India’s F&B export potential to Africa: A TPCI report

India is the top exporter of F&B products to Africa, and the continent provides strong upside potential in this sector across categories. TPCI’s research report on India’s F&B exports to Africa provides insights into the growth trends in F&B sector, challenges to market penetration and roadmap for further enhancement of trade.

- India-Africa trade has grown from just US$ 47 billion in 2012 to reach around US$ 89.54 billion in 2021-22.

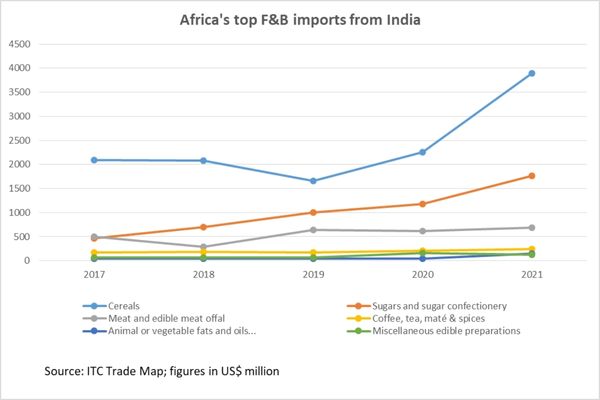

- Currently, India is the leading exporter of F&B products to Africa, led by Cereals, Sugar and Sugar Confectionery, Meat & Edible Meat Offal, Animal or Vegetable Fats and Oils and Dairy Produce.

- TPCI’s research on India-Africa F&B trade provides insights into opportunities for expansion in market presence and diversification of the trade basket.

- India can accelerate its F&B exports to African countries, leveraging the opportunities offered by the African Continental Free Trade Area (AfCFTA) agreement launched in 2021. However, this requires a strong market outreach effort to potential markets and

India-Africa trade has grown from just US$ 47 billion in 2012 to reach around US$ 89.54 billion in 2021-22. TPCI’s research division conducted a detailed analysis of India’s F&B trade basket with Africa to ascertain key products of interest, growth opportunities as well as market specific challenges.

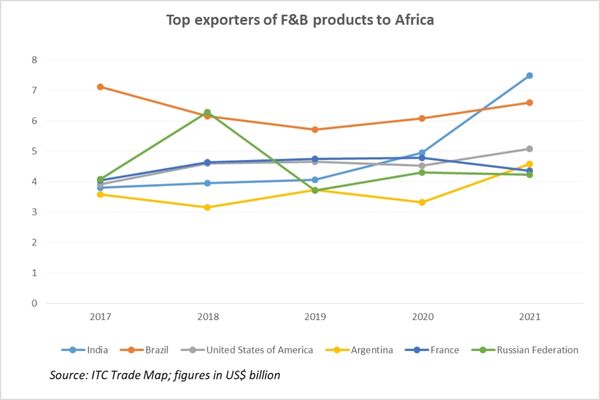

India’s food and beverages (F&B) sector exports to Africa increased significantly by an average of approximately 33% between 2019 and 2021. As per trade statistics, India’s F&B exports to Africa stood at around US$ 6.2 billion in 2021. Between 2017 and 2021, they grew at a strong compound average growth rate (CAGR) of 11.53%. India’s top five export items to Africa comprised of ‘Cereals’ (HS 10); ‘Sugars & confectionary’ (HS 17); ‘Edible meat’ (HS 02); ‘Coffee, tea and spices’ (HS 09) and ‘Preparations of cereals, flour, starch or milk; pastry cooks’ products.’

Within the African region, the top three importing countries for Indian F&B products are Egypt, Sudan and Benin, accounting for a share of 13.6%, 8.15% and 7.6% respectively in Africa’s total F&B imports. Other major importers are Somalia, Djibouti and Senegal. In terms of the growth rate of F&B imports from India, Mozambique records the highest growth rate of 87.2%, followed by Cameroon at 51.8%, Togo at 43%, Djibouti at 40.7% and Sudan at 40.7%.

When comparing growth rates of the top 10 markets, we find that the countries which hold the highest potential for increasing imports from India in future are Togo, Djibouti, Egypt, Sudan and Cote d’Ivoire.

Potential products & markets where India should focus its efforts

Africa as a continent is a net importer of food. Our analysis shows that there exists a potential to expand the F&B export markets across other countries of the continent for Indian traders.

Based on the analysis in this report, Africa’s top imported F&B products are

- Cereals (HS 10, US$ 30.14 billion);

- Animal or vegetable fats and oils (HS 15, US$ 13.2 billion)

- Sugars and Sugar confectionery (HS 17, US$ 7.9 billion)

- Dairy Produce (HS 04, US$ 5.4 billion)

- Meat & Edible Meat Offal (HS 02, US$ 4.5 billion)

India is the leading exporter of Cereals (US$ 3.9 billion) and ranks 2nd in Sugar and Sugar Confectionery (US$ 1.24 billion) and Meat & Edible Meat Offal (US$ 814.95 million). However it ranks low in Animal or Vegetable Fats and Oils (14, US$ 19.4 million) and Dairy Produce (36, US$ 19.3 million).

Products with potential for increasing exports are:

- Miscellaneous edible preparations (HS 21)

- Beverages, spirits and vinegar (HS 22)

- Fish and crustaceans, molluscs; other aquatic invertebrates’ (HS 03)

- Products of the milling industry; malt; starches; inulin; wheat gluten’ (HS 11) and

- ‘Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruit’ (HS 12)

When considering India’s F&B exports to Africa, the top competitors across its top export categories are Brazil, South Africa and some European countries such as Turkey and France. In the future, Indian businesses will have to compete with traders from these countries in areas such as quality of products and timeliness of exports. Economic growth in Sub-Saharan Africa has been strong in recent years supported by resilient domestic demand and high commodity price.

Challenges for Indian F&B exports in Africa

The USTR (2022) ‘National Trade Estimate Report on Foreign Trade Barriers’ published by US Trade Representative, reported that many products in some African countries are subjected to import prohibitions, restrictions, prior authorization, and stringent certification and import licensing requirements.

For example, South Africa’s average MFN applied tariff rate was 8.7% for agricultural products and 7.5% for non-agricultural products, Cote d’Ivoire’s average MFN applied tariff rate was 15.8% for agricultural products and 11.2% for non-agricultural products. Cote d’Ivoire has prohibited wheat flour imports since 2008. In January 2020, it banned the imports of sugar for five years.

Some other examples are animal products, flour, live plants and agri-seeds. For instance, all goods imported into Cote d’Ivoire must first be examined by a pre-shipment inspection company for compliance with relevant requirements. These processes often increase the time and cost to export without providing the assurance of a streamlined clearance process at the border. Some infrastructure related barriers concerning customs clearance presenting major obstacles to trade have been reported in Ghana and Morocco.

The USTR (2022) report also talks about lack of clarity vis-a-vis Sanitary and Phyto-Sanitary (SPS) measures for Egypt and bans in imports of beef, pork, sheep, goat meat, and edible offal by Nigeria. Some underdeveloped African countries still rely much on informal ways of communication rather than the more formal ways, such as exchange of emails, which are more established in the developed and developing countries. In such instances, adapting to the local ways and working closely with the local businesspersons can help to overcome problems.

For the purpose of exports, it is relevant to note that some countries in Africa have implemented stringent non-tariff measures, such as or product registrations, including a wide range of restrictive regulations, lengthy and complex processes and import bans, that make trade difficult and costly.

Another problem related to trade is that Africa as a whole is not a single market. Trade between African countries barely exceeds 10% of the total trade by the continent, which is much lower than the intra-regional trade share of other continents. There are issues related to lack of logistics and infrastructure, underdeveloped capital markets, and lack of regulatory harmonisation that hinder free movement of products in the region.

Growth opportunities offered by the market

Given that Africa’s urban population is expected to nearly triple, reaching 1.34 billion by 2050 and its GDP growth rate has been around 4.5% between 2000 and 2019, the continent holds a promising future as a growing market for F&B sector.

The growing prosperity in the African continent has meant that the region’s demand is also now moving beyond just cereal and food grain imports to more complex and processed food products. India, in itself being a large and mature player in F&B sector and a net exporter of agricultural and food products can continue to effectively fulfil this demand of Africa.

Africa presents itself as a continent of opportunity at a time when global growth in this segment is volatile. Some of the world’s fastest growing and populous economies are located in Africa, and its expanding middle-class of consumers and young workforce are attractive markets for global businesses.

India can also accelerate its F&B exports to African countries, leveraging the opportunities offered by the African Continental Free Trade Area (AfCFTA) agreement launched in 2021, offering a market potential of US$ 3 trillion. As part of its mandate, the AfCFTA aims to eliminate trade barriers and boost intra-Africa trade. In particular, it aims to advance trade in value-added production across all service sectors of the African Economy.

To read the detailed report, click here.

I am indian rice miller and expoter.

I need real buyer.

I am lithium and lead acid battery manufacturer

We need buyers from african continent