Reinvigorating India’s Dairy Value Chain for Export Competitiveness

Government of India has been supporting the dairy sector with innovative policy and financial support to create dairy infrastructure for scaling up milk production and processing. Dr Debesh Roy analyses issues and challenges facing the dairy sector in India, and proposes policy support for developing an efficient dairy value chain for improving export competitiveness.

Image credit: Shutterstock

While India is the largest milk producer globally, it was ranked 34th in the world in the export of milk in 2021, and 12th in the export of value-added dairy products in 2019. India’s potential for exports is much higher, however, and can be achieved with greater efficiency in dairy value chains and improvement in dairy export infrastructure across leading milk producing states. Major exporters of milk and dairy products, viz. New Zealand, the Netherlands, Germany, Belgium, France, Denmark, Australia, the UK, and the US are characterised by high exportable surplus, efficient dairy value chains and strong dairy export infrastructure.

Government of India has been supporting the dairy sector with innovative policy and financial support to create dairy infrastructure for scaling up milk production and processing. This article analyses issues and challenges facing the dairy sector in India, and proposes policy support for developing an efficient dairy value chain for improving export competitiveness.

India’s Dairy Value Chain: Issues and Challenges

The globally acclaimed White Revolution had enabled India to become the largest producer of milk in the world. The dairy sector in India is dominated by small milk producers who supply milk to over 1.90 lakh dairy cooperative societies across the country, providing livelihood support to millions of families. However, about 81% of India’s dairy and milk processing market is part of the unorganised sector. Lack of proper infrastructure for milk preservation, processing and transportation in most states limits the ability to produce exportable surplus in accordance with international standards.

Milk production has grown at a significant CAGR of ~ 4.7% since the White Revolution of the 1970s, mainly with government support through various incentives and developmental schemes across the dairy supply chain. Further, adoption of modern technology and digitalization across the supply chain is facilitating growth in milk productivity, improvement in farm management practices, better record keeping and enhanced technology for breed selection.

According to the Integrated Sample Survey, the average yield per animal in India is 1.5 times lower than the global average. In 2019-20, the average annual productivity of Indian cattle stood at 1,777 kg per animal as against the world average of 2,699 kg per animal. According to the OECD, between 2017 to 2019, the average yield per in-milk animal in the US was eight times higher than that in India. Further, New Zealand, the largest exporter of milk and milk products, recorded three times higher average yield compared to India.

While liquid milk dominates the domestic market, there is an increase in demand for value added dairy products (VADPs) viz., ghee, paneer, curd, butter, ice cream, cheese, and flavoured milk, accounting for ~35% in value terms. Therefore, dairy players are diversifying into VADPs, owing to higher margins as compared to liquid milk.

The major challenges faced across the dairy value chain are:

- Low availability and high cost of cattle feed and fodder.

- Unorganized dairy farming and small livestock holding makes it a challenge to automate processes.

- Inadequate medical facilities and shortage of qualified veterinarians and para vets has drastically hit the production system.

- Lack of basic breeding activities like livestock identification, performance recording and evaluation.

- Milk production by small and marginal farmers makes logistics of daily collection and chilling of milk at farm level a huge challenge.

- Inadequate quality testing infrastructure at milk collection centres.

- Shortage of electricity in many chilling plants, which cannot run optimally.

- Capacity utilization of the processing plants in lean season is lower on account of reduced supply of milk which hampers small scale dairies with limited product mix.

- Lack of commercialization of ethnic dairy products.

- Maintaining cold chain at retail level is a challenge due to lack of knowledge of how it impacts the quality and shelf life of milk and milk products.

Dairy Exports from India: An Overview

India’s low value of dairy exports may be attributed mainly to high domestic consumption demand for milk and milk products, very low yield of milk output (1.1 tonnes/animal, compared to 3.9 tonnes/animal and 5.9 tonnes/animal for New Zealand and Australia, respectively), and low exportable surplus of processed dairy products due to increasing demand in urban areas.

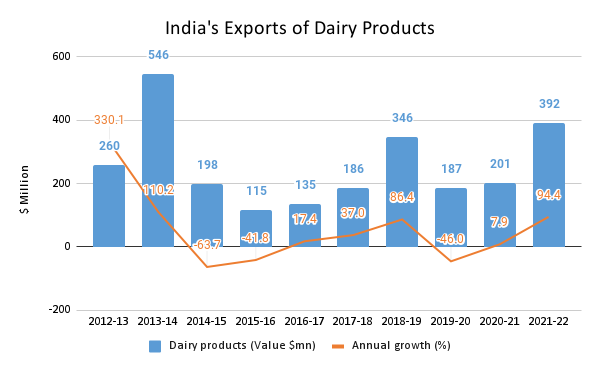

India’s exports of dairy products have experienced fluctuations during the 10-year period (from 2012-13 to 2021-22) (Figure 1). Dairy exports touched US$ 391.6 million in 2021-22, recording a massive growth of 94.4% over the previous year. While the amount of export was the highest in the last eight years, it was well below the peak of US$ 546 million achieved in 2013-14.

The CAGR of dairy exports stood at a meagre 0.1% during the 10-year period under review. While the first 5-year period (2012-13 to 2016-17) witnessed a negative CAGR of 24.9% of dairy exports, the second period (2016-17 to 2020-21) experienced a strong CAGR of 10%, which could be due to improved export competitiveness of value added dairy products.

Source: Data accessed from Apeda Agri Exchange

The Gujarat Cooperative Milk Marketing Federation (GCMMF Ltd. or popularly Amul) is the largest exporter of dairy products from India. It exports a wide variety of value-added dairy products, viz., UHT milk, pure ghee, sweets, beverages (flavoured milk, butter milk, etc.), butter, cheese, paneer, ice cream, skimmed milk powder (SMP), and full cream milk powder. Export destinations of Amul products are South Asian and South East Asian countries, Japan, South Korea, Taiwan, Hon Kong, Australia, New Zealand, Middle Eastern countries, the US, Canada and Congo.

Dairy Export Value Chains: The Global Experience

New Zealand is the world’s largest exporter of dairy products, although it produces a relatively small proportion of the world’s total milk (2-3%). The dairy sector accounts for around 20% of New Zealand’s exports and around 3% of GDP. A feature of the New Zealand dairy industry has been the emergence of different processing and exporting companies, with different business strategies, positioning themselves at different points on the value chain.

New Zealand exports 95% of its dairy products, and about 84% of its milk supply is controlled by Fonterra, the largest exporter of dairy products in the world. Fonterra attempted to span the value chain, not only in New Zealand but across a number of different countries, including India by way of an equal joint venture with Future Consumer, offering a wide range of nutritional dairy products targeted at urban Indian consumers.

Fonterra is also one of the world’s largest investors in dairy innovation and has one of the largest R&D facilities in the world. New Zealand has the advantage of low cost of freight because of its small size and reliance on rail for moving dairy products to ports for export.

The Netherlands, the second largest exporter of dairy products in the world, exports 65% of its milk production. Its dairy supply chain is increasingly dependent on technology to improve operations. The Dutch Dairy Organisation and the Dutch Federation for Agriculture and Horticulture have developed the Sustainable Dairy Chain (SDC), which encourages the dairy industry and dairy farmers to make the Dutch dairy sector a global leader in sustainability.

The US is one of the largest manufacturers of skimmed milk powder (SMP) in the world. The reasons for the global dominance of the US in the supply of SMP are:

(a) The plants are strategically located near large urban conurbations;

(b) Large number of pastures at its disposal;

(c) Substantial investments made in research and development;

(d) Adoption of strict health regulations and quality standards;

(e) Efficient manufacturing and marketing systems; and

(f) production all year round.

Global dairy industry leader Nestle’s “Dairy for You” initiative aims to continuously improve sourcing operations and transparently share its progress with key stakeholders, including consumers. The initiative encompasses:

(a) Delivering full milk traceability and ensuring food safety;

(b) Working with dairy farmers to continuously improve local production systems that improve the farmers’ livelihood and animal welfare; and

(c) Transitioning to climate neutral and regenerative dairy farming systems encompassing the climate footprint, water stewardship, soil health and biodiversity in Nestle’s dairy value chain, and using recyclable or reusable packaging.

Digital technologies have the potential to transform the dairy industry. Nestle has digitized the traceability of milk from farm to factory, using Global Milk Solution (GMS), a tool which includes payroll, GPS tracking and route optimization to ensure transparency and transport efficiency. It also calculates GHG emissions per farm or litre of milk to track progress and ensure continuous improvement.

Dairy Value Chain and India’s Export Competitiveness: Policy Agenda

India is one of the least cost producers of raw milk. Higher exportable surplus can be generated through improved breeding and feeding programmes. Steady rise in demand for value added products such as ice cream, ghee, curd, paneer, cheese, flavoured milk, chocolates, etc., is expected to drive strong industry growth, but liquid milk is expected to retain highest share in the dairy market. Other products focusing on boosting immunity and nutrition like probiotics and nutraceutical products could also be in high demand.

GoI has envisaged the double of milk processing capacity from 53.5 million MT to 108 million MT by 2025. A number of initiatives have been taken by GoI to develop dairy infrastructure and dairy value chain, viz.,

- Setting up of Dairy Processing and Infrastructure Development Fund;

- National Programme for Dairy Development to create and strengthen dairy infrastructure for procurement, processing and marketing of milk and milk products by State Cooperative Dairy Federations/ District Cooperative Milk Producers’ Union;

- Pradhan Mantri Kisan Sampada Yojana (PMKSY), which is a comprehensive package which will result in creation of modern infrastructure with efficient supply chain management from farm gate to retail outlet;

- Cold Storage Scheme to provide integrated cold chain, preservation and value addition infrastructure facilities without any break;

- Kisan Credit Cards (KCC) to Livestock Farmers for providing adequate and timely credit support from the banking system under a single window with the flexible and simplified procedures to the animal husbandry and fisheries farmers for their working capital requirements; and

- Production Linked Incentive Scheme for Food Processing Industry (PLI), incentivising manufacturing of mozzarella cheese.

- Significant investments are envisaged for the establishment of new processing capacities along with strengthening of procurement infrastructure.

Technology will play a crucial role in retail distribution with increasing adoption of e-commerce platforms by end consumers. For the development of an efficient dairy export value chain, digitalization will undoubtedly play an extremely crucial role. Digital tools used by Nestle, as mentioned earlier in this article, would enable traceability of milk in the entire value chain.

The impact of climate change, viz. fall in milk production, scarcity of water and dry fodder for the cattle, would need to be addressed. A strategy needs to be developed to deal with the situation arising out of climate variability. Learnings from SDC in the Netherlands and GMS adopted by Nestle, would enable the dairy industry in India to address climate change and sustainability issues.

To boost the export of dairy products and make the dairy sector globally competitive, GoI needs to consider the development of Dairy Export Zones (DEZs) in collaboration with state governments, in leading milk producing states like Uttar Pradesh, Rajasthan, Madhya Pradesh, Gujarat, Andhra Pradesh, Punjab, Maharashtra, Haryana, Tamil Nadu, and West Bengal.

Such zones could involve the creation of common infrastructure like a cold chain, chilling plants, processing facilities, R&D facilities, logistics, and connectivity to ports and airports. Leading dairy producers could set up modern hi-tech dairy processing units in the DEZs, for producing globally competitive high-value dairy products. The units in the DEZs could enter into contract farming arrangements with dairy FPOs/FPCs/cooperatives for sourcing milk. Such an arrangement would be mutually beneficial in terms of cost efficiency and higher export revenue to the dairy companies, and higher income for farmers.

The India-UAE Comprehensive Economic Partnership Agreement (CEPA), the India-Australia Economic Cooperation and Trade Agreement (ECTA), and the forthcoming CEPAs with the UK, the EU, and Canada would create significant opportunities for the export of dairy products from India. It is, therefore, imperative to raise export competitiveness of dairy products by focusing on the creation of efficient dairy export value chain, along with strategic marketing and branding of dairy products for the international markets.

Conclusion

Development of an efficient dairy export value chain with a focus on globally competitive value-added dairy products, strong infrastructure, digitalisation along the dairy value chain, and adoption of sustainable dairy practices, through coordinated efforts and strategic actions by GoI, APEDA, state governments, and cooperative, private and multinational dairy companies, along with financial support from NABARD and banks, would go a long way in transforming India into a leading exporter of dairy products in the world.

Excellent analysis

Thanks a lot Bijetri

Analysis is pertinent. For Indian dairy exports to become really competitive we need also to focus upon providing options for random testing to check for impurities and pilferage. Quite a lot of start ups are facilitating the testing environment.

Thank you Nalin for your comments. Yes, certainly random testing options are important, and the role of startups in this regard needs to be recognised.

Very informative

Thank you Chandrashekhar

really very informative article very well delivering information encompassing

wide range of contemplative challenges and opportunities