Laptops – A growing necessity for WFH warriors

• Demand for laptops has soared in Q1 2020, driven by remote working & online learning requirements from strict lockdown measures around the world. Demand of laptops will bolster as the new normal will be to work from home, conducting virtual meetings, ubiquitous online education and OTT (over the top media platforms like Netflix) entertainment platforms.

• There is big opportunity for India to accelerate the laptop manufacturing activities which will also help us to abstain ourselves from using made in China laptops. One of the flabbergasting facts, is that, our imports of laptops has 74% share coming from China itself.

• India’s imports of laptops remained at US$ 2923.3 million, while export was valued at only US$ 56.6 million making India a significant net importer of laptops. Domestic laptop market of India saw a growth of 18.1% year-over-year in 2019. Revenue in the Laptops & Tablets segment amounts to US$ 7.97 billion in India. Indian market for said product segment is expected to grow annually by 3% (CAGR 2020-2023).

• HP and Dell Technologies plan to move as much as 30% of their laptop production away from China, India can be an excellent manufacturing platform for these vendors. Adding to it, “Made in China” is now being boycotted, promoting Indian brands of laptops will provide an impetus to these vendors.

Tariff Line for India: 84713010 (ITC-HS CODE at six digit is 847130)

Laptop is a computer featured gadget designed for portability. Laptops are usually less than 3 inches thick, weigh less than 5 pounds and can be charged by a battery. They are designed for low power consumption and are most often used when space is limited. a laptop computer is also called a notebook. Flat-panel technology is used to make laptops light weight. This technology requires low power, is cost-effective and consumes low voltage.

The market has experienced a robust period of growth during the last two decades with laptops becoming a mandatory feature among the average consumer. The entire consumer electronics market is currently converging towards various handheld electronic devices and laptops, putting powerful and versatile latest gadgets in the spotlight. A number of consumers currently prefer cross-functional devices that offer integrated features and capabilities in the same device. This has encouraged the development of multi-functional devices. Laptops offer extensive diversity in their application areas, ranging from business and education to entertainment. Furthermore, high investments, availability of economical devices due to mass production, and a range of diverse applications are expected to provide a boost to the market.

Market dynamics

Burgeoning demand for technologically advanced products, owing to changing consumer lifestyles and increasing need across various industries such as education, IT, healthcare, etc. is a key factor expected to drive growth of the global laptop market over the next decade. In addition, improving internet infrastructure across the globe will further fuel growth.

High investments in digital economy by manufacturing and services sectors across globe, as well as investments in research and development activities to develop cost-effective solutions along with various functionalities are other major factors that will provide an impetus to the laptop industry. Post-COVID, growing acceptance of the work-from-home norm and the compulsion to connect via electronic means have emerged as a new catalyst for growth. On similar lines, several educational institutions have embraced e-learning as a way to bridge the gap between tutors and students/pupils while complying with the lockdown measures being enforced in most of the countries. Thus, the demand for laptops and tablets is high, which is boosting the revenue stream of display manufacturers. The global market size of laptops is projected to reach US$ 108.91 billion by 2025 adjusting for the COVID impact. From 2020 to 2025, the laptop market is projected to surge at a CAGR of 1% (Business Wire, London).

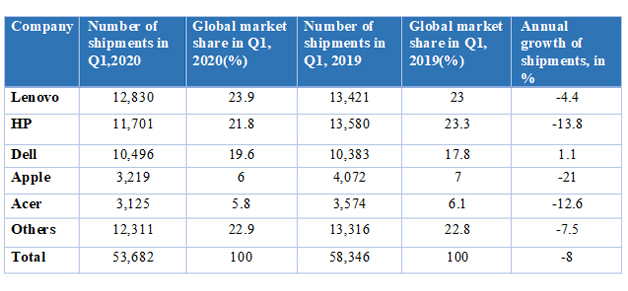

Demand for laptops soared in Q1 2020, driven by remote working and online learning requirements from strict lockdown measures around the world. But the crisis also caused severe delays in production and logistical issues, leading to worldwide laptop shipments falling by 8% year on year. Still, demand of laptops is expected to improve as industry watchers believe that the new normal will feature a rise in work from home, virtual meetings, ubiquitous online education and sunny days for OTT (over the top media platforms like Netflix). So, there is a big opportunity for India to accelerate the laptop manufacturing activities and improve trade balance. One of the flabbergasting facts is that imports of laptops has 74% share coming from China itself.

Table: Worldwide laptop shipments, market share & annual growth

Note: Units of shipment in ‘000; percentages may not add up to 100% due to rounding off.

Source: Canalys Analysis, April 2020.

Global laptop market segmentation:

Segmentation by type:

• Traditional laptop: The form of the traditional laptop computer is a clamshell, with a screen on one of its inner sides and a keyboard on the opposite, facing the screen. It can be easily folded to conserve space while traveling. The screen and keyboard are inaccessible while closed. Devices of this form are commonly called a ‘traditional laptop’ or notebook, particularly if they have a screen size of 11 to 17 inches measured diagonally.

• 2-in-1 Laptop: A 2-in-1 laptop is a device that provides the user experience of a tablet with the computing power, software compatibility, and overall characteristics of a laptop. It incorporates features of a laptop like a physical keyboard, large display and ample built-in storage. The 2-in-1 laptop segment is anticipated to exhibit the highest CAGR over the forecast period. This can be attributed to growing demand for lightweight and technologically-advanced laptops.

Segmentation by screen size:

• Up to 10.9″

• 11″ to 12.9″

• 13″ to 14.9″

• 15″ to 16.9″

• More than 17″

Segmentation by end use:

• Personal

• Business

• Gaming

Source: www.grandviewresearch.com

Globally China is the largest laptop market with the estimated market size of US$ 38.63 billion. Also, China exports 65.8% of global laptops. After China, US and EU combined account for half of the global laptop market. After China, Netherlands is the second largest exporter of laptops, exporting 9.7% of world’s export.

Industry scenario of laptops in India

Source: ITC Trade Map, figures in US$ Million

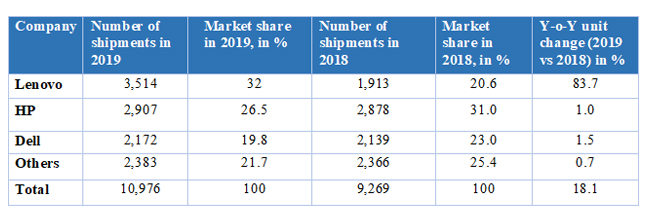

India’s imports of laptops stood at US$ 2.9 billion, while exports were valued at only US$ 56.6 million, making India a significant net importer of laptops. Domestic laptop market of India saw a growth of 18.1% year-over-year in 2019 with shipments of 11 million units–the highest in the last six years. The Indian laptop market is dominated by HP, followed by Lenovo and Dell. Revenue in the laptops & tablets segment amounts to US$ 7.97 billion in India. The Indian market for this product segment is expected to grow annually by 3% (CAGR 2020-2023).

Table: India’s laptop market: market share and Y-o-Y growth

Note: Units of shipments in ‘000. Percentages may not add up to 100% due to rounding off.

Source: IDC Worldwide Tracker, February, 2020

India’s laptop market provides a large opportunity for vendors, manufacturers and importers due to proliferation in domestic demand. in the next few years, as COVID is changing the business and professional approach to work altogether. Since HP and Dell Technologies plan to move as much as 30% of their laptop production away from China, India can be an excellent manufacturing platform for these vendors. Adding to it, “made in China” is now being boycotted, promoting Indian brands of laptops will provide an impetus to these vendors. This is also in sync with the Prime Minister’s flagship campaign of “Atmanirbhar Bharat”.

Leave a comment