PMMY: A success story in itself

Pradhan Mantri Mudra Yojana (PMMY), the Flagship Programme of the Prime Minister launched in 2015 aims to offer loans up to 10 lakh rupees to non-corporate and non-farm small and micro enterprises. These loans are categorized as MUDRA loans under PMMY. The loans are provided by the Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks, Micro finance Institutions (MFIs), and (Non-Banking Financial Company) NBFCs.

- The Mudra scheme provides loans which do not need any collateral.

- The interest rate on the loans obtained under this arrangement is not fixed. The base rate is applied to interest up to 1-7%. Depending on the risk involved and the customer’s profile, this could also be higher.

- To get benefit under the scheme, the borrowers can apply in nearby branches of the lending institutions or apply online for loans.

- MUDRA has three loan schemes under it – Shishu which provides loan up to Rs. 50,000, Kishore loan up to Rs. 5 lakhs and Tarun loan up to Rs. 10 lakh.

Image Credit: Shutterstock

What is the need of Mudra Yojana

There are many remote places in the country where people are unable to access regular and conventional banks. The primary goal of the MUDRA initiative is to provide financial assistance to persons who are in need in such remote locations. This programme offers all banking services, including credit cards, loans, and savings accounts. Now, MUDRA has INR 1000 crores in authorized capital, and Small Industries Development Bank of India (SIDBI) has completely subscribed for INR 750 crore of its paid-up capital.

This programme is primarily intended for MSME businesses nationwide. It was created specifically to provide capital, protect small business owners from money lenders’ exploitation, and aid 1.5 crore new business owners in growing their enterprises.

Schemes under the Pradhan Mantri MUDRA Yojana

Micro-credit scheme: Under this scheme, small businesses, self-help organizations, and joint-liability groups may obtain up to Rs. 1 lakh with the help from microfinance institutions.

Women Enterprise Program: This initiative, also known as the Mahila Uddyami Yojana, gives low-interest loans to women company’s owners with interest rate reductions of up to 0.25%.

Refinance scheme for Banks: Under this programme, borrowers like commercial banks, regional rural banks, and scheduled cooperative banks are eligible to refinance loans up to Rs. 10 lakh if they have given credit to micro-enterprises in accordance with the program’s guidelines.

Mudra Card overdraft: This card allows users to take advantage of overdraft options in addition to enabling debit transactions and ATM withdrawals. Also, it creates a way for cash-credit to get access to funding for working capital.

Credit Guarantee Fund: This fund was established to offer finance to improve lending to micro units and accessibility.

Equipment Finance Scheme: This programme offers a limited amount of equipment financing with the goal of assisting business owners in purchasing and upgrading their machinery.

3 categories under which one can apply

- Shishu: Businesses looking for a loan up to a maximum of Rs. 50,000 may apply for one under this category. Interest would be charged at a rate of 10-12%.

- Kishor: Un-established business units can apply for a loan in this category for an amount ranging from 50,000 to 5 lakhs rupees, at an interest rate of 14–17%.

- Tarun: Applying for a loan under this category with capital of up to INR 10 lacs is an option for established enterprises who want to expand their current unit, at an interest rate Over 16%.

Complete the loan application and submit it with recent passport-size photos, identification documentation, and proof of address. Below is the step by step procedure:

- The applicant prepares a business proposal

- Select the category (Shishu, Kishor, Tarun) under which he wants to apply

- Visit a private or public bank where you can apply for a Mudra loan

- Complete any other formalities required by the bank

The loan is disbursed in the form of a pre-loaded Mudra Card that is personalized with your name once the bank determines that you are eligible to obtain one under the Mudra Programme. With this RuPay debit card, which is linked to your Pradhan Mantri Jan Dhan Yojana Savings Account, you can conveniently withdraw money when you are making purchases for your company at any ATM. The daily cap on cash withdrawals, which applies to both current deposit accounts and cash credit accounts, is set at Rs. 25,000.

Sectors covered under Mudra scheme

- Transportation: purchasing of vehicles like rickshaws, three-wheelers, small delivery trucks, taxis, etc.

- Men’s bars, spas, gyms, boutiques, dry cleaners, drugstores, tailors, etc. are examples of personal services.

- Facilities for the production and packaging of food products, such as those for preparing papad, jam, sweets, ice cream, and canteen services.

- Agriculture and related industries, such as aquaculture, poultry, livestock, agro-processing, beekeeping, and beekeeping.

- Textiles: Handloom, khadi embroidery, vintage car accessories, etc.

- Business: Retailers, service providers, non-farm sources of income, etc.

Seven Year of MUDRA Yojana

After seven years of completion of the programme, Pradhan Mantri Mudra Yojana (PMMY), which aims to fund unfunded microenterprises and small businesses, has distributed a total of 18.91 lakh crore in loans to 34.93 crore loan accounts, primarily benefiting borrowers from the society’s weaker groups.

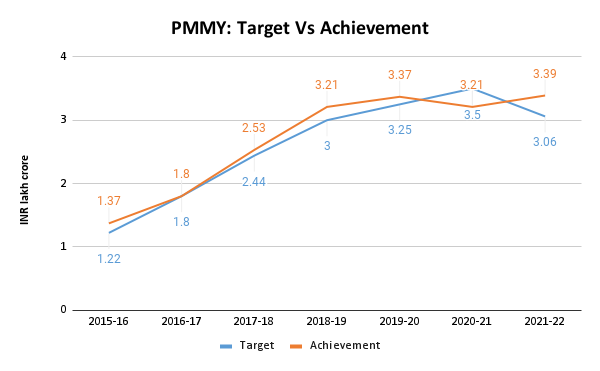

The Lending Institutions, which are made up of all Public Sector Banks, Private Sector Banks, Regional Rural Banks, Small Finance Banks, Micro-Finance Institutions (MFIs), and Non-Banking Financial Companies (NBFCs), have collectively surpassed the annual targets outlined by the Government of India under PMMY every year.

Source: Micro Units Development and Refinance Agency Limited

Micro Units Development & Refinancing Agency Ltd. (MUDRA), a support organization, has performed a dual function over the course of these seven years by providing refinance support to a number of lending institutions and closely observing the progress of PMMY implementation through a dedicated portal that collects various aggregated data pertaining to the scheme PMMY in accordance with the needs of the Government of India.

Performance of top 10 states

| States | Sanction Amt (2020-21),

INR in crore |

Sanction Amt (2021-22),

INR in crore |

| West Bengal | 29,335.98 | 34,893.20 |

| Uttar Pradesh | 29,231.35 | 33,663.73 |

| Tamil Nadu | 28,967.97 | 32,477.55 |

| Bihar | 25,589.31 | 32,096.95 |

| Karnataka | 30,199.18 | 28,695.29 |

| Maharashtra | 2,52,089.63 | 25,797.74 |

| Rajasthan | 18,571.38 | 18,999.20 |

| Madhya pradesh | 18,474.24 | 18,814.95 |

| Odisha | 15,328.63 | 16,900 |

| Gujarat | 11,579.26 | 12,152.39 |

| Total | 2,32,485.93 | 2,54,491 |

Source: Micro Units Development and Refinance Agency Limited

The state-level performance is being monitored by the respective State Level Bankers’ Committee (SLBCs) of the states. Of all the states, West Bengal topped with sanction of INR 34,893.2 crore, followed by Uttar Pradesh with INR 33,663.73 crore and Tamil Nadu stood at third position with INR 32,477.55 crore.

Very nice