Startups post COVID-19: Plans perish, DNA thrives

• Startups across the world face a sudden change in the business environment with COVID-19, which threatens to wreck the strategic outlook for many of them.

• A survey by Startup Genome reveals that around 41% of startups are in the red zone, with just around three months of cash runway remaining.

• Investor interest and outlook is also expected to change significantly in the aftermath of the pandemic, with most of them expected to get extremely selective.

• However, there are new business opportunities emerging, and startup founders must rely on the depth of their entrepreneurial resources to usher in new growth drivers.

Who Moved My Cheese, a remarkable book authored by Dr Spencer Johnson over two decades ago, is a remarkable tale of enterprise in the face of sudden change. The book allegorically tells a motivational fable of two mice – Sniff & Scurry and two little people – Hem and Haw. Their names quite define their nature too. All four get their supply of cheese from a certain location. When the supply of cheese (metaphor for happiness and success) suddenly vanishes, the mice are up to the task. Sniff and Scurry use the opportunity to embark on a new expedition to find fresh cheese. Hem and Haw, however, continue to return to the same old place and constantly crib that the cheese is gone.

It also signifies the dilemma of enterprise in this COVID-19 era. Sensing and adapting to change is an essential business virtue, but COVID-19 is a kind of change that no one could have sensed really. The world had a window of a month or two as the pandemic evolved to shocking levels in China. But they were clearly ill prepared for the fact that it had also simultaneously taken root in their backyard.

Startups develop business models quite meticulously – eying market trends and potential, scalability, planning resources, operations, funding, contingencies, marketing, and much more. But with the sudden onset of COVID-19 and a new normal for global living; business models, revenue projections and investment are all in a state of sudden flux. From mid-flight course correction to certain engine failure, suddenly these companies face a range of unpleasant scenarios.

NEW DRAWING BOARD

The Startup Genome launched a survey that analysed the impact of the COVID-19 on startups globally. The diagnosis is not very encouraging from the second edition of their survey released on April 21, 2020. Around 41% of startups are currently in the ‘red zone’ – they have around three months or less of cash runway remaining (length of time till which they will remain solvent). Among startups that have raised series A, B or later rounds, 38% have less than 6 months of cash remaining. Given the difficulty in raising funds in this period, that is a very dangerous position to be in.

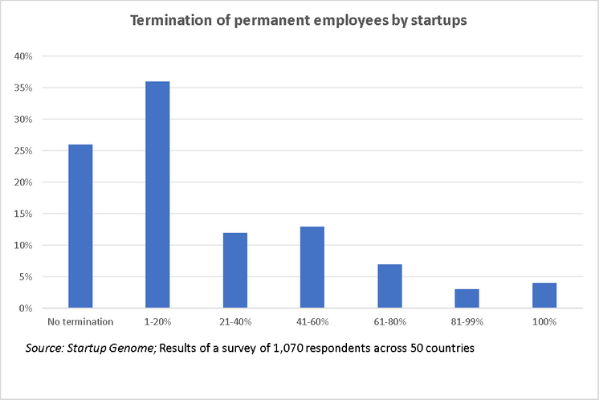

Furthermore, around 74% of startups have been compelled to terminate full time employees. Out of these 39% of startups have laid off 20% or more of their staff, while 26% have handed the pink slip to over 60% of their staff.

In line with this global trend, Indian startups also face a sobering 2020, after raising record capital of US$ 14.9 billion in 2019. Venture capital and private equity investments are estimated to fall by 45-60% this year. Major VCs have confirmed that very few startups may pass muster for further funding in the near term. India had 1,406 funded startups in 2019 compared to 351 in 2008.

Some of India’s top enterprises are trying to pivot to new business models. Cure.Fit and Ola Cabs have ventured into home delivery of food. The former has also started virtual yoga classes. Online ticket aggregator BookMyShow has launched free live shows on Instagram to keep its audience engaged.

It may seem pretty reasonable to write off much of the startup ecosystem given the manner in which several business models could be devastated by the virus. For instance, air travel may not return to its pre-COVID-19 levels before 2023. Travel in general isn’t expected to be the same again. Most consumer services like beauty salons, barbers, wellness centres, cab hailing apps, gyms, retail, restaurants, amusement parks, movies, etc had a strong ‘human element’, which has now been redefined as a ‘potential virus interface’. A lot of startup business models are based on these services, and the current crisis threatens their survival.

But there is also another side to this argument. The lockdown has been a boon for businesses that were delivering essentials, particularly food and medicines. Their major point of concern has been how to service demand in the middle of supply chain disruptions during the lockdown. Experts in the employment industry project a rise in hiring for e-commerce, transport & logistics, pharma and edtech.

FROM MISERY TO OPPORTUNITY

As the lockdown opens, e-commerce based delivery models are expected to thrive across categories. The medium was expected to post strong growth even before this crisis, driven by mobile-based shopping and rising touchpoints for consumers including social media, chatbots, voice assistants, etc. But after the global lockdown, the very definition of ‘strong growth’ would need redefining in this segment. Consumer goods majors like HUL, Apple, Samsung LG and Xiaomi have already started making changes to their India operations in expectation of significant growth in e-commerce share of sales.

Livestreaming could become one lucrative avenue for companies tapping consumers, especially for shopping and speciality products as the China experience indicates. popular. Toaobao, Alibaba’s live streaming platform, is one of the largest e-commerce websites in the world. It’s live stream sessions continued to register double digit growth even at the peak of the COVID-19 crisis in China, and the number of merchants using it for the first time surged by 719% from January to February.

Online engagement in general has attained new heights and is likely to witness accelerated adoption in the post-COVID era. Even SME or and MSME’s are using digital tools like websites, digital newsletters, blogs, digital conferences, workshops and webinars to reach out to customers and stakeholders. People are embracing video calling apps like Zoom and Skype in increasing numbers, and might in fact be able to convince themselves in future that this is as good as the real thing (read face-to-face meetings if so, that is bad news for the travel industry!).

The same goes for digital payments. From a mode to ensure greater transparency in transactions and even government schemes, digital payments have a new purpose in this milieu – keep the virus from spreading. India has a strong ecosystem of fintech startups, which will be understandably bullish about this opportunity. It attracted US$ 421 million in fintech funding in Q1, 2020, compared to US$ 175 million for China (which was at the peak of the pandemic) in the same period. New product development is a major focus area for this segment, and some of them could also gravitate to becoming full fledged marketplaces.

Edtech firms were on full swing since the beginning of the lockdown. A lot of people saw this crisis as a time for serious introspection on many ‘larger life questions’. Education and career obviously comes among the primary considerations. A slew of short career enhancing courses started popping up on our social media and search engine. Traffic, enquiries and bookings surged for players across the board like Byju’s, Unacademy, Vedantu, UpGrad and Toppr. As schools went online almost overnight, it was a sunshine moment for startups like Noida-based Edumarshal, which offers a proprietary e-campus solution (software-driven management of school administration). Since the inclusion of LMS and video conferencing tools in January this year, the company is seeing growth of 250% month on month.

Healthcare, understandably, has become a cradle for innovation in the COVID-19 period. Governments, academia and enterprise alike are continuously engaged in equipping mankind in its battle against the virus. Work is being done in a host of areas like vaccines, ventilators, drugs, PPE kits, face shields, contact less testing, testing equipment, etc. With social distancing as a buzzword, there is a lot of promising innovation to be expected in robotics as well, be it sanitising hospitals, conducting tests of patients and delivering them food and medicines. As offices open up, they would now find widespread application in the workplace. A case in point is Asimov Robotics, whose robots are now deployed outside office buildings in Kerala – dispensing hand sanitisers and giving health messages about the virus.

COVID-19 and the lockdown have brought mixed news for the food sector. Demand for food surged tremendously, but firms were ill equipped to serve this sector due to the lockdown and resultant disruption in the entire value chain. Moreover, the continued shutdown and uncertain future for restaurants puts a major revenue stream at risk. Home delivery may still return with a vengeance, but the revenue model for restaurants that have a strong dine-in component is expected to witness a huge setback.

A Mckinsey survey across 41 countries reveals that customers have by and large adapted to low touch solutions like video conferencing, curbside pick up for groceries and telemedicine. Around 40-60% of them indicate that they will stick to these practices under the new normal. Home delivery of essentials will definitely see a surge as the consumption shifts from out of home to within the house. Issues of cleanliness, safety and hygiene will be critical components of consumer behaviour with respect to food, as will concerns about the future, which will tend to keep them more focussed on essentials rather than discretionary purchases.

As in the case of food, entertainment options out of home are also virtually down to zero. This has precipitated a surge in demand for video streaming solutions. Research and markets estimates that the global content streaming market will grow from US$ 24.8 billion in 2019 to US$ 50.2 billion in 2020 as most people stay at home due to quarantine or lockdown. The report adds that the “increase in the number of mobile devices, internet connectivity and digital media players or content providers making it easier for consumers to access music and video content going forward”. But the sector still faces a constraint int terms of bandwidth limitations and reliability issues. But as demand shifts to this segment, investments in high speed broadband and 5G should accelerate.

STAY HUNGRY, STAY FOOLISH

These were the words of the legendary Apple founder Steve Jobs, who encouraged people to always be curious to learn more and achieve more. For numerous entrepreneurs around the world, this is a period for pain as well as new learning, before they can actually see positive results.

As these instances show, the cheese has moved significantly for a lot of startups in the COVID-19 period. With a lot of models become obsolete, it signals an existential threat. But rather than fret about what’s lost, startup founders need to focus on what they have and what new opportunities can become available. This interim period promises a lot of pleasant and unpleasant surprises. It will be a test of their enterprise, resolve, determination and ability to improvise. New opportunities will also come in with intense competition, so they need to be mindful of differentiation.

But then these are the very assets that have taken them this far, and tapping on these very resources could help usher in a bright new future for them in the COVID era. For those who can survive, thrive or pivot in this period, there are new market dynamics and demand equations to decipher on the other side, and a lot more fresh ‘cheese’.

Hi