Intermediate goods trade: A reflection of GVC participation

India needs to enhance its competitiveness in intermediate goods exports through the implementation of reforms in taxation, enhancing ease of trade and investments in skilling of the workforce.

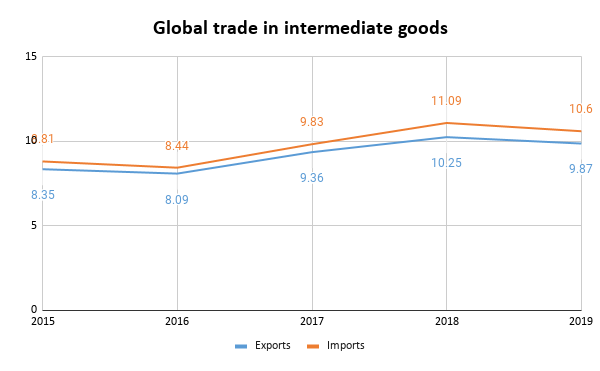

- In global trade, intermediate goods have a share of 52.8% in total exports and 55.6% in total imports of merchandise.

- India’s exports of intermediate goods amounted to US$ 152.86 billion in 2019, while its imports amounted to US$ 349.9 billion, making it a net importer.

- India shows a revealed comparative advantage in exporting consumer goods, but it is not so in the case of intermediate goods.

- The increase in exports of intermediate goods can help in increasing India’s participation in GVCs. This requires managing issues such as difficulty in custom clearance, logistics costs, and lack of skilled labour.

Source: https://bit.ly/3p5syaT

On the basis of tariff escalation, WITS classifies the trade of goods into different stages of processing which are raw materials, intermediate goods, consumer goods, or capital goods. The raw materials and intermediate goods are used as inputs for further production. Consumer goods and capital goods are generally considered as finished goods as they are ready to provide their utility.

As per United Nation Statistical Commission, the Broad Economic Categories (BEC) codes, which come under the class of intermediate goods are as follows:

111- Food and beverages, primary, mainly for industry;

121- Food and beverages, processed, mainly for industry;

21- Industrial supplies not elsewhere specified, primary,

22- Industrial supplies not elsewhere specified, processed;

31- Fuels and lubricants, primary;

322- Fuels and lubricants, processed (other than motor spirit);

42- Parts and accessories of capital goods (except transport equipment);

53- Parts and accessories of transport equipment.

In particular, to estimate trade of intermediate goods category wise, HS code wise data has been used after the conversion of HS 2017 into BEC 4.

In 2019, as per the BEC classification, global exports of intermediate goods accounted for 52.8% of the total exports, while imports accounted for 55.6% of the total imports. As per WITS database, some of the leading exporters of intermediate goods are the EU, China, the US, Germany, and Japan. The top importing countries of intermediate goods are China, the US, Germany, India, and the UK.

Source: UN Comtrade, figures in US$ trillion

Going by the BEC classification, during 2019, India’s exports of intermediates amounted to US$ 152.86 billion. This has been an increase in comparison to exports in 2015, which were US$ 121 billion. Figure 1 shows the exports of intermediate goods classified using BEC classification. It shows that India mostly exports industry supplies, particularly diamonds, aluminum, P-Xylene, and flat-rolled products of iron or steel.

Source: UN Comtrade, figures in US$ billion

The import value of intermediate goods shows that India is the net importer of these goods. During 2019, the total import of intermediate goods amounted to US$ 394.9 billion, an increase over the import value during 2015 (US$ 308 billion). The highest share in total imports of intermediate goods has been of industry supplies (39%) and fuel and fabricants (31%).

Source: UN Comtrade, figures in US$ billion

Global value chain participation

Trade of intermediate goods reflects a country’s participation in global value chains. Exports of intermediate inputs, mainly in the machinery industry, show the extent of a country’s integration in GVCs, since it shows the link of a country in different production chains spread across the world. Imports of intermediate inputs reflect the extent of foreign value added in the exports of a country, which again are used as an indicator for participation in GVCs. Integration of countries in GVCs has been proven beneficial as it provides firms with access to cheap inputs, which assist them in becoming competitive.

Furthermore, it assists in developing productive capacity and infrastructure, reducing poverty and increasing per capita income. China is a well known example, which has large factories employing thousands of workers and supplying goods to most parts of the world. It became a significant part of GVCs by importing intermediate inputs and then exporting assembled final goods to the rest of the world, mainly developing countries.

Over the past years, India’s participation in the global value chain has seen an improvement. As per the OECD TiVA GVC participation index 2018, India ranks 48. In 1999, the country stood at 57th position. A study from Institute of South Asian Studies shows that India has moved downstream in GVC in export of services, footwear, textiles and textile products, as these exports do not require foreign value added inputs. Furthermore, it shows that it has increased its upstream participation in manufacturing activities like semi processed intermediates which are then used for production purposes in other countries.

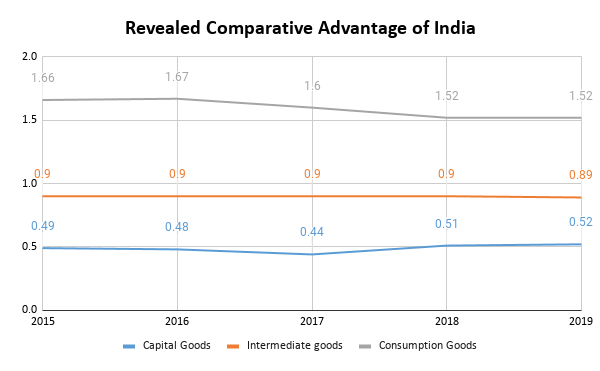

However, overall India is not coming out to be competitive in exporting intermediate goods. The figure below shows the Revealed Comparative Advantage (RCA) index of India in products based on the end use of the good. The figure shows that India has revealed comparative advantage in consumer goods with the RCA greater than 1. However, in intermediate goods and capital goods, the country does not have a comparative advantage. The index for intermediate goods has been at 0.9 during 2015 to 2019. This shows India’s lack of competitiveness in exporting intermediate goods in comparison to the rest of the world.

Source: CATR Analysis

In order to move the country’s contribution upstream stages of GVC for manufacturing and to make India competitive in export of intermediate goods, it is essential to improve infrastructure of the country to allow easier movement of goods. Furthermore, it is required to maintain quality standards to contribute to the global value chain. Recently, initiatives such as Make in India, de-licensing, and industrial corridors have been adopted which are moves in the right direction. The policies of the 1980s and 90s such as license raj, state-led industrialization, and import substitution were more focused on the domestic economy than participation in international trade.

Still, there are other factors such as significantly high taxes and difficulty in custom clearance, which are a push back for the big companies and slowing the pace of India in becoming a part of GVCs. To maximise benefits from participating in GVC, it is also essential to enhance skilling of the labour force, as it allows them to contribute to high-value-added segments. In addition, as an ICRIER study points out, India needs to identify and target large scale intermediate manufacturing of at least 15 intermediate inputs. SMEs should be identified and supported to enhance their capacities and cost competitiveness in these categories, while also providing them the wherewithal to participate in global trade.

Leave a comment