Printed Circuit Board Assembly: Key to catalyse India’s electronics manufacturing

India needs to strengthen its manufacturing ecosystem for printed circuit board assembly, since it is the heart of every electronics device. Doing so will help facilitate much needed backward integration, and help reduce India’s huge imports in the sector.

- In order to become an electronics hub, India must focus on the domestic production of printed circuit board assembly (PCBA), the heart of every electronic device.

- This is important as not only will it facilitate backward integration, it will also lead to the creation of jobs, bolster India’s exports and reduce its import bills.

- The government is already taking steps to facilitate an electronics ecosystem such launching Production Linked Incentive Scheme, Component Manufacturing Scheme, and Modified Electronics Manufacturing Clusters Scheme.

- However, to become a US$ 100 billion global manufacturing and export hub for PCBA by 2026, India needs to fix issues. These relate to domestic supply chain and logistics; high cost of finance; inadequate availability of quality power and limited design capabilities.

In January 2020, the Economic Survey of India cited the example of China, which successfully carved a niche for itself as the world’s manufacturing hub. What catapulted China to global fame was its image as a destination for assembling imported components. Not only did it become the epicentre of international electronics manufacturing, but it also created employment at an unprecedented scale. It stated that India should emulate this model and emerge as the world’s next factory. This is in consonance with the National Policy on Electronics (2019).

Resonating with this sentiment, IIFT’s professor Sunitha Raju opines that while India has the capability to integrate with global value chains in electronics, the focus should be on building a robust component ecosystem. Building India as the nucleus of production of printed circuit board assembly (PCBA) by 2026 holds the key to realising this vision. This blog explores how India can enhance the domestic production of PCBAs and its export potential.

Printed Circuit Board Assembly: The queen of hearts

A PCBA mechanically supports and electrically connects electrical or electronic components and constitutes as much as up to 50% of the cost of manufacturing. It is the heart of every electronic device such as mobile phones, tablets, computers, routers, televisions, washing machines, refrigerators and air conditioners. The global PCBA market is estimated to be around US$ 600 billion, with China (14.2%) being the world’s largest PCBA exporter. South Korea (11%), Singapore (10.7%), Malaysia (6.2%), USA (5.6%), Japan (3.9%), Vietnam (3.6 %) and Philippines (2.6%) are the other major exporters of the product.

| Country | Export value in 2019 (US$ bn) |

| Hong Kong | 134.5 |

| China | 102.2 |

| Taiwan | 100.4 |

| South Korea | 79.1 |

| Singapore | 76.9 |

| Malaysia | 44.8 |

| USA | 40.1 |

| Japan | 27.8 |

| Vietnam | 26.1 |

| Philippines | 19 |

Source: Worldtopexports.com

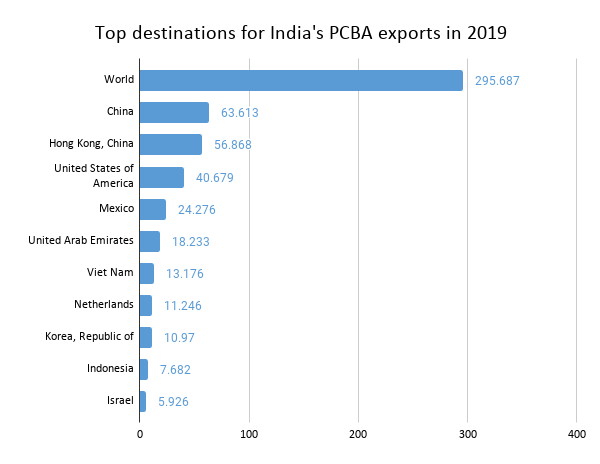

India currently, forms a very small part of this ecosystem – in 2019, its PCBA exports to the world were pegged at just 0.29 million (as per the ITC trade map). Promoting domestic production of PCBAs is a win-win situation for the country as India can be an option for de-risking the global supply chain, while shedding its own heavy import dependence on China, with which it currently has strained ties. It will also narrow down India’s trade deficit with China, which is estimated to be US$16.55 billion in April-June 2020-21. At the same time, it can trigger the establishment of an electronics component production ecosystem, boost technology & innovation and spur employment in the country.

According to a recent report by ICEA & EY, become a US$ 100 billion global manufacturing and export hub for PCBA by 2026. ITC Trade Map reveals that the destinations for enhancing its electronics exports include: USA (untapped trade potential in electronics exports: US$ 632.7 million), Germany (US$ 210.8 million), Netherlands (US$ 123.7 million) and UK (US$ 162.4 million).

Source: ITC trade map. All values in US$ mn.

India’s ticket to global success

In order to promote the electronics industry, the government has taken a few positive measures. For example, in June’20, it launched three schemes with an outlay of around US$ 7 billion to encourage domestic production of electronics – Production Linked Incentive Scheme, Component Manufacturing Scheme and Modified Electronics Manufacturing Clusters Scheme. However, there are quite a few obstacles that India needs to overcome, if it doesn’t want to lose out to its Asian peers. These have been noted by MEITY:

“The domestic electronics hardware manufacturing sector faces lack of a level playing field vis-à-vis competing nations. The sector suffers disability of around 8.5% to 11% on account of lack of adequate infrastructure, domestic supply chain and logistics; high cost of finance; inadequate availability of quality power; limited design capabilities and focus on R&D by the industry; and inadequacies in skill development”.

These factors compromise the ease of doing business in India, which secured 63rd rank last year. But when it comes to parameters like enforcing contracts, registering a property, starting a business and tax payment, India secured 163rd, 154th, 136th & 115th rank out of 190 nations. The country needs to fix these issues if it wants to become the linchpin of global PCBA production.

| Factor resulting in cost-reduction | India | Vietnam | China |

| Corporate income tax exemption/reductions | 0.73-0.95% | 1.5-2% | 2% |

| Subsidy for machinery and equipment | Nil | 0.20% | 3% |

| State subsidies in India for capital investments | 0.6-1.2% | NA | NA |

| Cost of power | 0% | 1% | 1% |

| Interest subvention on working capital | 0% | 1.5 – 2% | 3 – 3.5% |

| R&D subsidy | 0.15% | 0.4 – 1% | 2% |

| Incentive for supporting industry | 0% | 0.5 – 1% | 0% |

| Exemption/reduction of land rental | 0% | 0.50% | 0.60% |

| Industrial land development support | 0.40% | 0.50% | 0.60% |

| Building (or plug and play) | Negligible | 0.30% | 1% |

| Labor subsidy | Negligible | 0.50% | 2% |

| Logistics | 0% | 0.50% | 1% |

| Factors affecting “Ease of doing business” | – | 1.5 – 2.5% | 2 – 3% |

| Duty free imports for creating fixed assets, and of inputs not available domestically | 0% | 0.50% | – |

| Incentive schemes | – | 0% | 1 – 2% |

| Total | 1.88- 2.7% | 9.4 -12.5% | 19.2 -21.7% |

Source: Atmanirbhar Bharat: Making India the global hub for Printed Circuit Board Assembly, ICEA & EY Report (2020)

For this, it is suggested that import of used plant and machinery be allowed without any restrictions or conditions. Not only will this act as an incentive for decoupling from China, it will also ease the high capex burden of the country. Similarly, steps should be taken to facilitate easier import of raw materials required to make PCBAs.

Having a robust infrastructure is also a major thing that the government needs to fix. Issues like container shortage in India can be detrimental to the interests of the industry since raw materials for assembling PCBAs would need to be imported. Apart from these suggestions, the government must consider creating electronic-industry specific zones, creating flexible labour & land laws, imparting skills training to workers, offering tax holiday to firms investing in the sector.

Leave a comment