Is India’s energy sector headed for a summer of discomfort?

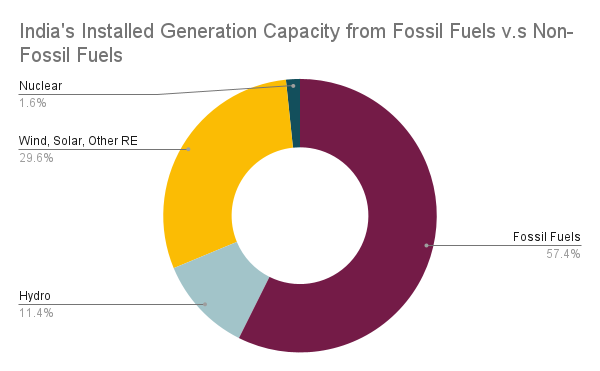

As of February 28, 2023, India’s total power generation capacity was at 412.21 GW. The government’s aim is to achieve 500 GW of installed electricity capacity from non-fossil sources by 2030.

But India faces a high risk of nighttime power cuts this summer due to delays in adding new coal-fired and hydropower capacity, which may limit the country’s ability to address surging electricity demand. IBT analyses the reasons for this shortfall and how India can get its power dynamics back on track.

Photo Source: Shutterstock

New Delhi, March 20: The central government has asked coal companies in India to run thermal plants at full capacity. This is due to high power demand from all major segments. In a post-pandemic era, economic activities have resumed at a feverish pace, given the increased urbanisation and demand from the industrial and commercial segment, as well as penetration of electricity in rural areas.

According to data released by the Central Electricity Authority, India’s power demand is expected to reach 1,874 billion units by the year ending March 2027, a CAGR of 7.2% from 2021-22. This is significantly higher than the CAGR of 4% witnessed during the previous five years.

Nearly every power plant is bracing for a scorching summer and with that, higher demand for electricity, especially to run air conditioners and other cooling appliances. India’s economy is also on the road to recovery and with that, industrial and manufacturing activities have picked up. As a result, demand growth for power remained robust in January 2023 and February 2023. Peak electricity demand is expected to touch 240 GW this summer, and has already reached 201 GW in the beginning of 2023.

India’s Present Energy Scenario

Earlier in February, the central government invoked Section 11 of the Electricity Act from March 16 for three months. This would mean that power companies running on imported-coal will have to run at full-capacity to meet electricity demand and avoid severe power outages. In case of stressed projects under the NCLT (National Company Law Tribunal) process, resolution professionals will ensure that they make these functional.

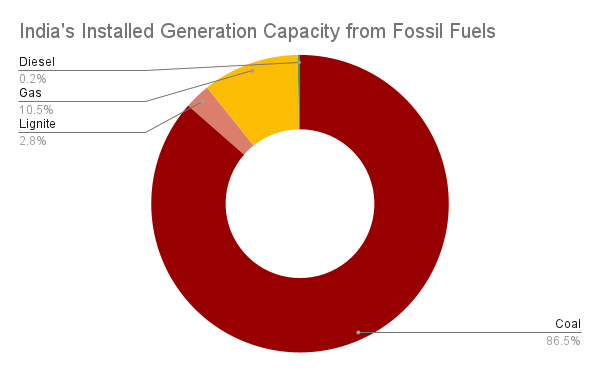

Ministry of Power and NRE has noted that the supply of domestic coal is not adequate, in accordance with coal requirements of the thermal power plant. Keeping in mind the surge in electricity demand, central government has directed all thermal plants to run at maximum capacity till the peak of summers. Despite continued efforts to generate electricity through renewable sources, the fact remains that India is still largely dependent upon coal for its electricity requirements.

Earlier in March, the central government announced, “In the current financial year 2022-2023 (upto February, 2023), the country has produced about 785.24 MT of coal as compared to about 681.98 MT during the same period last year, with a growth of about 15.14%. All India coal production in 2021-22 was 778.19 million tonnes (MT) in comparison to 716.08 MT in 2020-21, with a growth of about 8.67%. Most of the requirement of coal in the country are met through indigenous production/supply. The focus of the Government is on increasing domestic production of coal and to eliminate non-essential import of coal in the country.”

Data Source: Ministry of Power

As per information provided by Minister of Parliamentary Affairs, Coal & Mines Prahlad Joshi, India is trying to reduce its dependency on import of coal, and has therefore increased domestic supply of the fossil fuel. Total domestic coal supply for 2021-22 was recorded at 818.99 MT, an 18% jump from the previous years figures. Import figures for 2021-22, however, stood at 208.93 MT, a decline of 2.9% from 2020-21.

For the year 2022-23, government had set electricity generation target of thermal, hydro, nuclear at 1459.373 BU (which also includes imports from Bhutan). However, as of February 2023, the ministry has announced it has already surpassed 1,486.485 BU. Even then, India faces the daunting prospect of power outages. We further discuss some of the key issues affecting India’s energy preparedness.

Delay in Ultra Mega Power Projects

Government of India, through Ministry of Power, launched the initiative of Ultra Mega Power Projects (UMPPs) i.e. 4,000 MW Super Thermal Power Projects (both pit head and imported coal-based) in November 2005, with the objective to develop large capacity power projects in India.

Power Finance Corporation (PFC) Ltd. has been appointed as the Nodal Agency to facilitate the development of these projects. Various inputs for the UMPPs are tied up by the Special Purpose Vehicle (SPV) with assistance of Ministry of Power & Central Electricity Authority (CEA). CEA is involved in selection of sites for these UMPPs.

Power generation capacity of each of the existing and proposed UMPPs is 4,000 MW approximately. The fund for UMPP is arranged by the developer of the project, which is selected through International Competitive Bidding Route as per the Standard Bidding Document issued by Ministry of Power.

According to a report by the Power Ministry, only two out of 15 UMPPs are running at full capacity

- Mundra UMPP in Gujarat: The project was handed over to the successful bidder i.e. Tata Power Company Ltd., on 23.04.2007 at the evaluated levelised tariff of Rs. 2.26367/kWh. Mundra UMPP is fully commissioned.

- Sasan UMPP in Madhya Pradesh: The project was handed over to the successful bidder i.e. M/s Reliance Power Ltd., on 07.08.2007 at the evaluated levelised tariff of Rs. 1.19616/kWh. Sasan UMPP is fully commissioned.

A long wait for Green Energy

Parts of India receiving over 300 days of sunshine annually given the natural location along the equator. This lends it a strategic advantage in solar energy production. This advantage extends to wind energy projects, with India’s 8,000-kilometre coastline. Additionally, India’s vast hydropower potential is estimated at over 100,000 MW. These natural bounties have provided India with a unique opportunity to lead the way in renewable energy production and create a green economy.

Data Source: Ministry of Power

A report by the Institute for Energy Economics and Financial Analysis revealed that India witnessed a record-high investment in renewable energy in FY22, with a whopping US$ 14.5 billion invested, depicting a significant increase of 125% from the previous year. Furthermore, this represents a 72% increase from the pre-pandemic period of FY 2019-20. The country is poised to attract over US$ 20 billion in renewable energy investments in the year 2023 alone.

Credit rating agency ICRA says that the share of renewables (including large hydro) in electricity generation is expected to increase from 22% in FY 2022 to 25% in FY 2025 and further to 36% in FY 2030. This considers the renewable plus hydro capacity to reach 350 GW by 2030 from the current level of ~169 GW. On the other hand, the share of thermal segment in electricity generation is expected to come down to 60% by FY2030 from 75% in FY2022.

Apart from increase in renewable capacity, this would also require adequate storage sources like batter/pumped hydro to manage the intermittency associated with renewable sources. Though ample efforts have been made to boost supply of renewable energy, the efforts are still falling short due to delay in the execution. For example, on December 12, 2014, central government had launched the scheme for ‘Development of Solar Parks and Ultra Mega Solar Power Projects’ with aggregate capacity of 20,000 MW. Further, the capacity of this scheme was enhanced from 20,000 MW to 40,000 MW on 21 March 2017.

In the last year’s monsoon session, the Parliamentary Standing Committee on Energy observed there is a target to install 40 GW of solar power by setting up over 50 solar parks and Ultra Mega Solar Power Projects by 2022. However, of this 50, only 8 parks have been completed with commissioned capacity of 6,580 MW and 6 parks are partially complete with projects of 2,615 MW installed.

India stands committed to reduce Emissions Intensity of its GDP by 45% by 2030 but continous delay in the installation of new solar parks and expansion of the currently operational plants might result in delay of achieving the said zero carbon emission goal. Experts have said that coal will remain a major source of electricity generation in the country over the coming decade.

Power outlook for 2023

Energy experts and service institutions believe the ongoing spike in power demand is an indication towards economic growth and an end of the troublesome pandemic period. There has been strong recovery in electricity demand growth in the country with all-India demand increasing by 10.6% year-on-year (YoY) during the first 11 months of FY 2023.

This was supported by sharp growth of 18.5% reported in Q1 FY 2023 because of the severe heat wave in North and Central India, along with a low base effect owing to the impact of the second Covid wave in Q1 FY 2022. The full-year demand growth for FY2023 is expected to remain healthy at ~9.5 – 10.0%. For FY2024, the demand growth is estimated to be in the range of 5.5-6.0% basis the growth prospects of the Indian economy.

Leave a comment