Mixed bag for India’s exports so far in pandemic year

As India endeavours to stem the decline in exports of key sectors like engineering goods, gems & jewellery, readymade garments of textiles and leather, it has an opportunity to capitalise on the positive trend in agricultural and pharma exports.

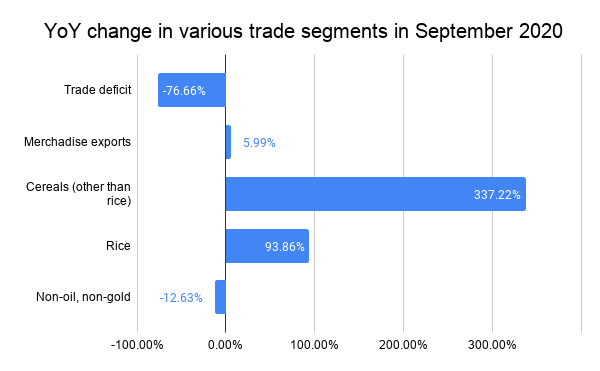

India’s merchandise exports in September witnessed a 5.99% increase on a YoY basis. This is an important number, not only because it exceeds the government’s previous export estimate of 5.27%, but also because it has been contracting since February this year.

India’s overall exports (merchandise and services combined) in April-September, 2020-21 (including estimated services exports data) are pegged at US$ 221.86 billion, exhibiting a negative growth of (-) 16.66% YoY. Imports for the same period are estimated at US$ 204.12 billion, with a negative growth of (-) 35.43% YoY.

Exports stood at US$ 27.58 billion in September, as compared to US$ 26.02 billion during the same time last year, finally moving into a territory of positive growth. Sequentially too, these numbers are an improvement over the August export value of US$ 22.7 billion. Engineering exports witnessed a positive 5.44% growth in September, with overall decline by 15.6% during April-September, 2020, while iron ore exports rose sharply by 59.74% YoY in the same period. Improvement in iron, steel, copper and zinc production shows possible gains during the month.

On the other hand, pharma has continued to make strong double digit gains, growing at 24.4% YOY in September and 15% YOY in the April-September period. The PPE industry, which has seen its genesis and growth during the lockdown, has also commenced exports. According to the Ministry of Health, India exported 23 lakh personal protection equipment (PPE) kits in July to five countries – US, Britain, UAE, Senegal & Slovenia. However, gain in these export categories could be temporary as their demand is need-driven driven, given the present scenario.

Agriculture has been a major silver lining for India’s trade in this period. Cereals other than rice witnessed a whopping 337.22% year-on-year growth in September 2020 (97.79% during April-September) and rice grew by 93.86% year-on-year during the month (33.01% during April-September). Some parts of it can be attributed to the slump in Thailand and Vietnam – India’s main competitors in non-basmati rice. Further, China’s movement away from Africa due to crop damage from floods has also opened African markets to India.

In cereals other than rice too, exports are situation driven – the main suppliers have imposed restrictions on exports to ensure food security for essential items in their home countries. But India, which had the benefit of surplus production, has been able to keep its shipments going. Other major agricultural commodities showing growth in the April-September 2020 period are oil meals (5.73% YoY), oil seeds (5.63% YoY), fruits & vegetables (4.35% YoY) and cereal preparations (3.66% YoY). Prof Basanta K Sahu, Indian Institute of Foreign Trade, comments:

It is a good opportunity for Indian agriculture exports and India can play a good role in exporting agricultural products at least in Asian and African countries.

The most common indicator of domestic demand – non-oil, non-gold imports – have declined YoY by 12.63%. However, considering the pandemic slowdown and the fact that contraction pace is comparatively lower (US$ 27.33 billion) this September than the last two months’ contraction of US$ 30 billion, the recovery is low but is a positive sign. Any pickup in this segment in the future will be a sign of sustainable recovery of imports. However, we need to consider the situation during September 2019 – amidst global economic slowdown and trade war, when manufacturing was slowing down due to sluggish market demand and exports were affected. Exports were slow at that time too, which means there could be a base effect in place.

A concern area is the declines in export value spread across finished good sectors as opposed to increase in raw material exports. As it tries to stem the decline in key sectors over the year till date – engineering goods (-15.6% YoY), gems & jewellery (-54.9% YoY), readymade garments of textiles (-39.25%), and leather (-41.38%), India has opportunity to capitalise on the uptick in agricultural and pharma exports. In agriculture, the establishment of overseas businesses by the exporters could be a step forward, apart from building long term engagements with existing/new buyers overseas for fresh and processed food products, improving quality standards and offering competitive prices. Finally, the need to boost domestic consumption cannot be overemphasized, as only that could enhance imports and end the continued cycle of weak domestic demand, high unemployment, and economic slowdown.

Leave a comment