Living life bite size: Healthy snacking in the post-COVID world

COVID-19 has precipitated a definitive shift towards healthy snacking habits across the world, a trend corroborated by industry inputs as well as export data. Indian companies should leverage the country’s positive brand equity and competitiveness in this segment to grow their presence in global markets.

- 9 in 10 global adults (88%) have admitted to snacking more (46%) or the same (42%) during the pandemic than before it. Further, over half of them relied on snacks for nourishment during the pandemic (54%) & have more control over the portions they eat (66%).

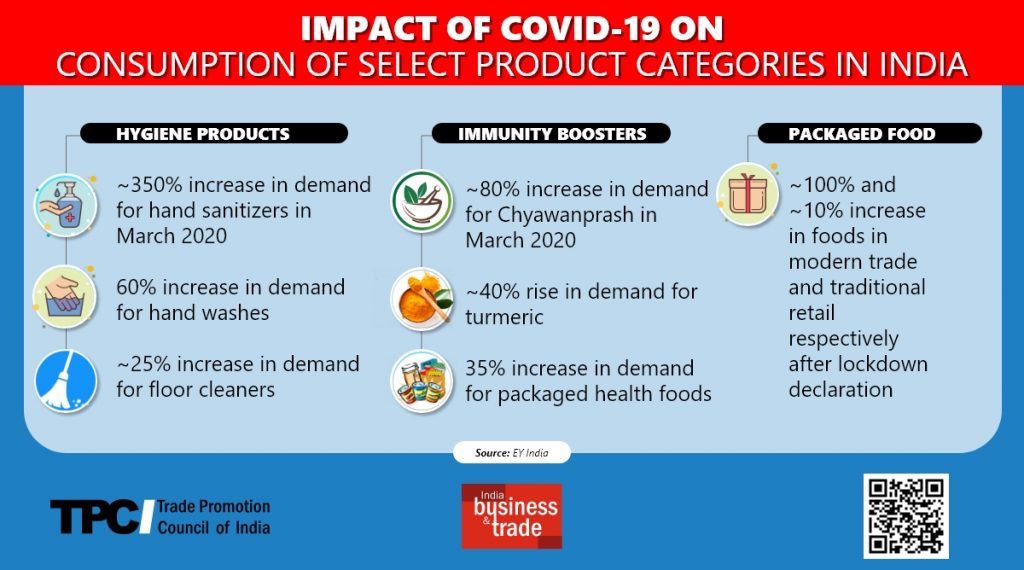

- India, too, saw a significant rise in demand for hygiene products as well as packaged food & immunity boosters. People looked for ways to lead a healthier life as the long working hours left them with little time to cook.

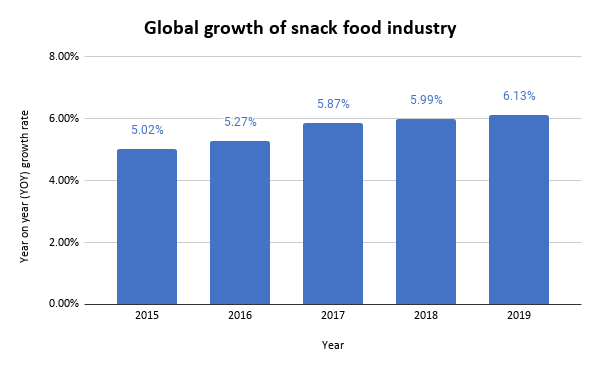

- According to a study, the global snacks market size was valued at US$ 439.9 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2019 to 2025. Europe, Asia Pacific & North America are the key markets for snack food products.

- While the demand for Indian snack food products is rising among global audiences, India is still a small share of the pie & is largely unorganised. This article explores how this situation can be rectified and how India can augment its exports.

Further, the survey also points out that as soirees & social get-togethers took a back seat and gyms across the world shut shop, the trend of at-home snacking was accompanied by mindful eating. Over half of global adults have relied on snacks for nourishment during the pandemic (54%) & have more control over the portions they eat, because they are snacking at home more often (66%).

This trend has struck a chord with people in India too. Luke Coutinho, Holistic Lifestyle Coach – Integrative Medicine, notes, what he considers a silver lining during the pandemic:

When no medication, drug, or vaccination worked, we turned to ingredients already lying in our kitchen. Turmeric, garlic, onion, black pepper, fenugreek seeds, star anise, tulsi, cumin, ginger – turned out to be the most powerful immunity-boosting foods. We have also gotten back to brewing the age-old kadha, powerful Indian superfoods like chyawanprash, giloy, ashwagandha and realized how powerful these ancient remedies are.

Similarly, EY’s study titled COVID-19 and emergence of a new consumer products landscape in India finds that there was a significant rise in demand for hygiene products as well as packaged food & immunity boosters. What explains the spike in the demand for these products is the wave of fear associated with this (potentially) deleterious disease. It is hardly surprising that according to Google Trends, coronavirus, COVID-19 test near me & how to boost immunity ruled as the top searches in India. Now that this trend has managed to establish its hold across the globe, this blog looks at the snack food industry & what the future has in store for it.

The global snacks market at a glance

According to a study, the global snacks market size was valued at US$ 439.9 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2019 to 2025. It also highlights that increasing health consciousness along with changing lifestyles (especially the rise of double-income nuclear families) and diets have spurred the demand for various snacking options. Thus, consumers across the globe are extra careful about their snacking routines and are shifting toward healthy alternatives such as organic snacks, allergen-free & vegan products. Thus, there has been a paradigm shift in global snacking habits. However, this segment of snacks is still a very niche one, with conventional items like confectionery items still dominating the sector.

Source: Mordor Intelligence

As per the Gulfood Global Outlook Report (2019), in 2018, Europe (US$ 174.7 billion) led sales of confectionery, snacks & ready-to-eat products, with a 30.4% market share in 2018. It was followed by Asia Pacific (US$ 161.2 billion) ranking second with 25.3%, and North America (US$ 142.2 billion) with 24.4% in third place. It notes that the trend of eating snacks made with healthier ingredients is on the rise. “The mindful eating trend that started a few years ago in developed countries has now hit all countries globally. Many companies all over the world are therefore choosing to reposition their portfolios towards healthier variants in comparison to former snacking options,” it states. Thus, this area offers a huge untapped trade potential & tremendous scope for product innovation.

Confectionery, snacks & ready-to-eat industry at a glance

| Indicator | Asia Pacific | Australasia | Europe | Latin America | Middle East & North Africa | North America | Sub-Saharan Africa |

| Consumer spending on this category as % of total F&B | 4.60% | 13.30% | 10.80% | 7.60% | 6.30% | 14.60% | 2.40% |

| Key growth markets for this category (2013-2018) | Nepal, Bangladesh, India, Cambodia & Laos | Papua New Guinea, Fiji, New Caledonia & French Polynesia | Iceland, Albania, Lithuania, Romania & Estonia | Guatemala, Bolivia, Cuba, Haiti & Panama | Syria, Qatar, Bahrain, UAE & Oman | USA & Canada | Sudan, Eritrea, Gambia, Burundi, Sao Tomé e Príncipe |

| Key sub-categories* | Savoury Snacks (34.0%) & Confectionery (31.5%) | Confectionery (34.4%,) Savoury Snacks (27.6%) & Ice Cream and Frozen Desserts (19.5%) | Confectionery (46.4%) & Savoury Snacks (21.9%) | Confectionery (33.8%), Savoury Snacks (27.1%), Sweet Biscuits, Snack Bars and Fruit Snacks (25.1%) | Confectionery (34.0%), Savoury Snacks (25.5%) Sweet Biscuits, Snack Bars and Fruit Snacks (20.6%) | Savoury Snacks (39.9%)& Confectionery (29.5%) | Confectionery (41.2%) Sweet Biscuits, Snack Bars and Fruit Snacks (24.6%) |

Source: Gulfood Global Outlook Report (2019)

Leapfrogging to the ‘categories of tomorrow’

Research estimates that India’s snacks market will be more than Rs 1 billion by the end of 2024, growing with double-digit CAGR for the time frame of 2018 to 2024. It also points out that at present, the unorganized sector is dominating the India snacks market. Further, studies also expect this trend of healthy snacking to stay after the pandemic. An EY report states:

There will be an increased focus on health and well being and higher demand for value brands as consumers trade down. Hence, re-evaluating the brand portfolio to win back consumers would entail re-adjusting pack sizes and pricing to redefine value proposition as well as taking an opportunistic stance by developing “categories of tomorrow” (such as hand sanitisers, disinfectants and immunity boosters).

In fact, the demand for healthy snack items from India has started rising. The Green Snack Co., an Indian snack maker that offers super snacks like kale chips, multigrain stix & Quinoa puffs is one case in point. Currently, the company’s products find popularity with customers in Dubai, Qatar, Oman, Germany & New Zealand. The company’s quinoa puffs are particularly popular among its audiences. Jasmine Kaur, CEO & Co-Founder – The Green Snack Co., remarks:

We’ve witnessed that consumers have been opting for healthy snacks more often post-COVID. The market has seen an uplift, primarily due to the increasing demand for functional foods, as consumers want to maintain a healthy lifestyle. Since consumers continue to seek healthy food products, which have functional-benefits, products that fulfill this need are readily absorbed in retail channels everywhere.

Umeshwari Machani & Srivardhan Sethuram, Founders, Monsoon Harvest, a brand that offers healthy snacks like buttermilk and millet crackers, too, have a similar insight:

As the popularity of these products started soaring in India, the company started getting a lot of queries regarding availability of products abroad. Prospective international distributors reached out to us to see if they could distribute these products in their local markets. Two years ago, Singapore became the first country that we exported to, though these products are only available in a select stores. Last year, we also started shipping our products to the Maldives and Dubai, where our products are getting a warm response.

Data from the Ministry of Commerce & Industry, too, substantiates this argument for some categories, indicating a rising preference for health/immunity boosting products. For example, the period April-November 2020 saw a year-on-year rise in exports of quite a few immunity boosting products from India. For example, India’s turmeric exports during this said period rose by 28.73% YoY from US$ 125.5 million to US$ 161.56 million; green tea exports rose 13.08% YoY from US$ 15.21 million to US$ 17.2 million; currants & gooseberry exports rose 74.9% from US$ 0.16 million to US$ 0.28 million; amaranth & other cereal exports rose 4.22% % from US$ 9.22 million to US$ 9.6 million; and moringa & other extract exports rose 13.79% from US$ 190.31 million to US$ 216.54 million.

Kausshal Dugarr, Founder and CEO of Teabox, India’s luxury premium tea brand, adds:

Healthy lifestyle’ themed teas or Wellness are increasingly becoming the norm, considering people are extra cautious with what they are having in this post-Covid world. We, at Teabox have come up with innovative product offerings in this segment which deal with the most common ailments of daily life viz. stress, anxiety, obesity, diabetes and tackles these problems head-on. These have managed to enthrall our consumers and we have seen quite substantial uptakes in this segment.

How should India’s snacks market gear up?

While healthy snack food offers promising prospects in the post-COVID world, one of the most common problems faced by the indigenous industry is the prevalence of higher regulatory control by global food regulators. The FAO notes that most governments have focused on the development and strengthening of import control systems to shield their populations and to prevent dumping of inferior quality products into their country. The harmonization of the food safety standards with international parameters (like Codex) is the need of the hour. At the same time, Indian manufacturers should be aware of these developments and ensure that their products are in sync with international best practices, as this will ultimately lead to higher gains for them.

Another major challenge that the industry faces is that it is unorganised. Capacity building initiatives such as food safety training, formulation of standards and setting of appropriate regulatory systems need to be undertaken. Automation coupled with product innovation can do wonders to boosting production and exports.

To better understand the potential and track market movements in the sector, it is also important to have timely data on how health foods from India are trending in the export market and what is working with customers. So far, such clear demarcation of what constitutes ‘health food’ is not available.

Actively tracking the movement of these products will be critical, considering their growing importance in global food trade. Moreover, India has a positive perception in the holistic healing paradigm, thanks to age-old traditions like Ayurveda and Yoga. Indian companies should leverage this positive brand equity and raise awareness and interest for such products in target markets.

Leave a comment