Sizing up the next wave of conglomerates

• The role of large conglomerates has been pivotal since the previous century. They influence manufacturing costs, technological advancement and internationalization of products and services.

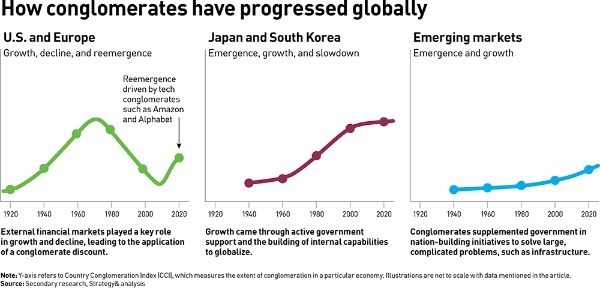

• Conglomerates in the US and Europe have been through a complete cycle of emergence, growth, and decline and are now in growth mode again.

• Emerging markets have been buoyed by a rising middle class in recent years, and this is offering a new avenue for growth for conglomerates in these markets.

• However, smaller companies and startups are gaining greater access to capital, resulting in massive competition. It is important for emerging market conglomerates to sharpen their focus and be clearer about their identity and business models.

A conglomerate manages several businesses across sectors that may or may not be related. For instance, a conglomerate may have a division for military engines for jet fighter planes at one end, and a division that runs a chain of supermarkets in another. Even within a single market such as media and entertainment, a conglomerate may operate diversified businesses like movie production, advertising, publishing, etc.

The role of large conglomerates has been pivotal since the previous century. They influence manufacturing costs, technological advancement and internationalization of products and services. The existence of conglomerates at different geographical locations during different time periods is an outcome of achieving technological access, greater competence and high market share. For example, during the 1950’s and 1960’s, most of the conglomerates were present in developed regions like EU and US.

After reaching satiation in terms of price, technical innovation and physical presence, these conglomerates were in search of new geographical locations. Then in the 1970’s and 80’s, they marked their presence in East Asian countries, followed by China & Hong Kong in 1990’s and 2000’s. Once satiation is attained in these locations, there is a shift towards south east Asian nations like Philippines and Thailand. India, too, is expected to experience a similar impact of conglomerates, mainly in manufacturing and mass assembly line production like China experienced 30 years before.

Big automobile and electronics companies, like Toyota and Sony, were typically surrounded by small and medium enterprises, which supplied parts and components. Such big companies were also members of vast conglomerates and much business took place within these groups. These national value chains were thus “unbundled” into GVCs in Japan. South Korea implemented a similar approach, as government policies fostered the development of its own conglomerates and was equally successful, as evidenced by its very rapid development, and the global market penetration of conglomerates like Samsung, LG, Hyundai and Kia.

Source: Strategy + Business

Emerging market conglomerates are at an inflection point

Looking broadly at three groupings which are US & Europe, Japan and South Korea, and emerging markets, it can be clearly observed that conglomerates in the US and Europe have been through a complete cycle of emergence, growth, and decline and are now in growth mode again as technology giants such as Amazon build diversified stables of businesses. In South Korea and Japan, conglomerates have proliferated significantly in the last 50 years and dominate the economy.

Western corporate strategies have often served as role models for businesses in emerging markets. The reaction to the financial crises in Asia and Latin America has only served to reinforce this practice during the late 1990s. Multilateral financial institutions, consultants, and academics that advise businesses and governments in emerging economies have all been pressing for a closer convergence of first-and third-world business models for the private sector.

The detailed characteristics differ, but the crux boils down to the same thing in virtually every emerging economy, and that is to dismantle the diversified business groups that dominate the private sector. These include huge conglomerates such as Samsung in South Korea, the Tata Group in India, and the Koç Group in Turkey. The arguments for restructuring conglomerates are simple and cogent. Selling off assets could quickly reduce the huge debt that some of these groups have built up, hence releasing blocked capital in the economy. Another argument is that breaking up these mammoth organizations could reduce their gross inefficiencies and promote greater entrepreneurship. Implicitly or explicitly, then, the western financial community is encouraging business groups in emerging economies to unbundle their assets.

On the other hand, emerging markets have in recent years been buoyed by a rising middle class, and this is offering a new avenue for growth for conglomerates in these markets. That is particularly the case for conglomerates whose businesses may historically have been based on manufacturing and asset-heavy industries in which there is now a degree of global overcapacity.

India clearly has an upper edge in fetching the gains from existing conglomerates and creating new conglomerates in future like developed economies did in the past. One recent example corroborating the said characteristics was a move in 2017 by India’s Reliance Industries into telecommunications with the launch of Jio, a mobile voice and data service, which has grown rapidly as more and more Indian consumers have been able to afford mobile telecom products. But on the other hand, India’s retail sector in 2018 was impacted when US-based Walmart bought a 77% stake worth US$ 16 billion in local e-commerce giant Flipkart, bringing it in direct competition with Amazon India.

However, it is also true that smaller companies and startups are gaining greater access to capital, resulting in massive competition. Since workers have many more choices than they previously did, it’s becoming increasingly difficult for conglomerates to attract and retain world-class talent, especially at the entry level. Finally, technology disruption is bringing its own set of challenges in the form of displacement of business models. These factors illustrate why it is now time for emerging market conglomerates to sharpen their focus and be clearer about their identity and business models.

Leave a comment