio. On the opposite side, the scope for other countries to export steel products to Japan and South Korea is very limited, as most experts believe that these countries have witnessed demand saturation, where the demand for steel products is expected to decline in both the medium and long run. In addition, low-scale investments into downstream facilities in India by the South Korean and Japanese steel industry encourage imports of upstream steel products, resulting in high value creation in these FTA countries at the expense of the Indian steel industry.

Steel production, consumption and exports of Japan and South Korea

| Country | Global Ranking in Terms of Crude Steel Production (2019) |

Crude Steel Production (2019) |

Apparent Steel Use (Consumption) (2019) |

Surplus (%) | Exports of Semi-finished and Finished Steel Products (2019) |

| Japan | 3 | 99.3 | 69.8 | 30% | 33.1 |

| South Korea | 5 | 71.4 | 55.4 | 22% | 30.0 |

Source: Author’s calculation based on the data of World Steel Association, value in million metric tonnes

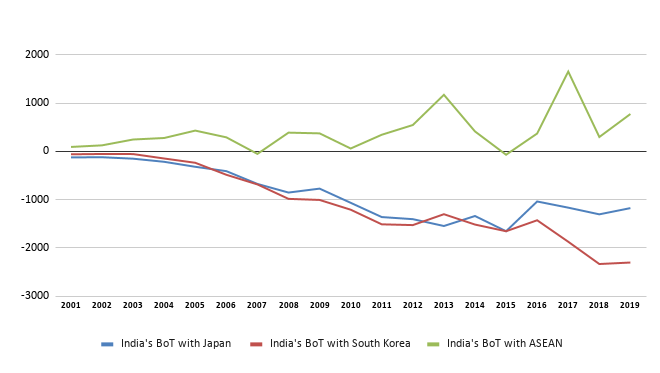

It has been observed, that in the post-FTA period, combined steel exports from Japan and South Korea to India recorded an increase of around 70%. On the other hand, exports from India to both Japan and South Korea have remained insignificant. The figure below depicts the clear picture with respect to the one-sided steel trade with Japan and South Korea in the post-FTA period. In the figure, the balance of trade (BoT) in steel products has deteriorated since the signing of the FTA with both countries.

Balance of trade in steel products* with Japan, ASEAN and South Korea

Source: Author’s Calculation based on ITC Trade Map Data; value in US$ million

*For calculating the BoT in steel products, selected products at HS 4-digit level were chosen (from HS: 7206 to HS: 7306)

With respect to ASEAN, India has a surplus trade in steel products. However, there are concerns with respect to the compliance of rules of origin and high Chinese investment in steel plants in ASEAN countries. In addition, India’s concessions to ASEAN countries has been far in excess as compared to the concessions granted to India.

It is also argued that more than 90% of the imports from the FTA partners (specifically from Japan and South Korea) are within the capacity and capability of the Indian steel industry and imports are purely a fallout of price differentials, as almost all of the steel products attract zero duty under these preferential trade agreements.

Apart from the significant negative trade balance, the need to re-negotiate these agreements also arises due to the following:

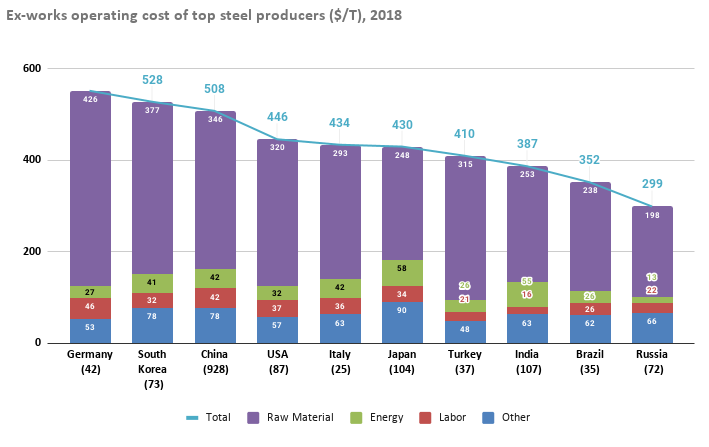

Cost difference: The Indian steel industry is considered to be highly competitive up to the factory gate. In 2016, World Steel Dynamics ranked India second in terms of cost of conversion of iron ore to steel after Ukraine. Indian mills were found to be more cost efficient in converting iron ore to steel than their counterparts in China, Japan or South Korea.

Ex-works operating cost for India is lowest among top steel producers in the world

Source: NITI Aayog

Despite being more efficient, India is still saddled with various structural deficiencies in the form of high cost of finance and power, cost of logistics, incidence of various non-creditable taxes and duties. All these deficiencies cumulate to a cost disadvantage of approx. US$ 80-100 per tonne as per NITI Aayog. Given this substantial cost disadvantage, most industry experts believe that there is a need for level playing parity for the Indian steel industry vis-à-vis imports.

| Cost Difference for Indian steel mills vis-à-vis other countries (US$/ton) | |

| Logistics and infrastructure | 25–30 |

| Power | 8–12 |

| Import duty on coal | 5–7 |

| Clean Energy Cess | 2–4 |

| Taxes and duties on iron ore | 8–12 |

| Finance | 30–35 |

| Total cost disadvantage | 80–100 |

Source: NITI Aayog

Lenient Rules of Origin: Rules of Origin (ROO) is a critical part of FTAs for conferring the originating status of goods being exported, thereby qualifying for concessional duty. Currently the negotiated FTA’s have lenient ROO’s. For instance, the Indo-Japan/Korea FTAs have a Product Specific Rule. These rules require changes in Customs Tariff Sub-Heading (CTSH) at the 6-Digit level without any value-addition requirements, whereas Indo-ASEAN FTA requires value-addition of 35% along with change in CTSH. Lenient ROOs have been leveraged by non-FTA countries to channelize their exports via these FTA countries by capitalizing on the concessional tariffs without adequate value addition.

To check these violations of ROOs and to cut down on frivolous imports at a preferential rate the GoI has notified the Customs Administration of Rules of Origin under Trade Agreements Rules (CAROTAR). However, the efficiency of these rules will significantly depend upon the implementation and monitoring by the government agencies.

Safeguard Provision under FTA: It is believed that the safeguard mechanism has been moderately negotiated by India. For instance, the transitional period for bilateral safeguard measures under India-ASEAN FTA was kept at only five years from the date of duty elimination. It is argued that the transitional period for safeguard under FTAs should be re-negotiated for a longer period. These terms require to be modified for a permanent safeguard provision in place of transitional safeguard.

It is also argued, that to protect the domestic industry, India can re-negotiate for the inclusion of the auto-trigger safeguard mechanism to check drastic import surges with its FTA partners. This auto-trigger safeguard mechanism was also proposed by India in the RCEP negotiations. According to this mechanism, in case there is a flood of imports (from the FTA partners) after reaching a certain threshold (trigger quantity), the auto-trigger of safeguard duties on the import of concerned products will be initiated.

These thresholds can be mutually decided by the two parties in the process of re-negotiation. For instance, South Korea in some of its FTAs has included product-specific safeguards mechanism to protect its agriculture sector. This mechanism provides the South Korean government the authority (and not to the other FTA partner) the possibility of imposing the safeguard measure.[2] Similar trigger safeguard mechanism has also been negotiated under the Free Trade Agreement between the Eurasian Economic Union and the socialist republic of Viet Nam[3].

In conclusion, it can be said that the preferential trade agreements with Japan, Korea and ASEAN have been one-sided from the date of inception. In the post-COVID scenario, the situation might further aggravate, which has the potential to adversely impact millions of jobs on the back of an unprecedented economic meltdown. As a policy suggestion, to protect the domestic industries and to promote the Aatmanirbhar Bharat initiative, the government must renegotiate these agreements uncompromisingly. Some of the key initiatives the government can introduce include Auto-Trigger safeguard mechanism, Border Adjustment Tax (to neutralize non creditable duties/taxes on manufacture of domestic steel vis-à-vis imports) and Quantitative restriction (QR) as done by European Union.

Leave a comment