Rate cuts: Inadequate defence against macroeconomic distress

- After a sharp upsurge in the March 2019 round, consumer confidence fell again in May 2019, indicating macroeconomic distress.

- Data from the Society of Indian Automobile Manufacturers (SIAM) has revealed a decrease of 8.62% in total domestic sales compared to May 2018.

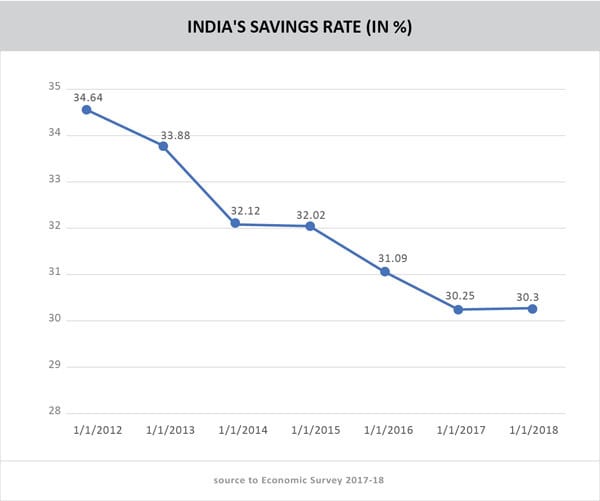

- India’s savings rate plummeted to 30.3% at the end of March 2018 compared with 34.6% in FY12 and 31.3% in 2015-16, pulled down by slow growth in household savings.

- Rate cuts are not getting passed on to industry and consumers. The government needs to boost FDI along with sectoral and consumption revamping through easing out liquidity.

The recent cut in short term lending (repo rate) by RBI by 25 basis points is a soft signal to improve liquidity in Indian economy without compromising on inflation targets. As we know, the consumption rate has declined in last few quarters, leading to a pessimistic macroeconomic environment. After a sharp upsurge in the March 2019 round, consumer confidence fell once again in May 2019.

The current situation index (CSI) compiled by RBI, which had entered optimistic territory after a gap of two years in the March 2019 round, returned to pessimism; and the future expectations index (FEI) slipped from its all-time high in the March 2019 round. There are many parameters, which are impacting India’s macroeconomic foundation ranging from automobile distress to truncated savings rate. It is critical for policy makers to address these issues before it takes the shape of an economic slowdown for India.

The descending spiral in automobile sales continued in May 2019 as lackluster retail offtake forced manufacturers to cut production in order to adjust to market demand. Data from the Society of Indian Automobile Manufacturers (SIAM) revealed a decrease of 8.62% in total domestic sales compared to figures from May 2018.

Non-banking finance companies are aggravating the sullen macro situation as currently, there are about 11,400 shadow banking companies in India with an aggregated balance sheet worth US$ 304 billion and with loan portfolios surging at nearly twice the pace of banks. But this fact isn’t about major NBFCs; instead it’s about the principal players of the breakdown and there is none bigger than the leading infra finance company Infrastructure Leasing and Financial Services (IL&FS). The liquidity crisis that shook NBFCs (non-banking finance companies) and HFCs (housing finance companies) almost broke the back of the real estate sector, as accessing capital from lenders got a lot tougher.

Now, if we add the aviation distress of Indian economy, situation is only get worse. Loads of debt and fare wars, excessive parking and landing charges, high aviation fuel prices, rupee depreciation, even some inefficient operations, have been the millstones around the Indian aviation sector. Australian aviation consultancy CAPA (Centre for Asia Pacific Aviation) anticipates that Indian carriers will lose an aggregate of US$ 550 million to US$ 700 million in the financial year 2020. One wonders if the Jet Airways, which is teetering on the brink of bankruptcy, is only a sign of things to come.

With world trade going through a slowdown, India seems to be the relative bright spot with a decent growth rate of 5.8% (which is revised). To maintain it, India needs to drive consumption growth, investment growth, macroeconomic pillars and export growth. The RBI is concerned about the shrinkage in the volume of trade. If exports don’t accelerate faster, GDP growth may slacken. If in addition we see the rise of protectionism, then India will face more problems on the export front in goods and services. India also needs to ensure that growth drives greater well-being for all and access to bank credit for small and medium enterprises and start ups.

India’s Savings Rate: Not offering a helping hand

India’s savings rate plummeted to 30.3% at the end of March 2018 compared to 34.6% in FY12 and 31.3% in 2015-16, pulled down by slow growth in household savings. Households, private corporations and the public sector are the three channels of savings. According to India Ratings, during 2011-12 to 2017-18, the share of the household sector in total saving was 60.9%, while private corporations accounted for 35%, and the remaining 4.1% was from the public sector.

Household savings are majorly channelized by banking and other non-banking financial entities, which are the main source of investment funding in India. Thus, a further reduction in household savings can impact the economy adversely as it can be observed currently. Despite the cut in repo rate, no relief has been provided to home and auto loan borrowers. Not all bankers are looking at a possible reduction in the interest rate. Hence, there is less easing for home or auto loan EMIs. Also, the demand for home and auto loans continues to be sluggish, hence there is little scope for reduction in interest rate, according to the banks.

Source: Indian Economy Data accessed from https://data.gov.in/dataset-group-name/indian-economy

Credit to deposit ratio of banks has been at around 77% or more since January 2019. Banks have to maintain a cash reserve ratio of 4% with RBI and an SLR of 19% through investments in approved government securities. After making these adjustments, the banks are lending nearly all the deposits they have, and are unable to reduce interest rates. They need new deposits.

The lowering of rates has only benefitted the new borrowers and not the existing borrowers, including those who have taken home loans on floating interest rate. If old borrowers want to take advantage of the new rate, they will have to switch, for which they will have to pay 0.25% to 0.5% of the outstanding amount as a fee.

Since the government is talking about inclusive growth, it is well known that access to loans is still difficult for poor farmers without adequate collateral. Better rural roads as well as mobile banking should make bank financing accessible to the remote areas. What we need is better infrastructure for banks in villages; otherwise access to the much-needed credit will be denied to those most in need. Perhaps the optimal way to start out would be to concentrate on attracting foreign capital largely into the infrastructure sector. To ensure that, the government must frame easier rules and regulations and must commit to leaving them untouched.

Leave a comment