Modi 2.0: Rebuilding the case for ‘Made-in-India’

• Export growth has witnessed a seesaw trend in the past four-five years due to a variety of extrinsic and intrinsic factors.

• The global trade environment is getting increasingly hostile due to unilateral trade restrictive measures and with the challenges to India’s subsidy framework, the coming years would no longer see a business-as-usual scenario.

• India needs to boost both its competitiveness in new age sectors which will drive trade and investment in the coming decades.

• At the same time it is also important to address the deficiencies in traditional sectors like agriculture, where India is a strong producer, but still maintains a weak share of global trade.

During the past four-five years, India’s export performance has witnessed more of a seesaw trend. Merchandise exports were in continuous decline between 2013-14 and 2016-17, dropping from US$ 314.4 billion to US$ 275.85 billion during that period.

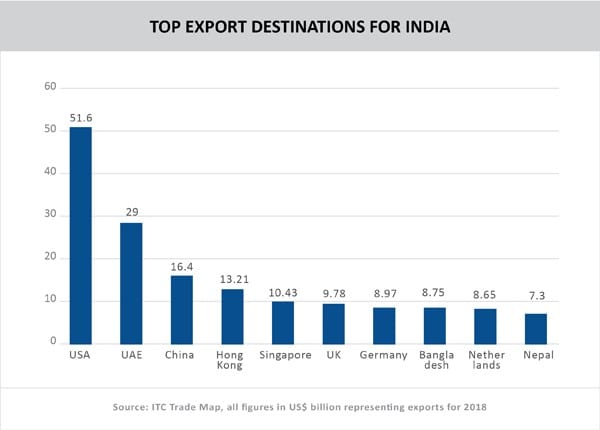

During the past two financial years, they witnessed a revival to reach US$ 331 billion in 2018-19. But the net growth as compared to 2013-14 is just around 5.2%. The Foreign Trade Policy 2015-20 had targeted to take merchandise and services exports to US$ 900 billion by 2019-20. However by 2018-19, total exports were recorded at just US$ 535.45 billion.

Exporters cite a number of reasons for this lackluster performance. While volatility in the global economy, teething troubles with the GST regime and declining commodity prices have played their part, India’s competitiveness in traditional sectors like textiles, leather & leather products and gems & jewellery has also declined. Even exports of major agri-product groups (under APEDA) have dropped from US$ 21.5 billion in 2014-15 to US$ 16.4 billion in 2018-19 (April-February).

Moreover, the WTO consensus seems to be falling apart, especially with the unilateral trade restrictive measures launched by a number of countries, particularly the US. Disagreements among the leading powers on the way forward threaten to paralyse the organization. India is defending its position under stiff opposition on a number of key issues including Special & Differential Treatment to Developing Countries, e-commerce rules, fisheries subsidies and import duties on IT products.

US has also attacked India for its export subsidies like duty drawback, advance authorization and SEZs under the WTO Agreement on Subsidies and Countervailing Measures (ASCM). India had crossed a GNP of US$ 1,000 thrice by 2017, and sectors like textiles have crossed the threshold of 3.25% global market share, which makes it hard for it to hold on to such subsidies for long.

A major drawback for India has been its failure to sign even a single free trade agreement in the past five years, even though it has been negotiating a number of them. Moreover, existing FTAs like the one with ASEAN nations have not yielded their desired benefits either. Instead, they have led to a widening of India’s trade deficit with these regions.

This conversely also implies that entering into wide-ranging trade agreements may not necessarily be a wise move for India, considering that a number of its industries lack the competitiveness to counter a possible influx of imports. An instance of this is the planned Regional Comprehensive Economic Partnership (RCEP) agreement; India has a trade deficit with 11 of the 16 RCEP nations at present. An analysis by CATR projects a potential increase in imports of around US$ 29 billion for India post-RCEP and a loss of 1.3% of GDP. Product-specific MoUs may be a better option in a number of cases, where India can leverage market opportunities on a demand basis, like the seven sector-specific MoUs signed with Kenya.

It is critically important for India to strengthen its export competitiveness and stay ahead of the curve not only in the traditional industries where it stands to lose its subsidy advantages, but also in the sunrise sectors of the future.

A key area of focus for the new government should be setting up of requisite infrastructure like SEZs, mega trade parks and clusters for HS Codes 84, 87, 88, 90 and 85. Products belonging to top 70% of export baskets are from these chapters. Currently, India only has 32 SEZs in these chapters out of a total of 188. High share in these chapters is a major factor driving the leadership of countries like China and Germany in global trade.

Among the traditional sectors, agriculture merits special focus due to India’s intrinsic advantages as a food producer. But despite being the world’s second largest producer of agri-products, India’s share in world trade is just around 2%. The culprit is the low share of value added and processed food exports, for which India needs to aggressively promote investments in processing infrastructure, brand Indian agri products abroad and also amalgamate Indian food products with local cuisines of target markets. The Agri Export Policy 2018 has proposed a number of positive steps, like allowing unrestricted exports of most organic and processed agricultural products.

India is also well behind the curve in the digital infrastructure space, which will drive the future of GDP growth and employment. An UNCTAD report finds that India continues to lag on a number of parameters in terms of digital infrastructure and value added digital services. For instance, India contributed only 2% of global software products in 2017, even though its software developer population is expected to have crossed the US and reached 5.2 million in 2018. It also ranks 134 out of 176 countries in the ICT Development Index. It is critical to spur sectors like cloud infrastructure, IoT, AI, and big data analytics, since these will also play a crucial role in the future of manufacturing.

India has been an exceptional case study in the growth saga of Asian economies, as it continues to manage high rates of GDP growth despite manufacturing and exports not having picked up in accordance with the vision set by respective governments. But with the fast-paced developments in global trade as well as the impending threat to its subsidy framework, India cannot sustain on this path for long. A strong agenda to overcome structural deficits and drive strong export-led growth needs to be central to the policy framework of Modi 2.0.

Leave a comment