PLI scheme for textiles: Weaving the fibers of growth

India’s textile and apparel sector is a key contributor to its GDP growth, employment and export basket. Yet it has lost its global competitiveness, leading to a dip in exports. Will the recently introduced textile PLI scheme finally help the industry weave threads of growth in the international market?

- The Indian textile sector is one of the largest industries in the world & the second largest contributor to employment generation in India. It is also a key contributor to India’s export basket, accounting for roughly 12% of total India’s export earnings.

- The sector has a lot of potential in terms of growth and development. A push in the right direction will enable further growth prospects in the sector.

- The Production Linked Incentive (PLI) scheme has recognized the key gaps in the textile industry, by covering man-made fibers (MMFs) and technical textiles in its ambit. It seeks to enhance India’s manufacturing capabilities by attracting investors and boosting exports.

- While the scheme can help ramp up production and build larger scale players, improving exports would also need effective redressal of issues like environmental clearances, low technology intensity, skill gap and high import content to truly leverage the advantages of PLI in global export growth.

Source: Pexels

Valued at US$ 75 billion in 2020-21, the Indian textile sector is one of the largest industries in the world. It is a key contributor to India’s export basket, accounting for roughly 12% of total India’s export earnings and the second largest contributor to employment generation in India.

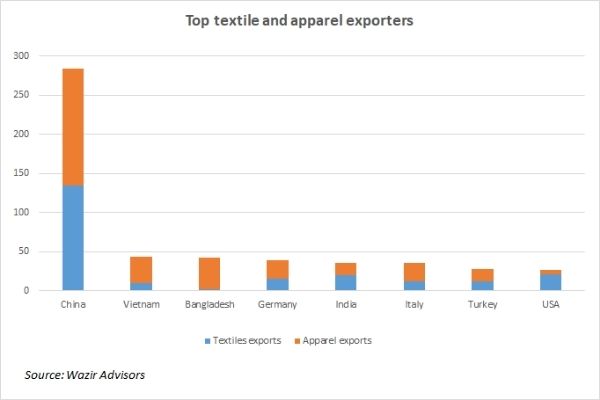

Yet the industry lags behind competitors like China, Bangladesh, Germany and Vietnam in the international market leading to a dip in textile exports. India’s textile and apparel exports have increased at a CAGR of 5% since 2005-06, amounting to US$ 33.5 billion in 2019-20. India’s share in global textiles and apparel exports has declined from 4.84% in 2015 to 4.34% in 2018. The pandemic worsened the situation, as India’s textile & apparel exports are expected to fall around 15% to reach US$ 28.4 billion in 2020-21.

Tuho boost the sector’s export performance, the government, therefore, recently cleared a Rs 10,683-crore production-linked incentive (PLI) scheme under for man-made fibre and technical textile products. The scheme is also likely to generate employment opportunities for 1 crore people over the next 5 years. Commenting on the scheme, Commerce and Industry Minister Piyush Goyal said:

We hope that this decision will produce some global champions. Factories based around aspirational districts or Tier-3 & Tier-4 cities will be given priority. It will especially benefit Gujarat, UP, Maharashtra, Tamil Nadu, Punjab, Andhra Pradesh, Telangana etc.

Product coverage

The PLI scheme is expected to cover nearly 40 product categories under the MMFs and 10 product categories in the technical textile segment. It will offer incentives of Rs 7,000 crore for man-made fibre (MMF) apparel, and Rs 4,000 crore for technical textiles. The MMF category covers garment segments like trousers, shirts, and jerseys of man-made fibers, whereas technical textile category includes products like bandages, adhesive dressings, safety airbags, and diapers.

The complete product categories are defined under the various chapters of the CUSTOMS TARIFF ACT, 1975. India’s share of exports for these aforesaid categories and products is significantly less in the global market. Moreover, India is also lagging behind in the man-made fibres (MMFs) textile trade due to the high cost of raw materials, higher tariff barriers, and cheaper imports from the neighboring countries. The graph given below depicts the top 10 exporters of textiles and how India is lagging significantly behind its neighbours.

MMFs and technical textile segments have much stronger competitors across the globe, whereas in India, these products are not manufactured to the full potential. The scheme seeks to establish few large world-class global companies in technical textile and MMF segments that have the potential to grow. They can develop in terms of both – size and scale, by the adoption of cutting-edge technology and thereby penetrate global value chains.

PLI Scheme – Eligibility and Incentives

The policy also seeks to attract fresh investments to the tune of Rs 19,000 crore in firms manufacturing textiles locally. It also hopes to increase the turnover of the textile industry by a whopping Rs 3 lakh crore over five years. To make India into a global textile manufacturing hub in the next 5 years, PLI Scheme incentives worth Rs 10,683 crore would be provided to both greenfield and brownfield investments. Incentives under this scheme would vary with the product categories in the range of (~3% to 11%) of the incremental marginal revenues year-on-year for the five-year period.

An individual or a firm ready to invest a minimum of Rs 300 crore to manufacture MMF fabrics or technical textiles will be eligible to apply for incentives under the first phase of the scheme, while an individual or a firm willing to invest a minimum of 100 crores will receive benefits in the second phase of the scheme. The following are the industry’s requirements and asks to make the scheme more efficient and effective:

- Reducing the limit for new greenfield investments: Indian textile sector is more fragmented as compared to many other sectors, as there are very few companies in Indian textile sector which have potential of manufacturing garments, unlike in neighbouring countries like China and even Bangladesh. Every process in garment manufacturing is being done by the multiple players, and for each process there are multiple layers. Moreover, the textile industry in India tends towards labour-intensive techniques, and thus it can achieve the benefit of the policy in real terms, the investments limit should have to be kept at the minimum.

- Special allocation to MSME sector: The textile sector in India is largely driven by MSMEs and the scheme enables medium scale units to operate at larger scale, as such units get larger benefits in terms of investment inflows enabled by the PLI scheme.

A harbinger of good times?

Since the traditional and conventional textile sector of India has reached a level of saturation in terms of innovation, value-addition and development in general, the MMFs and technical textile segments have the potential to further upgrade the Indian textile industry. The share of MMFs in Indian textile sector is currently at just around 20%, while the reverse is true in other markets. Even technical textiles have a very low penetration of 5-10% as compared to 30-70% in developed countries. Thus, the PLI scheme is the need of the hour to push the textile sector growth in the right direction and making it globally competitive.

However, is scale the only and most perfect solution? An ICRIER study points out that India should be mindful of the rising import content of its textile exports. The study notes that foreign value added share has risen from 13.03% in 2003-04 to 19.4% in 2013-14. India needs to enhance its share in global value chains, for which, the government needs to simultaneously also address the skills mismatch in the sector.

Apart from these factors, the industry is tackling environmental concerns, lack of efficiencies due to manual production, inadequate infrastructure and low penetration of technology. For instance, India has only 2% share in the global shuttle-less looms capacity. It is important to address these concerns effectively to enable India to revive its competitiveness in the global textile market.

Good information indeed. Till date this industry has the largest manpower utilization has shown and produce good amount of GDP.